3M: A Dividend Cut Is Needed – And Could Be Imminent

Summary:

- 3M’s dividend is at risk due to ongoing lawsuits, high debt levels, slowing free cash flow growth, and a high payout ratio.

- The company is facing major lawsuits, which puts a strain on its balance sheet.

- The planned spinoff of the healthcare segment will further impact 3M’s free cash flow, making it difficult to sustain its dividend payments.

Education Images/Universal Images Group via Getty Images

3M has long been considered a darling stock among dividend investors due to its solid starting yield and its history of increasing dividend payments for over 50 consecutive years. But due to ongoing lawsuits, high levels of debt, slowing free cash flow growth, and a high payout ratio, the once attractive 3M dividend appears to be in jeopardy.

If you’ve been paying attention to 3M, it’s no secret that this stock has been in a free fall over the past few years. Over the past year, the company is down over 15%, and over the past 5 years, they’re down around 56%. You may have heard the old Warren Buffett quote “be fearful when others are greedy and to be greedy only when others are fearful”, but I’m not so sure that should be our case with 3M stock for a multitude of reasons, and these reasons are the same reasons I believe a dividend cut is possible for 3M, and that it would likely be the right move for the company. Let’s address the reasons that make this the case.

Lawsuits

3M is currently facing several lawsuits that I believe have the potential to be detrimental to this company’s ability to reward shareholders with a growing dividend. The two major lawsuits facing 3M are the Combat Arms Earplugs litigation, and the Forever chemicals in U.S. public drinking water systems litigation. In August of 2023, 3M came to an agreement for the combat arms earplugs litigation. 3M agreed to a settlement amount of $6.01 billion. To put that into perspective, 3M currently has a cash position of 5.9 billion and net debt of 10.9 billion. It’s worth noting that this lawsuit is structured to be paid out over around the next 5 years. As for the chemicals lawsuit, 3M is expected to pay around 10.3 billion to settle the lawsuits. While it is important to pay a growing dividend, this puts 3M’s balance sheet in an even more difficult spot.

3M already has over 13 billion in long-term debt. So shouldn’t 3M focus on paying down debt? Maybe, but here’s the problem. 3M’s current annual dividend is sitting at $6.04, while their trailing 12 months free cash flow per share is sitting at $9.14. This means 3M is currently using around 66% of their free cash flow to pay out dividends, leaving little room leftover to reinvest back into the business and pay down debt.

Spinoff

3M currently has plans to spin off the healthcare segment of the business, with 3M projecting this to take place in the first half of 2024. While this has been planned for a while now, the exact timing of this move has been unknown until recently.

Healthcare spinoff 3M (3M earnings presentation)

The healthcare segment of 3M currently contributes around 25% of operating income, meaning we will see a further decline of 3M’s free cash flow after the spinoff.

Dividend Safety

While this company remains a dividend king, I worry that management is only increasing their dividend payments annually to sustain their dividend king status. While no investor of 3M wants to see a dividend cut, in my opinion, it appears that it could potentially be the best way to free up cash to address the large amount of debt on the balance sheet and the lawsuit payments over the coming years. The TTM cash flow payout ratio is sitting at around 66%, and that number has continued to climb over the past decade.

When we look at the income statement, we can see 10 years ago, revenue was sitting at around 31.8 billion, and in 2023 it was 32.6 billion. Little to no revenue growth is obviously a problem, but here’s where things get even worse. 10 years ago, the cost of revenues was 16.4 billion, and in 2023 it was 18.4 billion. So not only does 3M have very slow revenue growth, but their profit margins are also decreasing. Their gross profit margin for the trailing 12 months is 43.77%, while their 5-year average is 46.79%. Slowing revenue growth is oftentimes more typical for more mature companies, but it’s not what I want to see from my investments. When you add in the fact that margins are decreasing, it makes it much more unattractive.

And for a company that is wanting to keep its status as a dividend king with over 50 consecutive years of dividend growth, the increasing payout ratios, slowing revenue growth, and the decreasing margins does not bode well for the company. 3M’s most recent dividend hike was an increase of just 0.7%, raising it from $1.50 to $1.51. And when you consider the fact that historically speaking, inflation has on average ranged from 2% – 3%, 3M is technically paying out less in dividends every year, as their dividend hikes don’t keep up with the rate of inflation.

