Summary:

- 2U, the online education company, is struggling with declining enrollment and weak financial performance.

- The company has cut back on marketing, but this has further weakened its enrollment trends.

- 2U’s acquisition of edX has been popular but lacks the same monetization engine as its core degree programs.

- 2U has limited cash and a troublesome pile of debt, which makes its cash burn worrying.

AndreyPopov/iStock via Getty Images

So far, earnings season has been unkind even to tech companies that have posted good results. And for those that are still struggling under the weight of a macro recession and longer-term issues, this month has been even more of a challenge.

2U (NASDAQ:TWOU), the online education company, has been feeling that burn. Enrollment has been declining for years, defying the trend that macro recessions usually lead people back to school. In a bid to protect its bottom line, 2U has made the decision to cut back on marketing, but doing so has further weakened its enrollment trends. On the other hand, edX, the massive online-learning community that the company acquired in 2021, continues to be popular but lacks the same monetization engine as 2U’s core degree programs.

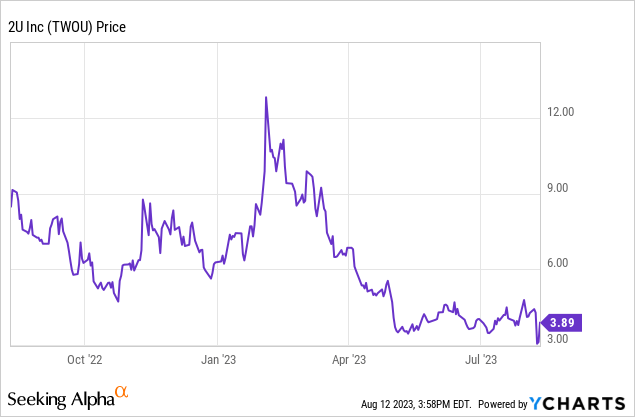

Year to date, shares of 2U have lost nearly 40%, and the stock is down ~10% since reporting earnings. In my view, there is no hope of a rebound here.

Despite recent efforts to turn around the business, 2U will remain challenged

My outlook on 2U is still very bearish. The company has struggled for years to make economies of scale work on its core degree programs. In recognizing the potentially flawed business model of setting up online courses for universities and shouldering the entire costs of both programming and marketing the course, 2U in recent years has turned more toward short-form courses and accreditations, building on the recent popularity of coding boot camps to sell less capital-intensive courses.

To its credit, 2U isn’t just doing nothing. In the degree program segment, the company is unveiling a new model that it calls “Flex”, which offers its university partners the option to shoulder more of the upfront cost but take more revenue share. In highlighting the mechanics of the program and its early traction with universities, CEO Chip Paucek noted as follows on the Q2 earnings call:

I want to highlight two notable degree developments. Our new signings are occurring at a pace that we’ve never seen before due to our recently unveiled flex revenue share model. We’re seeing a radical increase in demand for this model. This is part of our previously discussed rotation bringing in programs that meet a market need and have attractive pricing.

The new Flex model offers the university a variety of revenue share-based bundles to select from and has been a home run. We’ve really never seen anything like this. It allows us to aggregate degrees on the platform and bring in new programs that are attractive to students, either because the cost is lower, better pathways exist into the programs, or both.

Also note, this model is very CapEx-light compared to our full bundle as course build is not typically purchased by the university. Note, universities generally prefer the core flex model plus paid marketing netting out at 50%.

Demand for the flex model means we’re ramping up launches. I’m pleased to announce, that we’re doubling our degree cadence for 2024 launches, from our previously announced target of 25 programs to at least 50 programs.”

Still, 2U’s core issue has never really been about breadth of offerings, especially since the company acquired edX. Even if the company manages to roll out 50 new degree programs in 2024 (tripling its prior annual record of 17), the key question is whether the company can continue to attract enrollees and pack virtual classrooms at the density required to turn a positive ROI. Casting a broader net and offering more programs may help as long as 2U isn’t shouldering the upfront costs, but we haven’t seen any evidence so far that the company will be able to solve its enrollment issues.

The bottom line here: 2U still remains a beleaguered company and a high-risk investment. To me, this is a “show me” story that has very few catalysts for a rebound. Steer clear here and invest elsewhere.

Q2 download

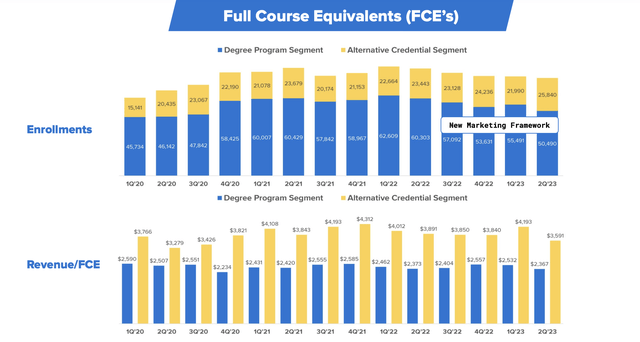

Let’s now go through 2U’s latest quarterly results in greater detail. The revenue and enrollment trends are shown in the chart below:

2U top-line metrics (2U Q2 earnings deck)

Focusing on the dark-blue bar chart above, enrollments in the degree program have been in free fall since Q1 of 2022. The company’s sequential loss of 5k net enrollees in the second quarter was the sharpest decline since degree enrollments started falling.

