Summary:

- 3M Company is facing challenges with falling organic sales, shrinking profitability and potential further lawsuits.

- The company has initiated restructuring by reducing workforce, spinning-off Health Care unit and transitioning to export-led business model with potential $700 to $900 million annual benefit.

- While the effects of the restructuring are to be seen, the combat earplug and PFAS lawsuits appear to be mostly resolved on the surface.

- Despite the uncertainty, 3M presents an attractive investment, trading at P/E of 11.37x, for those willing to take risk.

- The company is a dividend king with a dividend yield of 5.69% and 1.9x FCF coverage ratio.

josefkubes

The last time I have covered 3M Company (NYSE:MMM) was back in November 2023, recommending investors to initiate long position in this global industrial conglomerate as the company was trading at a very cheap valuation and at the beginning of its long-awaited turnaround.

Since that time the stock has delivered a total return on 9% which is pretty attractive in my view.

It’s no secret that 2023 has been a challenging year for most industrial companies as the PMI has signaled contraction in the industry and 3M was not resilient neither.

While the full-year 2023 results are nothing to celebrate, the company has now taken steps to improve its falling organic sales and shrinking profitability by spinning-off its Health Care business, reducing its workforce and switching to export-led model which should bring in extra $700-900$ million each year in efficiency.

The results of these efforts remain to be seen, but with the legal issues mostly behind us, I believe 3M with its blended P/E ratio of 11.37x and dividend yield of 5.7% still presents attractive opportunity for reversal to the valuation mean and could reward investors willing to take risk handsomely.

Let me show you how.

Business Update

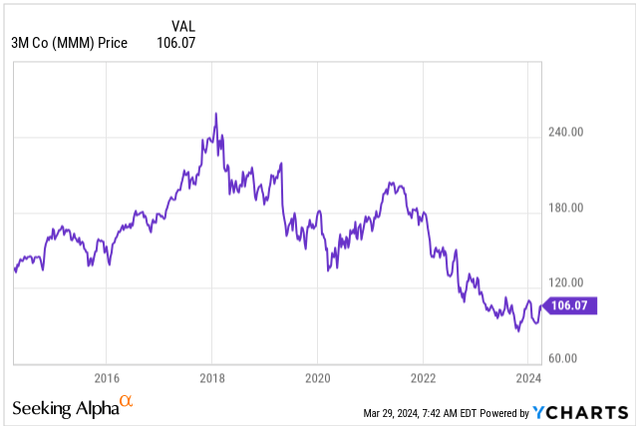

Owning 3M over the past 10 years has been an emotional rollercoaster for most investors, with the company’s stock price falling by more than 20% and the total return being a mere 11%, despite dividend yield being on the higher end of its historical range.

After such a lackluster performance for a better part of the decade, losing trust of many investors, questions arise why would one even consider investing into the industrial juggernaut, given that the future is highly uncertain in the face of falling organic sales growth, shrinking profitability and facing combat earplug and PFAS contamination litigation.

Price Development (Seeking Alpha)

Yet, I am a firm believer that depressed times like these, when even the most keen investors are losing faith in the company, present great opportunity to load up on shares at attractive valuation of only 11.37x blended P/E ratio, given that the company has the ammunition to fight back and to turn things around.

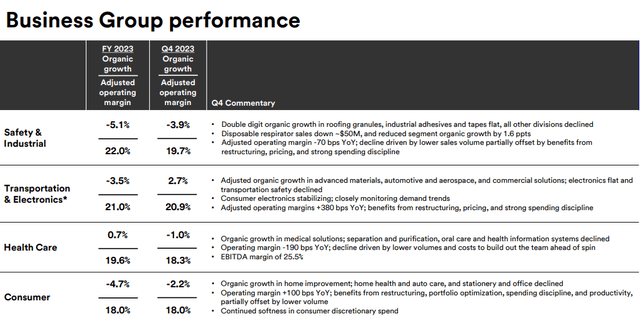

In the face of difficult 2023, with Manufacturing PMI being below 50 points for most of the year, indicating a contraction in the industry, 3M’s business has been no exception and the company has witnessed organic sales growth contraction in most of its businesses, for the full-year being down 3.2%.

This comes as a no surprise as 3M back in January 2023 guided for organic sales growth for the full-year to come anywhere between flat to -3%, yet the company has missed its original estimates, further disappointing investors.

Business Group Performance (MMM IR)

On the positive side of things, 3M has delivered EPS for the full-year of $9.24, significantly higher compared to the original guidance of $8.50 to $9.00, but still a decrease of 9% from the previous year, and the adjusted free cash flow conversion came at 123%.

One of the major issues which 3M is facing, are the contracting operating margins. Management is trying to address this issue by the restructuring efforts which are expected to cost the company anywhere between $700 to $900 million in pre-tax charges and should generate a similar benefit in pre-tax savings every year once complete.

These potential savings represent roughly 13% of 2023’s operating income and could increase the operating margin by 2.5% in the midpoint, reversing the declining trend of the last years.

The restructuring efforts are following:

- Laying off 8,500 employees (9% of the workforce)

- Spinning of its healthcare business

- Simplifying supply chains

- Reducing facilities

- Discontinuing less profitable products (5% of consumer business)

- Transitioning to export-led model

Most of these restructuring efforts were initiated already in 2023 where 3M incurred already $441 million in charges, yet another $250 to $350 million of charges are expected in 2024 and will impact the bottom line this year.

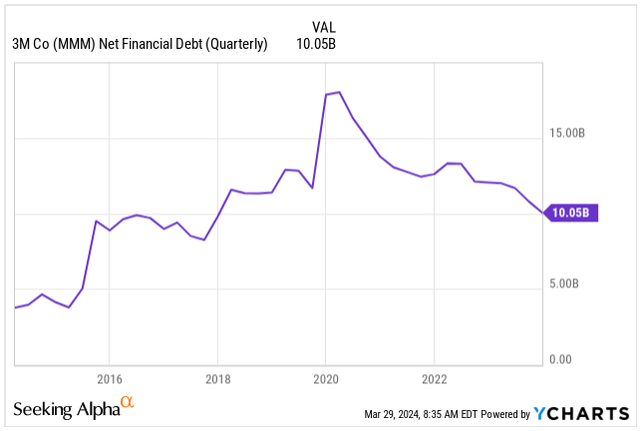

During Q4, the company has further reduced its net financial debt, which currently stands at $10 billion, decline of $2 billion or 17% YoY.

Net Financial Debt (Seeking Alpha)

3M continues to be a reliable cash generator, despite the challenges its facing. The Health Care spin-off, Solventum (SOLV.WI) is now trading as a separate company which should further strengthen the balance sheet. 3M expects receiving 1x dividend from Solventum at an initial leverage of 3x to 3.5x its EBITDA.

While we could argue that the restructuring efforts could have come much sooner to improve the profitability and the lackluster growth of the company, improving its reputation, it’s good to see the company’s leadership is actively addressing the main issues, while the final impact remains to be seen.

On the legal side of things, after years of legal battle, 3M has agreed to pay up to $6.0 billion between 2023 to 2029 to resolve the combat earplug litigation. This represents pre-tax expense of $5.3 billion, for which the company has built provisions already. I am expecting this lawsuit to be now closed and no further liability for 3M, which should mark the new beginning.

The one legal overhang which remains is the so called “forever-chemicals” or PFAS where 3M agreed to pay $10.3 billion back in June 2023 to settle hundreds of claims the company polluted public drinking water with the chemicals. While the settlement has been reached, the risk remains that individual residents could sue the company, even as Ohio court for now rejected the ruling which would allow 11.8 million Ohio residents sue the companies related to the issue.

While certainly risks remain on the execution of the restructuring, recovery of growth & profitability and surely the legal battles, there is no doubt that 3M remains a true dividend king which has been rewarding its shareholders handsomely with dividends over the past 60 years.

