Summary:

- Pfizer Inc. stock has plummeted due to collapsing revenues after the COVID-19 pandemic, but COVID-related sales are still meaningful.

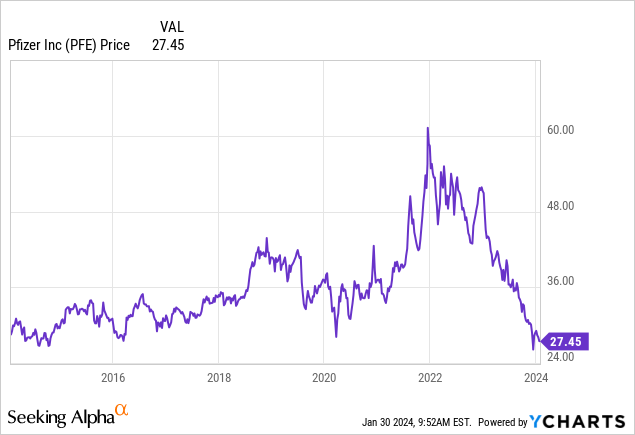

- The stock is near a 10-year low but may be on the verge of a turnaround in 2024, with potential support from a 6% dividend yield.

- Pfizer’s revenues have declined by 42% annually, but a return to growth is in store.

- Consider some bottom fishing on this long idea.

grandriver

Pfizer Inc. (NYSE:PFE) has fallen out of favor with investors. The stock has been crushed, but it is on the back of collapsing revenues, now that we are out of the COVID-19 pandemic. You may be surprised to know, but COVID-related sales are still in excess of $5 billion a quarter between vaccination and anti-COVID treatment Paxlovid. Now that sales are normalizing, the company must focus on its other treatments, and its future pipeline, to get its mojo back. The collapse in shares is so remarkable one has to wonder if this is primed for a turnaround in 2024.

The stock is essentially teetering around 10-year lows. The chart “suggests” support here. From a valuation standpoint, even with the collapse in sales, shares are relatively attractive to be on a rebound in the coming year. Of course, should operations erode further, then we may look back and say that this was a value trap, but at this point, the stock is worthy of consideration for a place in the income section of your holdings. It has been beaten down so much it is now a high income stock, yielding 6%. We suspect this level of a dividend provides a bit of a floor, in conjunction with the 10-year chart support.

Today the company just reported its results, and it shows that sales were down mightily from a year ago as expected, despite better than expected sales. The guidance however was relatively positive. We think shares are pretty much bottoming out here, though we do not necessarily expect a major rally. That said, we do see it as attractive for income at these levels after the shellacking for pretty much two years straight. Let us discuss.

You almost have to see it to believe it. If one said to us around Christmas of 2021 that in two years the stock would have fallen some 60%, on the back of cratering sales, we may not have believed it. Yet here we are. Q4 revenues were down 42% from a year ago to $14.2 billion, from $24.3 billion. The quarterly trend of course is on pace with the annual declines. Annual revenue was $58.5 billion down from $100.3 billion last year, also falling 42%.

Why? Because “Comirnaty” sales have collapsed. Again, this is the COVID-related revenue. For the exact definition, well “Comirnaty” as per the definition refers to “the Pfizer-BioNTech COVID-19 Vaccine, the Pfizer-BioNTech COVID-19 Vaccine, Bivalent (Original and Omicron BA.4/BA.5), Comirnaty (COVID-19 Vaccine, mRNA, 2023-2024 Formula), the Pfizer-BioNTech COVID-19 Vaccine (2023-2024 Formula), Comirnaty Original/Omicron BA.1, Comirnaty Original/Omicron BA.4/BA.5 and Comirnaty XBB.1.5.” Of course, these sales were expected to fall heavily. This drove the 40% plus operational decrease in revenues versus last year.

So then we have to look at the other sides of the business. If we back out the COVID-related sales, we see that revenues grew 8% in the quarter, driven by new products, as well as growth of existing products. However, the revenue still whiffed on consensus by $150 million. For the year, we saw similar trends.

The company lost money on a GAAP basis, driven by one-time events, notably a $3.5 billion revenue reversal associated with Paxlovid. Operational expenses also did not come down in line with the collapse in sales. Cost of sales was down 22%, selling and admin expenses only came down 1% from Q4 2022, and research costs also came down 22%. However, given the sales nosedive, it is no surprise earnings followed suit dramatically lower. The company lost $0.60 per share, but on an adjusted basis for these one-time charges, the company earned $0.10. That actually surpassed estimates as the consensus was looking for losses.

So the COVID bump is behind us, so we have to look to the future pipeline and other lines of business. The first catalyst for growth is the Seagen acquisition which was just completed last month. This is a major step in the oncology line. In Q4, the oncology line generated $2.9 billion in sales, also slipping 3% from a year ago. Specialty care was up 11% to $3.9 billion while primary care was down 60% to $7.0 billion on COVID-related declines. So-called business innovations, which include global contract development and manufacturing added $382 million in revenue.

So where has the money been going, aside from the $43 billion Seagen acquisition. Well, $10.7 billion in 2023 was pumped into research and the pipeline. Another $9.2 billion went to the dividends, but given the massive hit to cash, no shares were repurchased in 2023 despite $3.3 billion on the authorization remaining. Further, management was clear that it does not anticipate repurchases in 2024. Perhaps a bit crass, but they cannot afford it with these declines.

Some recent events are noteworthy. First, Elrexfio to treat myeloma was granted marketing authorization in Europe. This month, the European Medicines Agency validated for review a variation application for Padcev and Keytruda in combination to help with urothelial cancer. The FDA in December approved this treatment in the U.S. following phase 3 results. Prevnar 20 was recommended for receiving marketing authorization for immunization for the prevention of diseases related to Streptococcus pneumoniae in infants, children, and adolescents. Talzenna, a prostate cancer drug was approved in Europe. While we will not go into detail the major pipeline drugs being worked on are Danuglipron for obesity, Marstacimab for hemophilia, Vepdegestrant for breast cancer, and VLA15 for Lyme disease.

As we look ahead to 2024, revenues are guided to grow from 2023 by 8-10% (excluding COVID and including Seagen). Overall revenues will be $58.5 to $61.5 billion. So that is overall flat to up about 6%. Factoring selling and admin expenses of $13.8 billion to $14.8 billion and research expenses of $11.0 to $12.0 billion, benefitting from a cost realignment program, management expects 2024 EPS of $2.05 to $2.25. This would be a 17% growth in EPS from 2023.

Take home

2024 is a return to growth for Pfizer. The situation compared to a few years ago is precarious, but the COVID bump was temporary. The company basked in the glory of all of those sales of products related to the pandemic. Now it is back to focusing on treatments for chronic and infectious conditions. The pipeline is being advanced, and the incorporation of Seagen, while costly, will be a long-term benefit. Given the 6% yield, with a dividend covered from cash flow, and the return to growth, we think investors can consider some bottom fishing for Pfizer Inc. shares here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.