Summary:

- About 80% of M&A deals fail to create value for investors.

- Examples of failed acquisitions include AOL’s acquisition of Time Warner and AT&T’s acquisition of Time Warner.

- Cisco Systems, Inc.’s acquisition of Splunk is a needle-moving deal that is being paid for in cash and is not expected to put the dividend at risk.

- Splunk is a great fit for Cisco, turning it into a global software powerhouse. Cisco is paying a PEG of 1.1 for Splunk, which is growing at 25%.

- The downside of this deal is that Splunk shareholders get bought out for 1.2 years’ worth of expected growth. Cisco’s dividend will become slightly safer over time, and its growth rate might more than double. But there is one very important thing Cisco investors need to know about the limitations of this deal.

PeopleImages/E+ via Getty Images

According to the Harvard Business Review, about 80% of all M&A Deals fail to create value for investors.

Granted, that study looked at short-term stock price movement and not long-term growth in fundamentals. However, history is littered with the empire-building corpses of failed acquisitions.

How about AOL’s $182 billion acquisition of Time Warner, announced on Jan 10th, 2000, just three months before the peak of the tech bubble?

Just two years later, AOL took a $99 billion write-down on that acquisition after the profitability of the combined company fell off a cliff.

The new AOL Time Warner changed its name to Time Warner and spun off AOL in 2009, which Verizon (VZ) bought for $4.4 billion in 2015.

Verizon later sold AOL to Apollo Management (APO) for $5 billion, though it took a loss since that deal included other media properties it had bought, building its own media empire.

In the meantime, Time Warner was acquired by AT&T (T) for $85 billion in 2018, in a prolonged legal fight it eventually won.

Income investors wish it hadn’t, because AT&T bought Time Warner at a high premium during a period when “content was king,” and AT&T’s dreams of becoming a profitable streaming giant didn’t seem nearly as crazy as they do now.

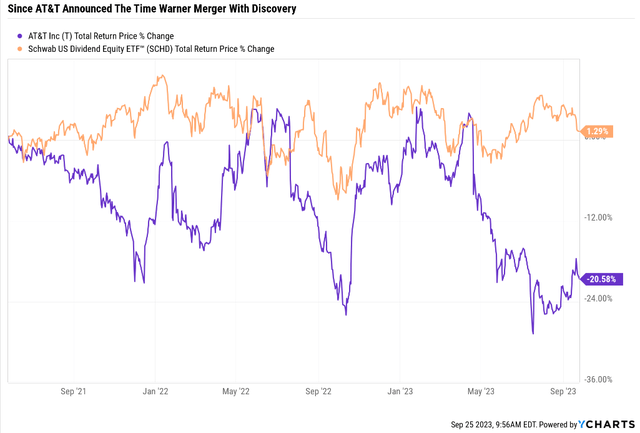

Sure, high-yield blue-chips haven’t done much in two years. But AT&T is down 21%, including dividends.

That’s since the company announced a significant reversal of its empire building, merging Time Warner with Discovery to create Time Warner Discovery in a $43 billion deal.

AT&T saddled the new company with a lot of debt. It cut its dividend by 50%, throwing away its dividend aristocrat status, breaking investors’ trust, and most certainly has failed to “create shareholder value.”

And let’s not forget that big M&A deals can also trigger big bear markets.

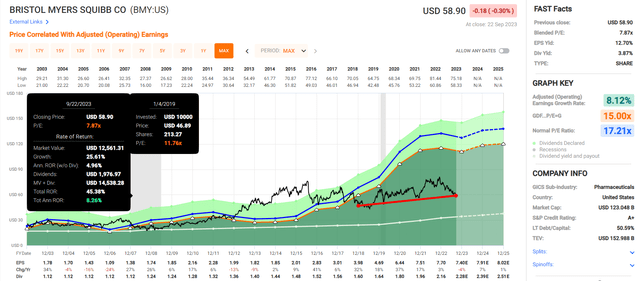

In Jan 2019, Bristol-Myers Squibb (BMY) announced the $74 billion debt-funded acquisition of Celgene, and its P/E fell from a dirt cheap 12 to 6X (factoring in the pro-forma earnings from the new company).

That deal was great for BMY’s fundamentals, with earnings growing 60% since 2019.

Bristol’s Growth Since Buying Celgene Hasn’t Worked Out That Well For Investors

But investors haven’t exactly been celebrating the 8% annual returns, which has underperformed most other dividend stocks.

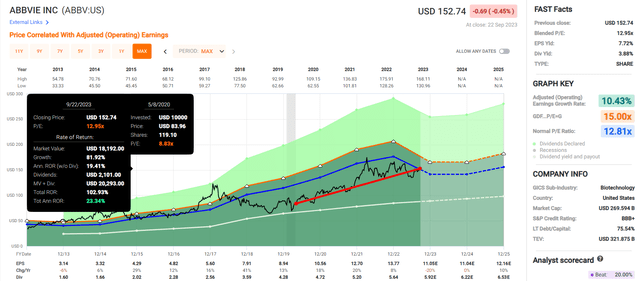

How about AbbVie’s (ABBV) $63 billion acquisition of Allergan in 2020? That deal did work out great for investors, though at one point after it was announced ABBV hit a forward pro-forma P/E of 7.

AbbVie’s $63 Billion Allergen Deal Was Glorious For Investors

Cisco Systems, Inc. (NASDAQ:CSCO) isn’t exactly new to the M&A game.

- 245 acquisitions since 1984 for $77 billion

- $28 billion of that for Splunk (NASDAQ:SPLK), announced Thursday, September 21st.

Is Cisco making a mistake with its largest-ever acquisition (by a factor of 4X)? Or will this prove to be Cisco’s Allergan moment and boost growth significantly?

Is the dividend safe? Or is this the next AT&T/Time Warner disaster?

Let’s look at the 2 reasons Cisco investors should love this deal, 2 reasons they shouldn’t and what it likely means for the future of its dividend.

Reason 1: Cisco Is Paying For This Without Taking On Debt

$28 billion sounds like a lot, but here is some context.

- Broadcom (AVGO) is waiting for final approval to buy VMware for $70 billion.

- Dell (DELL) bought EMC for $67 billion in 2016.

- IBM (IBM) bought Red Hat for $34 billion in 2019.

- Salesforce (CRM) bought Slack for $28 billion in 2021.

- Microsoft (MSFT) bought LinkedIn in 2016 for $26 billion.

So, this is a needle moving deal for Cisco whose previous biggest deal was cyber-security firm Scientific-Atlanta for $6.9 billion in 2005.

So this is about 4X the size of Cisco’s largest purchase.

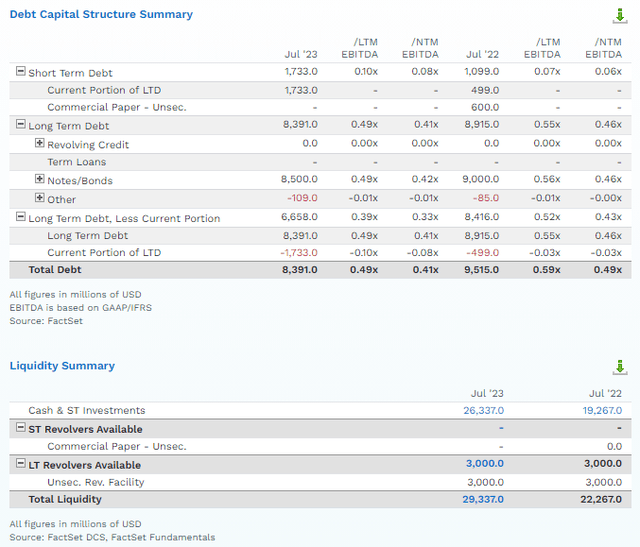

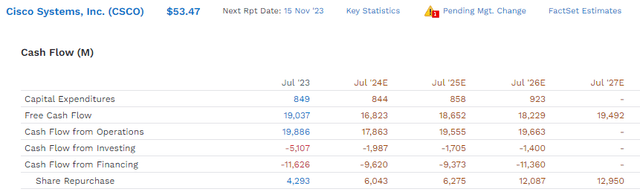

Cisco has $26 billion in cash and a $3 billion revolver so it can cover this deal, and it’s also generating $4 billion per quarter in free cash flow. So by the time this deal closes CSCO would have about $34 billion in cash to pay for this deal with no debt if it wanted to avoid selling higher interest bonds.

Analysts expect CSCO to avoid selling new bonds because it’s going to use cash to fund this deal. The dividend + buyback payout ratio is expected to hit 100% in the next few years as Cisco attempts to keep paying its dividend, and buying back 2% to 3% of net shares.

Reason 2: The Dividend Remains Very Safe

- Dividend Kings safety score: 94%

- dividend cut risk in average recession: 0.5%

- dividend cut risk in severe recession: 1.3%

- overall quality score: 94% very low risk Ultra SWAN.

