ViktorCap/iStock via Getty Images

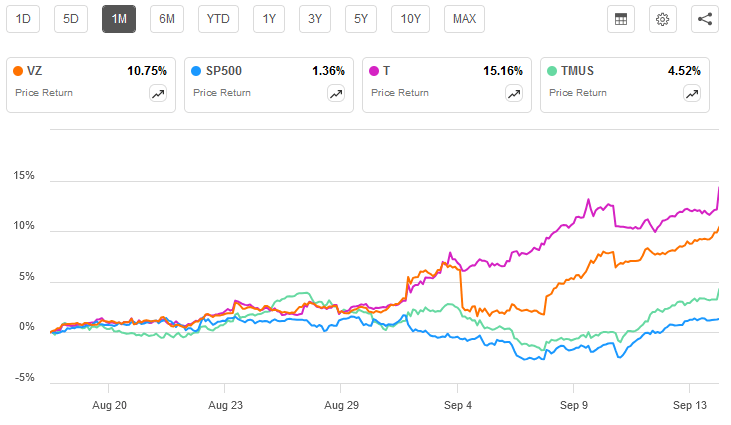

The big U.S. telecom stocks hit 52-week highs Monday, in part thanks to a September rally where they’ve broken away from the broader market to chart their course upward.

AT&T (NYSE:T) this week is putting the button on a year-to-date gain of 35.6% — weeks of increases it generally made in step with the broader market until the past month, where it broke from the S&P 500 to make its own rally. That stock is up 16% over the past month, up 29% over six months and up 52% over the past year.

Verizon (NYSE:VZ) too cut free from the broader market in September. It’s up more than 11% over the past month, bringing its 2024 gain to 19%, and it’s up nearly 33% over the past year.

And while T-Mobile (NASDAQ:TMUS) hasn’t quite run along with T and VZ, it’s also outpaced broader market gains a bit in recent weeks (up 6.2% over the past month, vs. the S&P 500 up 1.7%).

In part, that can be attributed to some correction-style declines on some very bad days among big technology and the broader market in late summer and early this month. Telecom services are generally considered defensive stocks — mature companies often providing a necessary service, and offering stable results and dividends when the overall market gets volatile.

The sector’s “duopoly” is a favorite among dividend investors, and so the stocks aren’t often counted on to outperform the market in price performance. Forward yield on AT&T’s (T) dividend is at 5.13%, while Verizon’s (VZ) yield is 6.1% ahead of a central bank rate-cutting cycle.

And overall, Seeking Alpha analysts and Wall Street are positive on the big names during a period of rate uncertainty. The strength of the AT&T (T) rally brought out a few naysayers this week: The recovery is “floundering,” SA Analyst Thomas Prescott argued, saying the biggest concern lately is downward revisions in earnings per share expectations. Meanwhile, SA analyst Dividend Sensei says the rally has eliminated short-term excess return potential, suggesting there are higher-yielding blue chips available and pointing to three reasons to sell AT&T.

Overall, Seeking Alpha analysts are bullish on AT&T (T) with a rating of Buy, matching the sentiment of Wall Street. Seeking Alpha’s Quant Rating on AT&T backs off a bit, at Hold.

Verizon’s (VZ) bullish chorus on Seeking Alpha got a lift from High Dividend Opportunities Investing Group leader Rida Morwa, who on Monday reiterated his positive stance noting “boring income means big rewards“: “I’m a huge fan of owning income from essential sources” like a monthly cell phone bill,” he said. Verizon has outperformed the market with the other telecoms, but the stock spent much of the past decade over $50 a share, while it’s now a “compelling buy” at $44, he notes.

Seeking Alpha analysts overall have a Buy rating on Verizon (VZ), as do Wall Street analysts. As with AT&T, Seeking Alpha’s Quant Rating on Verizon is a Hold.

One other caveat comes in the upcoming Federal Reserve action: As noted, all else being equal, telecoms often serve as a defensive sector, moving in indirect proportion to large marketwide moves. Given that the Fed is likely to surprise some investors whether they cut rates by a quarter point or a half-point, the telecoms may (at least for some number of trading sessions) serve as counters to the S&P 500, whichever way it travels.