Summary:

- Taiwan Semiconductor Manufacturing Company Limited’s Q2 beat and raise continues to solidify its path towards a $1 trillion market cap.

- The robust results and upbeat outlook corroborate sustained demand for HPC hardware given ongoing AI momentum, complemented by a stronger-than-expected cyclical recovery in consumer devices.

- This continues to highlight the competitive value in Taiwan Semiconductor’s technology advantage, given its sole capability in producing at the most advanced nodes and packaging processes critical to high-growth innovations like AI.

BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) stock is likely on course towards a sustained $1 trillion market cap, as the underlying business continues to ride the coattails of the AI rally led by Nvidia (NVDA). The company’s latest Q2 beat and raise was largely expected, after it reported another quarter of stronger-than-expected growth earlier this month.

Unlike the lofty premiums observed in the Magnificent Seven, which have increasingly decoupled from their respective underlying fundamentals recently, TSM’s current valuation continues to be backed by tangible financial strength from its core operations. Specifically, TSM’s latest Q2 outperformance continues to demonstrate three key drivers to its valuation prospects that remain intact.

First, the company’s unmatched technological advantage in producing advanced nodes at scale remains critical to enabling ongoing AI developments. This has accordingly awarded TSM with strong bargaining power in the marketplace, which is additive to its resilient demand environment.

Second, the company is also benefiting from the resurgence of demand for consumer electronics like smartphones and PCs. The cyclical recovery this time around is also buoyed by an added upgrade cycle stemming from the emergence of edge AI – or on-device AI processing capabilities realized through complex hardware. Only TSM possesses the manufacturing and packaging processes for these at the moment. Apple’s (AAPL) debut of “Apple Intelligence” at WWDC 2024 also marks an inflection point, in our opinion, with the upcoming iPhone 16 upgrades potentially driving additive near-term growth to TSM.

And third, TSM remains well-positioned for several imminent cash flow growth tailwinds. Incremental demand for chips based on advanced nodes remains accretive to accelerating economies of scale for TSM’s continued ramp of its 3nm technologies. This has likely alleviated some previous concerns about relevant challenges to near-term profit margins. Emerging pricing tailwinds underpinned by TSM’s competitive advantage in CoWoS packaging and advanced process nodes also complement a sustained trajectory of margin expansion ahead. Meanwhile, the company’s raised capex outlook also aligns well with stronger-than-expected growth prospects, thus keeping TSM’s ROE commitment intact.

Taken together, we believe the company remains well-positioned for a sustained earnings expansion trajectory in the long term, which would continue to benefit cash flows critical to both its ongoing growth investments and valuation prospects. Continued strengthening of its balance sheet also suggests potential for consistent expansion of TSM’s capital returns program over the longer term, consistent with the latest dividend raise, which is additive to shareholder value.

1. TSM’s Unmatched Technology Advantage

TSM remains the key enabler of AI-related technological developments. This is evident in the relentless demand for TSM capacity earmarked for HPC applications, with “almost all the AI innovators” currently working with the Taiwanese fab on existing and next-generation hardware.

And TSM’s latest Q2 earnings outperformance corroborates its competitive advantage. Specifically, the Q2 beat and raise continue to reflect strong market uptake of TSM’s market-leading chip manufacturing and packaging technologies to support the burgeoning demand environment for AI hardware. This is evident in the growing revenue mix shift towards advanced nodes that underpin AI hardware curated for data center and on-device applications. Specifically, advanced nodes accounted for 67% of Q2 wafer revenue at TSM, up from 65% in Q1. There has also been incremental demand for TSM’s latest 3nm process node, which currently accounts of 15% of wafer revenue, accelerating rapidly from 9% in the previous quarter.