Cisco’s dividend isn’t being put at risk by this big purchase, unlike many other examples of empire building (like AT&T).

Not only is Cisco paying cash, paid out of actual cash and free cash flow, but this extra $4 billion in annual revenue will grow sales by 7%.

Splunk’s recurring revenue is growing at 11% though its margins are solid at 22% EBITDA margins and here is how this will affect Cisco’s leverage.

| Year | Cisco Debt/EBITDA Without Splunk | Cisco Debt/EBITDA With Splunk |

| 2023 | 0.41 | 0.57 |

| 2024 | 0.40 | 0.54 |

| 2025 | 0.39 | 0.53 |

| 2026 | 0.39 | 0.52 |

(Source: FactSet Research Terminal.)

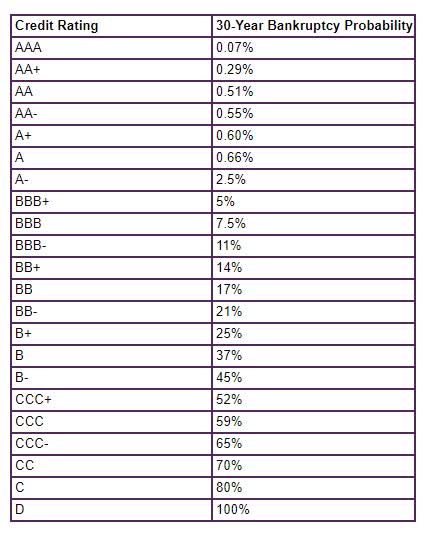

Yes, Cisco’s leverage is going to rise due to this deal, but 0.6X leverage shouldn’t affect its AA- stable credit rating. S&P says it wouldn’t downgrade Cisco to A+ until its leverage ratio surpassed 1.0 on a long-term basis.

S&P

Cisco’s risk of bankruptcy is just 0.55% and S&P likes this deal a lot.

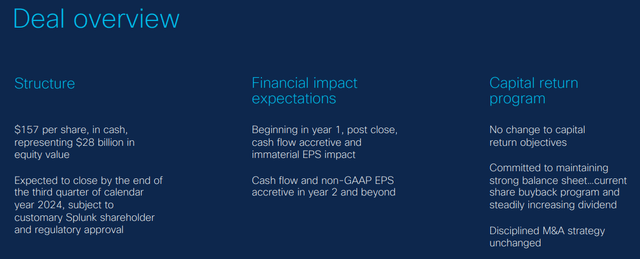

S&P isn’t worried that it’s going to take a few years for this deal to pay for itself. Management says that by the end of year two it will be cash flow and EPS accretive.

Splunk would account for 6% of the combined company’s pro forma revenue and 4% of its EBITDA, thus the transaction will have a modest impact on its income statement. Cisco has a significant net cash position, therefore we expect its credit metrics will likely remain in the acceptable range for the ‘AA-‘ rating. We estimate the company’s pro forma leverage will be about 0.6x, which compares with our downgrade threshold of 1.0x for the current rating, and believe this figure would improve if it conserves cash during the pre-close period.” – S&P.

CSCO plans to continue with its generous capital return program. Here is what analysts expect.

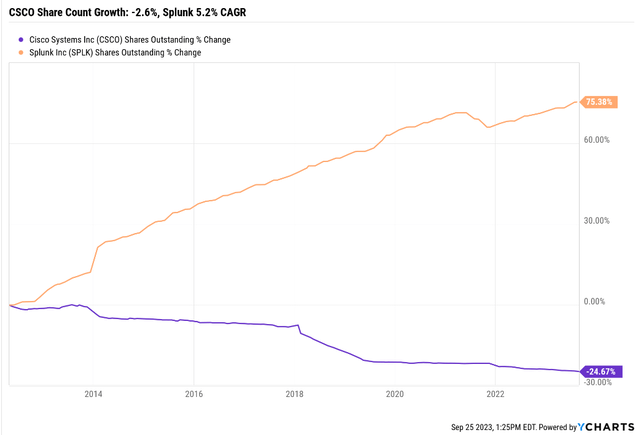

Cisco is expected to increase its buybacks next year by 50% and then double them again in 2026, hitting $13 billion per year by 2027.

- $40 billion cumulative buybacks between 2023 and 2027.

That sounds pretty impressive for a $217 billion company, almost 20% of shares outstanding or about 5% per year. But don’t get too excited.

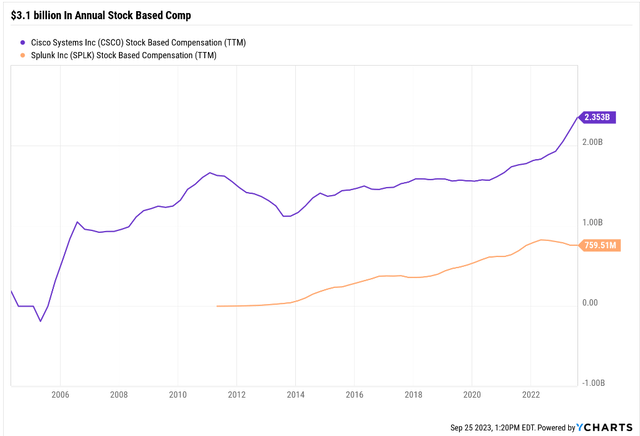

CSCO was already spending 50% of the buybacks on offsetting stock comp dilution.

In effect, Cisco is hiding the true cost of its employees, which it pays with printed shares that it later buys back.

Splunk is a much faster-growing company that was paying 20% of revenue in stock options. You can bet that Cisco is going to have to increase its stock comp to those employees or else it will lose them.

So, I would expect at least $4 billion per year or even $5 billion by 2027 in annual stock comp compared to $13 billion in expected buybacks.

So, around 2% to 3% annual reduction in share count when factoring in stock based comp.

There should be no problem for Cisco to keep paying a growing dividend.

| Year | FCF Payout Ratio With Splunk |

| 2023 | 38% |

| 2024 | 45% |

| 2025 | 41% |

| 2026 | 44% |

(Source: FactSet Research Terminal.)

In fact, management said it remains committed to “steadily increasing our dividend” as well as buying back stock at the current rate.

60% is the safety guideline from rating agencies for a safe dividend in this industry, and Cisco’s revenue is already extremely stable due to 43% of sales being recurring revenue subscriptions.

That will now increase to 46%, showcasing Cisco’s tech utility business model.

Reason 3: This Deal Makes Sense

Overall, the combination of these firms is not particularly surprising as Cisco was rumored to have made a $20 billion bid for Splunk in early 2022. Even at $28 billion, we think Cisco is paying a fair price for Splunk today, as the 31% premium is on par with many technology deals, and we anticipate that revenue synergies from faster-growing Splunk may offset this premium paid over time. The deal price is equivalent to 7 times Splunk’s annual recurring revenue, or ARR, of $4 billion, which we again view as a reasonable multiple.” – Morningstar.

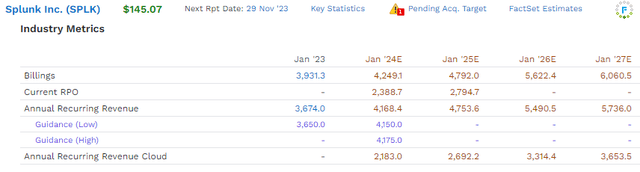

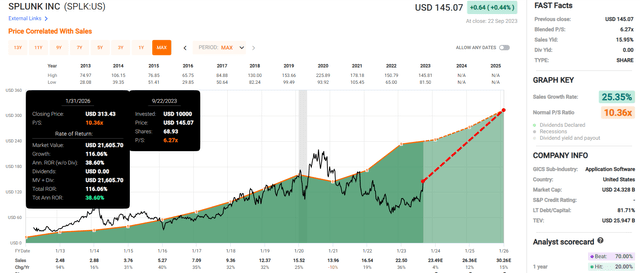

7X sales for a fast-growing company could indeed be a good deal, but let’s confirm that.

At first glance, it looks like CSCO is getting SPLK at a 30% historical discount, an impressive bargain.

But remember that its historical growth rate is 25% and sales are expected to slow to 11% annually through 2027.

So, only time will tell if Splunk will actually be worth 7X sales.

Cisco is paying 6.7X enterprise value/sales, pretty much the same P/S ratio.

Cash-adjusted earnings? 28X forward so this isn’t necessarily a cheap deal but I would say it’s a fair deal.

- 25.4% CAGR EPS growth consensus through 2027

- 28X cash-adjusted earnings for a company growing at 25%? That’s a PEG ratio of 1.1 and hyper-growth at a reasonable price.

Naturally, Splunk is only worth 7X sales if it actually can grow as expected.

Cisco thinks that it’s combination of AI, cybersecurity, and subscription cloud services will make for a natural fit with Splunk.

