Summary:

- Many analysts and investors anticipate a recession in 2023. But the strong December jobs report may spell a ‘Goldilocks’ economy ready for investment.

- Inflation is eating into revenue and profits. Particularly, the tech sector (XLK) is -26% over the past year. But I have 3 growth stocks quant-rated Strong Buys.

- Offering strong fundamentals, tremendous momentum, and upward earnings revisions, each of my picks is attractive and has remained resilient despite market declines.

- Where tech and software are extremely sensitive to rising interest rates, there can be an upside for growth tech, even in a down market, especially in Application Software.

- Discretionary spending may experience a slowdown in 2023, and consumer tech stocks could feel the effects. Application Software stocks are unique and may have some cushion from declines. Using quant ratings and factor grades as tools, I’ve outlined why my stock picks are rated strong buys for the New Year.

TU IS

Salesforce is Not Such a Force Right Now

Move over Salesforce (CRM). We have some application software gems with potential upside. The beaten-down tech sector has done a number on portfolios. As 2023 spells hope for some companies of a turnaround, big names like Salesforce, Amazon (AMZN), and Meta (META) are cutting jobs amid economic uncertainty and lower-than-anticipated performance.

According to Goldman Sachs Research, “higher interest rates and tighter financial conditions disproportionately impact the sector because tech company profits are typically expected further out in the future and therefore subject to greater duration risk.” The software giant Salesforce plans to lay off 10% of its workforce, or ~8,000 employees, a testament to the turnaround companies are preparing for in 2023. And while there’s still a Strong Buy rating on CRM, given Salesforce’s executive leadership shakeup and other unknown factors, it may be best to stay on the sidelines – at least for a bit longer, especially as they work through the layoffs, and focus on revenue and profits in the new year.

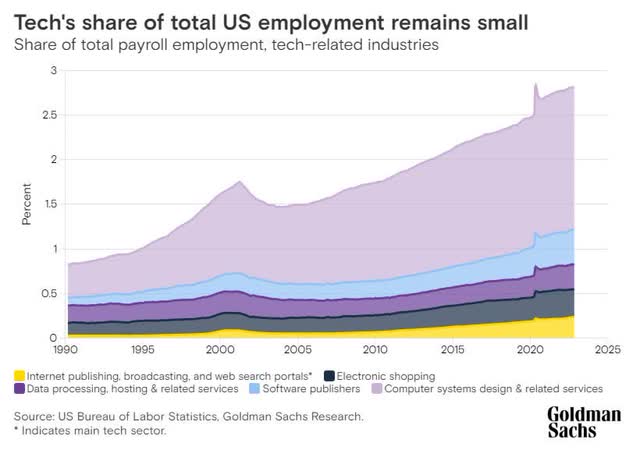

Tech Sector U.S. Employment Chart ( (Goldman Sachs Research, Bureau of Labor Statistics))

Although the tech sector’s employment and its share of unemployment is relatively small compared to other sectors, layoffs are taking place and may prove positive for companies who anticipate a challenging environment and slowing sales in the New Year. The latest employment data release shows that the U.S. economy added more than 220,000 jobs in December, ~4.5M total for 2022. Headlines indicate a strong labor market, and despite the hot jobs report and inflation on fire, wages have cooled, signaling the time may be ‘just right’ for the Fed to slow hikes.

Goldilocks Economy & Growth Stocks

Like the fairytale Goldilocks and the Three Bears, a Goldilocks economy is not too hot or cold; but ‘just right’ – an ideal environment for investing, with companies tending to produce positive earnings growth that leads to a rise in stock prices. With slowing job growth and an unemployment rate of 3.5%, its lowest since the 1960s, the markets are trading higher.

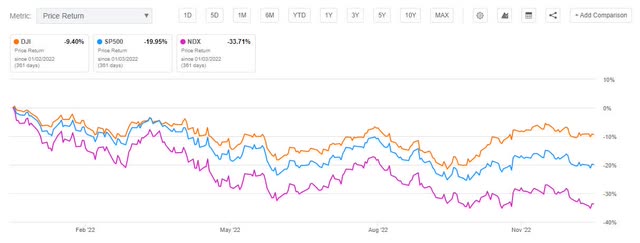

Since the pandemic, we’ve seen the boom and bust of many industries, with tech paving the way for sharp increases and market declines. While timing the market is nearly impossible, the Nasdaq lost 33.71% of its value in 2022, followed by the S&P 500 -19.4%, and the Dow Jones -9.4%, prompting investors to question where to invest their money in 2023.