The upcoming start of production of N3P is also expected to complement the current ramp of existing N3B and N3E nodes, and build on TSM’s growth prospects. Specifically, N3P boasts even “better power, performance and density” than N3E, which is optimal for complex HPC workloads like AI/ML. The improved efficiency gains of the upcoming N3P variant also come at a lower cost, which is likely to garner greater interest from customers. TSM’s N3P SOP is also expected to bolster its competitive lead against emerging foundry rival Intel (INTC). Specifically, Intel’s upcoming Lunar Lake CPU will initially be manufactured on TSM’s N3P node later this year, before transitioning to its internal equivalent – Intel 18A – in 2025.

This follows our previous discussion that the jury is still out on whether Intel’s 18A process node can restore its foundry leadership. Specifically, TSM has long disagreed with Intel’s claims that Intel 18A will be the industry’s leading node, given N3P is expected to offer better performance and cost efficiency. And the next-generation N2 node, which will start volume production in 2025, is expected to further outperform N3P and Intel 18A. The N2 is also expected to garner premium pricing to its predecessor, with better-managed manufacturing costs, complementing expectations for emerging tailwinds to TSM’s topline growth prospects.

And TSM’s unmatched technology advantage pairs favorably with the currently constrained capacity environment in reinforcing its bargaining power. Recall that N3 has a longer ramp trajectory towards the corporate average gross margin, hence management’s persistent caution over near-term margin dilution from the advanced node. The adverse margins of N3 were largely due to its early pricing ahead of volume production, which precluded consideration of inflationary pressures recently. Yet robust demand for the advanced process node observed in recent quarters, driven by persistent AI momentum, bolsters TSM’s case for better “selling its value.”

Management has long acknowledged the possibility of passing off some recent cost pressures onto TSM’s customer, with discussions ongoing. Paired with the continually supply-constrained environment, industry currently expects price hikes at TSM as an imminent base case.

Specifically, CoWoS advanced packaging capacity remains the key bottleneck in sufficing demand for AI processors. CoWoS packaging – which refers to chip-on-wafer-on-substrate – addresses the scalability needs of increasingly complex processors. Specifically, next-generation AI processors recently, like Nvidia’s H200 GPUs and Advanced Micro Devices’ (AMD) Instinct MI300 accelerators, have relied on the stacking of chiplets to optimize performance while maintaining the chip size to ensure scalability. CoWoS packaging is a key complement to increasing precision of process nodes by further reducing the space data needs to travel, thus enabling greater power and cost efficiencies without compromising performance. And TSM currently remains the only manufacturer equipped with CoWoS packaging capabilities at scale, strengthening its bargaining power.

This is further corroborated by robust profit margins observed at Nvidia – TSM’s leading customer for its CoWoS packaging capacity – as well as other chipmakers. Driven by eye-watering demand for the higher margin data center processors, particularly AI accelerators, Nvidia’s compute and networking segment operating income have jumped almost eight-fold y/y during the fiscal first quarter. The leading AI chipmaker currently boasts an operating margin of more than 75% for its compute and networking segment, which includes data center sales, up from about 48% in the prior year.

This accordingly leaves significant headroom in end-markets to absorb potential price hikes by TSM for its CoWoS packaging capacity, as well as its advanced nodes – particularly the costly 3nm process. Industry currently forecasts a price hike of as much as 20% for TSM’s CoWoS advanced packaging capacity in 2025, alongside a more than 5% price increase for its 3nm process node. This would be additive to TSM’s growth trajectory, which also continues to benefit from a robust demand environment. More importantly, pricing gains for 3nm and CoWoS will be critical to offsetting near-term ramp-up costs, elevated electricity and material costs, and incremental tool conversion costs. This is likely to result in a net benefit to profit margins and, inadvertently, cash flows underpinning further valuation gains for TSM from current levels.

2. Emerging Cyclical Recovery in Consumer Electronics

In addition to outsized HPC growth in recent quarters, TSM is also benefitting from an emerging cyclical recovery in consumer end-markets like PCs and smartphones. Admittedly, the recovery has been slower than expected since bottoming out in late 2023:

Yes, smartphone end-market demand is seeing gradual recovery and not a steep recovery, of course. PC has been bottomed out and the recovery is slower.

