Summary:

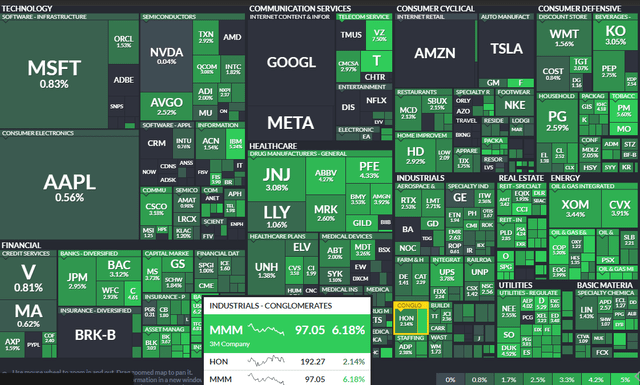

- Among the top S&P 500 dividend yield stocks is 3M.

- Following a more than 60% drawdown off its 2021 peak, the company remains profitable with high free cash flow.

- I spot a key technical development on this Industrial-sector stalwart.

jetcityimage

Seeking high-dividend stocks with ample free cash flow? You might not think of heading to Minneapolis, Minnesota.

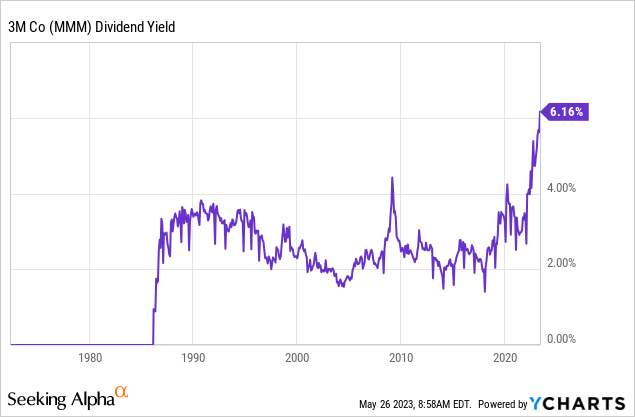

3M (NYSE:MMM) now yields a record-high rate. The blue chip’s 6.2% dividend rate is more than 3x that of the S&P 500, and I see upside to the stock price despite shares being in one of the biggest downtrends you will find.

S&P 500 Component Dividend Yields

Finviz

According to Bank of America Global Research, MMM was founded in 1902 as a mining concern. Today, the Minnesota-based company is a diversified, global manufacturer. Its businesses are technology-driven and organized under four segments: Consumer, Safety and Industrial, Transportation and Electronics, and Health Care. Its popular brands include Scotch, Post-It, 3M, and Thinsulate. It holds over 500 US patents. MMM provides diversified technology services in the United States and internationally.

The $54 billion market cap Industrial Conglomerates industry company within the Industrial sector trades at a low 10.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 6.2% dividend yield, according to The Wall Street Journal.

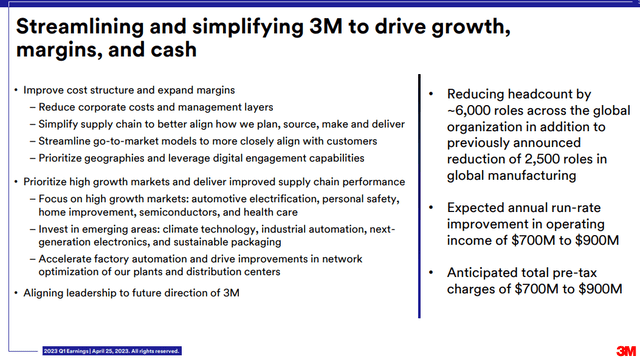

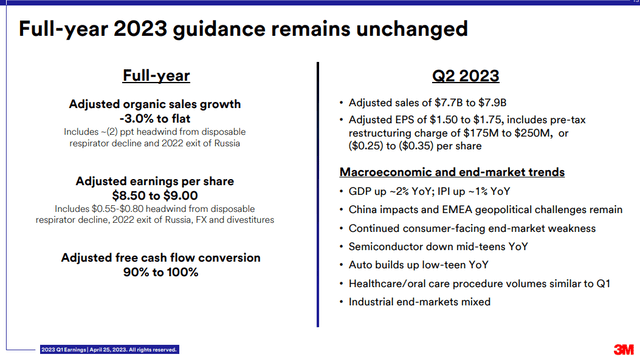

Back in April, 3M topped analysts’ EPS estimates, although earnings forecasts have come way down in the prior months. Amid ongoing restructuring at the struggling Industrial sector giant, the management team did reiterate its 2023 earnings guidance. The better-than-expected earnings were attributed to better pricing execution, cost cuts, and productivity gains. FX was also a modest tailwind to start 2023.

With some retooling costs that should amount to $700 to $900 million in added expenses this year and next, total layoffs should total 6,000. Following the strong report, BofA raised its 2023 earnings outlook, so the hope here is that we are near trough profits. Uncertainty remains regarding three court cases surrounding Aearo’s bankruptcy and Combat Arms. Court proceedings may impact net profits and any unfavorable ruling would be important risks to a bullish outlook.

Cost-Reduction Efforts

3M

FY2023 Guidance In Tact, Near $9 NTM EPS

3M

With all that taken into consideration, the dividend appears safe and set to grow. Now yielding close to 6.2%, stepping into 3M shares could bolster a yield-focused portfolio’s income stream. With positive EPS and free cash flow, I see the yield as safe for now. Total cash flow from operations totals nearly $6 billion versus the firm’s 5-year average of $7.0 billion.

Record-High Dividend Yield

YCharts

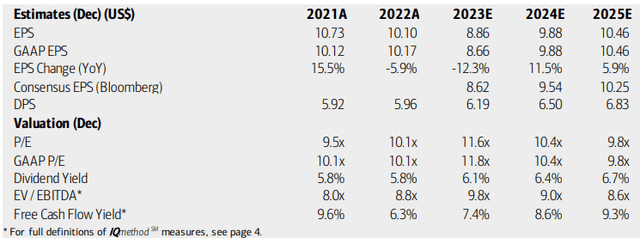

On valuation, analysts at BofA see earnings falling sharply this year after 2022’s 6% EPS decline. Per-share profits are then expected to rise at a robust clip in 2024 before earnings stabilize above $10 by ‘25. The Bloomberg consensus forecast is about on par with what BofA projects.

Dividends, meanwhile, are expected to continue rising despite the yield being at all-time highs today. Both MMM’s operating and GAAP P/Es appear cheap in the low double digits and the company’s EV/EBITDA is materially below the S&P 500’s average. But I notice that MMM is solidly free cash flow positive.

3M: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

BofA Global Research

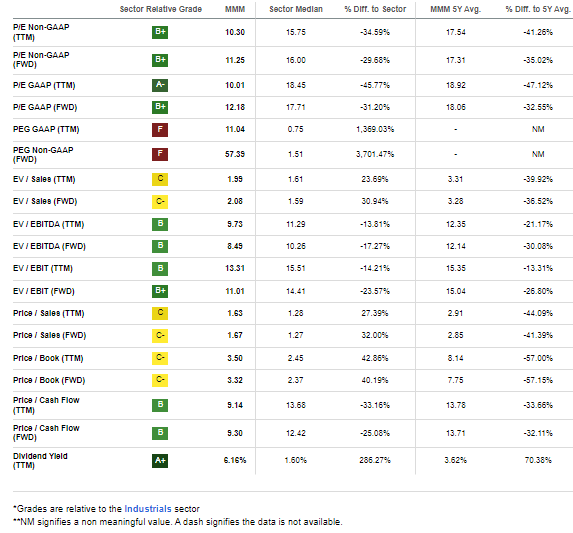

MMM trades at a discount to almost all its 5-year average valuation ratings. If we apply a 15-forward multiple on $9 of EPS, then the stock should be near $135. For another view, we can apply an also-discounted 2.2x sales ratio and arrive at a fair value of $125 or so. With the company being solidly profitable on both EPS and FCF, I have a buy rating.

