Summary:

- Microsoft owns 33% of OpenAI, and ChatGPT 4 now has 720 plugins available, allowing it to access the internet, search scientific studies, Wolfram Alpha, scan PDFs, and create charts.

- ChatGPT 4+ is a potentially revolutionary research and productivity tool that Microsoft is already incorporating into new subscriptions and planning to roll out enhanced Office365 products this year.

- Evercore ISI estimates that OpenAI integration into its products could boost MSFT’s annual sales by $100 billion by 2027, increasing sales growth from 13% annually to 20%.

- Microsoft’s earnings growth rate could soar from 12% to 26%, increasing today’s 2030 potential total return consensus from 105% to 340%.

- Microsoft is trading at a 16% premium and pricing in most growth through 2025. This article shows you at what price Microsoft is a reasonable buy and what price you should back up the truck to potentially achieve 561% total returns.

Mykola Sosiukin

This is part 6 of a 10-part series on safely and prudently investing in AI, the potential future of everything. The series will be completed in September.

- 11 Billion Reasons To Buy Nvidia, And 2.2 Trillion Reasons To Sell

- 1.3 Trillion Reasons Microsoft Is A Must-Own World-Beater AI Dividend Blue Chip.

- Google Vs. Meta: One Could Dominate The Future Of Everything

- Amazon: The Hype Is Right

- Brookfield Is The Best 4% Yielding AI Blue-Chip You Can Buy

————————————————————————————-

In the following article, a full deep dive into the promises and perils of AI, I also showcased why ChatGPT is considered the gold standard of generative AI chatbots.

The biggest downside to ChatGPT was its lack of access to new information since its training data ended in September 2021. That is something that OpenAI and developers have corrected with Plugins.

But I’m sure by now you’re tired of hearing me talk about AI and management teams, too.

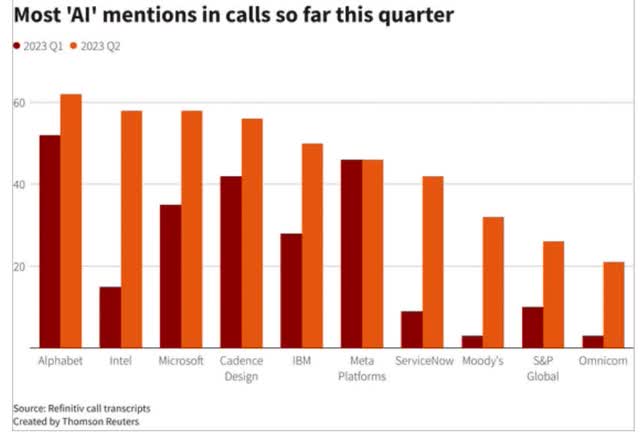

AI is all the buzz, with everyone and their grandmother claiming it will be the next big thing and turn them into a hyper-growth company. Microsoft validly claims to be a leading AI company, owning 33% of OpenAI and integrating the tech into its products.

But what if I told you AI might be a game-changer for Microsoft? Let me show you how it could potentially double this company’s growth rate!

100 Billion Reasons You Want To Own Microsoft

ChatGPT 4 with plugins is a fantastic research tool. YouTube is full of free academies of people teaching you how to import PDFs, build charts, and do advanced analyses.

But I’m sure you’re thinking, “How much of a needle-moving opportunity is generative AI like ChatGPT for a company the size of Microsoft”?

Is this like those articles about how Verizon (VZ) is a “5G play”? While, technically, Verizon is heavily involved in 5G, analysts do not believe that 5G will make Verizon grow faster.

Or how about Procter & Gamble (PG)? PG says it will use AI to become more efficient and profitable like all large companies. But that doesn’t make PG an AI stock that will grow twice as fast or support a permanently higher valuation.

But here is the reason I am writing this update article on Microsoft’s AI efforts.

Microsoft, not OpenAI, owns the mega-computers that enable the chatbot to compose a sonnet about your cat or write a thank-you note to your uncle. Microsoft is OpenAI’s largest shareholder, financial backer, and key technology partner. And to a great extent, it’s Microsoft now responsible for turning ChatGPT’s buzz into a real business.” – Bloomberg

My thesis around Microsoft being a leading “AI play” is that it will potentially one day buy OpenAI and fully integrate ChatGPT and its other AI programs into Microsoft’s ecosystem.

That will allow future versions of OpenAI’s generative AIs to become supercharged.