The current dividend yield is attractive 5.69%, well above historical standards due to the depressed stock price and most importantly it remains safe.

For the full-year 2023, the company has paid $3.3 billion in dividends to its shareholders, while the adjusted FCF came at $6.3 billion, implying 1.9x FCF coverage.

Yet, if you are looking for a dividend growth story, this might not be the right pick for you as 3M has grew its dividend in the last 5 years only by 4.8% altogether. The last increase was only by a penny to $1.51 back in February this year.

Valuation

As the company is navigating challenges, the stock price has been in terminal decline ever since it reached its all-time-high of $258 back in 2017, giving investors very little reason to celebrate.

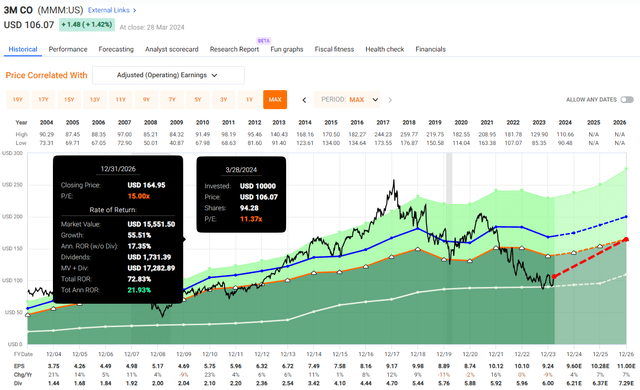

Since 2003 3M has been on average trading at around 18.2x its earnings, which seems reasonable if we consider that over the same duration the company grew its EPS at around 5.7% annually.

Today, the valuation is significantly depressed trading at only 11.37x its blended P/E, even though the expectation is for the EPS growth to resume after a 9% drop in 2023:

- 2024: EPS of $9.60E, YoY growth of 4%

- 2025: EPS of $10.28E, YoY growth of 7%

- 2026: EPS of $11.00E, YoY growth of 7%

Naturally, the risk remains if the company fails to turnaround or perhaps if the lawsuit become the center stage once again, we could be poised for another ride downwards.

From my standpoint, the company is too cheap to ignore today with a potential light at the end of the tunnel, trading 62% below its historical valuation.

Given the issues the company is still facing, I would expect the company to trade at least at around 15x its earnings. If indeed the valuation would revert to this level, and the growth of around 5% annually would materialize (which I think is completely feasible given the historical EPS growth rates), we could see 3M trading at around $165 by the end of 2026.

If this scenario would play out as expected, investors could expect up to 22% annual total returns over the next three years.

MMM Valuation (Fast Graphs)

As this investment is clearly a reversal to the valuation mean play, I would recommend risk averse investors to stay on the sidelines as long as the legal issues are not fully resolved.

For those willing to take on more risk for the sake of greater returns, similar to myself, loading up anywhere around $100 might turn to out be an opportunity of this decade.

Takeaway

3M has been testing the loyalty even of its most keen investors for a better part of the past decade with lackluster returns.

The company is navigating challenges such as contracting organic sales, falling profitability and combat earplug and PFAS legal battles.

While the legal issues may be self inflicted over the long duration of the company’s existence, most of the criticism stems from the fact that the management has been very slow to initiate restructuring efforts sooner, which are well needed for this industrial conglomerate.

Even as the final impact of the restructuring remains to be seen, 3M appears to be on the right track with its litigations and the company could be a great play for reversal to the valuation mean, trading today at 62% discount to its historical valuation.

I would recommend aggressive investors who are willing to take risk and potentially want to enjoy up to 22% annual returns to do their due diligence and consider investing in 3M at attractive blended P/E of 11.37x

For those who are more risk averse, standing on the sidelines for the moment might be a prudent idea, even as the company is yielding attractive 5.7% dividend yield with a 1.9x FCF coverage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.