hatchapong/iStock Editorial via Getty Images

Visa (NYSE:V) is “just getting started” in its efforts to scale stablecoins as a new payment technology, according to the payment network giant’s product executive.

Stablecoins are digital currencies designed to hold a stable value by being pegged to a reserve asset like the U.S. dollar, euro gold, etc.

These price-stable tokens are only starting to become mainstream, with key, framework-creating legislation moving through Congress, though Visa (NYSE:V) has been participating in the digital evolution of money movement for years.

Since 2020, Visa (NYSE:V) has facilitated nearly $95B in crypto purchases and more than $25B in crypto spending, Jack Forestell, the company’s chief product and strategy officer, wrote in a blog post.

The company specifically delivers native stablecoin settlement and programmable money solutions; enables cross-border money movement tools across stablecoin infrastructure; and deploys Visa credentials and Visa tokens to connect stablecoin and crypto platforms to fiat currency and Visa’s global network, he explained.

However, “it is less obvious that consumers and businesses will seek to make payments using stablecoins in developed markets such as the United States as there are already a wide array of competitive options to pay with ‘digital dollars’ directly from a bank account,” Forestell wrote.

Jefferies analyst Trevor Williams is not worried about “stablecoin risk” for Visa (V) or rival Mastercard (MA).

“We think two things can be true: the actual long-term risks to the businesses are limited, but the overhang from the perceived threat can be enough to keep the stocks range-bound,” he wrote in a note to clients.

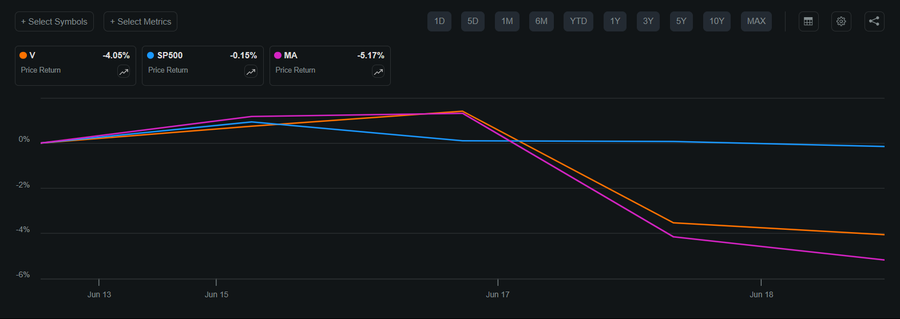

Visa (V) and Mastercard (MA) shares have come under pressure since June 13, when the Wall Street Journal reported that retailing titans Amazon (AMZN) and Walmart (WMT) are considering issuing stablecoins to transform their payment systems and reduce their reliance on banks and card payment systems. A week later, the U.S. Senate passed its stablecoin legislation, adding to the selling pressure.

V, MA stock performance: June 13 – June 23 (Seeking Alpha)

More on Visa

- Stablecoins, Don’t Call Them A Visa Killer

- Visa: Too Long Since The Last Misinformed Panic, Enter ‘Stablecoin’

- Visa Investors Ignoring The Potential For Lost Business To New Stablecoin Networks

- Visa, Mastercard stocks slide, Coinbase jumps after stablecoin bill passes Senate

- Visa, Mastercard stocks slide after stablecoin report