2Ban/iStock Editorial via Getty Images

Compass Point started coverage of Visa (NYSE:V) at Buy and Mastercard (NYSE:MA) at Neutral on the basis that Visa has the edge in growing its value-added services (“VAS”) business.

The firm’s VAS analysts quantifies Visa’s (V) potential total revenue contribution if the company penetrates VAS from its current ~24.3% to Mastercard’s (MA) ~34.3% (15% increase to V’s total revenue long-term), said analyst Dominick Gabriele in a note to clients.

The analyst also initiated coverage of Jack Henry & Associates (NASDAQ:JKHY), a provider of services and payments to community and regional banks and credit unions, with a Neutral rating. While Gabriele views JKHY as a “consistent grower, a compounder, growth stock that has low sensitivity to macro trends,” three factors keep him on the sidelines.

Those are: bank M&A is likely to stay muted until at least H2 FY2025; weaker adjusted revenue growth in its core segment and corporate leading to Compass’s lower-than-consensus FY2025 EPS estimate; and return on invested capital is likely to stabilize at ~20% with free cash flow reaching ~72.7% by 2026FY, leaving little room for multiple expansion.

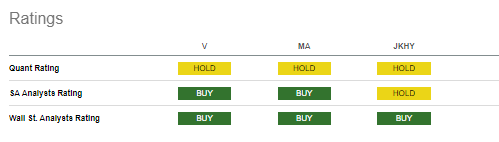

The SA Quant system has Hold ratings for all three stocks.

Visa (V) stock rose 0.7%, Mastercard (MA) increased 0.2%, and Jack Henry (JKHY) dropped 1.0% in late morning trading on Wednesday.