Matteo Colombo

Wall Street on Saturday marked the two-year anniversary of its current bull run, a stretch in which the benchmark S&P 500 index (SP500) has surged more than 60% from its bear-market bottom.

COVID-19 in 2020 decimated the world economy and triggered a sharp rise in inflation across the globe. The situation was further exacerbated early in 2022 after Russia invaded Ukraine. It all came to a head on October 12 that year, when the S&P (SP500) closed at 3,577.03 points, firmly in bear-market territory.

Today, the S&P 500 (SP500) sits at a record closing level of 5,815.03 points, marking a 62.6% advance from two years ago.

Several factors have contributed to the current bull market, chief among them the explosion of the artificial intelligence (AI) trade, heavy lifting done by megacap stocks such as the Magnificent 7 club, and a Federal Reserve that appears to be on track to deliver a soft landing.

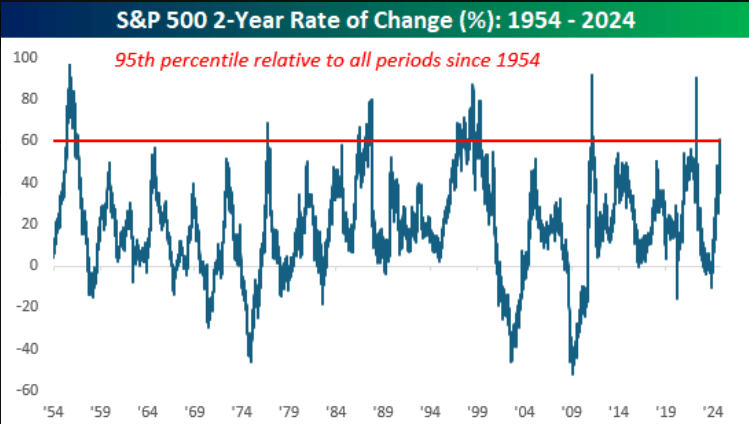

“As the bull market turns two, the S&P 500’s current 2-year rate of change of 60% ranks in the 95th percentile relative to all other periods,” Bespoke Investment Trust noted on X (formerly Twitter) on Friday, while sharing the chart below:

One of the questions now is: How long this bull run can last? Signs show that there are still plenty of legs in the market – the Fed just delivered its first rate cut in four years, estimates for U.S. economy growth have been revised upward, and investors seem resilient to geopolitical risk.