The lead that ChatGPT 4 has today could be maintained.

Then, Microsoft could take that lead in AI and sell it to customers via a monthly recurring revenue stream.

This is the key to MSFT as an “AI play.” Being able to make serious money off this super cool technology has the potential to change the world.

How AI Could Double Microsoft’s Growth Rate, $100 Billion In Extra Annual Sales

OpenAI’s ChatGPT Plus was the first attempt to monetize this incredible technology. Reuters reports that OpenAI expects to generate $200 million in revenue in 2023 and $1 billion in 2024.

That’s impressive growth, though reasonable people can argue whether Microsoft investing $10 billion more into OpenAI at a $30 billion valuation, and thus 30X 2024 projected sales is a good idea.

- MSFT paid 150X forward sales for 30% of OpenAI

Is this investment going to go down in history as Google buying YouTube? Or Altria buying Juul? Is this another LinkedIn acquisition for Nadella? Or AT&T buying TimeWarner?

It’s still too early to say, but MSFT’s $30 billion valuation on OpenAI might be one of the smartest financial moves in corporate history.

The company’s GitHub Copilot tool, which suggests new lines of code to computer programmers, was its first paid offering and has attracted more than 10,000 companies as customers.” – Bloomberg

OpenAI’s ChatGPT Plus was the first attempt to monetize this incredible technology. But MSFT is now monetizing this technology and generating monthly recurring revenue.

OK, so Microsoft has 10,000 developers paying it $10 per month for AI that helps them write better code. That hardly moves the need. It’s just $1.2 million per year for a company with annual revenue of $205 billion.

But this is just the beginning.

Over the past several months, Chief Executive Officer Satya Nadella has announced plans to incorporate other Copilots into Windows (where they’ll rewrite, summarize and explain content) and its Microsoft 365 office suite (where they’ll create slide decks in PowerPoint, sift through emails in Outlook and make charts based on Excel data).” -Bloomberg

Now we’re cooking with gas. Copilots hooked up to OpenAI’s generative AI technology, helping to supercharge the usefulness of Office.

There’s no point in hyping technology for technology’s sake,” Nadella says. “All of these technology shifts are only useful if they do something in the real world.” – Bloomberg

As a future MSFT shareholder, I can say to Nadella, “Amen! Preach, brother, preach!”

Okay, so Nadella is taking the smart approach and trying to hook ChatGPT into Microsoft’s ecosystem. But what does that mean for the company’s top line? How much can it make from Office Copilot subscriptions?

GitHub’s version starts at $10 per user per month, and Copilots for Microsoft’s office apps could be similarly priced, translating into as much as $48 billion in extra annual revenue within the next four years, according to Kirk Materne, an analyst with Evercore ISI.” – Bloomberg

Oh, now we’re talking about some needle-moving revenue potential.

Evercore ISI thinks MSFT could boost its annual sales growth rate by 5% annually from selling enhanced Office365 subscriptions alone!

But wait, that’s just Office365; what could selling Copilot subscriptions to all of Microsoft’s services potentially mean?

In a research note published on June 2, he estimated that Microsoft’s revenue from OpenAI-powered features could hit $99 billion by 2027.” – Bloomberg

Naturally, this is just one analyst’s forecasting model. It’s not the gospel truth, and I can’t estimate how likely this forecast for $100 billion in AI revenue is.

But here is what I can tell you.

If Evercore is correct and Microsoft executes OpenAI integration well, then Microsoft’s sales growth would accelerate by 9.5% annually through 2027.

- 2023 sales consensus: $223 billion

- 2027 sales consensus: $346 billion

- consensus sales growth rate: 13% CAGR

- 2027 Evercore POTENTIAL sales: $445 billion

- AI POTENTIAL sales growth rate: 20%

Microsoft is a highly efficient business able to boost EPS growth above sales through buybacks and economies of scale.

What kind of leverage does MSFT in the Nadella era have?

- Nadella era sales growth: 11.8% CAGR

- Nadella Era EPS growth: 15.3% CAGR

- MSFT has been leveraging sales growth 1.3X under Nadella

Assuming Nadella can maintain the leverage ratio, then a 20% sales growth rate, powered by AI, could translate into 26% EPS growth for Microsoft through 2027.

Boom, there’s a 100% boost to growth courtesy of AI.

Is AI a potential changer for MSFT? According to Evercore ISI, it might be.

What about other analysts? Does anyone else think that Microsoft might get a long-term EPS boost from AI?

- Deutsche Bank: 13.2% CAGR

- Oppenheimer: long-term growth forecast 17.0% CAGR

- Wells Fargo: 20.0%

- unknown analyst (restricted data): 25.0%

Now, are these super bullish analyst forecasts all based on AI? Probably not entirely, but it certainly looks like a strong case can be made that Microsoft could potentially be facing another blockbuster decade.

At least in terms of fundamentals.

This Price Is Still Too High To Pay For Microsoft AI

Microsoft is overvalued, almost certainly.

- NVDA, MA, and ADBE historically trade at 30 to 35X earnings

- MSFT MIGHT potentially be able to sustain the same level of premium

- If it achieves Evercore’s POTENTIAL AI sales forecasts

| Metric | Historical Fair Value Multiples (11-Years, Nadella Era, New Business Model) | 2022 | 2023 | 2024 | 2025 | 2026 |

12-Month Forward Fair Value |

| Earnings | 24.65 | $227.27 | $254.70 | $290.45 | $345.06 | $389.88 | |

| Average | $227.27 | $254.70 | $290.45 | $345.06 | $389.88 | $280.82 | |

| Current Price | $325.59 | ||||||

|

Discount To Fair Value |

-43.26% | -27.83% | -12.10% | 5.64% | 16.49% | -15.94% | |

| Upside To Fair Value | -30.20% | -21.77% | -10.79% | 5.98% | 19.75% | -12.91% | |

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward PE | Current Forward PE |

Current Forward Cash-Adjusted PE |

| $10.40 | $11.86 | $2.80 | $8.67 | $11.47 | 24.5 | 28.4 | 19.7 |

If MSFT does double its growth rate over the next few years, then MSFT will make a good investment today.

You could lose about 10% adjusted for inflation if it doesn’t.

MSFT has priced in all the growth analysts expect through 2025.

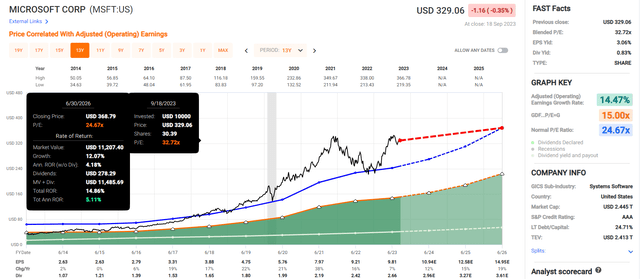

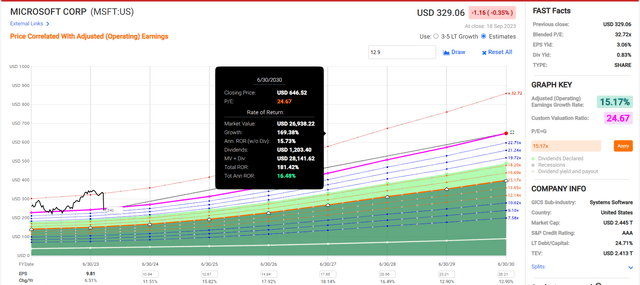

Microsoft 2029 Consensus Total Return Potential (Current Price, 16% Premium)

- Evercore model: 26% CAGR = 340%

You’re still likely to make decent and possibly even market-beating returns if you buy MSFT today.

But here is what you could make if you buy MSFT at a fair price or better.

| Rating | Margin Of Safety For Low-Risk 13/13 Ultra SWAN Quality | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $256.57 | $292.59 | $282.89 |

| Potentially Good Buy | 5% | $243.74 | $277.96 | $268.74 |

| Potentially Strong Buy | 15% | $218.08 | $248.70 | $240.46 |

| Potentially Very Strong Buy | 25% | $182.80 | $219.44 | $212.17 |

| Potentially Ultra-Value Buy | 35% | $166.77 | $190.18 | $183.88 |

| Currently | $325.31 | -26.79% | -11.18% | -15.00% |

| Upside To Fair Value (Including Dividends) | -20.21% | -9.14% | -12.12% |

Here is the consensus return potential for MSFT if you buy at fair value or better:

These are not price targets! I am not predicting MSFT will fall to these prices!

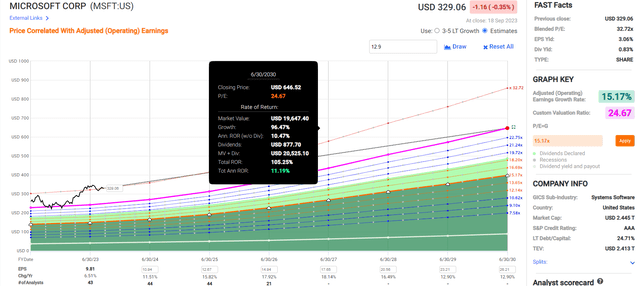

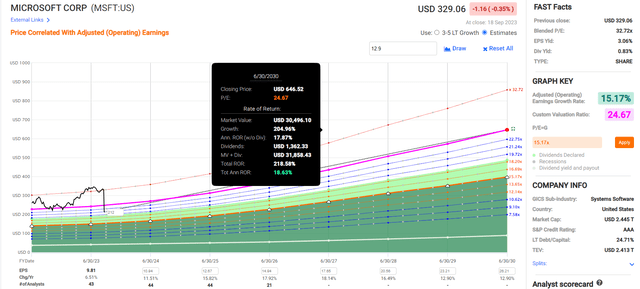

Microsoft 2030 Consensus Total Return Potential (Fair Value, $283)

- Evercore potential AI boost: 28% annual returns = 340% total return

In other words, if you buy MSFT at fair value, analysts think you might make 14% annual returns or 138% by 2029. If Evercore is right, it might be 340% and 28% annual returns.

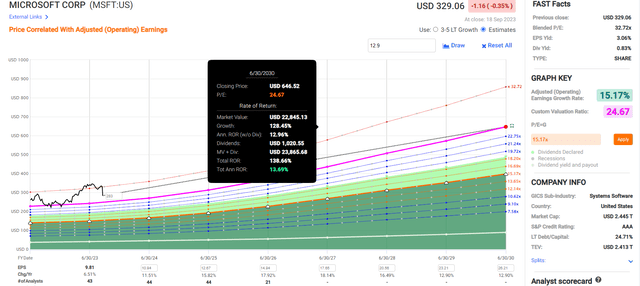

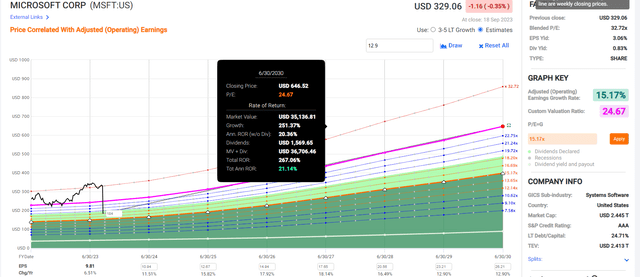

Microsoft 2030 Consensus Total Return Potential (Strong Buy Price, $240)

If Microsoft becomes 15% undervalued, the consensus total return potential jumps to 181% or 17% annually.

- Evercore potential AI boost: 31% annually = 405% total return

Microsoft 2030 Consensus Total Return Potential (Very Strong Buy Price, $212)

If Microsoft becomes 25% undervalued, then the consensus total return potential jumps to 219% or 19% annually.

- Evercore potential AI boost: 34% annually = 480% total return

Microsoft 2029 Consensus Total Return Potential (Ultra Value Buy Price, $184)

If Microsoft becomes 35% undervalued, the consensus total return potential jumps to 267% or 21% annually.

- Evercore potential AI boost: 37% annually = 561% total return

Bottom Line: Microsoft Could Double Its Growth Rate With AI, Get Ready To Back Up The Truck

- MSFT’s consensus sales growth through 2027 is 13%.

- Evercore ISI thinks that Nadella’s announced plans for integrating ChatGPT tech into its ecosystem could boost that to 20%, an extra $100 billion per year in monthly subscription revenue by 2027.

- Including buybacks, MSFT has the potential to double its growth rate to 24% using this technology.

- Boosting MSFT’s total return potential from 105% by 2030 to 340%

According to one analyst, at least. Is that enough to justify my family’s future 5% allocation (when we can afford to switch the portfolio) or 7%, including ETFs? I would say yes.

- Just buy at fair value of $283

- currently, 16% overvalued and a “hold”

According to the analyst consensus, if Evercore is wrong, long-term MSFT makes “just” 14% long-term.

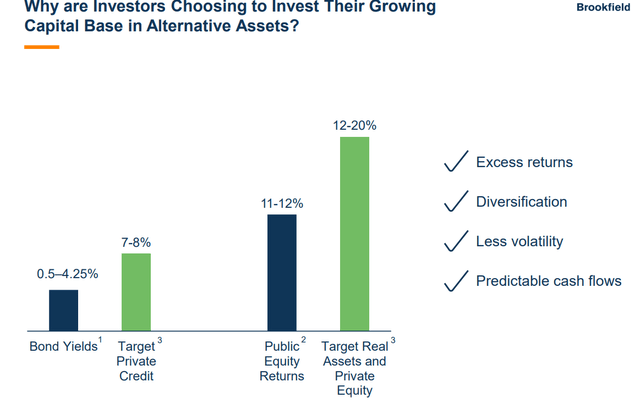

12% to 20% returns are what private equity investors are paying 2% to 6% fees for companies like Brookfield to generate.

At fair value, MSFT yields 1%. That means you can earn private equity-like returns while getting paid 1%, or 3% to 7% lower fees than the world’s richest and most powerful institutions are currently paying.

If Evercore is right, MSFT becomes the world’s most valuable company.

Heads we win, tails we don’t lose.

This is an example of a smart, low-risk way to profit from AI. Buy companies so wonderful and strong that buying them as “AI plays” is only a question of how much long-term money you’ll make, not whether you’ll make money.

There are two times in a man’s life he should not speculate. When he can’t afford it, and when he can.” – Mark Twain

Right now, AI is a speculative mania.

Charlie Bilello

The Nasdaq soared 8% in May alone, and pure bubble stocks like C3ai more than doubled.

This is not rational; this is crazy. This will end in tears; it’s just a matter of time.

Almost Enough To Make You Question Your Sanity…Almost;)

Do not fall victim to the dangerous greater fool theory that “no price is too high to pay for AI.”

ChatGPT is impressive tech, and it could change the world. But that doesn’t mean you can or should pay any price for AI stocks.

Invert, always invert.” – Charlie Munger

This is a new technology, and we don’t yet know the final productivity and growth-boosting effects.

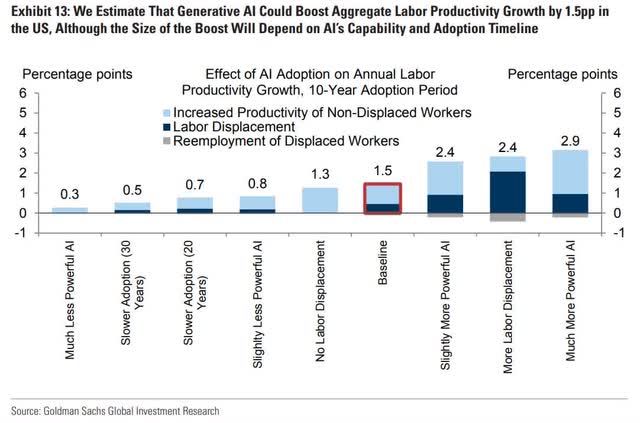

The benefits to productivity and GDP growth range from 0.3% per year to 2.9%.

In other words, do not buy stocks chasing the AI hype bubble that will collapse unless the best-case scenario is realized.

Currently, speculators are paying absurd valuations that could result in 70% to 90% permanent losses.

My family charity fund will eventually invest in AI in a big way—30% to 33% exposure to the world’s best AI companies.

- 25% direct ownership of six AI companies

- and 5% to 8% through core ETFs

But we’re doing it the smart way. If Microsoft’s AI sales aren’t $100 billion in 2027? They will be something. And even if they are zero, MSFT is still expected to grow sales by 13% annually in the coming years.

AI is a pure “cherry on top” of already impressive growth.

If you want the lowest-risk way to profit from the AI revolution, then AAA-rated Ultra SWAN future aristocrat Microsoft, at fair value or better ($282), is the closest thing to a risk-free AI investment.

According to S&P, Fitch, and Moody’s, anyone buying MSFT today has a 0.07% chance of losing all their money in the next 30 years.

- what AAA-stable credit ratings mean

That’s a 1 in 1,429 chance, lower than the US Treasury’s risk of default.

The bottom line is that given its safety and quality and 13% long-term consensus total return potential, Microsoft is as close to a “must own” dividend growth world-beater as it exists.

And with the potential to double its growth rate through AI, that makes the investment case even stronger.

If you’re not invested in Microsoft, either directly or through funds, you’re simply doing long-term investing wrong.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own MSFT via ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my family’s $2.5 million charity hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.