Source: TSM 1Q24 Earnings Call Transcript.

Yet increasing interest in edge AI, or on-device AI processing capabilities, with the introduction of AI PCs and AI smartphones are expected to harbinger an impending upgrade cycle and hasten the tepid recovery. Although the AI PC sales mix will remain nominal in the near-term at about 3% of total shipments, interest is rising with the increasing build of apps and features that depend on the emerging technology.

The tailwind for on-device AI has been further solidified by Apple’s push into “Apple Intelligence” after its WWDC keynote in June. Following its announcement of AI-enhanced Macs and iPads with the M3 and M4 chips earlier this year, Apple stunned the crowed at WWDC 2024 with the debut of generative AI features for the next-generation iPhones. Through its initial launch partnership with OpenAI, Apple will feature several on-device generative AI features that include a ChatGPT-powered Siri starting with the iPhone 16 coming fall.

This has accordingly bolstered confidence in growth tailwinds driven by an impending upgrade cycle for Apple. Its key suppliers – which include TSM – have recently received a memo to prepare for “about 10% growth in shipments of new iPhones” later this year. With Apple being TSM’s largest customer, emerging interest in on-device AI capabilities and the ensuing requirement for supporting hardware makes an additive tailwind to the foundry’s near-term growth outlook.

Emerging optimism for further growth outperformance at TSM this year is reinforced by robust uptake of AI PCs fitted with hardware based on its advanced nodes. This includes the 14% jump in Apple Mac shipments observed in the June quarter tally compiled by IDC, which includes sales of AI-enhanced laptops fitted with the recently introduced M3 processors. Recall that the M3 processors are built on the industry-leading 3nm process by TSM, which makes recent observations of better-than-expected end-market uptake an incremental tailwind to the continued ramp of the foundry’s latest node.

This accordingly reinforces optimism that the previous upper range of TSM’s growth guidance has now become the base case, underpinning further pent-up valuation gains within the foreseeable future.

3. Resilient Cash Flows

TSM’s second consecutive quarter of outperformance continues to suggest that 3nm-related ramp-up costs are finding alleviation from stronger-than-expected end-market uptake. This accordingly makes a positive contribution to economies of scale and operating leverage improvements, which in turn yields favorable margins. Specifically, the 3nm-driven wafer revenue mix has expanded from 9% in Q1 to 15% in Q2, with prospects for further growth as the AI-optimized N3P variant enters volume production later this year.

Admittedly, management had previously warned that the increasing mix shift towards the 3nm process node will be margin dilutive in the near-term, given its unfavorable pricing structure. Yet stronger-than-expected end-market uptake is likely to benefit ongoing efforts in driving economies of scale, and provide alleviation to the near-term ramp-up cost challenges. This is also evident in the robust demand environment for TSM’s advanced nodes driven by AI momentum, which continues to outstrip supply and bolster the case for profit-enabling price increases on upcoming output volumes. The ensuing accretion to profitability is likely to turn management’s long-term target for 53% gross margins conservative, in our opinion.

Management has also narrowed the capex outlook for TSM to the upper range of an earlier guidance. This is consistent with the persistently strong demand profile, and it aligns with the uplift observed in revenue growth, keeping its ROE target intact. Taken together, TSM remains in a net positive set-up for sustained FCF growth. Not only is this supportive of ongoing growth investments and further upside potential to its valuation, but a sustained FCF growth trajectory also offers a favorable outlook for TSM’s capital returns program. This is consistent with management’s recent acknowledgement of the need for an uplift to TSM’s existing dividend policy, and supports the case for an impending transition to a “steadily increasing” payout.

