2U: Await Visibility On Platform Strategy, Initiate At Neutral

Summary:

- 2U has been facing significant deterioration of operational performance like several other Ed-Tech players.

- TWOU reported an underwhelming set of numbers in Q2 2023 amidst declining enrollments and revenue per enrollment with expectations more 2H weighted.

- 2U’s balance sheet remains weak, but its platform strategy and growth in alternative credentials show potential.

- Post the recent plunge of ~30% in its market price, we remain neutral on the stock and await clear signs of its platform strategy working.

miniseries

Investment Thesis

2U, Inc. (NASDAQ:TWOU) is a key player in a growing $36 bn global online higher education market formed through a merger of 2U and edX back in 2021. It witnessed a meteoric rise in the initial phases topping the $90 mark before declining in late 2019/ early 2020 after which COVID again gave the company a lifeline where in it briefly flirted with the $60 mark to eventually settle below $10 as schools reopened post COVID which has been similar. However, its platform strategy is seeing marginal improvement in operational efficiencies, which has however not translated fully into the company’s results. Post the Q2 results, it shaved off about a third of its market cap, and we believe while the near-term ride may be volatile, we await any tangible progress on the platform strategy driving topline.

Strategic Shifts

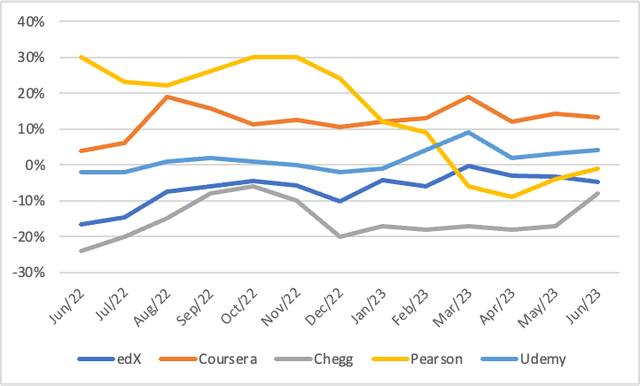

2U merged with edX and announced its transformation to be in a platform business, unlocking the value creation potential between edX and 2U. As the tuition fee continues to spiral upwards, its shift to a revenue-sharing model with a focus on bringing the cost down and providing flexible, affordable access to higher education is a step in the right direction. This also involves focusing on profitability and sustainability and reducing the marketing dollar spends to drive revenue. However, that has not yet translated completely into driving user growth amidst declining web traffic lagging peers as well as a decrease in enrollments and revenue per enrollment.

Total Web Traffic Growth Y/Y

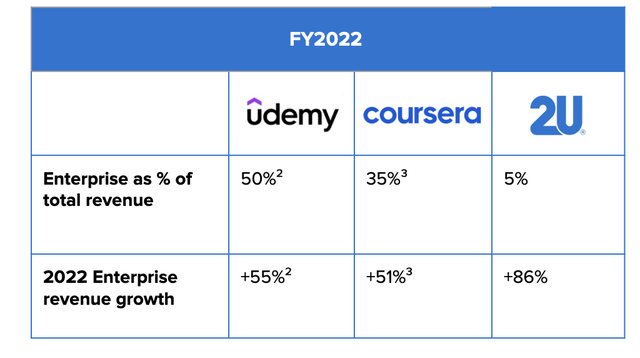

Despite that, its launch of edX for business could significantly drive growth as enterprise customers are relatively sticky along with higher spends and improved visibility on billables. It has partnered with several enterprises along the globe already, including Netflix (NFLX), Unilever (UL), Goldman Sachs (GS), and Accenture (ACN), and has seen strong growth and with enterprise revenue currently representing a miniscule part of the total, it has significant room for upside.

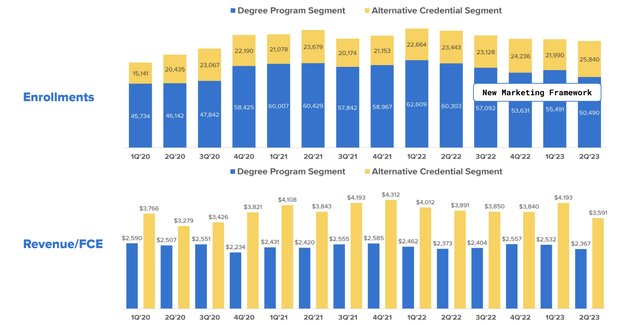

Poor Earnings but Slightly Better Guidance

2U posted weak earnings in Q2 2023 with revenues declining by 8% YoY as a result of the phasing of a few Degrees contracts coming to an end, which is pushing revenue into the second half of the year. Enrollments for the Degrees continued to decline along with revenue per enrollment, which has been at a 10-quarter low. However, given the past track record, it may have reached its bottom.