The Downside Of This Deal For Investors In Both Companies

OK, so Splunk investors get a 31% premium, and then Cisco shares, a company with a 12-year dividend growth streak, ever since it began paying one.

But here’s the downside for Splunk investors. They are trading shares of a 25% growth company for this.

Cisco is a tech utility and growing at the same rate as the utility sector.

- utility sector growth rate is 6% according to Morningstar.

What about Cisco’s expected dividend growth rate? 3.3% annually through 2027.

OK, but Splunk is expected to grow earnings at 25%, so what kind of earnings boost might Cisco get?

| Year | Cisco Earnings Without Splunk | Cisco Earnings With Splunk | Splunk earnings |

| 2023 | 15979 | 16479 | 500 |

| 2024 | 16474 | 17195 | 721 |

| 2025 | 17026 | 17877 | 851 |

| 2026 | 17611 | 18630 | 1019 |

| Annual Growth Rate | 3.3% | 4.2% | 26.8% |

| Buybacks | 2.6% | 2.6% | -5.10% |

| EPS Growth | 5.9% | 6.8% | 21.7% |

(Source: FactSet Research Terminal.)

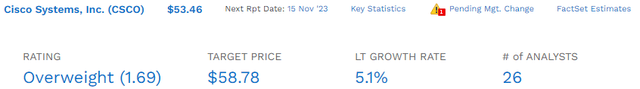

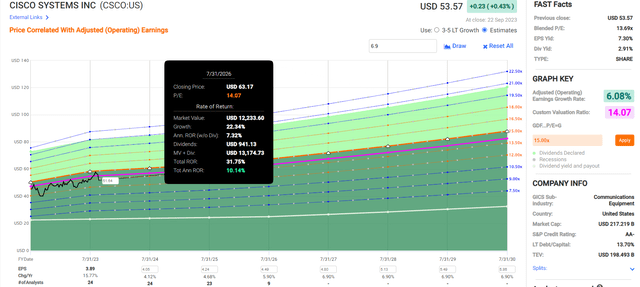

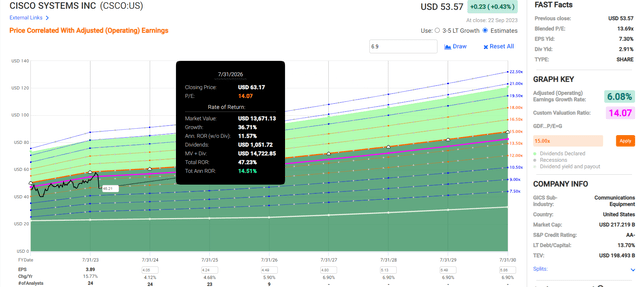

Buying Splunk might be able to boost Cisco’s growth rate to 7%, and its long-term return potential to 10%, including the 3% dividend.

- Utilities offer 9.4% long-term return potential

- S&P 10.2%.

So Cisco is now basically expected to deliver around 10% long-term returns, market level, just with a much safer dividend with twice the yield.

Bottom Line: Cisco Makes A Great Deal, But Don’t Forget It’s Still A Tech Utility

Is Splunk really going to grow earnings at 20% to 25% in the coming years? Cisco management thinks so, and that’s why they are buying the company for a PEG ratio of 1.1, hyper-growth at a reasonable price.

S&P and Morningstar like the fit of the deal, and I agree, this deal makes sense.

It’s nothing like the empire building we saw with AT&T or AOL, with their disastrous Time Warner deals.

This is a sensible deal that is being paid with cash and at a reasonable valuation.

Is the timing perfect? Not necessarily. If long-term rates keep rising, now at 16 year highs, then tech could get wrecked and Cisco might end up buying Splunk at the top of this mini-tech bubble.

On the other hand, deals this big can’t be turned on or off with a switch. Typically a deal this size requires 6 to 12 months of due diligence and negotiations before it’s announced.

So Cisco might have started negotiation for Splunk back in October of 2022, when the valuation was probably a lot lower.

They likely closed the deal by raising the price to $28 billion and that PEG ratio of 1.1.

The only downside of this deal I see is that it won’t significantly boost Cisco’s growth rate like some investor might think.

Splunk investors should be somewhat upset that they are getting a buyout of a 25% growth company for a 31% premium.

Basically Splunk investors are getting 1.2 years’ worth of expected growth as their payout and that’s it.

But as far as income investors go? I wouldn’t expect Cisco to grow the dividend any faster than the 3% to 4% rate of the last 1 to 5 years.