Fundamental Considerations

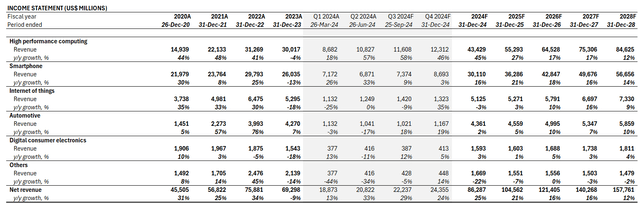

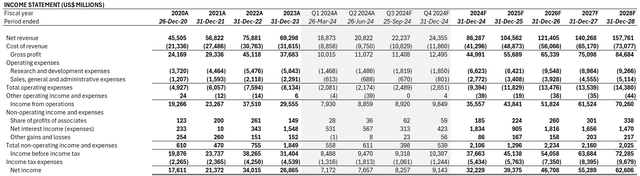

Considering TSM’s Q2 outperformance and raised revenue outlook, we view the mid-20% range as the base case for full year 2024 sales growth. Our foregoing analysis on TSM’s key valuation drivers also reinforces confidence in further fundamental outperformance in 2H24, especially given incremental tailwinds in the previously modest consumer electronics segment.

Our updated forecast expects full-year 2024 revenue growth of 25% y/y to $86.3 billion. HPC sales will continue to dominate the mix, with the highest revenue growth of 45% y/y to $43.4 billion in full year 2024. This is consistent with the increasing mix shift towards TSM’s advanced nodes driven primarily by demands from data center and cloud service provider applications, followed by emerging interest in edge AI.

There are also several margin accretive factors for TSM heading into 2H24, which are expected to drive a better-than-expected earnings growth outlook. This includes emerging pricing tailwinds supported by its robust demand environment, and continued improvements in operating leverage as 3nm-related ramp-up costs find alleviation from stronger uptake.

Valuation Considerations

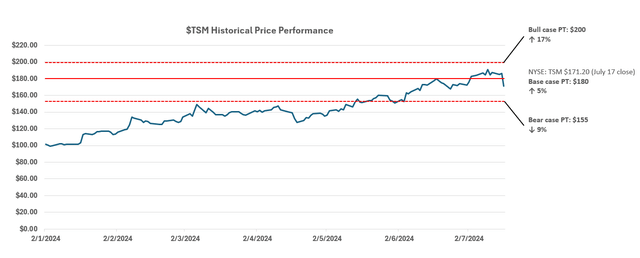

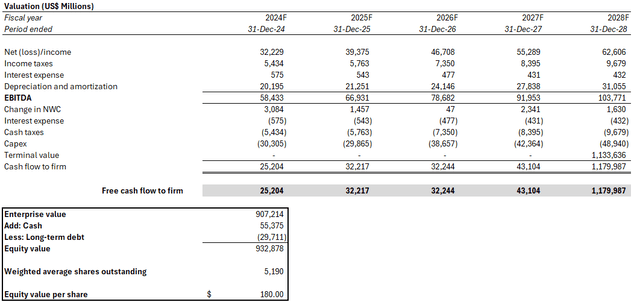

In light of TSM’s raised guidance and our expectations for further outperformance based on the favorable 2H24 set-up, we are increasing our price target for the stock to $180 (previously $154).

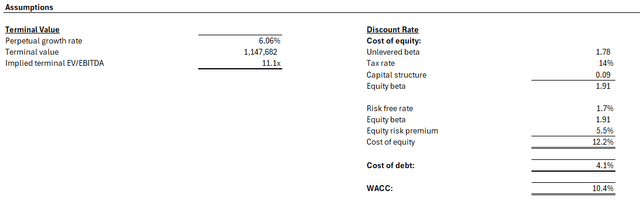

The price is derived using the discounted cash flow analysis, which considers projections taken with the foregoing fundamental discussion. A WACC of 10.4% in line with TSM’s capital structure and risk profile is applied. The analysis also considers an implied perpetual growth rate of 1.5% on 2033E EBITDA (or 6.1% on 2028E EBITDA) to determine TSM’s estimated terminal value at steady-state. Our updated valuation analysis also considers a higher-range capex outlook in line with the raised revenue guidance. The analysis anticipates a capex spend of more than $30 billion in 2024, or 35% of estimated current year revenue, in line with the upper range of management’s previous guidance, which has now been updated to the base case.