MMM: Strong Earnings-Based Valuation Metrics

Seeking Alpha

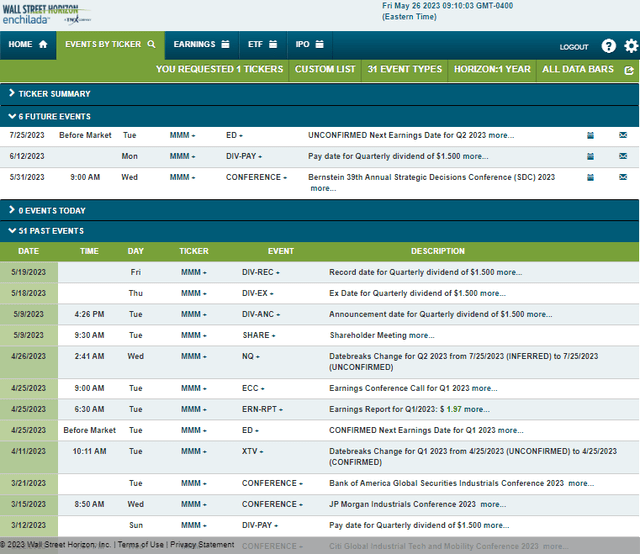

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Tuesday, July 25. Before that, the management team is expected to present at the Bernstein 39th Annual Strategic Decisions Conference (SDC) 2023 from May 31 through June 2 in New York which could include some new business insights.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

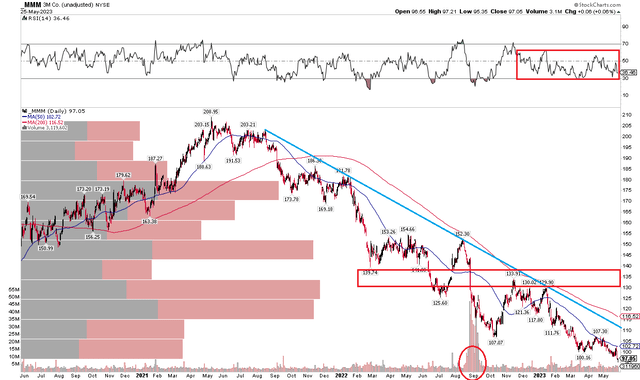

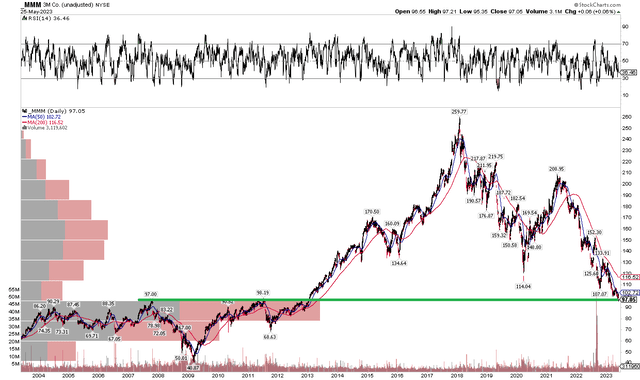

With shares solidly undervalued given earnings and free cash flow realities, the technical situation appears bleak at first blush. Notice in the chart below that MMM is mired in a massive downtrend. Shares peaked years ago near $260 then made a rebound peak of $209 in the middle of 2021. But the last two years have featured dominance by the bears. A protracted decline was underscored with a high-volume gap down last fall – and the $130 to $140 range is key resistance in my view.

Also take a look at the RSI momentum indicator at the top of the chart – it’s stuck in the notoriously bearish zone of 20 to 60. With the downtrend resistance line coming into play around $110 and the falling 200-day moving average moving lower, currently at $116, there are problems even if we see a modest bounce.

MMM: Bears In Control, $135 Resistance

Stockcharts.com

But stretching out the chart to a 20-year view, we see significant long-term support just below $100 – where MMM trades today. With a high amount of volume by price starting at $97, now appears to be a good time to dip your toes in from the long side.

Bonus Chart: MMM At Long-Term Support

Stockcharts.com

The Bottom Line

I have a buy rating on MMM and see upside to about $135 based on valuation and where significant technical resistance comes into play. With the stock at long-term support, now’s the time to get long this high-yield blue chip.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.