The dividend is rock solid, very safe, with a 1.3% risk of a cut in even a Pandemic or Great Recession level economic calamity.

The 3% yield is also attractive compared to the S&P 500 though not necessarily high-yield blue-chip ETFs like Schwab U.S. Dividend Equity ETF™ (SCHD) (3.7% yield).

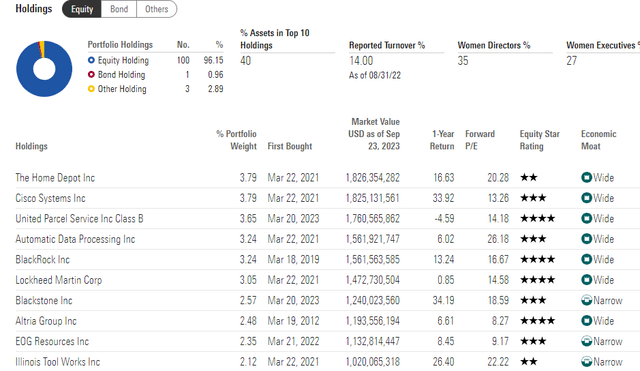

In fact, CSCO is the 12th-largest holding in SCHD right now, making up 3.8% of the portfolio.

So, will I be buying Cisco myself? No, because I already own it in SCHD, which makes up about 6% of my family’s charity hedge fund.

- so about 0.25% of our net worth is invested in Cisco.

That’s certainly below the 20% max risk cap recommendation for a very low risk Ultra SWAN future dividend aristocrat like Cisco.

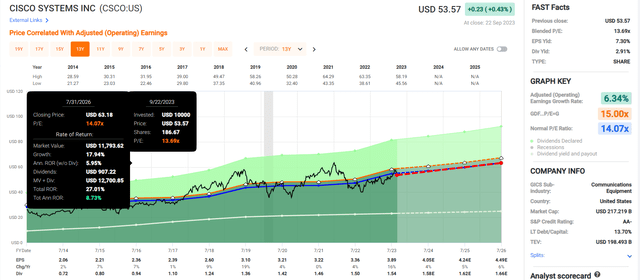

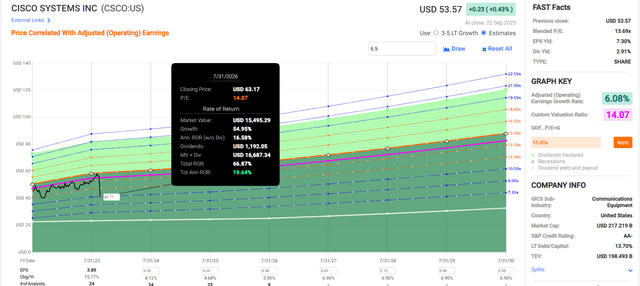

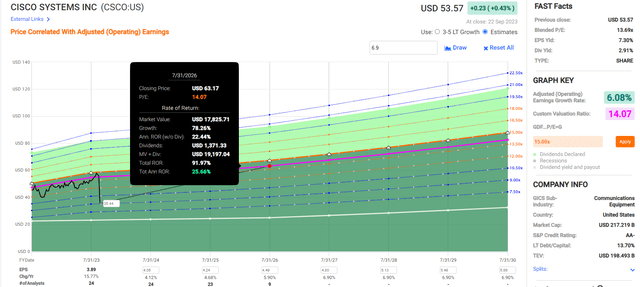

Including Splunk About 10% Annual Total Returns Through 2026

A 0.25% position in a steady and rock-solid tech utility that can deliver long-term market-like returns? About $6,000 in total exposure? Sure, I think that’s reasonable and prudent.

Should you buy Cisco right now? Here are the return potentials right now at larger discounts.

- current price: $53.44

- historical fair value: $54.36

- discount: 2%

- DK rating: potential reasonable buy

- good buy price (5% discount): $51.64.

- strong buy price (15% discount): $46.21

- very strong buy price (25% discount): $40.77

- Ultra value buy price (Buffett-style “fat pitch,” 35% discount) $35.34

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own about $6,000 worth of CSCO via SCHD.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, Company Screener, and more.

Membership also includes

- Access to our 13 model portfolios (each one beating the market in this correction)

- My personal correction watchlist

- my family’s $2.5 million charity hedge fund

- 50% discount to iREIT (our REIT-focused sister service)

- real-time chatroom support

- exclusive email updates to all my retirement portfolio trades

- numerous valuable investing tools

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.