abadonian

The boom in artificial intelligence technology development and demand sets up companies focused on natural gas as trend winners, Wells Fargo Investment Institute (WFII) said.

Midstream energy companies focused on natural gas should be visible long-term beneficiaries from the build out of data-center capacity in the U.S. to run AI operations, WFII said in a July 1 strategy note. About 43% of electricity is generated from natural gas and the build-out of energy-hungry data centers is in very early stages, Ian Mikkelsen, equity sector analyst at WFII, said.

“We believe that U.S. natural gas production capacity and reserves are sufficient to meet growing demand, with infrastructure being the key constraint in balancing supply with this demand growth over time,” Mikkelsen said. “We expect this to provide midstream companies with incremental growth opportunities and higher utilization of existing assets, ultimately extending the terminal value of natural gas infrastructure.”

While many developers prefer to power new data centers with renewable energy, WFII expects expects the share of natural gas generation in the power mix to remain fairly steady in the intermediate term because of pace limitations on developing renewables.

Meanwhile, the re-shoring of industrial manufacturing facilities and the build out of additional export capacity for liquefied natural gas serve as other supportive pillars.

“We believe these trends are secular in nature and, in our view, large companies in the Midstream Energy sub-sector that are focused on natural gas and have broad interstate operations are well positioned to benefit,” Mikkelsen said, without specifying any companies.

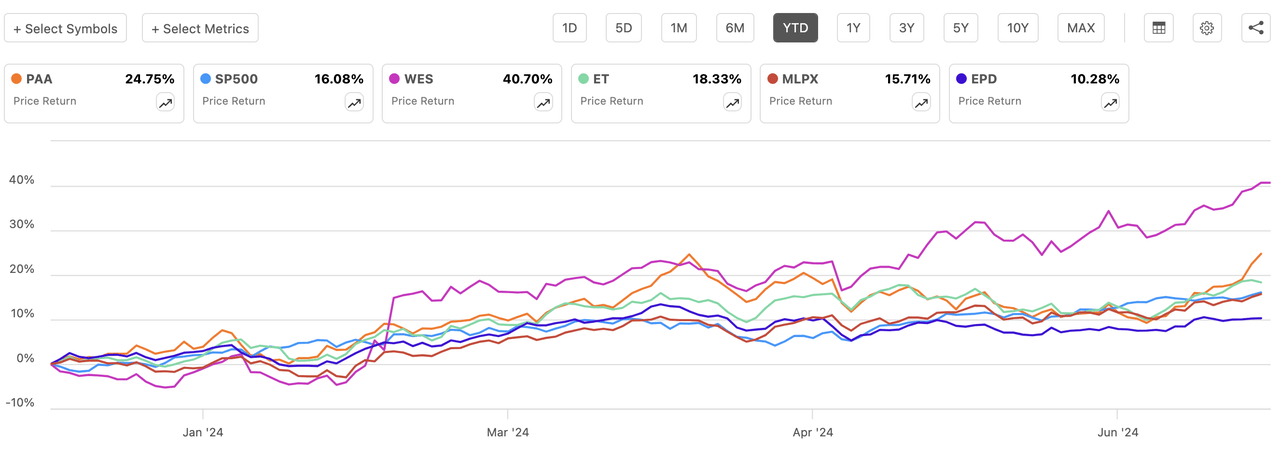

Midstream ETFs include Alerian MLP ETF (AMLP), Global X MLP & Energy Infrastructure ETF (MLPX), and First Trust North American Energy Infrastructure Fund ETF (EMLP).

The top 5 holdings in the Alerian MLP ETF as of July 3 were: