Summary:

- The improving macroeconomic environment can benefit PepsiCo’s financial performance. Gasoline and raw material prices have been declining in the recent months, which could positively impact PEP’s margins.

- China’s “reopening” may fuel demand growth in Asia.

- FX headwinds are not likely to be as significant as in 2022.

- For these reasons, we upgrade PEP to “buy”.

LoveTheWind/iStock via Getty Images

PepsiCo, Inc. (NASDAQ:PEP) manufactures, markets, distributes, and sells various beverages and convenient foods worldwide. We published an article on Pepsi in June, 2022, titled: “We Are Staying Away From Pepsi For Now”. Back then, we rated Pepsi’s stock as “hold” due to the following reasons:

- Overvaluation according to the traditional price multiples.

- Macroeconomic headwinds have been expected to negatively impact the firm’s margins.

- On the other hand, PEP has a strong track record of returning value to its shareholders through dividends and share buybacks.

Since our writing, PEP’s stock price has increased by about 4%, outperforming the broader market, which has declined by 5% over the same period.

Analysis history (Seeking Alpha)

Today we are revisiting our previous thesis on Pepsi to provide an update on the main factors that have been the driver for our neutral rating earlier.

Macroeconomic environment

While the macroeconomic environment is expected to remain challenging in the first half of 2023, there have been improvements across many factors that we have been analysis last year.

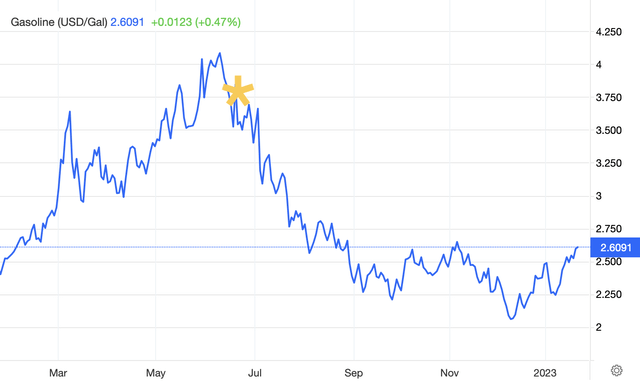

Gasoline prices

Gasoline prices in the past six months have fallen substantially in the United States. Gasoline prices have a substantial impact on the freight costs, therefore declining prices could have a substantial positive impact on the costs and therefore on the margins.

Gasoline price (USD/Gal) (Tradingeconomics.com)

While the gasoline price may remain volatile in 2023, we do not expect a dramatic increase in the near term.

Food commodities

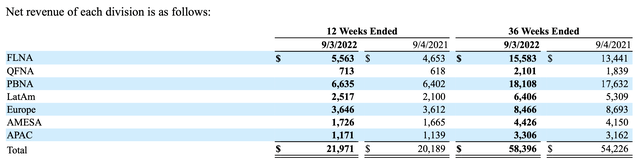

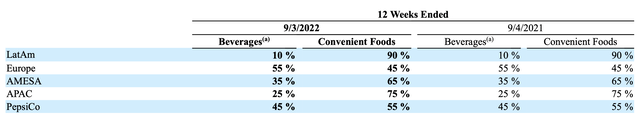

As Pepsi generates a substantial portion of its revenue in the convenience foods segment, prices of food commodities could influence their margins and earnings per share in the near term.

Percentage of revenue by product type (Q3) (PEP)

In our previous article, we have been focusing on wheat and corn prices, so we will be looking at these two commodities again.

Wheat price (USD/Bu) (Tradingeconomics.com) Corn price (USD/Bu) (Tradingeconomics.com)

The prices of both of these commodities have been developing favorably in recent quarters. In our opinion, this is likely to have a positive impact once again on PEP’s costs and therefore its margins.

FX environment

Due to the relative strength of the USD compared to other currencies, many firms have been having substantial FX headwinds in 2022. While Pepsi is generating a substantial portion of its revenue in North America, the international segment has also a meaningful contribution to total revenue. For this reason, the relative strength of the USD is an important factor for the firm’s financial performance.

The Dollar Index peaked in Q4 2022 and since then it has been gradually declining.

Dollar index (Tradingeconomics.com)

In our view, going forward, the relative weakening of the USD in recent months is likely to have a positive impact on the company’s sales in the coming quarters.

All in all, we believe that the macroeconomic environment has somewhat improved in recent months and this could potentially positively impact Pepsi’s financial performance in the coming quarters.

The reopening of China

Another reason why we are becoming more optimistic on PEP stock is the reopening of China. China has been following its zero Covid strategy for quite a while, but in recent months it has decided to gradually lift the restrictions. This is likely to have a positive impact on China’s economy and the country’s economic growth.

In our view, this is likely to increase the demand for Pepsi’s products in Asia. Although the APAC region is one of the smallest contributor to Pepsi’s revenue (as of Q3 2022), its growth could have a material impact on the company as a whole. For this reason, we are also turning more bullish on Pepsi’s stock.

Risks

Before concluding our analysis, we would like to mention a company specific risk that could have an impact on the share price in the near future.

This risk is the preliminary probe initiated by the Federal Trade Commission (FTC) with regard to potential price discrimination. Coca-Cola, Pepsi’s competitor is also being probed. At this moment, we do not see a high chance for a negative outcome, as it could potentially lead to increasing prices for consumers, which the FTC is not intending to do. At this point, BofA analysts also believe that the likelihood of a negative outcome is relatively low:

While the retail prices are making headlines (and potentially drawing scrutiny from regulators) the margins for KO and PEP in the US are compressing as the price increases have not caught up to inflation. This makes it difficult to draw a line from higher prices to some anti-competitive behavior.

For this reason, this probe does not severely influence our bullish view.

Other risks include:

High valuation – it could be justified right now as the market appears to be improving. However, if PEP will miss its estimates and targets , the price multiples may start contracting.

Competition – While competition is always a concern in the beverage- and food industry, we believe that brand awareness is the single most important factor inn this market. In our opinion, PEP has a loyal customer base and they will likely be able to keep their market share in the near future.

Key takeaways

While Pepsi keeps trading at relatively high price multiples compared to the consumer staples sector medians, we believe that in the slowly improving macroeconomic environment the premium may be better justified than in 2022. As the consumer sentiment in the U.S. and around the globe continues to be poor, firms in the consumer staples sector are still likely to remain a good bet for 2023. The reopening of China is also making us more optimistic. For these reasons, we are upgrading Pepsi’s stock to buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.