Guido Mieth

Both lenders and consumers in the U.S. adopted a more cautious approach to credit, as “many consumers de-leveraged and reduced credit utilization,” Susan Fahy, executive vice president and chief digital officer at cred-scoring company VantageScore, said in a Tuesday statement.

Consumers’ credit broadly still remains healthy, though, with an average VantageScore 4.0 credit score of 702. But their caution showed up in credit utilization, which hit a four-year low of 51.6%.

What’s more, early-stage consumer credit delinquencies (30-59 days past due) rose the most in over four years, “as the weaker employment environment negatively impacted consumer payments on recent loans,” the report said.

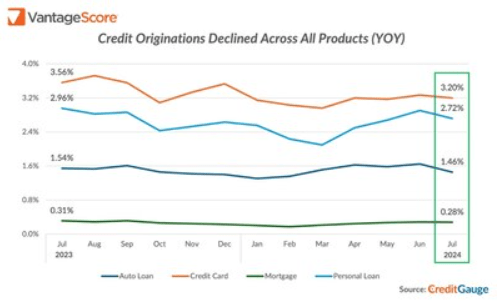

Lenders, plagued with elevated interest rates, reduced new credit loan growth in July versus a year ago for all categories of credit products.

The Y/Y decline in credit originations reflects a more cautious borrowing by consumers, and, at the same time, increased risk perception by lenders. Consumer spending, however, remains strong as credit card debt continued rising above $1T in Q2 2024, with many consumers swiping away to counter their dwindling purchasing power and largely depleted pandemic-related excess savings.

Do note that within credit originations, mortgages were the only product category to roughly hold steady from a year ago, the report noted. Mortgage lenders include Rocket Companies (NYSE:RKT), UWM Holdings (NYSE:UWMC), PennyMac Financial Services (NYSE:PFSI) and LoanDepot (NYSE:LDI).

New auto loans, meanwhile, saw the biggest monthly decline among all products, at -0.19%. Ally Financial (NYSE:ALLY) and Credit Acceptance (NASDAQ:CACC) provide auto loans.

The VantageScore data coincide with the fact that credit card delinquencies continued to creep up in July, while the proportion of loans that lenders are writing off as losses declined, according to a compilation of data from company disclosures.

Credit-card issuers: Capital One (NYSE:COF), American Express (NYSE:AXP), JPMorgan (NYSE:JPM), Synchrony (NYSE:SYF), Discover (NYSE:DFS), Bread Financial (NYSE:BFH), Citigroup (NYSE:C), Bank of America (NYSE:BAC).