Summary:

- Intel was a risky decision for a top investment; however, we felt the company had crossed the line into being substantially undervalued.

- The company has strong “home field” support as the most technologically advanced U.S. foundry/chip producer.

- The company remains on track for its goals of N4/N3 production, but the ramp and final sales to customers will be the telling step.

- At the end of the day, financials are what makes an investment, so we expect, over the next few years, Intel will improve its business and generate stronger shareholder returns.

Justin Sullivan

At the start of the year, we recommend Intel (NASDAQ:INTC) as our top investment recommendation for the year. Since then, the company has generated almost 15% in total returns, versus the benchmark of less than 5%. As we’ll see throughout this article, the company’s aggressive focus on success across its business lines makes it a valuable investment.

Intel Xeon Demand

Despite the arrival of other forms of more specialized compute card, and the rise of GPUs for AI, compute still forms the backbone of technology.

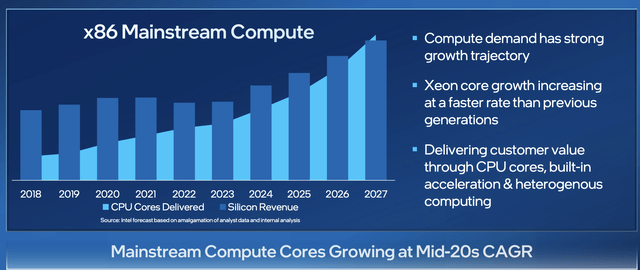

Intel Xeon Demand – Intel Investor Presentation

CPU cores delivered are expected to continue increasing. However, supported by Xeon core growth increasing faster than previous generations, silicon revenue is expected to start increasing in 2024. CPU cores, especially with Intel’s model of E-Core vs. P-Cores that can take advantage of more specialized tasks.

The company’s 4th generation Xeon arrived with incredibly strong customer adoption. The company has 50+ OXMS shipping and 450 design wins and seeing adoption increase faster than other businesses.

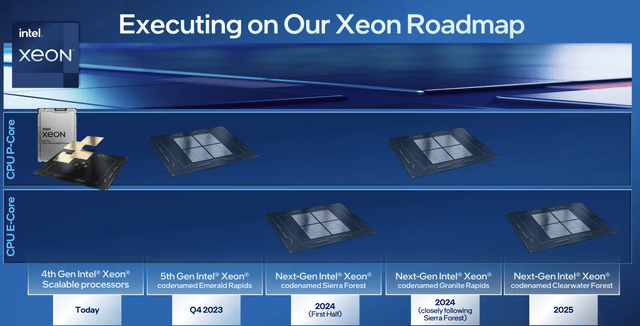

Intel Xeon Roadmap

Intel Xeon’s roadmap highlights the company’s goal to pass TSMC and offer unparalleled technology.

The key for Intel Xeon is the upcoming Sierra Forest and Granite Rapids both slated to come out next year. Sierra Forest at the start of the year is expected to be the lead vehicle for Intel 3 with up to 144 cores and the first node on N3. Granite Rapids is expected to have N3 on the P-Cores. Clearwater Forest in 2025 will be on an 18A node.

Intel’s future success will depend on these processors. Should the company manage to accomplish this it should hit parity with TSMC next year and go past the company in 2025. It’s an impressive accomplishment that will revitalize the company and is central to the thesis of continued success.

The company has been hurt in recent years by the growing trend of customers to move production towards TSMC while designing their own ARM (or perhaps RISC-V) cores in house. However, there is one benefit to Intel. The company now has a single competitor, TSMC. If it can achieve higher transistor densities than TSMC it can outperform in speed and value to customers.

Intel Strategy

Intel’s strategy is to lead in process manufacturing which will enable the company to outperform overall.

The company has the goal of 5 nodes in 4 years. However, to accomplish that it needs to not only excel in developing the nodes, it needs to excel in ramping up production of the nodes, which is its own tough problem that needs to be solved. For the next two years, the company’s future depends on whether it can accomplish this goal.

The company now has spin-off businesses that can result from these goals and help. It’s working to close its acquisition of Tower Semiconductor for more than $5 billion with a new Intel 3 customer that could have more than $4 billion in lifetime value. The company is also working to grow its accelerator and newfound GPU businesses to help increase shareholder returns.

The first step in the company’s strategy and success is whether it can successfully launch Intel 4 by year-end.

Intel Financial Highlights

Intel had a rough year in 2022 and with an overall downturn it expects to continue underperforming in 2023.

The company had $63.1 billion in 2022 revenue at a 47.3% gross margin. Revenue decreased by 16% YoY while gross margin decreased by 10.8%, leading to $1.84 in EPS or a 65% YoY decrease. That gave the company a P/E ratio of roughly 16, but it also highlights the negative impact of both decreasing revenue and gross margins.

The company sees long-term TAM at roughly 300 million units but its forecast for 2023 is lower TAM. In the 1Q 2023, the company expects continued struggle with $11 billion in revenue (a 40% YoY decrease) and 39% gross margins resulting in EPS of -$0.15 / share. In general the expectation is that 2023 will be an especially difficult year before the industry improves.

Our View

Intel has a unique portfolio of assets.

The company is the foundry leader in the United States, something that the U.S. government is willing to support. Government support of semiconductor companies is in the $10s of billions and we expect Intel with its new factories to be one of the largest benefactors. At the same time, Intel is working to re-accomplish its node dominance.

We expect the company, despite its historical troubles, will be able to accomplish its node dominance. Assuming it can, as the PC market recovers, we expect shareholder cash flow and returns to increase substantially. Intel cut its dividend 66%, but it still has an almost 2% yield that can generate returns along with other forms of shareholder returns.

Thesis Risk

The largest risk to our thesis is what we have discussed numerous times, whether Intel can continue to allocate capital efficiently and achieve its strategy for 5 nodes in 4 years. The company has historically failed to achieve these new development goals so it remains to be seen whether or not the company can succeed.

Conclusion

Intel was originally our top recommendation for 2023, a risky proposition. That’s because the company’s ability to outperform really depends on whether it can accomplish its main goal, which is release N4 before the end of the year. We expect that the company’s continued guidance indicates that that’s likely, but the company has struggled with ramp going forward.

Should Intel accomplish its goals, the concentration of customers with TSMC could help it significantly. Those customers that have moved away from Intel are now heavily attached to TSMC and there’s not a lot they can do if TSMC’s technology falls behind. That can result in Intel growing past its prior levels of strength.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.