Summary:

- JPMorgan Chase is the largest bank in the world, ranking first in market cap, revenue, profits, and assets globally (excluding China).

- Despite its size, JPMorgan Chase trades at an average valuation, pays a modest dividend, and lacks competitive share buybacks compared to Morgan Stanley, its smaller peer.

- Today, we explore why the smaller house of ‘Morgan’ might be the right buy for investors at the present moment in time.

- We rate MS a “Buy” and JPM a “Hold”.

Michael M. Santiago

JPMorgan Chase (NYSE:JPM), by some measures, is the largest bank in the world.

It holds the number one spot in terms of Market Cap, the third spot in both Revenue and Net Profit, and the fourth spot when measured by Total Assets.

If you take Chinese banks out of the equation (which, to some degree, are extensions of the Chinese government), then JPM is the top ranked bank in all four categories, globally.

Last year, the bank raked in profits of more than $37 billion, which outstripped competitors Bank of America (BAC) and Citigroup (C) (which came in second and third place), earning $27 billion and $15 billion respectively.

Despite the bank’s size and weight, however, the company seems to trade at an average valuation, pay a modest dividend, and isn’t buying back shares at a pace we think is competitive.

In contrast, Morgan Stanley (NYSE:MS), the smaller investment bank, is much more attractive in our eyes.

Trading at a cheap historical multiple, sporting a solid dividend, and buying back shares at a quick clip, the other house of ‘Morgan’ seems like the better place to invest your capital at the present moment.

Let’s take a look at the top three reasons you should consider MS as your next financial sector purchase.

1.) Business Performance

On the surface, it’s tempting to look at some of the metrics between JPM and MS’s businesses and come to the conclusion that JPM is a better performing bank overall.

For one, JPM sports higher Return on Equity and ROTCE metrics. You can see this reported in each banks’ respective recent earnings reports:

“The Firm [MS] delivered ROE of 10.0% and ROTCE of 13.5%”

vs.

“For the third quarter of 2023, JPMorgan Chase reported … ROE of 18% and ROTCE of 22%.”

Additionally, JPM sports significantly better net income margins. JPM’s profit margin stands at a sector-beating 36% as of the most recent quarter, while MS’s net income percentage stands a bit lower at 18.3%.

Taken together, it’s tempting to argue that JPM is simply a more profitable bank that is more efficient with its asset base and business operations.

However, that doesn’t tell the whole story.

The key piece to know here is that the makeup of each company’s businesses are different, with Morgan Stanley earning the lion’s share of revenue and profit from its investment banking and wealth management divisions.

By contrast, JPM is more diversified, with a massive consumer franchise, mortgage banking activities, and a large outstanding loan book.

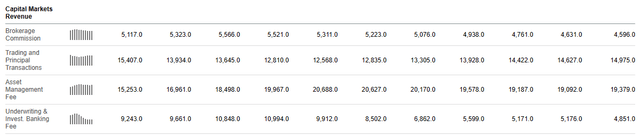

While MS’s businesses may be less profitable overall, they are far less cyclical, and thus, more stable. Asset management fees and capital markets revenue remains robust, and has stayed consistent over time:

Seeking Alpha

The bank has some exposure to net interest margins, but only at 17% of total revenue.

Alternatively, JPM is much more exposed to the credit cycle, with ~60% of revenues coming from net interest margins.

This has allowed the bank to earn far more in recent quarters as the hiking cycle has taken off.

However, looking forward, it appears that the cycle will be coming back in:

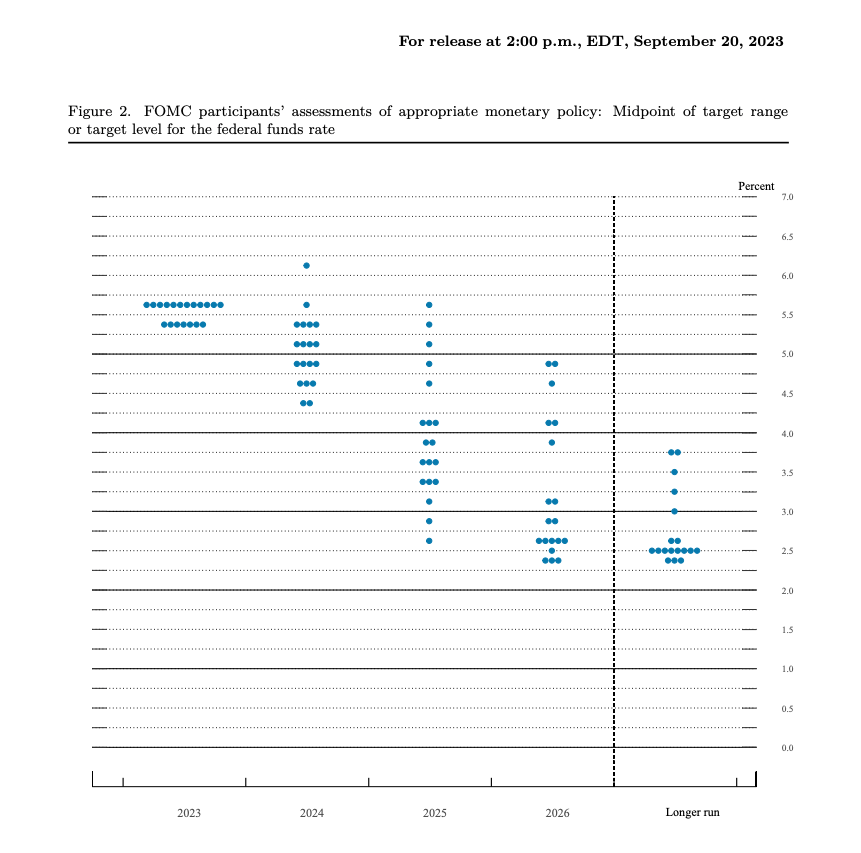

Federal Reserve

The dot plot above shows where FOMC members expect monetary policy will be in the coming years.

As you can see, there’s a general downwards trend, with a majority of FOMC voters expecting rates below 3% by 2026.

If this is how interest rates play out, then JPM has far more exposure to a collapsing NIM’s in an easing cycle, which could dent margins and ROTCE.

Additionally, if rates stay higher for longer, JPM holds more risk on its balance sheet in the form of commercial real estate loans, which could present risks on deals that can’t get funded at higher rates. While JPM’s percentage of office loans outstanding remains small, this could also hurt earnings and margins.

Looking forward, it would appear that JPM could see some mean reversion in its net interest income, which could shrink back from its current spot at $22 billion per quarter towards $15 billion per quarter over the next few FY’s.

This is what the bank was earning on the flip side of the hiking cycle we’ve experienced.

This could flow through to a $2-3 billion per quarter drop in net income, which would dent annualized earnings by nearly 25%, which could drop the stock in line assuming a fixed valuation. At the very least, there are earnings headwinds from here in an easing scenario.

MS’s situation only includes perhaps a total of 3-5% downside as a ‘worst case’, as net interest income has remained mostly flat through the recent cycle. No explosion of recent profits, but no corresponding cyclicality, either.

Net net, MS may take less risk, but the bank’s more insulated revenue streams have a strong possibility of outperforming in whatever coming rate environment should manifest.

2.) The Valuation

While we prefer MS’s more insulated business and revenue profile going forward, the bank is actually trading at a better historical valuation than its larger, more diversified peer, JPM.

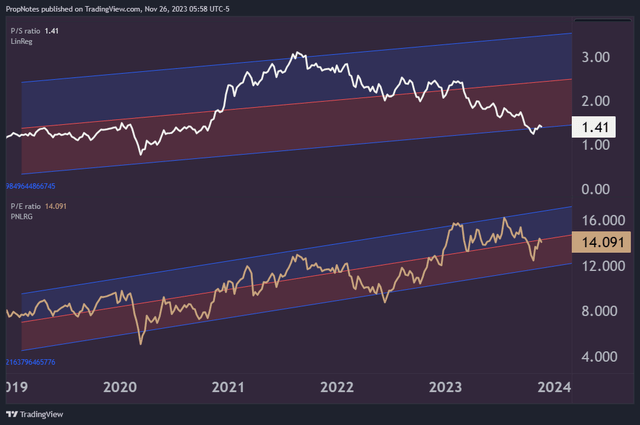

On both top line sales and bottom-line earnings, MS is trading at the lower end of its historical regression/deviation range, at 1.41x sales and 14x earnings, respectively:

TradingView

While the sales multiple is really the one that sticks out here, MS’s 14x net income multiple is also slightly below the average regression trend of the last 5 years.

