Summary:

- QFIN is a strong value and growth play over the next 10 years.

- Growth will be driven by an expanding moat and macro tailwinds in the Chinese credit market.

- The company is significantly undervalued compared with its U.S. counterpart Upstart, only due to geopolitical risk.

- So stop thinking about China as a risk, and start thinking about the business case.

Editor’s note: Seeking Alpha is proud to welcome Philip Eriksson as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

PM Images

Investment Thesis

It is astonishing to me that 360 DigiTech (NASDAQ:QFIN) is currently trading at 3.97x forward earnings, a free cash flow yield of 29%, and a dividend yield of 4.86%. Investors are only thinking of China as a risk, while I see an incredible opportunity. QFIN is a capital-light and innovation-driven company that will benefit from China’s expanding credit markets and consumption-based growth. Moreover, Chinese regulators are now encouraging tech companies to continue expanding. I believe the company can receive a revaluation to 10x P/E or higher over the next 10 years, coupled with earnings growth.

Company Overview: Tech-driven Innovation

If you are not yet acquainted with 360 DigiTech, here is a brief overview of their business model. The company provides a credit platform in the People’s Republic of China, where it runs an app (360 Jietiao) that connects consumers and SMBs with financial institutions. The company is specialized in credit assessment, where it uses comprehensive AI models to enable an almost completely automated process. This is what made me most excited about this company in the first place. As of Q1 2022, the company’s proprietary AI Argus Engine creates risk scoring and credit models that allow for a 97% automated user profiling and evaluation. Later on, QFIN collects the consumer’s/SMB’s interest and principal payments with a 75% automation rate using AI-powered chatbots. This technological innovation has allowed QFIN to scale its loan assessment operations profitably, where loan facilitation volume has grown on a 67.8% CAGR basis since 2017 and net profit margins lie at 24.2%.

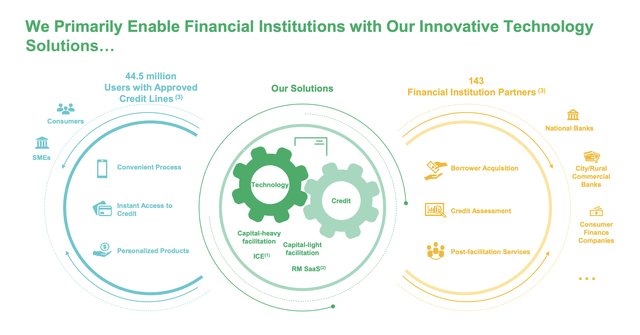

The second exciting factor about QFIN’s business model is that it operates as a platform. The 360 Jietiao app has 44.5 million users with approved credit lines on the one side and 143 financial institution partners on the other. As this platform grows, QFIN will be able to create better AI models and continue to grow profitably given their capital-light, automated credit assessment technology.

360 DigiTech Business Model (360 DigiTech investor relations)

Geopolitical Risk

The single largest factor, in my opinion, that is leading to the undervaluation of QFIN is US-China tensions. A fundamental misunderstanding between these two countries seems to have arisen in 2022 when the US claimed to have too little insight into Chinese firms listed in the US. Since then, the auditing issues have been resolved. Though it has been resolved, it is important to consider the overall information asymmetry of investing in China from abroad, which led to the auditing conflict in the first place. The information asymmetry, in the form of uncertain political risk, such as technology crackdowns, is definitely priced in and valuation multiples of Chinese ADRs (American Depository Receipts) will not reach higher levels until broad trust across the investor base increases.

In November of 2022, QFIN took the right steps in order to mitigate delisting risks in the US, which is a proof point of a strong management team. At the time, QFIN announced that they will be offering 5,540,000 class A shares on the HKEX. This is compared to their (as of November) ~321 million shares outstanding. The offering price was issued at the equivalent of $12.75 per ADR which means that the company raised about $70.6 million. The company said this would be used for R&D investments. But, this is a minuscule amount of money raised compared to the company’s current market cap of $2.75 billion. I believe that QFIN made this dual listing in order to expand its investor base and increase the liquidity of its stock since they note in the press release that the ADRs will be fully fungible with the class A shares in Hong Kong upon listing. This gave me optimism that the company made the offering, not due to the fact that they need cash, but rather in order to increase the liquidity of the stock.

There is further optimism for regaining investor trust in the Chinese tech industry. The most recent Q4 report from the company states that

“[we have] substantially completed rectification measures to our operations in 2022 and the regulators’ focus was shifted toward regular supervision from rectification.”

“We note policymakers’ recent comments regarding a recovery driven by consumption, which is expected to provide extra support to the consumer credit market. We are also pleased to see continued supportive statements for platform economy and private enterprises by various government officials.”

The collaboration between Chinese political leaders and private industry will lead to consumption-oriented growth in China for decades to come. This new collaborative rhetoric is what leads this investment thesis to become even more attractive, and it should not be understated.

Growing Market Potential

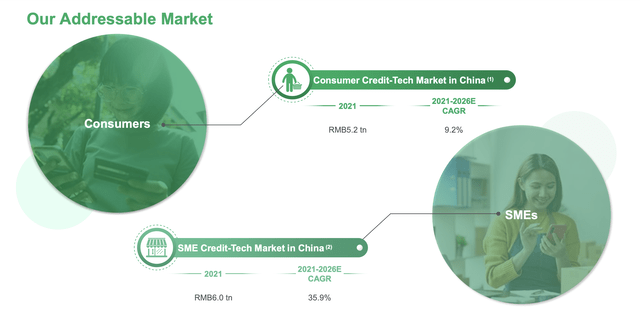

China’s Credit-Tech total addressable market (TAM) is $1.623 trillion and will grow at an unprecedented rate over the next few years.

The company splits its addressable market in two: consumer credit and SMB credit. When translated to USD, the credit-tech market for consumers was around $750 billion while the SMB market is around $870 billion. These are large market opportunities with almost unheard of CAGRs, especially SMBs credit-tech market projected to grow 35.9% CAGR. This is an incredible growth projection and could be realized based on China’s growing regulatory support for SMBs and consumption-driven growth. Given these CAGRs, the company estimates the directly addressable market to be worth $5 trillion by 2026. If QFIN can manage to just retain its market share, then this will mean that the company will grow its loan facilitation volume by 21.5% yearly.

Addressable Market (360 DigiTech investor relations)

As of preliminary views, QFIN expects to grow loan facilitation and origination volume between 10% and 20% YoY to between RMB455 billion and RMB495 billion. But, management seems to be giving a prudent estimate as we are still early into the year. Given that the credit market grows as quickly as the research claims and given that QFIN gains some market share, then the growth rate in their loan facilitation and origination volume will be larger than 20%.

Valuation

As of FY 2022, QFIN is selling at a market cap of $2.75 billion which I consider a relatively small cap with large growth potential. The company posted a net income of $583.5 million, and has a forward P/E of 3.97x according to Seeking Alpha. Furthermore, it generated cash flow from operations of $858 million. The company does not report capital expenditure costs in the cash flow statement, which makes it difficult to calculate a FCF figure. But, since this company is very capital-light (meaning they don’t need to invest much more into the business in order to get outsized returns) I will assume that CAPEX is very low. Given that the CAPEX would be $50 million, it would imply a 29% free cash flow to market cap yield.

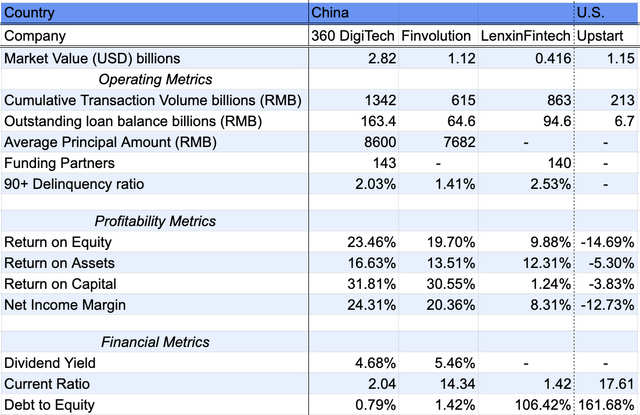

Despite this seemingly undervalued stock, the company has incredible profitability metrics that outperform its peers.

