PHOTO MIO JAPAN/DigitalVision via Getty Images

Home improvement stocks appear on the cusp of advancing further if the Federal Reserve delivers firm forward policy guidance, Wells Fargo Securities said.

Fed funds futures heading much lower in the first half of 2025 and a clearer outlook from the Fed are positive for consumers, levered firms, and mortgage rates, Wells Fargo Equity Analyst Christopher Harvey said in a note Wednesday, ahead of the Fed’s September policy announcement.

Home improvement stocks such as Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW) are beginning to rally, and “we think this is the start of a bigger move for the group,” he said.

“We think [the Fed] communicating a measured pace would be more helpful for planning and volatility, a key for mortgage spreads,” he said. “Rate vol is beginning to decay, and as the Fed’s path is better understood it should reduce uncertainty and ultimately spreads,” which is a “big plus” for housing and consumers, Harvey said.

Since the S&P 500 (SP500)(SPY)(IVV) on Sept. 11 staged a dramatic intraday turnaround to surge, Home Lowe’s (LOW) has risen ~3.8% and Depot (HD) has picked up 3%.

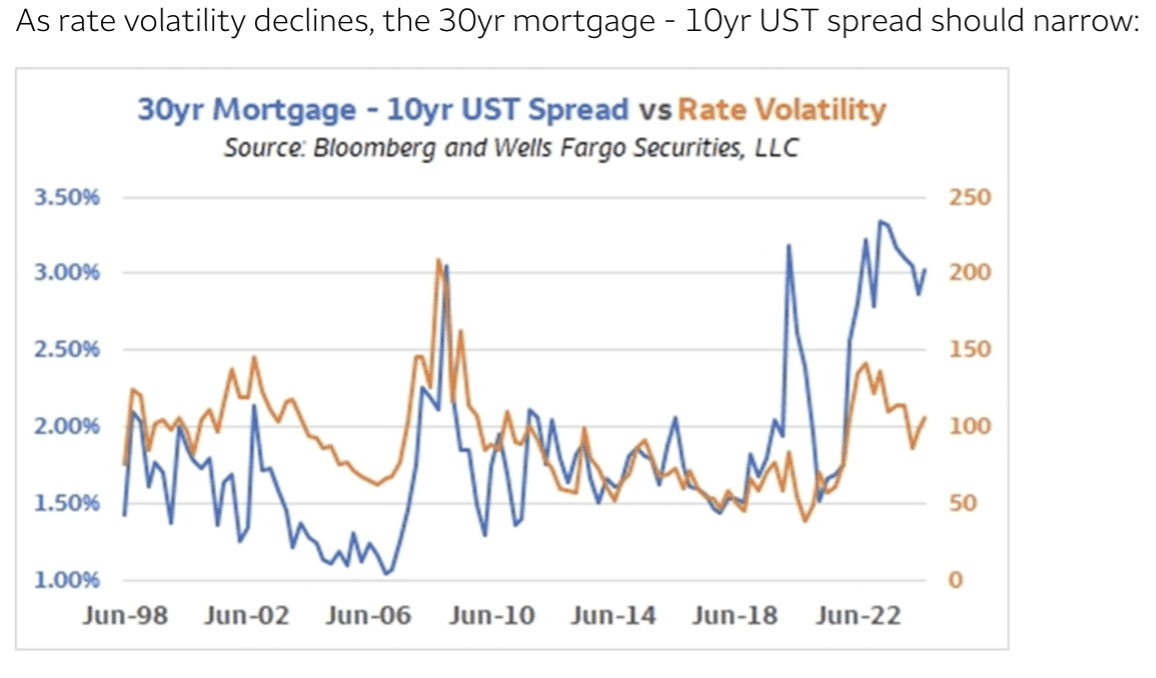

Harvey said rate volatility has significant influence over 30-year mortgage spreads (3-yr mortgage rate less 10-yr Treasury), and a lower rate of vol typically leads to tighter spreads, and vice-versa. Harvey included this chart:

Policymakers need to be more definitive about their forward path after having “ample opportunity” to evaluate inflation and employment trends, Harvey said.

Bank of America (BofA) separately this week noted that home builder and building product stocks have rallied since early July as 30-year mortgage rates fell to ~6.2% from 7% with investors anticipating Fed rate cuts.

“Housing sector outperformance ahead of rate cuts is consistent with prior cycles, but the magnitude and valuations are higher this time around,” Rafe Jadrosich, research analys at BofA, said. “Stock performance following the first cut is more mixed although usually positive for homebuilders.”

Since July through Tuesday, the SPDR S&P Homebuilders ETF (NYSEARCA:XHB) has risen ~21%. Constituents Home Depot (HD) and Lowe’s (LOW) have climbed 11% and 16% during that period. Here’s how other (XHB) holdings have performed during the time: