Summary:

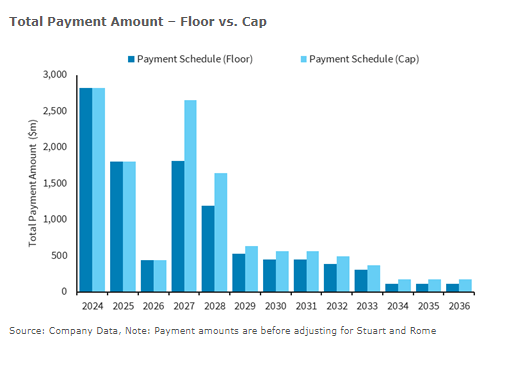

- $10.3 billion present value of payments start with almost $3 billion of payments in 2024 and almost $2 billion in 2025.

- Settlement could grow to $12.5 billion, depending on costs.

- Deal only covers US water utilities, not State Attorney Generals, Personal Injury, property damage, US military, the EPA, foreign governments or areas around MMM PFAS manufacturing sites.

- Earplug litigation still in play.

- Dividend will not be covered under payment plan.

Armastas/iStock via Getty Images

3M Settlement with US water utilities

Relatively consistent, if slightly worse, with the settlement tentatively announced earlier this month, 3M (NYSE:MMM) officially announced a $10.3 billion present value settlement with the multi-district litigants of the U.S. water utility pool. The payments will begin in 2024 and will be paid over 13 years. I don’t know the discount rate used to calculate the “present value” of $10.3 billion, but over $2.8 billion will be paid in 2024 and $1.8 billion will be paid in 2025. Payments are scheduled for a small break ($440 million) in 2026 before increasing again in 2027. The total payments can grow depending on litigants’ incurred costs.

Payment Schedule for MDL Settlement (Barclays)

Important to note, this settlement ONLY covers US water utilities. I have not seen any details on how many of the utilities in the MDL have signed onto this deal or how many are allowed to opt out of the settlement before it becomes void. For simplicity and conservative sake (from the short perspective), let’s assume this settlement goes through, there are still plenty of problems for 3M. My short thesis on this company remains unchanged from my first article on the company, “3M Stock: Catalysts for a Potential Bankruptcy.”

Organically, they will not cover the dividend for the foreseeable future unless cash flows materially improve. I have seen several sell side reports that speculate there will be a spin out of the healthcare business that will fund the dividend shortfall. Call me crazy, but I just don’t see how any spinoff can happen while this known liability is out there. Moreover, if the spin occurs, the balance sheet might be less leveraged upfront but future cash flows will come up even shorter covering future dividends.

In addition to the dividend shortfall caused by this settlement alone, it does not cover a host of other parties with current or highly likely future claims against 3M. They include State Attorney Generals, Personal Injury, property damage, US military, foreign governments, areas around MMM PFAS manufacturing sites and most importantly, the EPA and its power to declare sites Superfund areas. Everything I have read suggests that these liabilities combined will be much larger than the water utilities. I believe the $10 billion is only 20-30% of the total eventual liabilities from this issue.

Moreover, the earplug liability is still hanging over the company. I think a bull case is a $5 billion settlement, which I would be surprised if that amount did not have to be paid upfront or over a short period of years. Those payments make the dividends even less covered.

Risks

The main risks to the short are an earplug liability less than $5 billion and the other PFAS liabilities going away for some reason. I don’t see either of those situations happening, but anything is possible.

Conclusion

I think this settlement is a sell the news event. It’s inline to slightly worse than the tentative settlement announced earlier this month. The company faces much larger liabilities in the immediate and intermediate future, leverage will go up and the dividend will not be covered by earnings for years to come. Barring a major improvement to revenue growth and margins, this company is in grave danger on multiple fronts.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

My new investment group, Catalyst Hedge Investing, is live. The launch has been terrific. The chat board is live and active as is the best ideas portfolio. There are still generous introductory prices for early subscribers that will continue for the life of your subscription. Come join the fun!