Sergey_P

Wolfe Research is bullish on U.S. stocks (NYSEARCA:SPY), (SP500) in 2025 and expects U.S. GDP growth to be solid, as well as financial conditions to remain loose and consumer spending to stay resilient, according to their 2025 Market Outlook report.

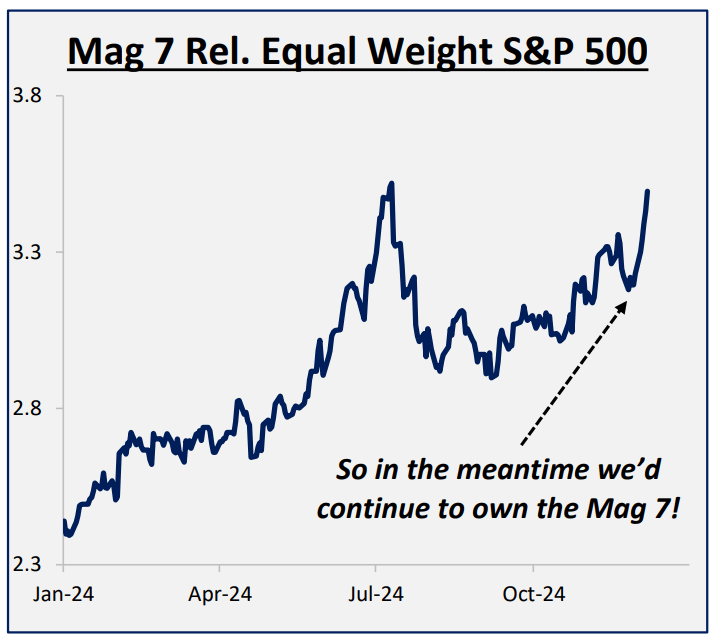

Analysts expect three interest rates cuts by the Fed in 2025, inflation to trend down towards 2% by 2025’s year-end, 2.5% real GDP growth, S&P 500 (SP500) earnings at $250 in 2025 and $305 in 2026, 22x 2026 EPS, and for the Magnificent seven stocks – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), Tesla (TSLA) – to resume their leadership and outperformance.

Credits to Wolfe Research Portfolio Strategy.

“Market concentration remains very elevated, with the top five companies in the S&P 500 (SP500) comprising 26% of the index,” wrote Chris Senyek, chief investment strategist at Wolfe Research. “We don’t see this dynamic changing until either the other side of the next recession and/or if AI enthusiasm substantially wanes.”

Here are other sector/style preferences:

- The Mag 7 (MAGS) over equal weight (RSP)

- Cyclicals (GMAEX), (PEZ) over quality (QUAL)

- Early cyclicals over defensives

- U.S. (SPY) over rest of the world (DBAW), (DFAX)

- Growth (SCHG), (SPYG), (IWF) over value (IWN), (IWD), (IWS), (IVE), (IJS), (SPYV)

- SMID (SDVY), (SMOT) over large (SP500)

Subsectors to own and their top quant-rated stocks:

- Semis (SMH), (SOXX) – Credo Technology (CRDO); Rigetti Computing (RGTI); TSM (TSM)

- Interactive media – (SOCL), (ESPO) – Travelzoo (TZOO); Bilibili (BILI); Outbrain (OB)

- Online retail, (IBUY), (ONLN) – JD.com (JD); Global-E Online (GLBE); Amazon (AMZN)

- Home improvement (ITB) – The Home Depot (HD); Lowe’s Co. (LOW); Floor & Décor Holdings (FND)

- Banks (KBE), (KBWB) – Grupo Supervielle (SUPV); Wells Fargo (WFC); Mizuho Financial (MFG)

- Rail transport (IYT), (XTN) – Norfolk Southern (NSC); Union Pacific (UNP); CSX Corp. (CSX)

Subsectors to avoid and their lowest quant-rated stocks:

- Pharmaceuticals (PJP), (XPH), (PPH) – PainReform (PRFX); NLS Pharma (NLSP); Traws Pharma (TRAW)

- Chemicals (FSCHX) – Mativ Holdings (MATV); Tronox Holdings (TROX); Orion (OEC)

- Integrated oil (PXJ) – Repsol (OTCQX:REPYY); Ecopetrol (EC); Cenovus Energy (CVE)

- Food (PBJ), (FTXG) – Grocery Outlet Holding (GO); BRC (BRCC); Westrock Coffee (WEST)