By contrast, the alternative credential segment has seen continued growth in enrollment, albeit at a lower revenue per enrollment. This demonstrates the shift towards a more flexible model servicing university partners with a fee for service. It observed strong growth in Enterprise business (35%) which bodes well for the business, while coding courses suffered a decline in line with the industry trends, partially offset by growth in AI courses. Adj. EBITDA came in flat at $21.8 mn with margins improving marginally by 80 bps driven by a decrease in paid marketing costs in connection with the platform strategy as well as employee costs.

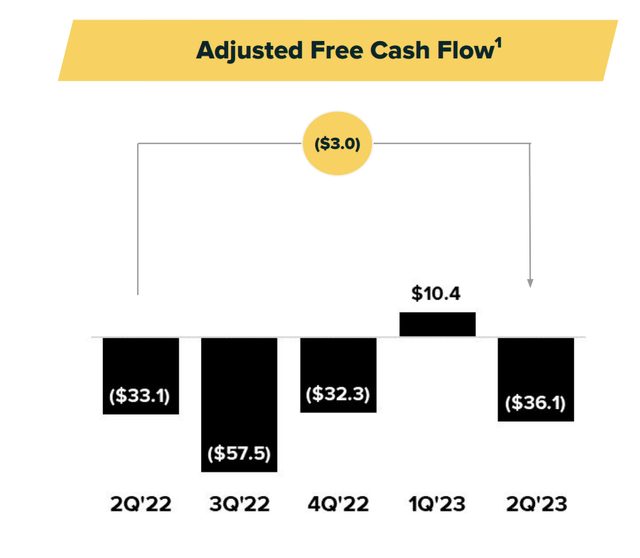

Balance sheet remains weaker as cash balance further dwindled from $94 mn last quarter to $53 mn in the current quarter with total debt outstanding remaining at ~$900 mn. Cash balance declined primarily as a result of a $36 mn decrease in adjusted free cash flow.

2U reiterated its full year guidance for the year with revenues of $985-$995 mn while marginally increasing the EBITDA guidance to $160 – $165 mn (from $157-$163 mn previously) which might not affect the consensus change meaningfully.

Valuation

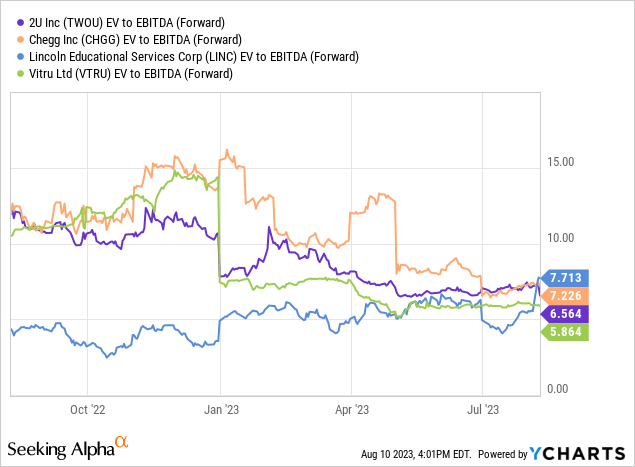

2U trades at 6.6x EV/ Fwd EBITDA in line with the broader peers while Coursera (COUR) is yet to breakeven. We believe the current valuation is fair considering the sharp plunge in share prices post the print, and we remain neutral on the stock with several risks to the downside given the commentary is more 2H weighted, and we remain to see how 2U is able to subside the decline in enrollments and revenue per enrollment.

Seeking Alpha’s Quant rating assigns a “Sell” signal to the stock citing degrading profitability and momentum, however, the valuation grade and growth metrics point to a relatively better outlook with a ‘B’ and ‘A’ rating, respectively. Its valuation grade of B is on the back of a Fwd PE ratio of 21x compared to 15x of its peers, which makes it looks a bit expensive given its leveraged balance sheet. While the price to book ratio (forward) is a comfortable 1.1x compared to 2.2x of its peers which also denotes some valuation comfort.

Risks to Rating

Risks to rating include:

1) Economic Downturn: Prolonged economic downturn could have a significant impact on the demand for Degree programs, given their relatively higher cost. This can put pressure on the number of enrollments and revenue per enrollment, which has been declining since some time and could face further pressure should the economic woes linger.

2) Course Launches: It expects to launch about 50 programs in 2024 against 25 in the recent past which could deepen its scale and enhance better demand to be able to launch courses more suited to the current industry trends such as AI, ML, etc. However, failure to generate interest could put a dampener on its growth prospects.

3) Negative Free Cash Flows: 2U has a sizeable debt on its balance sheet (~$900 mn) and its free cash flow remains negative.

Its inability to improve its margin profile could have a significant impact on its debt-raising capacity and financial performance, and would have to continually raise funding to meet operational needs.

Final Takeaways

2U has seen some positive signs as it shifted to a platform strategy model with improvement in Alternative Credentials segment and Enterprise growth. However, the company is still walking on a thin ice and needs to substantially improve its offering amidst an already challenging demand environment. Its launch cadence for the next year has been strong and the revenue per enrollment can be bottoming out, but we await a clear sign of visibility of its platform strategy working out. We initiate neutral given balanced risk-reward post the recent plunge at ~6x EV/ EBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.