Major Indexes 2022 Price Performance (S&P 500 vs. DJIA vs. Nasdaq)

Major Indexes 2022 Price Performance (S&P 500 vs. DJIA vs. Nasdaq) (Seeking Alpha Premium)

Although technology and high-growth stocks prospered over the last decade, they have been pummeled in the current environment, with many trading at suppressed levels. Amid the slowdown in discretionary and consumer spending, consumer technology stocks intended for general use by individuals could see greater volatility than tech intended for businesses or larger organizations. For this reason, I’m focusing my three growth stocks on software companies that don’t heavily rely on individual consumers.

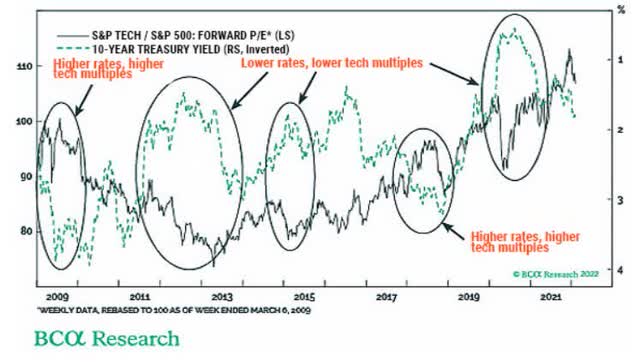

Each of my picks possesses solid fundamentals and is attractive despite market declines. Where tech and software tend to be extremely sensitive to rising interest rates, there is a lot more upside potential for tech, with rates going lower than downside, with rates going higher. Longer-dated debt used as the discount rate is higher when discounting future earnings, which lowers earnings expectations. However, the risk of longer-dated bonds moving higher from their current levels is much less than longer-dated interest rates moving lower from current levels. Where interest rates can impact equity returns, as showcased in the below chart, “the purported link between interest rates and relative tech-stock performance must come down to price-earnings multiples. But for the first ten years following the global financial crisis, tech’s relative multiples rose and fell in tandem with interest rates.”

Tech Stock Performance and Interest Rates’ Effects

Tech Stock Performance and Interest Rates’ Effects ((BCA Research))

Most interest rates movement will be on the front end of the curve, and given the Fed’s guidance, it is likely mostly priced in. That being said, the relative risk to potential reward favors high-quality growth and software companies, particularly those that could maintain margins thus far. For this reason, I’m highlighting three top Application Software stocks with bullish momentum and strong EPS revisions to buy in the new year.

My Top 3 Growth Stocks: Application Software Industry

My three stock picks are in the beaten-down tech sector (XLK), -26.35% over the last year. Despite the sector’s sharp sell-off, focusing on growth companies with strong fundamentals that have shown resilience in the contracting environment may prove to be an opportunity. Focusing on quality is a great way to navigate the uncertain environment by diversifying your portfolio with our quant Strong Buy-rated companies with solid financials and free cash flows.

1. Ceridian HCM Holding Inc. (NYSE:CDAY)

-

Market Capitalization: $9.19B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 1/6/23): 45 out of 659

-

Quant Industry Ranking (as of 1/6/23): 10 out of 214

Cloud Human Resources (HR), payroll, benefits, and workforce management IT company Ceridian HCM Holding Inc. and its subsidiaries offer a unique business model through direct sales force and third-party channels. Headquartered in Minneapolis, Minnesota, Ceridian’s “people platform” employs the workforce to simplify tasks and work more efficiently using modern technology for better bottom-line results. Despite a -32% price decline, CDAY offers upside potential with its bullish momentum.

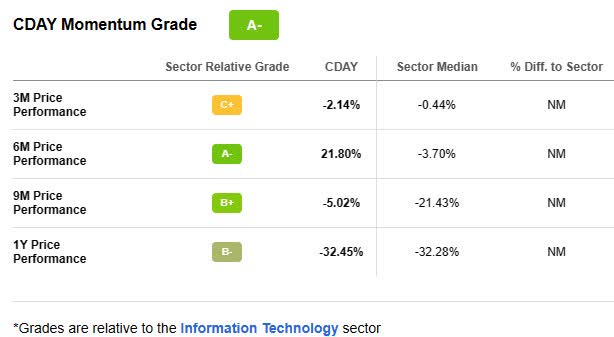

CDAY Stock Valuation & Momentum

Like much of the tech sector, CDAY’s stock experienced volatility in 2022. Despite a stretched valuation, investors are purchasing more shares of CDAY as it continues to outperform sector peers, according to our quant ratings.