This was partially offset by an 18% sequential and 10% y/y increase in alternative credential enrollees to 25.8k, but note as well that revenue per FCE in the AC space also fell -14% sequentially to $3,591 (and down -8% y/y) – indicating that 2U is rotating into cheaper, shorter classes.

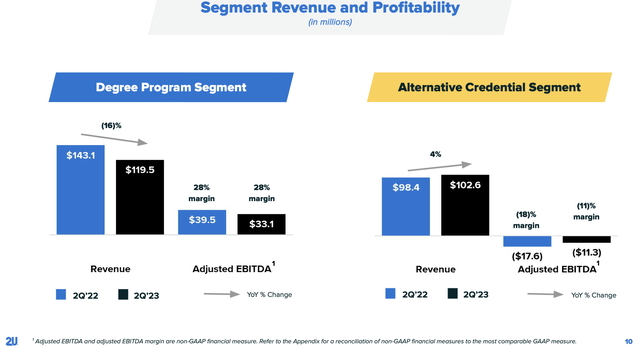

The chart below, meanwhile, showcases each segment’s revenue and profitability. Degree program revenue fell -16% y/y, while adjusted EBITDA margins remained flat at 28% (despite the cuts to marketing that shrunk the enrollee base in the first place), while alternative credential revenue grew only 4% y/y and still saw negative adjusted EBITDA margins. Total companywide revenue, meanwhile, declined -8% y/y to $222.1 million.

2U segment results (2U Q2 earnings deck)

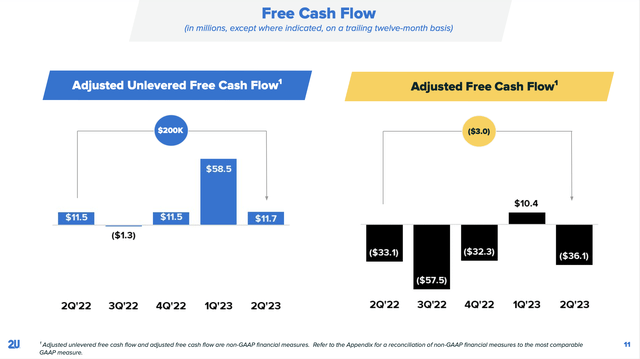

We should watch out for how these declining trends are impacting 2U’s cash position. Adjusted FCF in the second quarter stood at a -$36.1 million burn, roughly 10% greater than the year-ago FCF loss.

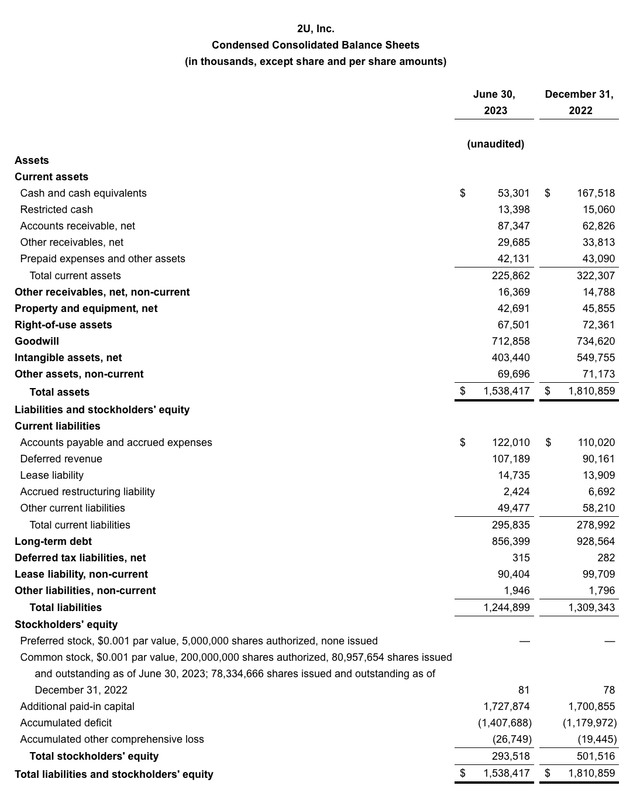

Meanwhile, as shown in the snapshot below, 2U has only $53.3 million of cash remaining on its most recent June quarter balance sheet. That cash position, meanwhile, is burdened by $856.4 million of debt:

2U balance sheet (2U Q2 earnings deck)

At its current burn rate, 2U will need to raise capital quite soon, in a market where interest rates on debt are at multi-year highs and 2U’s drastically weakened equity prices make an equity offering prohibitively dilutive.

Key takeaways

With multiple sequential quarters of revenue declines and enrollments dropping, it’s unclear if 2U will be able to get around its current cash crunch. The best move is to stay on the sidelines here and continue to watch 2U struggle from a safe distance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.