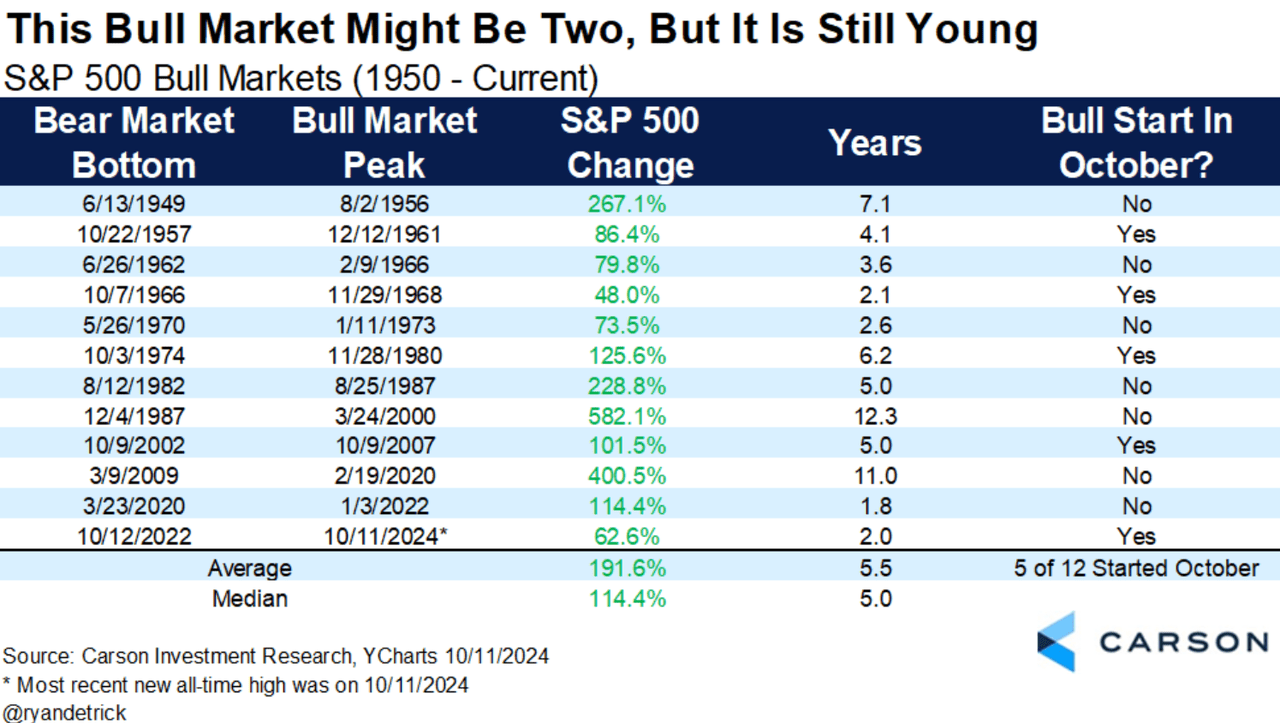

“Up 62.6% the past two years is probably something most didn’t have on their bingo card in (October 2022). The good news? Bull markets last more than five years on (average), so this one likely has more left in the tank,” Ryan Detrick, chief market strategist at Carson Group, said on X on Friday.

See below for the table shared by Detrick:

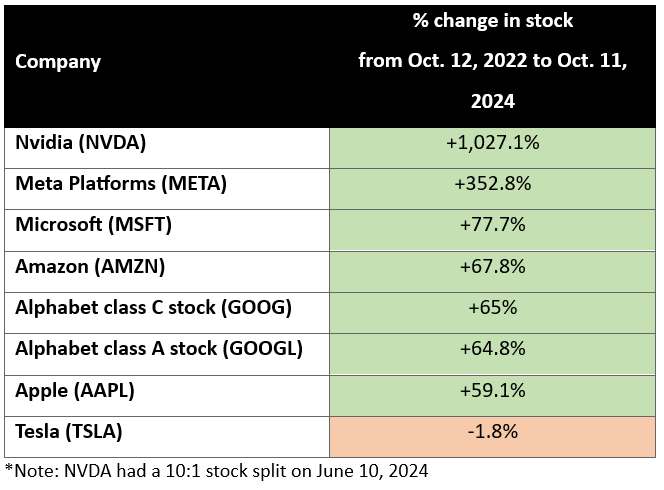

In terms of equities, the Magnificent 7 has done most of the heavy lifting in the bull run. Since October 12, 2022 to their last close, every member of the club – except electric vehicle giant Tesla (TSLA) – has climbed at least about 60%.

See below for a breakdown of the performance:

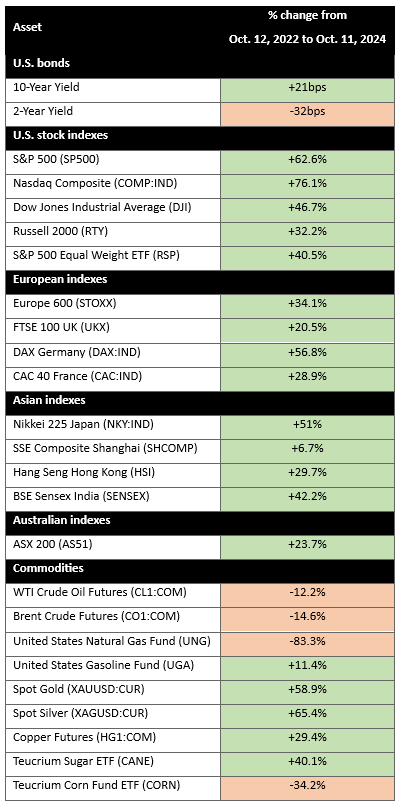

See below for another breakdown of the total return of several major global financial assets in the current bull run:

For investors looking to track the benchmark S&P 500 (SP500), here are some exchange-traded funds of interest: (VOO), (IVV), (RSP), (SSO), (UPRO), (SH), (SDS), and (SPXU).