Peer Comparison (Seeking Alpha & Investor Presentations)

FinVolution (FINV) and LexinFintech (LX) are the two main publicly listed competitors to 360 DigiTech. I chose to exclude Futu Holdings (FUTU) and UP Fintech (TIGR) since they are in the Investment Banking and Brokerage industry and are therefore not directly comparable to Consumer Finance companies. Clearly, QFIN has been the company to be able to scale the most profitably. The company currently has a cumulative transaction volume of RMB1.3 trillion, with a 2.03% 90+ day delinquency rate (the loan value that has not been paid back after 90 days of the due date). The closest public competitor, FINV, has an impressive 1.41% 90+ day delinquency rate but bear in mind that they only have ~40% of the outstanding loan balance as QFIN. It is positive to see that QFIN is a market leader compared with these companies, but a more serious threat is two other consumer finance companies who are ranked #1 and #2 in regard to market share: Ant Group and JDT. QFIN is the third largest credit-tech platform in China and can have serious threats from the leaders. From my own estimation, the company has a 3.67% market share based on its loans-outstanding volume. If QFIN can compound its loan facilitation and origination volume by 15% per year, which is in line with management’s next year’s forecast as well as the industry growth trends, then I believe the company can be considered to be significantly undervalued.

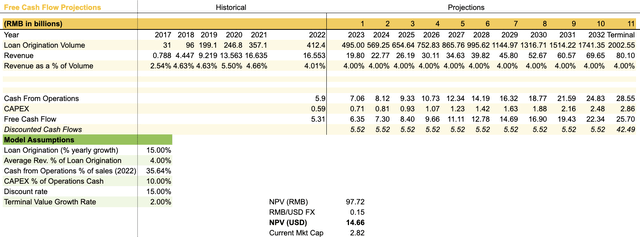

DCF Modeling – Assumptions

In the model, I have assumed a 15% yearly growth of loan origination volume, which management uses as guidance. Based on a five-year history, QFIN has retained about 4.33% of the Loan Origination as revenue. Being prudent, and given the difficulties in the credit market I use a 4% take-rate for all of the following years. Furthermore, based on FY 2022 QFIN retained 35.64% of revenue as cash flow from operations which I keep steady and finally, I subtract a 10% CAPEX to get the bottom-line FCF estimate for the 10-year model. I want to note that the company does not disclose CAPEX, but I believe 10% to be prudent since they do not need to reinvest heavily into the business in order to expand. In order to model the risk of the information asymmetry of investing in China along with the slowdown of the Chinese economy due to COVID, I have incorporated a 15% discount rate. Furthermore, I have assumed a 2% modest growth for the terminal value, which is in line with long-term GDP growth for mature economies.

The model yields a present value for the company of $14.66 billion, which implies a discount of 81% at the current valuation – excluding dividends! This is equivalent to a return of 5.2x. Even if the growth opportunities of QFIN do not come to fruition, you can still buy and collect a 4.68% dividend yield for the time being.

QFIN is incredibly undervalued according to my DCF model and has substantial growth opportunities, which is why I believe the stock can potentially grow by 10x in 10 years. Currently, the company’s FCF (RMB6.35 billion) / Market Cap (RMB18.8 billion) is 33.8%. QFIN, FINV, and LX are incredibly undervalued compared with their U.S. counterpart Upstart (UPST) which makes it reasonable to believe that an earnings multiple revaluation in the next coming years is far from uncertain. Given continued strong cash flow generation and a risk-on attitude to Chinese credit-tech companies, QFIN is going to give immense returns to shareholders.

U.S Counterpart: Upstart

Upstart has been destroyed by the market over the past year due to the high -interest rate environment in the U.S.

Despite the opposite trend in QFIN and UPST’s 1-year performance, the companies are operating very similar business models. There are some differences between operating a consumer finance company in the U.S. and China. Chinese credit-tech firms have fewer data collection laws than the U.S. which will enable Chinese firms to keep delinquencies low. For example, QFIN and its Chinese peers are able to build a very accurate risk model based on a more comprehensive set of data such as the consumer’s mood. On the other hand, UPST has a much larger addressable market ($5 trillion) due to the U.S. being the most developed and comprehensive credit market on earth. China is still in the beginning stages of developing a credit culture given that Chinese household saving levels are incredibly high.

Key Takeaway

QFIN, a leading digital consumer finance platform in China, has the potential to grow by 10x over the next 10 years. This is due to the company’s strong competitive position in the Chinese market, its innovative and customer-focused approach to financial services, and its increasing adoption of technology such as artificial intelligence and big data. The main concern that is hindering growth is the risk-on attitude of investors toward the credit-tech industry in China. QFIN and its peers are deeply undervalued compared to UPST, which is why investors should leave ideology beside and focus on the business case. QFIN has a potential 15% CAGR in its free cash flows, which will leave investors with a considerable dividend along with a possible 10x capital returns over the next 10 years.

Disclosure: I/we have a beneficial long position in the shares of QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.