Summary:

- 3M has faced numerous controversies and lawsuits, while its stock lost half of its value in the past 2.5 years.

- The company’s dividend yield is currently over 6%, but its lack of growth and litigation risks make it unattractive for investment.

- Two recent settlements already amount to a total of $15.8B of costs for 3M, about thrice the company’s annual operating income.

- The pattern of lawsuits and potential for more allegations pose significant risks for investors.

alfexe

Lately, 3M Company (NYSE:MMM) seems to have been in the news continuously for all the wrong reasons: lawsuits over ‘forever chemicals’, lawsuits over military earplugs, lawsuits over water pollution. While the company has been able to deflect or settle some of these allegations, its stock has suffered, losing about half of its value over the last 2.5 years. At the same time, the company kept steadily growing its dividend and currently yields north of 6%. In this article, I will show you why I believe 3M is not worth the risk investing in at this moment, even though its current valuation looks modest.

3M

This is my first article about the industrial conglomerate 3M, but as an investor, I have already been following the company for quite some years. I have been an investor in 3M since 2015 and finally sold my shares at the start of 2022.

3M is a very large and differentiated company, active in many different industries, selling more than 60,000 products. An snapshot from the 3M website reveals the following list of product categories:

3m list of products on website (Website 3M)

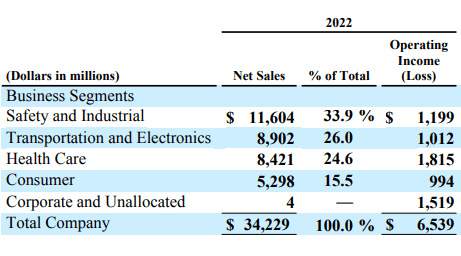

In 3M’s 2022 annual report, its sales were split up into the following categories:

- Safety and Industrial (33.9% of sales)

- Transportation and Electronics (26.0% of sales)

- Health Care (24.6% of sales)

- Consumer (15.5% of sales)

It is difficult for any investor to get a detailed overview of the products of 3M since the company is active is so many different industries and selling so many different products. Its diversification can be a double-edged sword: on the one hand, diversification creates a buffer when specific parts of the company experience sector-specific headwinds. On the other hand, diversification could make the company as a whole less efficient, operating more like a number of individual companies in practice instead of a coherent entity. Also, investors (or ETFs) who like to target specific industries are less likely to invest in heavily diversified companies, so being more specialized could attract more investor attention as well.

3M seems to recognize this, as it is planning to spin off its healthcare business under the name of Solventum in the first half of 2024. 3M’s healthcare business generates about a quarter of the company’s sales and was responsible for $1.8B of operating income in 2022, about 28% of the company’s total (and if we exclude the ‘corporate and unallocated’ segment that accounts for almost zero sales, 36%). The healthcare business looks to be one of the more profitable segments of 3M right now.

3M revenue and operating income by business segment (3M 2022 financial report)

What made me sell my shares two years ago?

Of course, companies active in industries such as chemicals and health care often experience higher legal risks than average due to the nature of their products. In my opinion, this must mean that in such companies quality assurance (QA) policy should be very important, which decreases the likelihood that problems will occur. At 3M, a recent pattern of allegations and controversies seems to indicate that its QA policy is not performing as well as it should.

For example, only 3M’s recent controversies in the chemical industry amount to a quite impressive list. Note that many of these controversies could lead to long-term environmental cleaning costs, that could lead to large and ongoing financial risks for 3M. These cases are different from, for instance, asbestos legal problems (with which 3M also has experience) because in some cases entire rivers, ecosystems or drinking water facilities have reported pollutions.

As my frequent readers will know, I am situated in the Netherlands, and starting at the end of 2021, allegations of the dumping of PFAS by 3M surfaced on the national media. This happened in the Scheldt, a river that runs through both Belgium and the Netherlands, of which the international geographical course made matters much more complicated. As the case unraveled, it appears that 3M has knowingly dumped illegal concentrations of the substance of PFAS over a long time period, while Belgian authorities looked the other way. PFAS concentrations in the river were discovered to be much higher than allowed, with concerns raised about whether it was still safe to eat fish caught in the river, and even vegetables that were grown in gardens nearby. Some people living near the river were found to possess alarmingly high concentrations of PFAS chemicals in their blood. The area around Zwijndrecht, near the Belgian city of Antwerp is thought to be one of the most PFAS-contaminated in the world.

3M was not the only company involved in illegal dumping of chemical waste in this river, but the fact that 3M seemingly knowingly resorted to this practice made me suspicious of the performance of 3M’s QA policy in practice. Looking at the list of legal problems related to PFAS which 3M currently faces, this was not an isolated incident. It seems to be a pattern. So either the QA policy of 3M has failed spectacularly, or the company knowingly accepted the risk of litigation. The first would be bad, the second might be worse.

This is a huge financial risk for investors because litigation can lead to large impacts on future profitability. As such, after being a shareholder for almost 7 years, I decided to sell my shares of 3M. Apparently I needed a national media out roar to become aware of the severity of 3M’s quality issues, while (with today’s knowledge) I could have been conscious about this much earlier.

