Jose Luis Pelaez Inc

The co-founder of biotech giant Regeneron Pharmaceuticals (REGN) recently raised concerns about the potential side effects of popular weight-loss drugs, which he said could lead to increased loss of muscle mass. This contributed to a growing narrative about the dangerous unintended consequences of taking these drugs — concerns that could chip away at the spectacular demand they have seen since hitting the market.

How much should investors in the sector worry about the impact of these worries on major players like Novo Nordisk (NVO) and Eli Lilly (NYSE:LLY)?

Concerns Over Side Effects

The comments from Regeneron’s co-founder, which appeared in the Financial Times, represented another red flag about potential side effects of weight-loss drugs. (REGN is currently testing medicines that preserve muscle mass while losing weight.)

These comments follow close on the heels of reports about Roche’s (OTCQX:RHHBY) experimental obesity pill CT-996, which was linked to significant side effects in early trials. These included gastrointestinal issues and increased heart rate.

Similarly, Novo Nordisk faced concerns over psychiatric side effects in their obesity drug candidate, monlunabant. The drug works differently from the popular GLP-1 receptor agonists being sold by Novo Nordisk and Eli Lilly as monlunabant is an oral cannabinoid receptor 1 (CB1) inverse agonist. As both Roche and Novo Nordisk continue developing their respective drugs, the issue of side effects remains at the forefront of discussions about the future viability and competitiveness of these treatments.

The Weight-Loss Drug Market

The weight-loss market is dominated by the likes of Novo Nordisk (NVO) and Eli Lilly (LLY). Novo’s Wegovy (semaglutide), also marketed as Ozempic for type 2 diabetes and Eli Lilly’s Zepbound (tirzepatide), which is sold as Mounjaro for diabetes. Both semaglutide and tirzepatide are GLP-1s and have shown favorable results in promoting weight loss.

However, safety concerns remain a potential obstacle to their long-term success. For example, weight regained after cessation of GLP-1 drugs adds another layer of complexity, necessitating prolonged drug use to maintain initial results.

Still, even amid the worries about harmful side effects, these drugs also continue to show other benefits, which could lead to an even bigger market. Ozempic could help with opioid overdoses. Wegovy has shown promise in helping with heart ailments. In March, the FDA approved a new indication for the drug, as the regulatory agency put it, “to reduce the risk of cardiovascular death, heart attack and stroke in adults with cardiovascular disease and either obesity or overweight.”

Investor Reaction

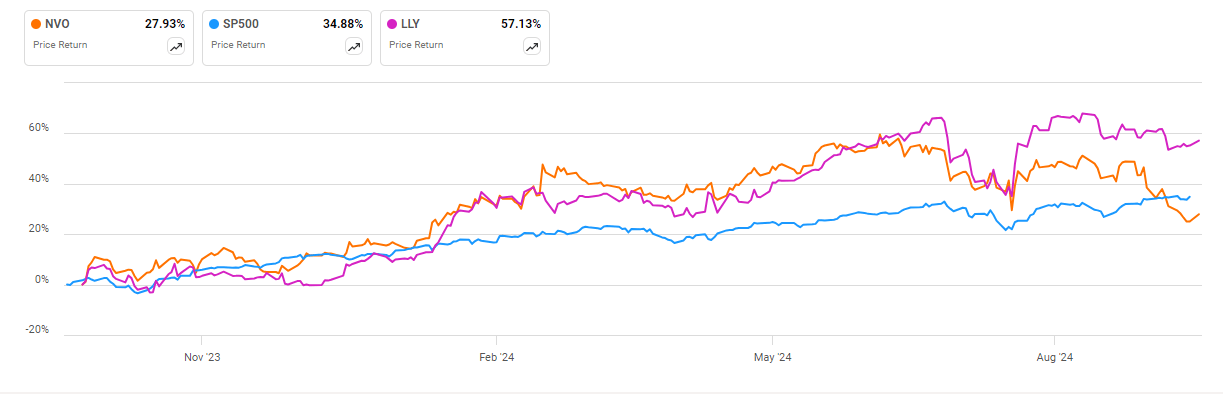

Helped in part by the hype around weight-loss drugs, both NVO and LLY have outperformed the overall S&P 500 for most of the past year. However, NVO has suffered a setback lately and recently fell behind the overall market around the same time a paper came out indicating semaglutide would likely be one of the next medicines facing Medicare drug price negotiations in 2025.

In general, LLY is up about 57% over the past 12 months. NVO remains higher by about 27% over that time, although that trails the 35% advance the S&P 500 has seen.

Looking at the prospects of this market, Seeking Alpha contributor ONeil Trader maintains an upbeat view of NVO’s obesity business, although the analyst also raised concerns about the firm’s manufacturing capacity in the face of the heavy demand for the products.

“The key risk in the near- and medium-term is the company not being able to produce enough of Wegovy and Ozempic, not to fully satisfy all the demand that exists but to significantly outperform the current consensus revenue estimates,” ONeil Trader stated, although the analyst quickly added, “Based on the efforts the company is making and the supply starting to come online, I do not expect this risk to materialize.”

Meanwhile, fellow SA analyst Mike Zaccardi noted worries about price stability in the market. “There are … emerging signs of an all-out price war between Lilly and Novo as they seek to gain market share as more insurance providers cover Zepbound and Novo’s Wegovy,” the analyst said.

More on Eli Lilly and Novo Nordisk

- Eli Lilly: Ebglyss To Challenge Dupixent In Atopic Dermatitis

- Roche: The Devil Is In The Details – Obesity Data Presentation Disappoints

- Eli Lilly Is Finally Cheap, Warranting An Upgrade To Buy

- Lilly to take Q3 IPR&D charge of $2.83B, or $3.08 per share

- Eli Lilly obesity drug shortage ends fueling lawsuit against FDA