Summary:

- 2U, the online education company, continues to see declining enrollments threaten its survivability.

- The company’s revenue contracted -6% year-over-year in the first quarter, which doesn’t make its full-year growth outlook of 3% year-over-year look promising.

- The company is drastically slashing marketing spend to conserve its cash, but this may worsen the revenue problem.

- With less than $100 million on its balance sheet and a huge load of debt on its books, 2U looks incredibly risky.

SDI Productions

During a recession like this one, investors aren’t really looking to take chances with speculative companies – and 2U (NASDAQ:TWOU), the online education company that helps universities digitize their course content into online degree programs, has emerged as an incredibly risky proposition. Enrollments are down, the company’s acquisition of edX has not materially lifted its growth prospects, and the company is saddled with a tremendous load of debt.

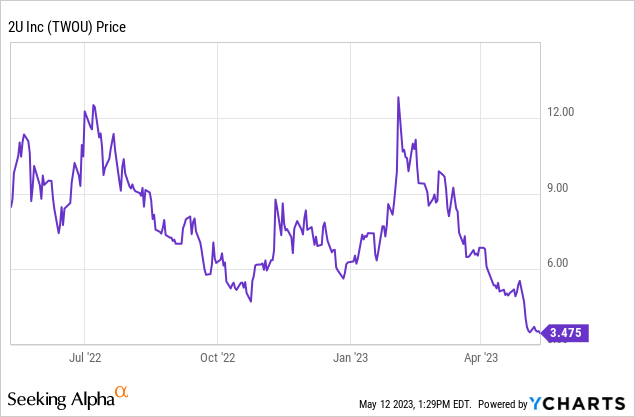

Against this backdrop, 2U recently posted dismal Q1 earnings that sent the stock into a fresh collapse. Now down more than 60% year to date, 2U is hanging on by just a thread.

I remain very bearish on 2U. For investors who are catching up to the latest on this stock: In a nutshell, 2U’s enrollments have been declining since the pandemic era. In order to survive the current recession, 2U has made drastic spending cuts, particularly in marketing and advertising – and while this is a prudent cash-conserving move in the short term, it may accelerate 2U’s decline.

The single biggest issue with 2U is the very premise of its business model: Taking over the responsibility of not only creating online course content on universities’ behalf, but also being primarily responsible for advertising these online degree programs and attracting students. 2U does not benefit from having a single brand across its courses to streamline its marketing spend, and it may take years for any given degree program to recoup its setup costs.

To refresh investors who are newer to this stock, here are the two biggest bearish concerns on 2U:

- 2U relies on economies of scale, and declining enrollment is a major red flag. As a reminder on how 2U’s partnerships with universities work, its core degree program calls for 2U to take the brunt of developing/digitizing course content then marketing programs to prospective students. 2U’s one-time course development and setup costs require economies of scale and full course seats in order to make up for the initial investment.

- 2U’s plan for profitability calls on relatively flat revenue for FY23. This may not be feasible if marketing spend is dropping double-digits. A sharper than expected decline in enrollments could sap away the expected margin gains that 2U is planning to achieve.

Now, in a recession, we would expect based on history that many professionals go back to school in order to upskill themselves while the economy is weak. If this is true at a macro level, we’re not seeing it in 2U’s individual results – even for its short-form courses that offer incredibly popular “coding bootcamp” classes that should be in high demand in the tech-centric workforce.

All in all, the situation is not trending in 2U’s favor. Steer clear here and watch the company’s implosion from the sidelines, and resist the temptation to catch a falling knife.

Enrollments fall yet again

In late April, 2U released Q1 results that showed “more of the same” – declining enrollments and decaying revenue. Take a look at the key enrollment trends below:

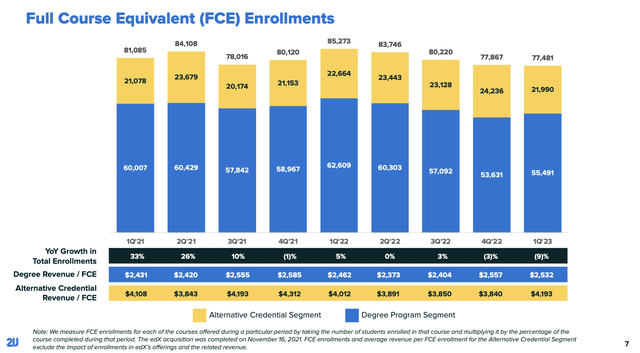

2U enrollments (2U Q1 earnings deck)

As can be seen in the chart above, total enrollments fell -9% y/y to 77.5k. Full degree programs enrollment fell by -11% y/y, while alternative credential programs fell -3% y/y. And as can also be seen in the trended charts above, 2U’s nominal enrollment counts have been falling sequentially since Q1 of 2022.