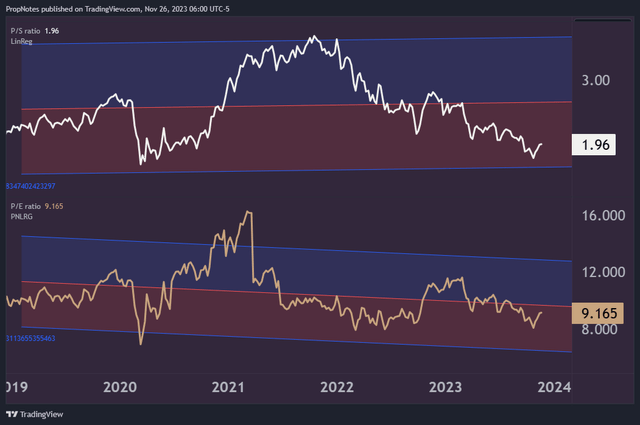

On the flip side, JPM is trading at 1.9x revenue, and 9.1x earnings:

TradingView

Yes, JPM’s earnings multiple is nominally cheaper. However, each of JPM’s valuations are trading closer to their long-term average, which indicates that buying at the present moment doesn’t present as much of an interesting entry point.

If you extrapolate JPM’s valuation and earnings trends, shares are currently trading around $157. Assuming an ‘on-trend’ fair value, you’re looking at a range between $155 and $185.

Alternatively, for MS, shares are trading at ~$80. The fair value range looks a bit wider, but ‘fair value’ from a linear regression standpoint is somewhere between $87.5 – $125 per share, depending on which metric you’re looking at.

Finally, another key thing to note here is that MS’s valuation trends remain firmly up and to the right, while JPM’s valuation trends look stagnant over the last 5 years.

In other words, it looks like MS’s lower-risk business model is earning points with the market, and investors have rewarded the company with multiple growth, on average, over the last 5 years.

This can’t be said for JPM.

When it comes to owning assets, buying into companies that are growing their average multiple over time can be a powerful component of wealth building.

Because of this, and combined with the attractiveness of the top line multiple, MS seems like a much better buy in the present market environment.

3.) Capital Returns To Shareholders

Finally, at the end of the day, owning financial sector stocks is really about earning concrete returns as a shareholder.

Sure, profitability and growth sound great, but if a bank isn’t rewarding shareholders, then it’s hard to see how one can compound capital over time.

From this angle, MS is also doing a much better job than JPM.

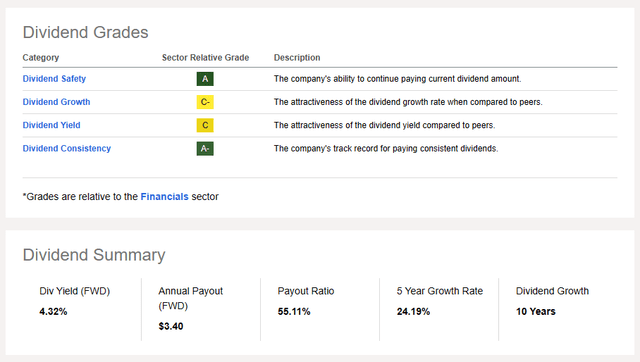

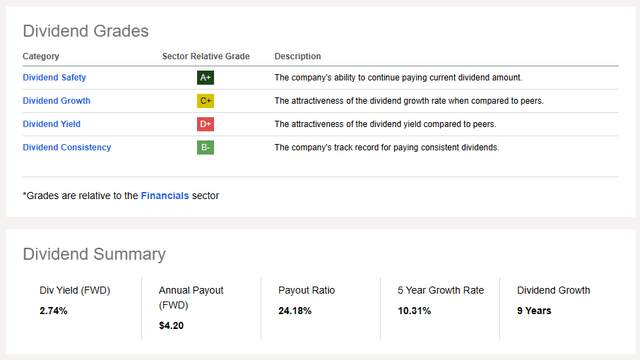

For one, MS pays a much higher dividend:

MS (Seeking Alpha)

JPM (Seeking Alpha)

As you can see, MS’s current 4.3% dividend compares favorably to JPM’s 2.7% payout.

