The S&P 500 Industrial Index (SP500-20) sector reversed its Q2 loss and was sharply higher in Q3, with the index being the third-largest gainer among the 11 sectors. S&P 500 Industrial Index (SP500-20) gained 11.15% during the quarter along with its accompanying ETF, The Industrial Select Sector SPDR Fund ETF (NYSEARCA:XLI) gaining 11.13% almost double from the S&P 500 benchmark index gain of 5.53%.

Industries Q3 Performance

Among Industries, S&P 500 Capital Goods Index (SP500-2010), which contributed highest to the index gained 13%, S&P 500 Commercial Professional Services Index Industry (SP500-2020) climbed 9% and S&P 500 Transportation Index (SP500-2030), which includes airlines, is up 5%.

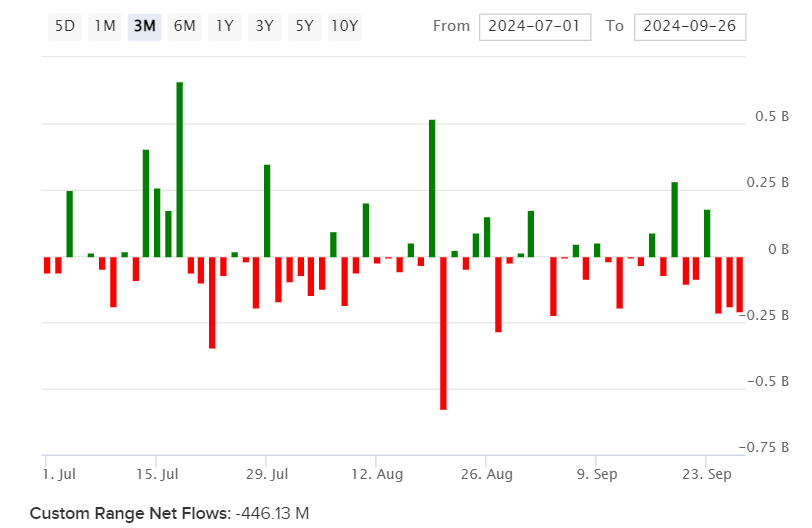

Fund Flows

Image Source: etfdb.com

XLI has $19.62 billion in assets under management as of September 30, 2024. XLI registered net outflows of $446.13M during Q3.

Top gainers

GE Vernova (NYSE:GEV) +48.67%.

Builders FirstSource (NYSE:BLDR) +40.06%.

Stanley Black & Decker (NYSE:SWK) +37.85%.

Axon Enterprise (NASDAQ:AXON) +35.81%.

3M (NYSE:MMM) +33.77%.

Top losers

Boeing (NYSE:BA) -16.47%.

FedEx (NYSE:FDX) -8.72%.

Jacobs Solutions (NYSE:J) -6.31%.

PACCAR (NASDAQ:PCAR) -4.14%.

Copart (NASDAQ:CPRT) -3.25%.

What Quantitative Measures Say

Seeking Alpha’s Quant Rating system gives Industrial Select Sector SPDR Fund ETF (XLI) a Buy rating, with a score of 4.14 out of 5, boosted by A+ ratings in its liquidity, A for momentum, expenses, and dividends categories. Notably, the ratings’ system sees risk as a threat and assigns the ETF a grade of D in this category.

What Analysts Expect

Seeking Alpha analysts gave (XLI) a Buy rating with a quant score of 4.0.