2U: Major Restructuring Needed

Summary:

- 2U, an online education platform, is facing significant challenges due to rising debt costs and ongoing cash burn.

- The company has experienced strong revenue growth but has not been profitable, leading to a strained balance sheet and negative working capital.

- With over $750 million in debt due in early 2025, 2U needs a major debt restructuring or a potential acquisition to stay afloat.

DoubleAnti/iStock via Getty Images

The Federal Reserve has continued to battle inflation throughout 2023, engaging in a series of rate hikes to get the situation under control. For many major companies, this isn’t a big deal, as strong balance sheets can actually benefit from added interest income in some cases. For much smaller firms, especially those trying to turn a profit, however, rising debt costs can be a big deal. One of those names I’d like to focus on today is 2U (NASDAQ:TWOU), which needs a major restructuring in the next couple of years.

2U is an online education platform that operates around the globe, with two major areas of focus. The Degree Program segment provides technology and services to nonprofit colleges and universities to enable the online delivery of degree programs. The Alternative Credential segment offers online open courses, executive education programs, technical, skills-based boot camps, and micro-credential programs through nonprofit colleges and universities.

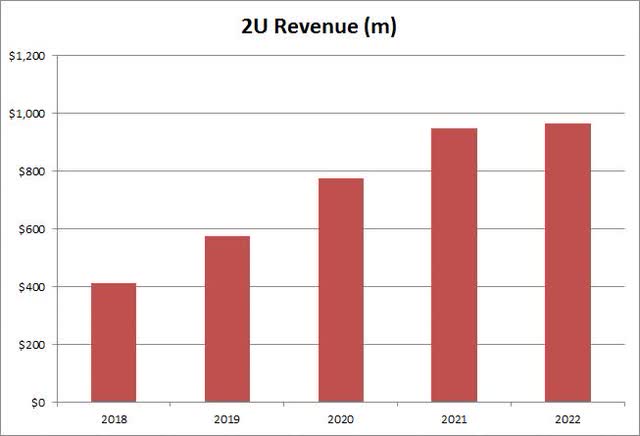

The company has experienced strong revenue growth over its roughly 15 year history. A decade ago, 2U reported just $83 million on the top line, but that number has grown to nearly a billion dollars currently. However, things have stalled out recently, as the chart below shows, with current analyst estimates calling for less than 2% additional revenue growth in 2023 before hopefully a growth acceleration next year.

2U Revenue History (Company SEC Filings)

Like we’ve seen a lot lately with newer tech names, getting this strong revenue growth has come at a major cost. In the past three years, the company has seen net losses of more than $150 million annually (when excluding restructuring and impairment expenses), and that’s a number that 2U management hopes is starting to improve. Q2 this year showed some slight progress on the bottom line, but this is still a name that’s losing tens of millions of dollars per quarter.

All of these losses, as well as capital expenditures to bolster growth, are leading to some decent cash burn. This has weakened the company’s balance sheet quite a bit, especially in recent quarters. At the end of 2021, 2U had a positive working capital balance of $60 million. Just 18 months later, not only has that number completely evaporated, but gone heavily negative to the tune of roughly $70 million. The company finished Q2 with just over $53 million in non-restricted cash, with the majority of assets on the balance sheet being either goodwill or intangible assets.

The big problem here is a ticking time bomb, and that’s the company’s debt situation. There are $380 million in convertible notes due on May 1st of 2025, which is only about 18 months away. It is obvious that 2U does not have the money to pay that debt back right now, and given where the stock is trading, the debt is highly unlikely to be converted to equity. This debt itself is more than twice the company’s market cap, and the bonds are yielding roughly 37%, showing that investors have very little faith in the future here.

This one debt alone is large enough to potentially sink the company, but unfortunately, it’s not the only large borrowing. 2U has a term loan facility that had roughly $378 million outstanding at the end Q2. Earlier this year, the company was able to get this facility’s maturity pushed out until late 2026, but that comes with a major caveat as detailed in the 10-Q filing:

Pursuant to the Second Amended Credit Agreement, the lenders thereunder agreed to, among other amendments, extend the maturity date of the term loans thereunder from December 28, 2024 to December 28, 2026 (or, if more than $40 million of the Company’s 2025 Notes remain outstanding on January 30, 2025, January 30, 2025).

At the moment, it seems very likely that more than $40 million of the 2025 notes will be outstanding just around 13 months from now. Thus, the company will need to repay this term loan or find a way to extend its maturity yet again. If lenders do agree to some sort of push back, they probably will demand a lot more interest. 2U’s effective rate on this facility was already over 14% in the first half of this year, up more than six whole percentage points from the same time in 2022.

Any new debts that the company can find will only add to significant interest expenses that are already being incurred. On the flip side, with a market cap of under $180 million today, investors would need to be diluted multiple times over to pay back these loans. Shares are already near multi-year lows, but having a tremendous equity raise would add significant further downside pressure. This is a major reason why 2U trades at just 0.17 times expected 2024 revenues, a very small fraction of the 3.72 times that a comparable name like Coursera (COUR) goes for.

In a couple of weeks, we’ll get the company’s third quarter results when 2U reports on November 9th. Analysts currently expect revenues to decline by 3.53% over the prior year period, which the street hopes will be the last quarter with a lower top line. Adjusted earnings are forecast to be a 13 cent loss per share, up significantly from last year’s 5 cent loss. Street estimates have come down quite a bit over the last three months, given the company’s big miss on the top and bottom lines for Q2. I’ll certainly be watching the conference call to see if management discusses any plans to fix this troubled balance sheet.

Another thing that could add major downside pressure is if a big supporter of the name decides to sell. Cathie Wood and her ETF firm ARK Invest have been a major holder of 2U in recent years, owning well over 8 million shares of the company, which is a little more than 10% of the entire name. 2U is held in the flagship ARK Innovation ETF (ARKK), as well as the ARK Autonomous Technology & Robotics ETF (ARKQ), and the ARK Next Generation Internet ETF (ARKW). Given 3-month average volume, it would take Cathie Wood’s firm almost six full trading days to sell their entire position.

Due to the extremely strained balance sheet and the potential for Ark Invest to unload a huge position, I am rating 2U shares a sell today. While the company has shown tremendous revenue growth over the years, it has not done so in a profitable manner, and ongoing cash burn only complicates the situation. With those two major debts coming due in just about the next 18 months, a major move needs to be made rather soon to keep this name afloat.

While I would sell the stock currently, I wouldn’t necessarily recommend shorting at this juncture. As I mentioned above, the valuation is extremely depressed, so if the company shows any meaningful progress in the next couple of quarters, perhaps some upside could be seen. At the same time, there is also the risk that the low valuation leads to 2U being acquired, whether by a larger player in the space or someone that wants to take the name private. The idea here would be to wipe out the company’s debt, which would eliminate $75 million a year in pre-tax interest expenses based on the Q2 run rate. While that won’t necessarily make 2U profitable right away, it might just be enough to get the company to be free cash flow positive.

In the end, 2U is a heavily distressed company that needs a major debt restructuring in the next two years. The online education platform has well over $750 million in debt that seemingly will be due in early 2025, a number that’s more than four times the stock’s market cap at present. Without results improving dramatically in the coming quarters or a white knight coming in to acquire the company, the stock will likely have a lot more downside from here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.