Sure, MS’s payout ratio is elevated compared to JPM, but both banks remain in a stable range, as indicated by the Seeking Alpha Quant scores which put both bank’s Safety ratings in the ‘A’ tier.

This higher payout has manifested in a better yield on cost over time, as well.

If you purchased shares in MS and JPM 5 years ago, you’d be earning 7.6% yield on cost on your MS position, vs. 3.8% on a JPM position.

Clearly, MS’s dividend policy is more rewarding for shareholders.

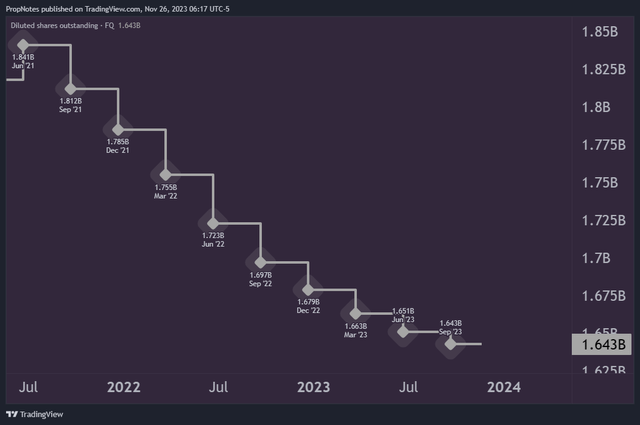

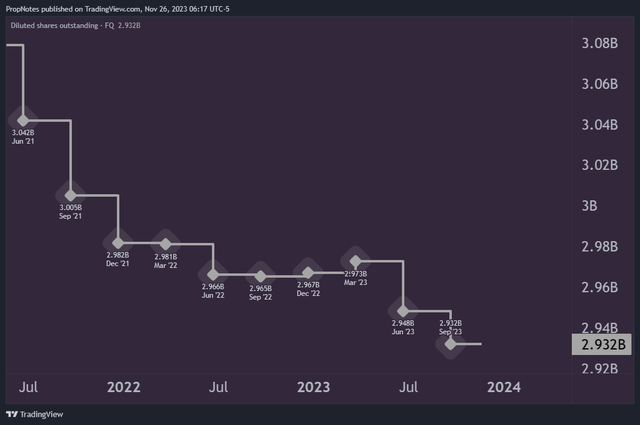

MS also has the edge when it comes to controlling share count.

Since the company’s purchase of Etrade closed in 2021, MS has bought back almost 11% of the company’s float:

TradingView

This compares favorably with JPM, which has only purchased back 3.6% of the company’s outstanding shares over that same period:

TradingView

Buying shares back like this increases investor’s ownership of the business without having to do anything else, which increases leverage and ultimately, rewards, over time.

Because of this, on both the dividend front and the buyback front, MS seems to be the far-and-away better bank when it comes to rewarding shareholders.

Risks

There are some risks to this thesis.

The main one centers around the credit cycle. If rates are higher for longer, than JPM stands in a good position to outearn MS over the interim. The dot plot is forever changing, and inflation could pick back up for a number of reasons. We don’t see this happening, but it’s a risk nonetheless.

Additionally, the valuation trends expressed over the last few years could mean revert. In other words, the fact that MS has been continually rewarded with a higher multiple over time should have some theoretical upper limit, above which shares simply won’t trade. This could happen, but we don’t see it happening yet, given the continued growth pathways that MS has available to it.

On the flip side, JPM could see higher average multiples if it continues to out-earn.

Finally, there’s a risk that MS stops buying back shares at the rate it has been once it gets back to the diluted share count it was at pre-ETRADE acquisition. This would dampen the capital-returns thesis somewhat, although the dividend output is still far and away the better deal.

All in all, there are some risks to our assumptions, but we stand by the picture as a whole.

Summary

Adding it all up, MS seems like a better buy vs. JPM at the present moment due to the company’s highly stable business model, attractive historical valuation, and superior capital returns profile.

This isn’t to say that JPM is a bad bank that will run into trouble in the short or medium term – we don’t think that it will.

However, for our money, MS remains favorably stacked up against the biggest bank in the world on all of the metrics that matter.

Thus, we rate MS a “Buy”, and JPM a “Hold”. MS shares have upside room into what we think is fair value, while JPM shares are already within that range.

Cheers!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.