3M looks attractive on paper

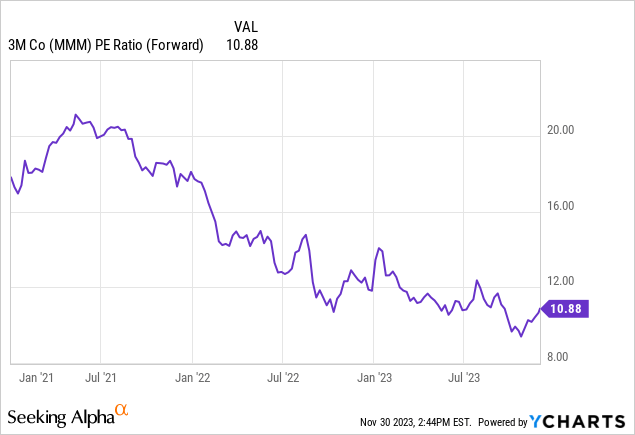

In its third quarter 2023 financial update, 3M reported an improved outlook of the full year of 2023, with and expected adjusted earnings per share of $8.95 to $9.15. This would mean that with current share prices, 3M shares are trading for a forward P/E ratio of only around 11.

This looks historically cheap, but do note that 3M has not grown its earnings or its revenue since 2021; 3M is not a growing company at the moment. A 6% dividend yield and a forward P/E of 11 does not look too bad though, even in the absence of growth. If a recession is averted, interest rates return to lower levels and the economy starts gearing up again, organic growth in combination with multiple expansion could be a real opportunity for 3M’s shares to gain in value.

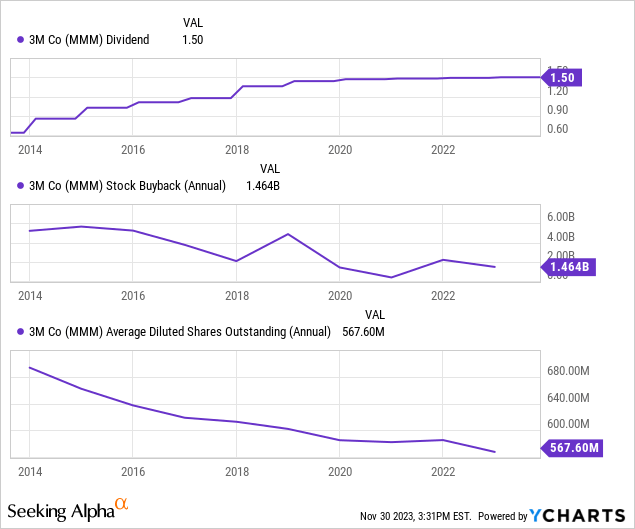

Also, 3M has shown it is a shareholder-friendly company. During the last 10 years, the company has raised its dividend with an average annual percentage of 9%, while only raising the dividend by token amounts over the last 3 years.

3M also spent billions of dollars buying its own shares, reducing total share count from about 700M ten years ago to 567M right now. All in all, 3M looks to be a very decent and stable investment by most metrics.

But litigation risks are high

Still, I would be careful with investing in 3M at this moment. By the spin off of its health division as Solventum, 3M seems to recognize that it needs to de-diversify in order to stay competitive, and with a current product portfolio of over 60,000 different items, its differentiation might seem excessive.

But I believe the most important risk is on the legal front, since 3M cannot seem to stay out of the court rooms over the last years. I think this is a large risk that cannot be ignored. 3M’s previous settlements have shown that the allegations are not without financial consequences: they have cost the company real money. Given the previous pattern of allegations, it is very possible that more of these litigations will surface, and this greatly increases risks for investors. For instance, the company recently reached a combat arms settlement (for ear plugs) that is costing the company a total of $5.5B, which was only slightly less than 3M’s annual cash from operations in the entirety of 2022. Also, 3M recently reached a PFAS pollution settlement of $10.3B over 13 years. Of course, the company now and then also has some important claims which are rejected, but PFAS-related litigation is a risk for 3M that will not go away soon. 3M has stated that it will stop producing PFAS in 2025, but this does not remove risks from pollution that already happened before this year.

It is partly an ethical question of whether investors are willing to invest in a company that in the past has attracted so much litigation about serious environmental issues. But I recognize that Seeking Alpha is an investors’ website and we’re here to make money. But even if I would have no ethical objections to investing in a company where there seems to be a pattern of legal and environmental controversies, I believe financial risks resulting from litigation are simply too high.

Even nothing that 3M has basically experienced zero growth during the last two years, the company still looks attractive with a P/E ratio of 11 and a dividend yield of 6 percent, but not extremely cheap. If more ‘lawsuit-damage’ is coming, chances are this will continue to eat into 3M’s balance sheet.

No, 3M will not go bankrupt anytime soon. And the company and its spin-off Solventum will likely remain profitable, although its legal troubles have cost the company serious money. Depending on the future growth of 3M and the extent of future legal payments, the dividend might or might not be sustainable. 3M will likely try its very best to continue growing its dividend, but I would only expect small raises over the next couple of years. At the very least, I believe there exist safer alternatives when searching for a 6%+ dividend yield. I sold my shares almost 2 years ago, and share prices have fallen off a cliff since then, making 3M’s valuation more modest. But considering the continuing uncertainty surrounding the company with regard to litigation risks, I rate the company as a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.