Summary:

- Medtronic is a well-diversified healthcare company with strong secular growth and pricing power.

- The company has four major business segments, each contributing over $2 billion in annual revenue.

- Medtronic’s recent financial results have exceeded expectations, and the company has adjusted its full-year guidance upward.

Diy13

Introduction

It’s time to discuss a stock that combines so many of the benefits that turn stocks into long-term compounders: a decent dividend yield, consistent dividend growth, a fortress balance sheet, strong secular growth, a very attractive valuation, and high total return potential.

That company is Medtronic (NYSE:MDT), a dividend growth stock that truly has it all.

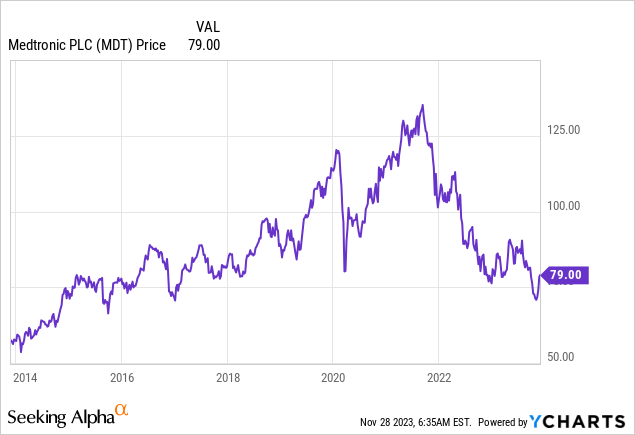

After falling more than 40% since mid-2021, I believe that MDT offers tremendous long-term value.

In this article, I’ll walk you through the details and explain what makes this stock such a great long-term investment, poised to deliver consistently rising income and potentially market-beating capital gains.

So, let’s get to it!

Well-Diversified Healthcare

It may not come as a surprise when I say that I really like healthcare stocks.

Good healthcare companies have anti-cyclical demand, secular growth tailwinds, and pricing power.

All of this applies to Medtronic.

Headquartered in Dublin, Ireland, Medtronic is a global healthcare technology leader founded in 1949.

With a presence in over 150 countries, the company is dedicated to contributing to human welfare through biomedical engineering.

This mission, which was established in 1960, focuses on alleviating pain, restoring health, and extending life, which are significant secular tailwinds for the company and critical areas to address.

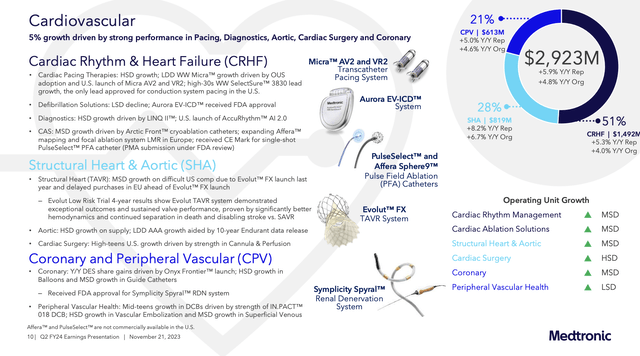

As we can see below, the company has four major business segments, each contributing more than $2 billion in annual revenue.

| USD in Million | 2022 | Weight | 2023 | Weight |

|---|---|---|---|---|

|

Cardiovascular |

11,423 | 36.1 % | 11,573 | 37.1 % |

|

Neuroscience |

8,784 | 27.7 % | 8,959 | 28.7 % |

|

Medical Surgical |

9,141 | 28.8 % | 8,433 | 27.0 % |

|

Diabetes |

2,338 | 7.4 % | 2,262 | 7.2 % |

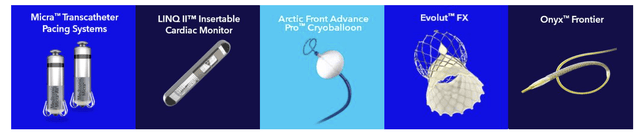

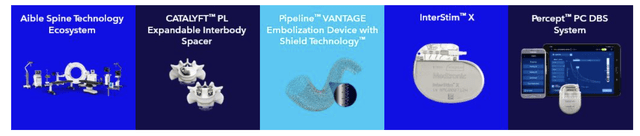

- Medtronic’s Cardiovascular Portfolio includes divisions such as Cardiac Rhythm & Heart Failure, Structural Heart & Aortic, and Coronary & Peripheral Vascular. This segment focuses on developing, manufacturing, and distributing device-based medical therapies and services to address heart rhythm disorders, heart failure, heart valve disorders, and various cardiovascular diseases.

Medtronic

- Medtronic’s Neuroscience Portfolio covers Cranial & Spinal Technologies, Specialty Therapies, and Neuromodulation divisions. This segment focuses on developing, manufacturing, and marketing devices and therapies for surgical technologies related to neuro procedures, treatments for the spine and musculoskeletal system, and others.

Medtronic

- The Medical Surgical Portfolio includes Surgical and Respiratory, Gastrointestinal, and Renal divisions. This segment provides advanced surgical solutions and therapies primarily used by healthcare systems, physicians’ offices, and ambulatory care centers.

Medtronic

- The Diabetes Operating Unit specializes in developing, manufacturing, and marketing products and services for managing Type 1 and Type 2 diabetes. This segment caters to endocrinologists and primary care physicians, offering insulin pumps, continuous glucose monitoring systems, and smart insulin pen systems.

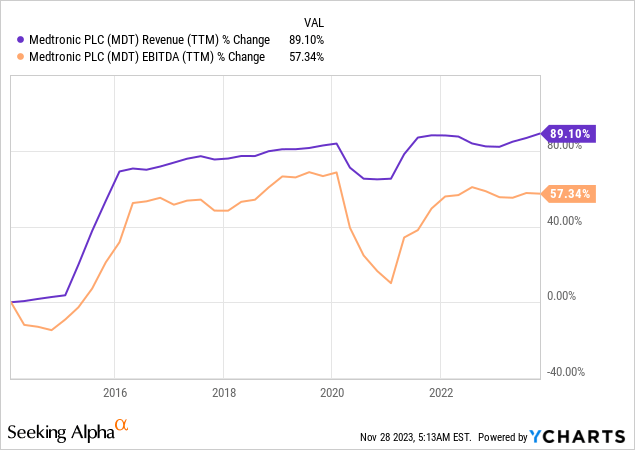

Over the past ten years, the company has grown its revenue by roughly 90%. EBITDA increased by 57% during this period. This is a solid performance, but not perfect, as it shows that the company struggled a bit with margins.

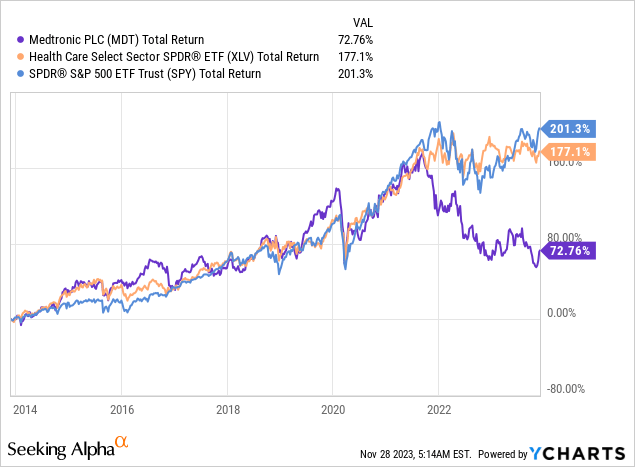

When adding post-COVID struggles, we get a very disappointing total return since 4Q23. MDT shares have returned just 73%. Both the S&P 500 and the healthcare sector (XLV) had much higher returns.

The good news is that Medtronic has four strategic areas that are expected to fuel future growth.

- Leveraging Innovation for Growth: Utilizing a robust pipeline, recent launches, and disruptive technologies, Medtronic aims to accelerate revenue growth and bring inventive solutions to healthcare opportunities globally.

- Accelerating Innovation-Driven Growth: By understanding patient challenges and supporting partnerships, Medtronic aims to simplify and enhance patient experiences through innovative healthcare solutions.

- Technology Disruption: Confident in its ability to utilize new technologies, including AI and data analytics, Medtronic aims to improve therapies in real-time.

- Enhancing Operational Agility: Since February 2021, Medtronic has streamlined its operating model to accelerate decision-making, improve commercial execution, and leverage the scale of the company effectively.

This brings me to the next part of this article.

The Return of Growth

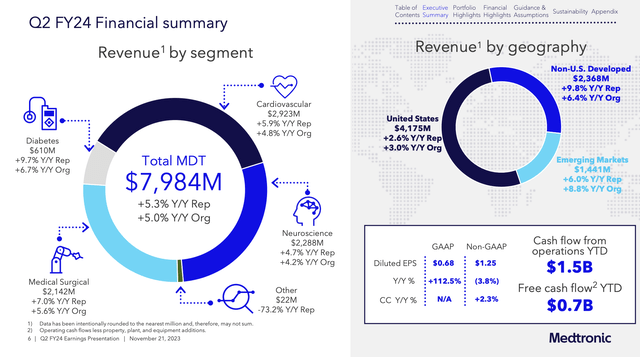

Earlier this month, the company released the second-quarter results of its 2024 fiscal year.

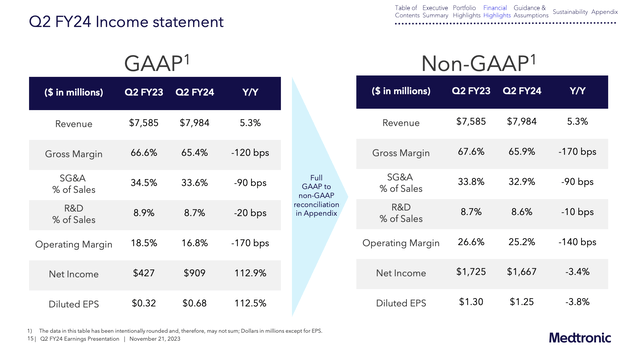

The company reported robust financial results, as revenue experienced a noteworthy 5% growth, surpassing initial expectations.

The adjusted earnings per share stood at $1.25, exceeding the midpoint of the guidance range.

This positive EPS outcome was driven by a $0.07 increase, attributed to stronger-than-expected revenue, improved gross margin, and operational efficiencies below the operating profit line.

Medtronic

Notably, the Diabetes portfolio accelerated to high single-digit growth, contributing to the company’s focus on delivering sustainable mid-single-digit growth on the top line.

This strategy has been consistent, leading to growth for four consecutive quarters.

Furthermore, while adjusted gross and operating margins declined, both surpassed expectations.

Approximately one-third of the year-over-year change in gross margin was due to currency exchange rates, and the remaining was driven by inflation. The decline in adjusted operating margin was entirely currency-driven.

Medtronic

With that in mind, one of the reasons why some healthcare stocks have performed poorly is the threat from GLP-1s (weight loss drugs).

The market fears that less obesity means less demand for healthcare solutions.

During its most recent earnings call, Medtronic addressed the substantial impact of GLP-1s on the broader med-tech landscape, acknowledging their excitement for patients and their influence on med-tech stocks.

Despite the promising potential suggested by SELECT data, the company asserts that its growth outlook, particularly in the bariatric surgery market, remains largely unaffected.

The impact on bariatric surgery is expected to be modest and temporary, as the gold standard for addressing obesity is anticipated to remain surgical.

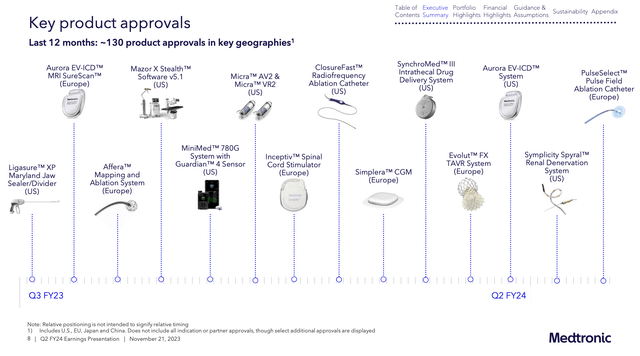

Adding to that, during the earnings call, the company emphasized the positive impact of recent product launches, regulatory approvals, and other business improvements, positioning the company for lucrative business opportunities.

This includes enhancements to global operations, quality standards, and supply chain efficiency.

Medtronic

Furthermore, the allocation of capital into fast-growing med tech markets, including robotics, AI, and closed-loop systems, reflects a commitment to long-term business improvements and sustained growth.

In the highest growth markets, Cardiac Ablation Solutions grew by 6%, driven by strong procedure growth.

Medtronic also aims for significant long-term growth in the electrophysiology ablation space with innovative Pulse Field Ablation catheters.

Structural Heart, specifically TAVR, grew in the mid-single digits, with a focus on the global rollout of Evolut FX supported by superior valve performance data.

Medtronic

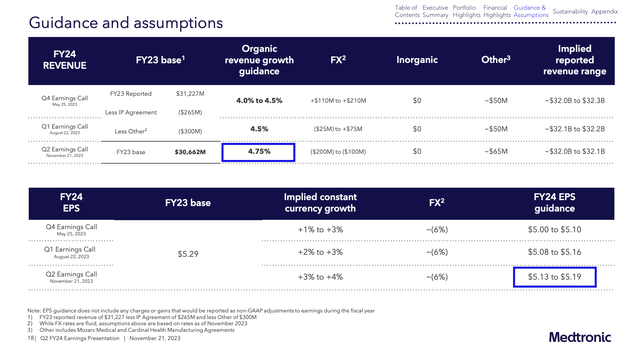

In light of these developments, the company’s guidance was strong.

Based on the second-quarter outperformance and the continued strength in underlying fundamentals, the full-year guidance for the fiscal year 2024 has been adjusted upward.

- The company now anticipates organic revenue growth of 4.75%, up from the previous estimate of 4.5%.

Medtronic

The guidance suggests a trajectory of accelerating growth, supported by the ramping of recent product launches in the latter half of the year.

What’s interesting is that the company’s past investments in growth are paying off, supporting strong guidance.

Notable projections include:

- The U.S. return to growth in Diabetes,

- The continued rollout of the surgical robot Hugo and GI Genius in Medical-Surgical and

- Advancements in Neuroscience and Cardiovascular products.

Needless to say, this bodes well for shareholder distributions and the total return outlook.

Shareholder Distributions & Valuation

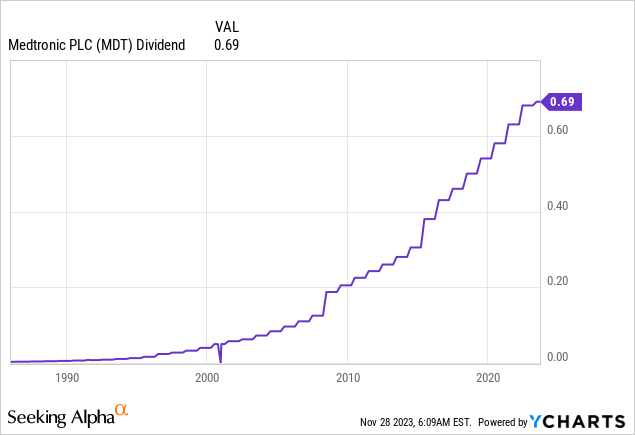

Another benefit is that MDT offers a 3.5% dividend yield, which is unique in its industry.

This dividend is protected by a 52% payout ratio. The five-year dividend CAGR is 7.4%.

On May 25, the dividend was raised by 1.5%. The dividend is also protected by a balance sheet with an A credit rating, one of the best ratings on the market.

Last year, it hiked its dividend by 8%.

It also kept hiking during the Great Financial Crisis.

Going forward, I expect dividend growth to pick up again, as MDT is in a great spot to not only boost growth but maintain higher growth rates.

The dividend is also a big contributor to its potential total return.

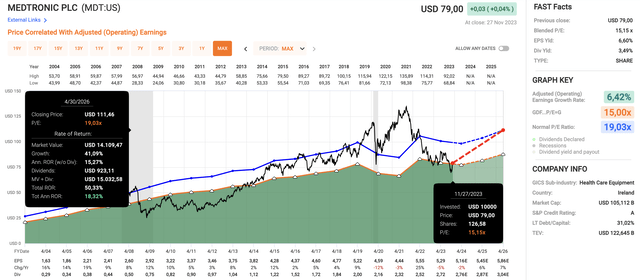

Using the data in the chart below:

- MDT is currently trading at a blended P/E ratio of 15.2x.

- Going back twenty years, the normalized P/E multiple is 19.0x.

- This year, EPS is expected to decline by 2%.

- Next year, EPS is expected to increase by 6%, followed by a 7% expected growth rate in the year after.

- If we incorporate a return to 19x earnings, which would be a good valuation if the company maintains high single-digit annual earnings growth, the stock could return 18% per year over the next three years. This includes its dividend.

FAST Graphs

Needless to say, this is a theoretical performance. If rates remain elevated, the stock will likely keep trading at a more subdued valuation.

Nonetheless, these numbers show that the MDT risk/reward is good, making it one of my favorite healthcare stocks at the moment.

Sure, the +40% stock price decline since mid-2021 has done damage. However, MDT is bouncing back. Innovation is paying off, demand is growing, and its valuation has become very attractive.

If you are looking for undervalued dividend growth in an anti-cyclical sector, MDT may be right for you.

Takeaway

Medtronic stands out as a robust investment with a compelling blend of solid dividend yield, consistent growth, and innovative healthcare solutions.

Despite past challenges, the company’s strategic focus on innovation, global expansion, and operational efficiency is yielding positive results.

With a diverse healthcare portfolio and a forward-thinking approach to technology, Medtronic is well-positioned for sustained growth.

Shareholders benefit from a unique 3.5% dividend yield backed by a strong balance sheet and healthy payout ratio.

As the company rebounds and embraces future opportunities, MDT emerges as an attractive choice for those seeking undervalued dividend growth in the healthcare sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.