CDAY Stock Momentum (Seeking Alpha Premium)

With a net debt position of ~$852M and a market cap of $9.19B, Ceridian is on solid footing with an enterprise value of $10.04B. A- momentum is showcasing how the stock outperforms its peers quarterly, with significant price-performance showings for three-, six-, and nine-month periods. While some prudence is needed when investing in this stock at its current price, consider Ceridian’s continued momentum and Q3 performance, which showcased a 23% year-over-year revenue increase despite headwinds from the macroeconomic environment.

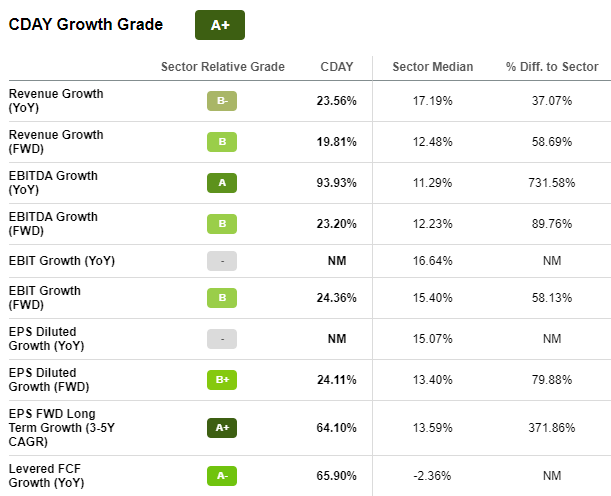

CDAY Growth & Profitability

With an EPS of $0.20 beating by $0.08 and revenue of $315.60M beating by $10.04M (22.71% Y/Y), Ceridian has benefited from customer acquisition and ultra-high-margin interest income revenue. With a focus on cost-cutting measures for labor and better automation, CDAY has better operating leverage and expanded its EBITDA margins by 20.1%.

CDAY Growth Grade (Seeking Alpha Premium)

As a result of a strong Q3, CDAY raised its full-year guidance by 1%. On the Q3 2022 Earnings Call, Co-CEO David Ossip said:

“We had a very strong third quarter. We exceeded the high end of our guidance across all metrics despite the headwind of a stronger U.S. dollar…I’m pleased to report that adjusted EBITDA was $63.5 million, a 61% improvement year-on-year, and adjusted EBITDA margin was 20.1% of revenue and expansion versus a year ago when the business operation at 15.3%…We continue to invest in sales and product innovation to fuel durable revenue growth while also demonstrating our ability to scale operations.”

In our digital world, it’s only natural that a company of CDAY’s caliber considers expansion into on-demand pay, digital wallets, and prepaid cards, offering an ability for greater revenue and leverage with clients. Consider this stock for a portfolio in 2023, along with our next application software pick.

2. Model N, Inc. (NYSE:MODN)

-

Market Capitalization: $1.52B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 1/6/23): 12 out of 659

-

Quant Industry Ranking (as of 1/6/23): 2 out of 214

Is your company missing or leaving money on the table? Model N, Inc. offers cloud revenue management solutions to help curb the price erosion of products for high-tech and life science companies. Extending into their enterprise resource planning (ERP) and customer relationship management (CRM), MODN automates revenue management processes so that companies can maximize their workflows to help grow revenue.

MODN Valuation & Momentum

On a continuing uptrend, Model N’s 200- and the 10-day moving average is rising. Over the last year, the stock is trading at +41%, one of the few tech stocks that experienced a rise in share price during the markets’ volatile 2022. Although the stock is trading near its 52-week high of $42.45 per share, its overall valuation grade comes in at a C+, with earnings beats continuing to impress. Some of MODN’s underlying valuation metrics are less than ideal, with values higher than better-known tech companies, so some prudence is needed when considering an investment. Still, MODN’s collective fundamentals, which include growth and profitability, are very attractive.

MODN Growth & Profitability

Following another consecutive earnings beat, seven analysts revised estimates up in the last 90 days. Q4 2022 EPS of $0.20 beat by $0.01, and revenue of $58.17M beat by $1.79M, a year-over-year increase of 13%.