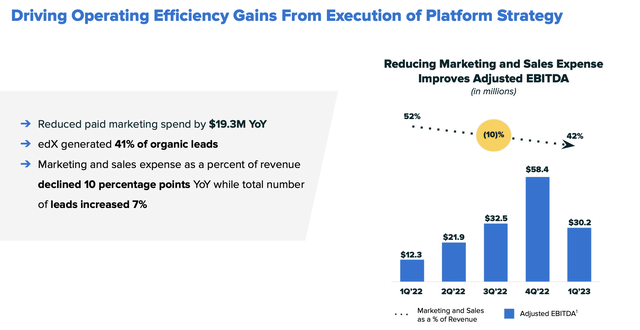

Of course, this is in part driven by 2U’s decision to slice down marketing spend. Paid marketing spend declined by -$19 million y/y, down to 42% of revenue in the most recent quarter – 10 points lower than 52% in the year-ago quarter.

2U marketing spend (2U Q1 earnings deck)

But the question here is: If 2U isn’t going to invest in boosting the programs that it spends millions to develop, how is the company going to return to revenue growth?

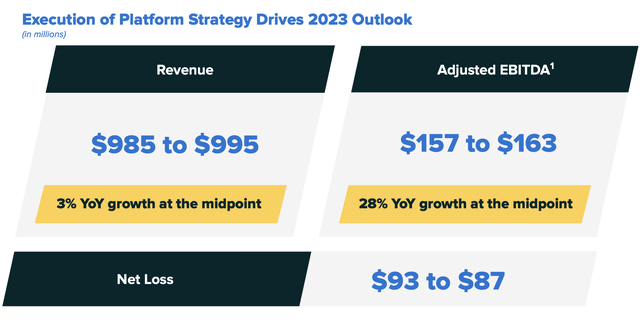

As a reminder, 2U has guided to 3% y/y revenue growth for FY22, which the company re-affirmed in its Q1 guidance. With revenue contracting -6% y/y in the first quarter alone, this outlook doesn’t look incredibly attainable especially if marketing spend continues to tumble.

2U outlook (2U Q1 earnings deck)

Note as well that 2U’s fundamental results as well are being shadowed by potential regulatory actions against third-party education companies like 2U that participate in revenue-share agreements with universities. 2U has filed a suit against the Department of Education, per CEO Chip Pack’s remarks on the Q1 earnings call:

Now a couple of points for you to note about the third-party servicer guidance and our lawsuit. First, suing the Department of Education was not a decision we made lightly. As with any business, we have to take calculated risks and measure potential benefits vs. those risks. And this lawsuit is no different. We obviously consulted our internal and external constituencies, including our Board and it was something we thought through quite meaningfully.

At the end of the day, we recognize the importance of being a leader in this industry, and we recognize the need to protect our shareholders and shareholder value and to ensure that we’re able to continue to deliver for universities and their students, each of which is critically important. Here, this meant pushing back against the department when it overstepped its legal authority.”

Regardless of the outcome and whether or not 2U’s business model becomes fundamentally impaired, the press surrounding this issue is a negative stain on 2U’s brand and may deter both student enrollments as well as prospective university partners.

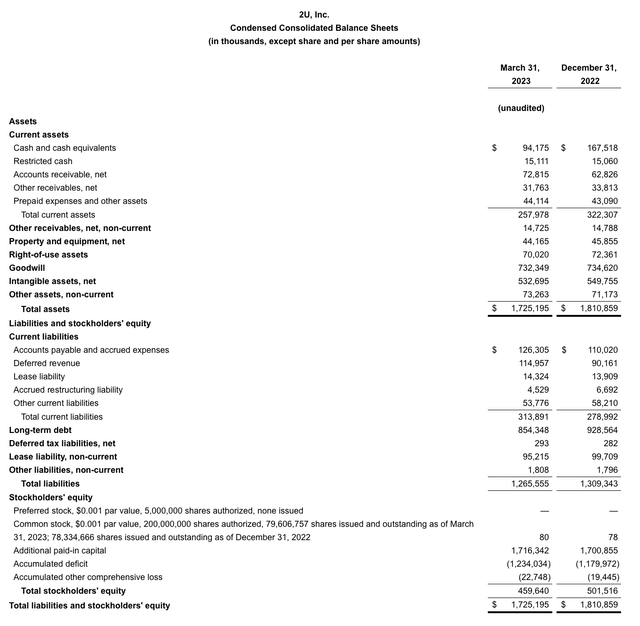

As a last note here: Investors should watch out for 2U’s dwindling balance sheet. The company has only $94.2 million of cash left on its books, which is additionally saddled with $854.3 million of debt.

2U balance sheet (2U Q1 earnings deck)

The company’s ability to deliver positive adjusted EBITDA and cash flow to service this debt hinges entirely on its ability to retain enrollments – which have proven to be shaky over the past two years.

Key takeaways

There’s very little incentive, in my view, to invest in 2U while its enrollments continue to be in free fall and the company tries to manage a near-$1 billion pile of debt. Steer clear here and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.