Summary:

- I’ve compared 360 DigiTech’s financials with its four most important peers.

- Based on the company’s growth, balance sheet, and PE Ratio, QFIN looks like a great buy.

- In an already cheap industry, QFIN and FINV are in a league of their own.

In my previous bullish article on FinVolution (FINV), I had readers ask me to also take a look at its peers, especially market leader 360 DigiTech (NASDAQ:QFIN). Below I will compare the most important financial ratios of QFIN with its competitors LexinFintech (LX), Yiren Digital (YRD), Qudian (QD), and FinVolution. The results show that 360 DigiTech is trading at a very low valuation and that it can be a great alternative to FinVolution.

Introduction

You can find a detailed overview of the business model of 360 DigiTech in this article by a fellow Seeking Alpha Contributor. My main goal in this article will be to make a head-to-head comparison between QFIN and its peers. To stay objective, I only want to use quantitative criteria, and therefore selected the following three factors:

- Strong growth

- Safe balance sheet

- Cheap valuation

Growth

With changing regulations and a quickly reducing number of online lending platforms, the operational competitiveness of each company has been important in shaping the trajectory of the industry. Only well-managed companies can stay a part of this industry; all other companies will not be able to generate new business and were already or will soon be forced out of the market. (Note that of 6,000 ex-P2P-lending companies in 2015, only a few are still alive.)

The recent growth rate of each company is one of the best indicators to show QFIN’s competitiveness. Companies that can currently not grow might soon be gone; therefore, the growth rate is the single most important number to look at. Below you can see the y/y growth rate of the trailing twelve months (TTM, comparing Q3 2020 – Q2 2021 with Q3 2019 – Q2 2020) as well as the more recent y/y growth rate for the second quarter:

Source: Author of this article

QFIN and FINV have the best growth rates over the past 12 months with 27% and 20%, respectively. A growth rate of 27% resulted in QFIN becoming the market leader over the past 12 months, overtaking Lexin. This strong growth rate of QFIN should give investors high confidence that QFIN will still be an important part of the industry in the coming years. Lexin grows as well, but at a much slower pace than the other two.

To give perspective that these growth rates are not a given in this industry: YRD’s business shrunk by almost one-third (but they had a great second-quarter performance) and QD is positioned to become the latest victim in this bloody competition, losing two-thirds of its business in just twelve months.

Balance Sheet

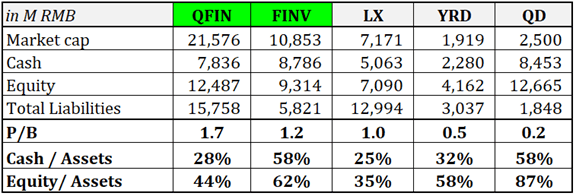

The second thing I want to take a look at is how QFIN’s balance sheet stacks up to its peers. Due to the highly profitable business over the last years, all five companies are swimming in cash. However, there are still differences between the balance sheets. What I care about is: 1) How much do I have to pay for the book value of the equity of the company (“P/B” = Price-to-Book)? And 2) How safe is the balance sheet? How much margin of safety is there? (Percentage of cash of the company’s total assets and percentage of equity of the company’s total assets.) Below you can see these three KPIs per company:

Source: Author of this article

This comparison reveals 360 DigiTech’s biggest weakness: its equity is more expensive, and compared to its peers, due to the lower equity ratio and cash ratio, the company is not as well-positioned for a downturn. But keep in mind that compared to other industries the balance sheet is still very solid.

Worth mentioning is that FinVolution’s equity seems to be fairly valued, and the balance sheet has a very high margin of safety. Also, Qudian has by far the cheapest and safest balance sheet. The company’s RMB 12.66B of equity is currently trading for only RMB 2.5B – an incredible 80% discount. (Please note that the CEO and owner of the company, Mr. Luo Min, holds over 75% of the voting rights of the company, making it difficult for the remaining investors to just sell all assets and pay out a huge dividend.)

PE Ratio and Dividend Yield

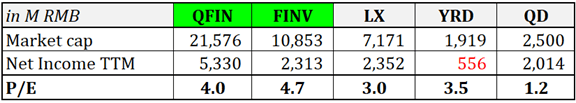

Below are the P/E ratios based on the reported earnings of the recent four quarters:

Source: Author of this article

The first thing to notice: all companies are valued very cheaply, with the PE ratios ranging from 1.2 to 4.7. As expected, the fast growth and the market-leading position of QFIN led to a premium over its peers. However, a PE ratio of 4.0 is, of course, still extremely cheap and is still almost 20% below the best comparable company FinVolution.

Please note that for YRD I had to make an adjustment of RMB 655M, as the company had a huge write-down during their business restructuring at the end of 2020. With these adjusted earnings, the company has a low PE Ratio of 3.5. Also note that Qudian has a P/E ratio of 1.2 for past earnings, but can certainly not keep this low valuation in the future, as the company will soon barely have any revenues or earnings left.

Like almost all of its peers, 360 DigiTech does not pay a dividend (out of the five companies; only FinVolution pays a dividend with an annual yield of around 2.8%).

Bottom Line

Source: Author of this article

Based on the numbers above, QFIN and FINV are in a league of their own, as their growth rates give big confidence in their future. QFIN’s position as a market leader as well as its high growth rate, make it a very cheap investment at a PE Ratio of 4.0. Starting to pay a dividend would make this stock even more attractive.

In a very undervalued industry, I believe it makes perfect sense to pay a slight premium for the two best companies, and therefore, like for FINV, I am also bullish for 360 DigiTech.

Disclosure: I/we have a beneficial long position in the shares of FINV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.