MODN Stock EPS & Revisions (Seeking Alpha Premium)

Trending at or above 90%, MODN has maintained best-in-class Software-as-a-Service (SAAS) subscription growth retention rates, with a SaaS net dollar record rate of 129% for its full year that ended September 30th. According to MODN President & CEO Jason Blessing:

“At the start of the fiscal year, we set a target to exit the year at a 20% SaaS ARR growth rate, and I’m pleased to report that we have exceeded this goal. SaaS revenue growth for the full year eclipsed 23% and accelerated throughout the year to 31% in Q4, up seven points from 24% just last quarter. One of the key drivers to our subscription growth has been the fact that Model N provides a high ROI mission-critical solution, which among other things, results in very strong renewal rates.”

Guidance remains strong following financial results for Q4, which again exceeded the top-end of MODN’s projections. With a 12% increase ($42.9M) in subscription and professional services revenue +15% Y/Y, the company continues to look toward the future. As cloud computing continues to drive results, MODN is making strides to transition its customers to the cloud successfully and has accelerated its SaaS business, which allowed SaaS ARR to climb to $109.4M for Q4, an increase of 31% over the last year. With figures like this, consider this Strong Buy-rated stock for a portfolio, along with the next pick.

3. Box, Inc. (NYSE:BOX)

-

Market Capitalization: $4.27B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 1/6/23): 23 out of 659

-

Quant Industry Ranking (as of 1/6/23): 3 out of 214

If you’re looking for a beaten-down tech stock to check a box, look no further than Box, Inc., offering cloud content management that can be shared anywhere to any device. With SaaS offerings that allow collaboration internally and externally, BOX is simplifying how companies work through automation. Like MODN, the stock’s valuation is not ideal and requires some prudence when investing. But the stock is on an uptrend, with bullish momentum, showcasing tremendous factor grades, which rate investment characteristics on a sector-relative basis.

Box, Inc. Factor Grades

Box Inc. Factor Grades (Box Inc. Factor Grades (SA Premium))

BOX has excellent potential and is fundamentally sound compared to the sector. With ‘A’s’ across four of its five-factor grades, Box Inc. showcases that it is a very profitable company in its sector with solid growth prospects and continued momentum, as evidenced in JPMorgan’s upgrade for the stock.

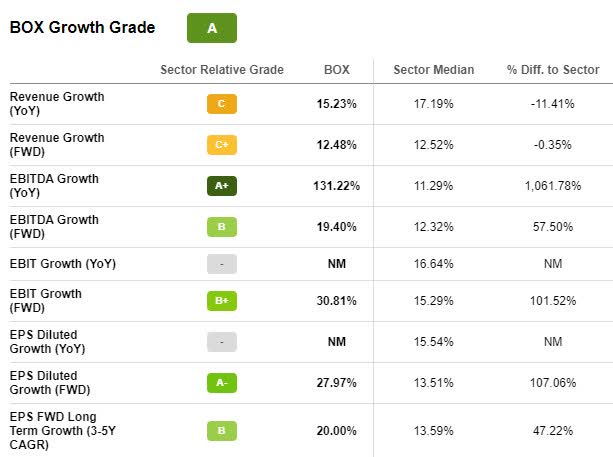

Box, Inc. Growth & Profitability

Delivering substantial growth, operating margin improvements, and an EPS of $0.31 that beat by $0.01, Box Inc. focuses on profitability resulting in record non-GAAP operation margins of 24% compared to the 20.7% from the prior year. The inflationary environment is costly, so BOX is focused on cost-cutting measures that support a hybrid workforce and digitization while also catering to its customers. Q3 emphasized innovation, and scale, by transitioning clients to cloud-based and building stronger partnerships with leading tech companies.

Box Inc Growth Grade (Box Inc. Growth Grade (SA Premium))

As showcased in the above Growth Grades, Box inc. offers strong results going into the new year.

