Summary:

- Intel has been through the ringer, but we see signs of life.

- Significant cost cuts should give the company breathing room to reinvest into the segments that are working, and Foundry margins should improve as the unit matures.

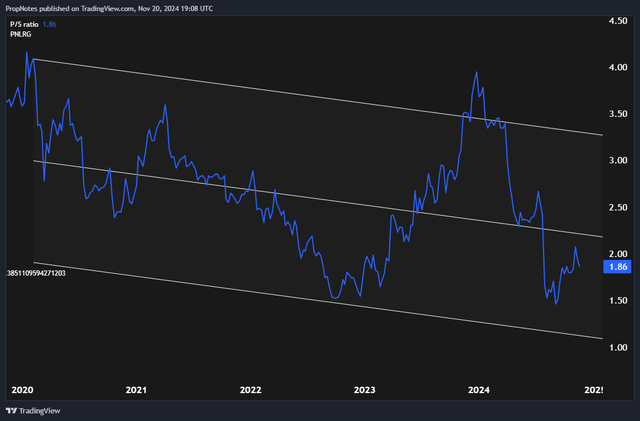

- While there are serious risks when it comes to competition and execution, we think the stock, at less than 2x FWD sales, appears interesting.

- We’re initiating coverage of INTC with a ‘Buy’ rating.

JHVEPhoto/iStock Editorial via Getty Images

Boy oh boy, what a rough few years Intel (NASDAQ:INTC) has had.

Once a mainstay of the global semiconductor industry, the company has recently faced significant challenges from competition in core markets, alongside a shifting tech landscape that has prioritized AI computing – a vertical which is not Intel’s strong suit.

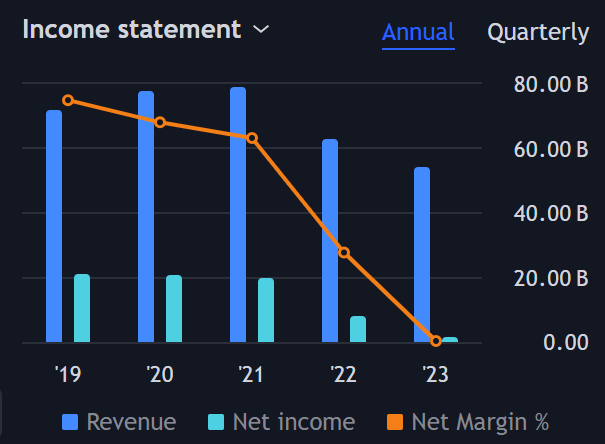

Since 2021, the company’s financials have come under significant pressure, which has led to turmoil for shareholders:

TradingView

Falling margins and market share have caused investors to question the company’s strategic direction, and INTC is currently undergoing a massive restructuring as a result.

While some remain skeptical that Intel will be able to achieve a successful turnaround, Under CEO Pat Gelsinger’s leadership, the company is aggressively cutting costs, increasing investments in innovation, and positioning itself for the future.

With a renewed focus on efficiency and a bold roadmap for AI and foundry, we think the stock presents an interesting risk-reward opportunity at the current price.

Today, we’ll explore updates with INTC’s restructuring, explain our outlook on the company’s prospects, and lay out 3 key reasons why we think the worst may be behind investors at this point in time.

Sound good? Let’s dive in.

Reason 1: Cost Cutting

If there’s anything that Nvidia’s (NVDA) rise has proven, it’s that INTC looks incredibly bloated by comparison.

Over the last twelve months, INTC spent $22.5 billion on operating expenses (with 40% gross margins). By contrast, Nvidia spent $13.6 billion in operating expenses (with 76% gross margins).

As the industry evolves, there simply isn’t room for a bureaucracy the size of INTC’s.

This is why the company recently decided to undergo a strategic restructuring, which is expected to save over $10 billion in 2025:

The restructuring charges we took in Q3 were significant and necessary to right-size the company as we reduced spending by over $10 billion in 2025.

While painful, we think management is making the correct moves to cut the workforce, re-align R&D to the correct objectives, and light a fire to get everyone moving in the right direction once again.

Numerically, the cuts represent a >15% workforce reduction and 20% Capex drop, which are quite significant, but it proves management’s commitment to streamlining operations.

As a result, INTC is expecting to post positive Adjusted FCF in 2025:

In 2025, with OpEx of approximately $17.5 billion and gross and net CapEx of $20 billion to $23 billion and $12 billion to $14 billion respectively, we expect to achieve positive adjusted free cash flow.

We’ve seen some analysts discuss the impact of these cuts as a net negative, with the general idea being “you can’t cut your way to growth”, but we disagree.

For a company with severe cost structure problems, these are moves in the right direction. Cutting costs causes stronger prioritization internally towards the highest IRR opportunities, which is exactly how a company pivots quickly and organically. Additionally, improved profitability gives the company more breathing room to make long term strategic decisions.

Said differently, even if a person is jacked, you can’t see their abs if they’re under a layer of fat.

Intel needs to compete harder for market share, but potential gains will mean scant little for investors if the cost structure remains uncompetitive.

Reason 2: Next Gen Computing

Cost-cutting has gotten a majority of the attention from the analyst community since the Q3 report, mostly due to the ‘kitchen sink’ nature of the impairments, but equally important are the company’s plans to grow revenue and compete with the likes of AMD (AMD) and Nvidia.

