Summary:

- McDonald’s is largely insulated from inflationary pressures given its mostly-franchised business model.

- The company’s value offerings are delivering for consumers on a tight budget, and the fast-food giant’s digital efforts continue to resonate.

- McDonald’s strong free cash flow generation in excess of cash dividends paid has helped contribute to McDonald’s multi-decade streak of consecutive annual dividend growth.

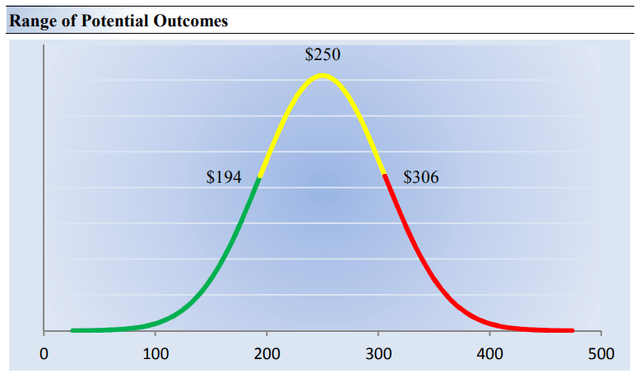

- Though McDonald’s has a large net debt position and free cash flow faced pressure during 2022, we value shares at $306 at the high end of our fair value estimate range, indicating upside potential.

- McDonald’s may be the perfect stock for this market environment, in our view.

M. Suhail

By Valuentum Analysts

Fast-food giant and dividend growth behemoth McDonald’s (NYSE:MCD) is one of our favorite stocks for consideration in this market environment for three reasons.

- Because of its largely-franchised business model, McDonald’s rakes in new revenue from its franchisees and is largely shielded from wage and food cost inflation.

- The company’s value offerings for consumers are tremendous, not only with respect to 6- and 20-piece chicken nugget offerings but also with respect to its 2 for $2 breakfast options.

- McDonald’s is a dividend growth stock with a strong growth track record. With dividend payers performing strongly over the past 12-18 months, the company may be one of the best ideas for the current market environment.

The high end of our fair value estimate range for shares is $300+, and we would not be surprised to see McDonald’s fetch a valuation like that in the coming years. As we will outline in this note, the company is well-positioned and executing well, though we note investors should be cognizant of its large net debt position and that free cash flow faced pressure during 2022 after a very strong 2021.

We value shares of McDonald’s at $306 at the high end of our fair value estimate range. (Image Source: Valuentum)

Shielded from Rising Inflationary Pressures

McDonald’s business model is perhaps not as well understood as it should be. The company has 40,000+ McDonald’s restaurants as of the end of 2022, but ~95% of these are franchised. These fees from restaurants owned by franchisees are highly lucrative, generating stable and predictable revenue, as they are a function of the sales at their franchised restaurants (not profits).

Let’s look more closely at the numbers to get a feel for how lucrative its franchise revenue stream is relative to its company-owned restaurant revenue stream. During 2022, for example, McDonald’s generated $14.1 billion in revenue from franchised restaurants, but it only had $2.3 billion in franchised-restaurants-occupancy expenses. The margin on its franchised sales is huge compared to sales of its company-operated restaurants, where revenues came in at $8.7 billion and company-operated restaurant expenses absorbed almost all of that, coming in at $7.4 billion.

When we think of McDonald’s business model, it is really its franchisees that are its customers, and these franchisees take on the operating risk of higher inflationary pressures, not only from rising wage costs but also rising food costs. McDonald’s mostly-franchised business model helps shield it from these rising costs and is a big reason why we like McDonald’s shares in an inflationary environment.

Tremendous Value Offering for Consumers

McDonald’s global comparable store sales have performed quite well of late, despite pressures on consumer pocketbooks. During the fourth quarter of 2022, for example, global comparable sales advanced 12.6% in the period, and digital systemwide sales (e.g., mobile app, deliver and kiosk) now account for more than 35% of its systemwide sales.

The company’s mobile app is changing the game, in our view, as the rewards can be meaningful. For example, one can get a free Big Mac for making one’s first delivery purchase on the app, and the consumer can earn Reward Points to redeem for more food in the future. This can be a needle-mover for consumers looking to save a couple of bucks on each order. Perhaps they can get a free Frappe or another item to shrink their bill, and the app is resonating.

Another key value offering for consumers is the price of its chicken nuggets. At most locations in Northern Illinois, for example, a six-piece chicken nugget is $2, while the 20-piece can be anywhere from $6-$8. But perhaps its best deal is its 2 for $2 specials. It has been a long time since one has been able to find a value such as this, and getting a couple of sausage McMuffins for a couple bucks is quite the savings.

Strong Dividend and Growth Track Record

McDonald’s is a dividend growth powerhouse. It last raised its dividend 10% in October 2022, to $1.52 per quarter, which translates into an estimated forward dividend yield of 2.2%. The maker of the Big Mac first started paying dividends in 1976, and it has now raised its dividend for 46 consecutive years, and we don’t think the executive team will do anything to jeopardize the track record.

McDonald’s consistent dividend growth has been supported by its free cash flow profile. During 2022, cash flow from operations came in at $7.4 billion versus capital spending of $1.9 billion, translating into free cash flow of $5.49 billion, which was in excess of cash dividends paid of $4.2 billion over the same time period. Though cash flow from operations dipped from levels in 2021 due to lower net income and working capital headwinds, the firm’s free cash flow remains very healthy, even as growth endeavors may increase capital spending in 2023.

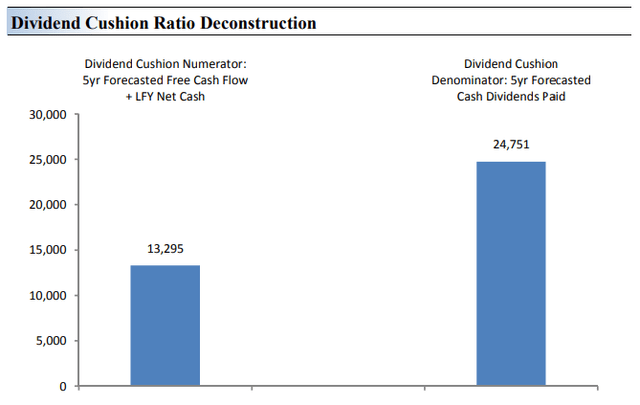

McDonald’s has a large long-term debt position, which stood at $35.9 billion, which isn’t great, but the firm has investment-grade credit ratings. Standard & Poor’s and Moody’s rate the company’s debt at BBB+ and Baa1, but arguably McDonald’s is a stronger credit given its tremendous brand name and predictable franchise revenue stream. It ended 2022 with $2.6 billion in cash and equivalents on hand. McDonald’s doesn’t score well on our pure financially-based dividend health rating system, the Dividend Cushion ratio, but the company’s fundamental backdrop is as strong as that of any company in our coverage.

McDonald’s Dividend Cushion ratio isn’t great as a result of its net debt position, but free cash flow coverage of the dividend remains solid. (Image Source: Valuentum)

Concluding Thoughts

McDonald’s is doing a lot of things right in the current market environment, treating both consumers and stockholders well with its value menu offerings and given its strong dividend growth track record, respectively. Management expects to add another net 1,500 restaurants this year, and we’re expecting another dividend increase in 2023. In our view, the firm remains insulated from many of the inflation pressures hurting restaurant owners these days, given its largely franchised business model. McDonald’s free cash flow did face pressure during 2022, higher growth spending should be expected in 2023, and long-term debt load is something to keep top of mind, but we think the stock may be perfect for this kind of market environment.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.