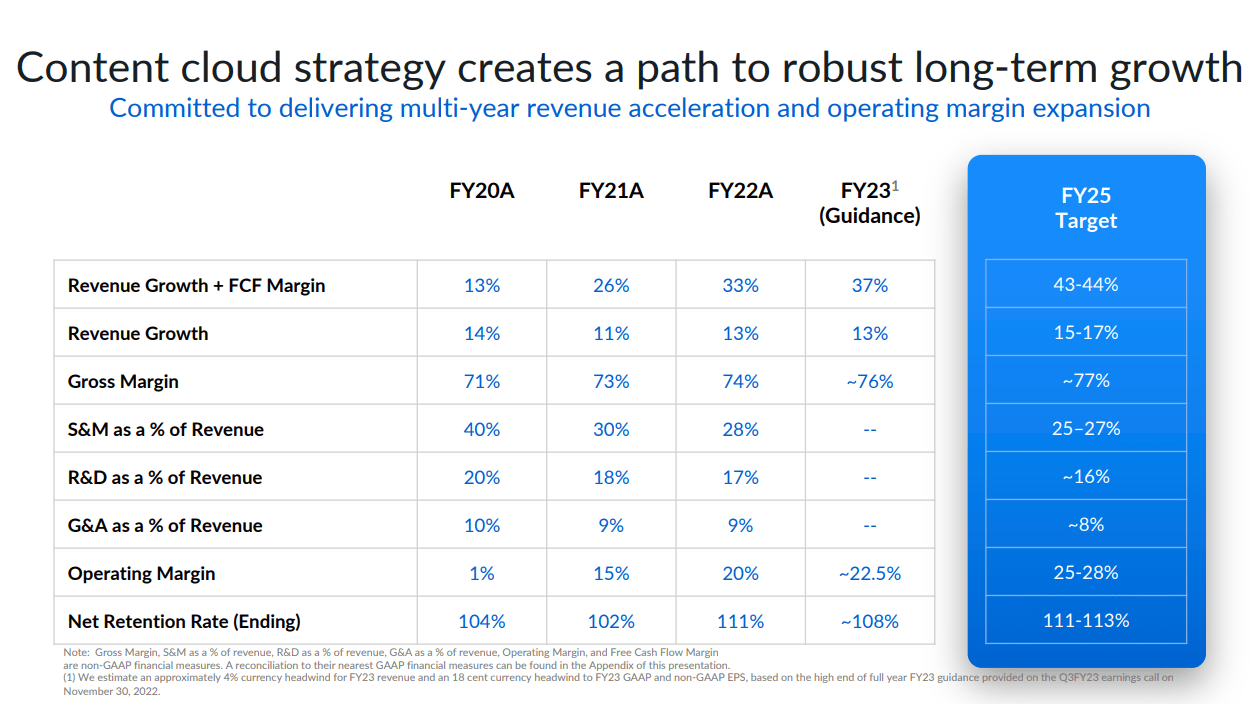

“We remain committed to delivering against our FY 2023 revenue growth plus free cash flow margin target of 37%, a 400 basis point improvement from last year’s outcome of 33%. Our ability to expand our operating margins and free cash flow margins in this environment is a testament to our operational discipline and resilient financial model,” said Dylan Smith, Co-Founder & CFO.

With solid Q3 2023 earnings, Box’s Board of directors announced the expansion of its stock repurchase program by $150M, an increase of its aggregate $760M for share buybacks. Despite the difficult macro environment and currency headwinds that ate into revenues, BOX’s cloud strategy is creating a path to robust long-term growth, as showcased in their third quarter FY2023 results.

Box Inc. Content Cloud Strategy (Box Inc. Content Cloud Strategy (Box Inc. Q3 Investor Presentation))

Because of the popularity of cloud computing and enterprise workflows, Box Inc.’s business model is in hot demand. Like my other two stocks focused on go-to-market tech offerings that drive top-line growth, each pick continues to see strategy margin progress.

Application software can expand and increase operating efficiencies in the new year, so I selected CDAY, MODN, and BOX, which are better at generating free cash flow and offer their clients greater flexibility and value in the race to digitization. Consider my three growth stocks in the macro environment. Inflation is still hot, but CPI and other macroeconomic indicators signal some cooling, which may offer tailwinds for these three stocks that could be ‘just right’ for investing.

My 3 Growth Stocks are ‘Just Right’

Growth stocks rated Strong Buys in the Application Software industry can be a great way to capitalize in the tech sector. Where many beaten-down tech stocks may continue declining in 2023, CDAY, MODN, and BOX offer excellent fundamentals and growth, focused on tech customers in big businesses and organizations rather than consumer tech.

Lagging labor data and reports may prove volatile for some stocks. Application software companies focus on automation, and my stock picks’ cloud focus is in high demand, allowing them to remain competitive. Showcasing strong earnings, each stock offers an opportunity to diversify a portfolio and get in on the action before a future tech rally. Consider my three growth stocks with strong analyst upward revisions. The professional analysts covering these stocks indicate that results will be better than expected, and each stock has robust fundamentals.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.