On that front, we think INTC’s efforts are being undercounted.

At present, Intel operates in 4 key segments: Client Computing (chips for laptops and desktops), Data Center & AI (chips for ‘industrial’ computing), Networking & Edge (Ethernet & infrastructure) and Foundry (fabricating the chips).

There are some auxiliary businesses as well, like Altera, but their financial impact on the company is relatively small.

Of these segments, CCG and DCAI have the two largest upside, in our view.

For CCG, the company has a roadmap that actually leads competitors, which is something you don’t often hear when it comes to Intel:

In CCG, we continue to lead the AI PC category. In September at IFA, we launched our Intel Core Ultra 200V series processors formerly named Lunar Lake. This is the most efficient family of x86 processors ever created, setting a new standard for mobile AI performance and significantly outperforming competitor platforms…

We remain on track to ship more than a 100 million AI PCs accumulative by the end of 2025.

Next up is Arrow Lake, which launched earlier this month and brings the power of the AI PC to the desktop, delivering a huge leap in performance per watt…

Panther Lake will be our first client CPU on Intel 18A, a more performant and cost competitive process that will allow us to bring more wafers home and improve overall profitability.

Overall, we are making good progress in CCG.

Most of the AI story up to this point has focused on AI training and compute within a data center context, but as models distribute globally, we expect that on-device AI hardware will become a big selling point for laptop and desktop PCs. At present, Intel leads in this category, which we expect will continue.

Additionally, on the data center front, we see room for significant growth.

While the firm has projected that they’ll miss 2024 Gaudi AI accelerator revenue targets, we think they’ll be able to bounce back in 2025.

This is mainly down to INTC’s TCO advantages over competitors like Blackwell.

At present, big CSPs and other developers are shelling out for NVDA GPUs and architectures for the purpose of training & speed. What this doesn’t optimize for is cost. At present, Intel’s Gaudi 3 accelerators sell for roughly half (or less), NVDA’s H100, with a similar performance profile.

We don’t think this offering will catch on with large customers, but for those who are struggling to afford/secure B200 inventory, Intel’s chips could be a good option into the next year.

Thus, we think the company will be able to grow DCAI revenue despite the performance gap.

Together, we actually see a path to increased revenue in these key segments despite the dip in allocated OpEx.

Reason 3: Foundry & Government Partnerships

Finally, many have called for INTC to shuck off the highly unprofitable Foundry business, but we see it as core to the INTC thesis going forward. Why?

Partnerships.

At present, nearly all the world’s advanced semiconductors are created in Taiwan, by TSMC, the Taiwan Semiconductor Manufacturing Company (TSM). In short, this is a geopolitically risky location. China’s claims and overt hostile action towards the island has left a lot of political and business leaders feeling uneasy.

As a result, Intel Foundry is a key asset for the company, not only for financial reasons, but for strategic reasons.

On the government side, INTC just announced $3 billion in direct funding under the Secure Enclave program, showcasing how important the segment is to the U.S. from a geopolitical standpoint:

We were also awarded an additional 3 billion in direct funding under the Secure Enclave program to produce leading-edge semiconductors for the US government.

We are proud to be the US government’s Partner of Choice to fortify the domestic semiconductor supply chain and ensure the US maintains its leadership in advanced manufacturing microelectronic systems and process technology.

Additionally, progress on the company’s 18A node has led to significant orders from Amazon’s (AMZN) AWS, which proves the unit’s competency at producing competitive chips for big clients:

Most recently, as announced, we are finalizing a multiyear, multibillion dollar commitment by AWS to expand our existing partnership to include a new custom Xeon 6 chip on Intel 3 and the new AI fabric chip on Intel 18A.

Yes, Foundry is significantly unprofitable, but the unit has only recently begun being run like a separate unit. Previously, chip manufacturing costs were just baked into INTC’s other OpEx.

As the unit matures, grows an external client base, and sees ROI from recent investments, we see the segment becoming significantly less unprofitable.

Taken together, we’re highly positive about INTC’s prospects.

Between significant cost cuts, potential strength in important product segments, and a strategically important foundry business whose economics should improve materially over time, we think the stock, at less than 2x FWD sales, looks like a really interesting opportunity:

Trading at the low end of the stock’s 5-year historical valuation, right now, we think the fundamentals and valuation line up for a ‘Buy‘ rating.

Risks

This is not to say that there aren’t still significant risks when it comes to investing in INTC.

At present, much of the work we’ve laid out still needs to get done. There’s finally a solid path for the company to follow, but Pat Gelsinger and management need to walk it. We’ve seen some solid first steps, but there’s a long way to go.

If the company can’t execute without stumbling, then the macro prospects for the stock dim considerably.

At the same time, INTC’s competition is only getting stronger and richer. AMD and NVDA continue to charge ahead, offering more and more efficient chips to a wider and wider customer base.

Slower-than-anticipated adoption of key products like the Gaudi Accelerators prove that INTC still has significant room to improve and market share to take, which won’t be easy.

Summary

That said, we think the risks skew to the ‘long’ side in INTC.

As a strategically important company to the U.S. government, we think the risk profile for the stock is perhaps slightly less severe than perceived, and with significant progress on cost-cutting, Foundry, and AI PCs, INTC could be in a good position to begin growing margins going forward.

At the present valuation, we think INTC looks like a ‘Buy’.

Stay safe out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.