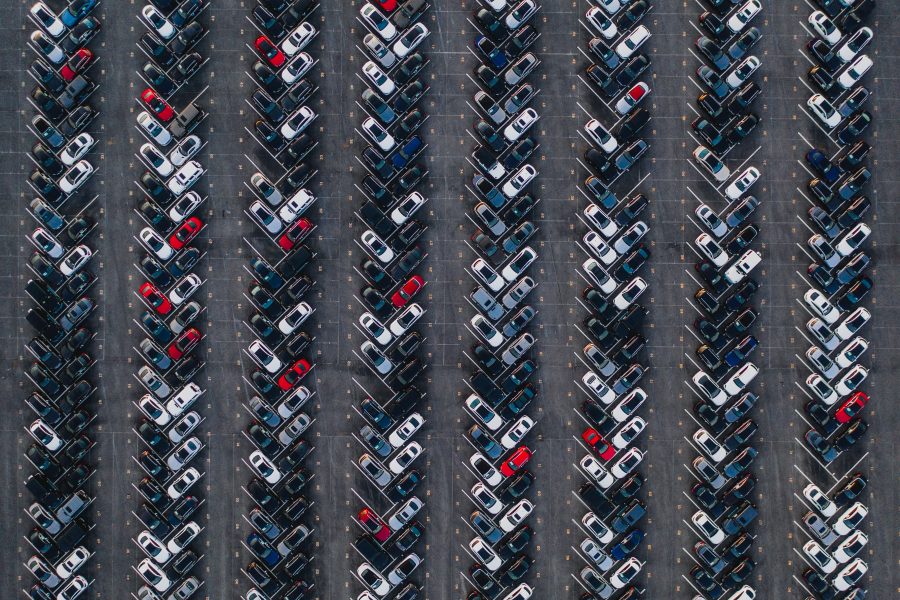

J.D. Power estimated that total new-vehicle sales for September 2025, including retail, will increase 0.1% year-over-year to 1,232,200 vehicles after adjusting for the extra selling day this September compared to a year ago. On an unadjusted basis, sales volume is expected to be up 4.5% from 2024.

The seasonally adjusted annualized rate for total new-vehicle sales is expected to be 16.2 million units, up 0.3 million units from September 2024.

“In aggregate, September sales results point to another month of strong demand for new vehicles. However, as has been the case for the past few months, assessing the health of the industry requires a closer look at the underlying market dynamics,” highlighted Thomas King, president of the data and analytics division at J.D. Power. He noted that the biggest driver of September’s strong sales pace is temporarily inflated demand for electric vehicles due to the federal EV tax credit expiring on September 30. EV share of retail sales is expected to reach a record of 12.2% this month vs. 9.6% a year ago.

The average new-vehicle retail transaction price in September is expected to reach $45,795, up 2.9% from September 2024. The average manufacturer incentive per vehicle is on track to reach $3,116, an increase of just $24 from August and a decrease of $3 from a year ago. Expressed as a percentage of MSRP, incentive spending is at 6.1%, a decrease of 0.2 percentage points from a year ago.

Trucks/SUVs are on pace to account for 82.1% of new-vehicle retail sales vs. 80.5% a year ago.

The average interest rate for new-vehicle loans in September is 6.51%, a decrease of 25 basis points from a year ago, according to J.D. Power.

Looking ahead, a very significant decline in EV sales is expected by J.D. Power for October, reflecting both the effect of the federal EV tax credit expiring and the pull-forward effect of all the electric vehicle purchases that were accelerated into the summer period.

Auto stocks: Toyota (TM), Tesla (TSLA), General Motors (NYSE:GM), Honda (HMC), Ferrari (RACE), Ford (NYSE:F), Hyundai (HYMTF), Nissan (OTCPK:NSANY), Daimler (DDAIF), Volkswagen (VWAY), Subaru (OTCPK:FUJHY), Rivian Automotive (RIVN), and Lucid Group (LCID).