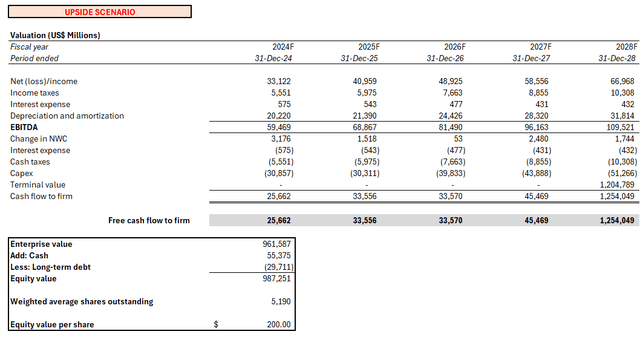

Upside Scenario Considerations

We believe TSM continues to demonstrate momentum for a further upsurge towards the upside scenario price of $200 apiece in the near-term, which considers cash flows in line with the upper range of management’s raised guidance. Specifically, in the upside scenario, we value cash flows stemming from revenue estimated at a 12% 10-year CAGR, which includes consideration for management’s anticipation for a 50% CAGR in AI processor demand over the longer-term. The robust outlook for processors based on TSM’s advanced process nodes and packaging capabilities is a key margin accretive factor, underpinning cash flow growth critical to the stock’s valuation prospects. The upside scenario price considers the same key valuation assumptions as the base case analysis (i.e., 10.4% WACC; 1.5% long-term perpetual growth rate).

Downside Scenario Considerations

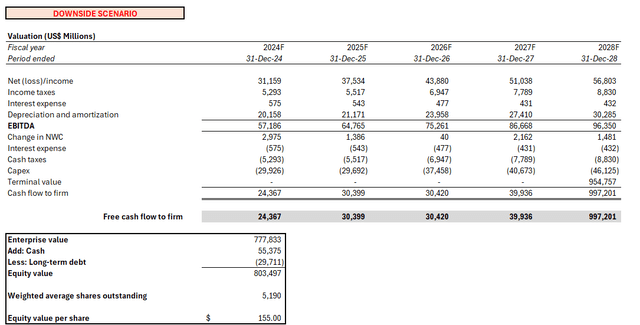

However, we remain cautious of several overhanging multiple compression risks to the TSM stock. They include considerations over ongoing macroeconomic uncertainties, geopolitical headwinds, and the company’s inherently elevated exposure to cyclical challenges.

This is evident in the stock’s recent volatility following adverse remarks from the ongoing U.S. President Election campaigns regarding the future of U.S. support for Taiwan, alongside risks of further tightening on chip export curbs. External cost pressures, which include heightened electricity costs in Taiwan – TSM’s core manufacturing base – also remain near-term headwinds weighing on the company’s ability to realize its optimal earnings prospects. Despite expectations for emerging pricing tailwinds stemming from both TSM and its customers’ openness to accepting pass-through costs, the extent of which remains uncertain. Ensuing downside impact on cash flows is expected to yield an estimated intrinsic value of $155 apiece for TSM.

Final Thoughts

TSM’s current valuation has yet to price in the upper range of its raised guidance, which, in our opinion, is likely to get realized given robust AI-driven demand trends and additive recovery tailwinds in consumer end-markets. This will also be key to partially offsetting the geopolitical risk overhang on the stock’s multiple. The favorable end-market dynamics for TSM is further bolstered by the deep pockets observed in key customers spanning Nvidia and Apple. This accordingly leaves ample room for end-market absorption of price increases that will better reflect the unmatched value of TSM’s technology advantage, as well as external cost pass-throughs.

Taken together, margin expansion driven by both pricing tailwinds and stronger-than-expected uptake to support economies of scale will be accretive to TSM’s sustained long-term FCF growth trajectory. This is critical to shareholder value generation by reinforcing its valuation outlook and capital returns prospects.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.