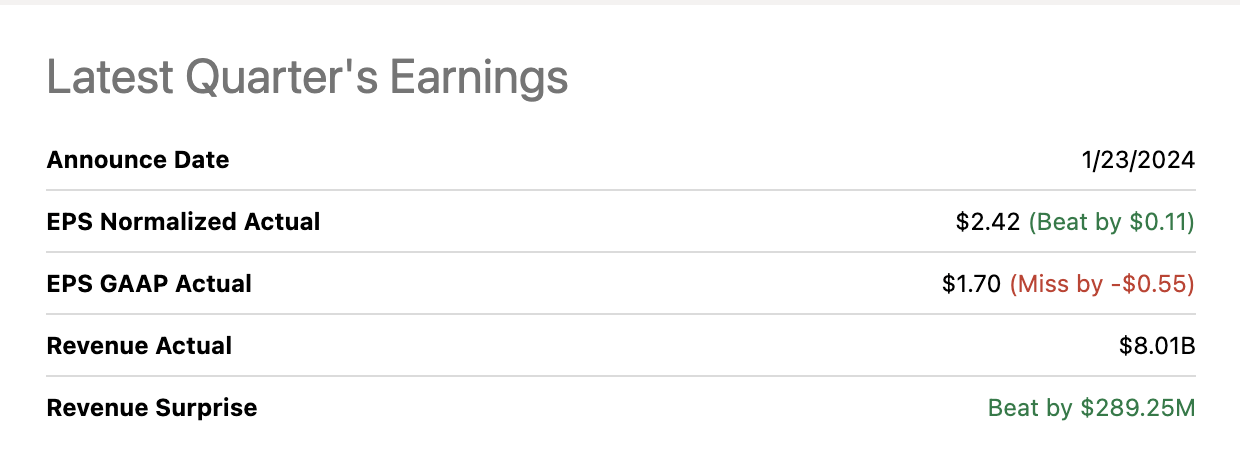

Earnings Report and 2024 Guidance

3M saw a slight beat on their top and bottom lines with their latest quarter’s earnings report. EPS normalized saw a beat by $0.11, and revenue saw a beat by $289M.

3M latest quarters earnings report (Seeking Alpha)

Since this earnings report, 3M’s share price has dropped from around $96 a share to around $92 a share, partly due to the company issuing weak guidance in 2024.

During the earnings call, analyst Julian Mitchell from Barclays proposed the following question/statement to 3M CFO Monish Patolawala:

Just trying to understand the free cash flow guidance because I think you did $6.3 billion of free cash in 2023. And this year is guided at about $5.3 billion. So it’s a big decline year-on-year even with net income, I think, growing $200 million in the guide and CapEx is up about $100 million in the guide. Anything to sort of call out on that?

To which 3M CFO Monish Patolawala responded-

I would just say, Julian, 3M has historically always been a good cash generator. And that’s what we plan to continue doing. If you look at 2022, we had 86% of free cash flow conversion, which we were not happy with at all. And the teams have done a great job in 2023 to get us back. If you take the two years, it’s around 100%. And if you look at the history of 3M, we have always been in that range. And I would say we’ll continue doing that. But at the same time, we’ll keep investing in growth, productivity and sustainability as and when the volume comes up as and when the opportunities arise because at the end of the day, our first priority is organic growth because that gives us the best return. And the best way to do that is organic investment. So that’s our first priority.

In my assessment, Monish did not properly address this question. He pointed out that the past few years, 3M has seen poor free cash flow conversion ratios, yet pointed to the potential for organic growth as the solution to this. But with high debt levels compared to the cash on their balance sheet, over 16 billion in lawsuit settlements to be paid out, and using around 66% of their free cash flow to payout dividends, it’s difficult to see where the capital to reinvest back into the business will come from to drive organic growth, and where they have high ROI opportunities.

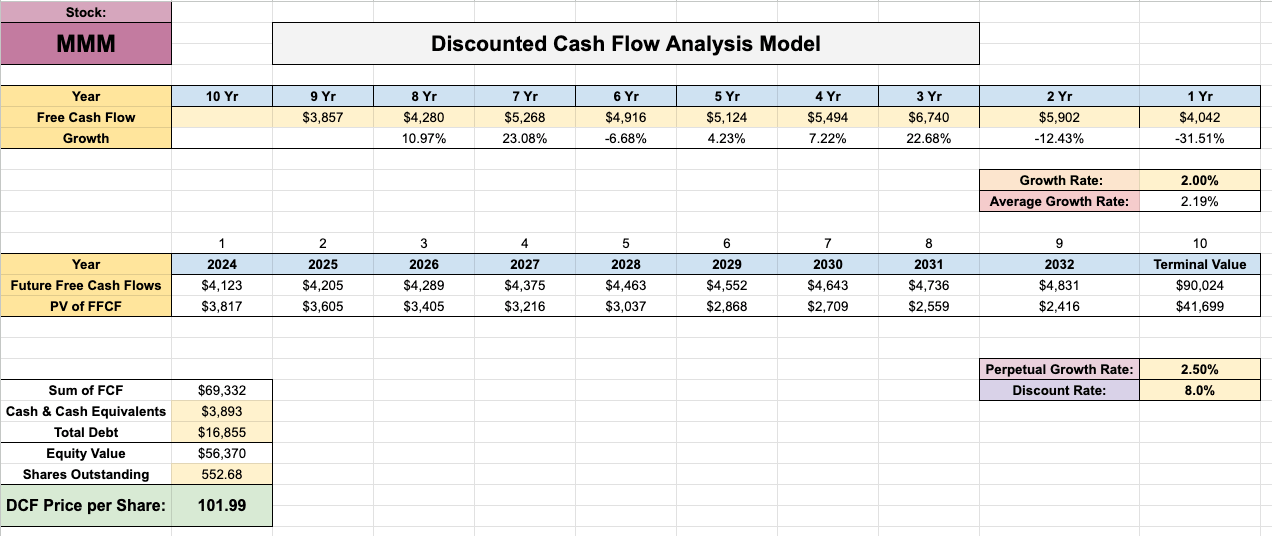

Valuation

To value 3M, we will use a discounted cash flow analysis as well as a dividend discount model. After accounting for 2024 free cash flow projections and adjusting cash equivalents and debt to more accurately represent the company’s financial situation with the impending lawsuit settlement payments, we come to a fair value of $101.99 with our discounted cash flow analysis. We projected a 2% free cash flow growth rate moving forward, which may only be attainable in the future for 3M if there is a dividend cut.

3M Discounted Cash Flow Analysis (Dividendology Patreon)

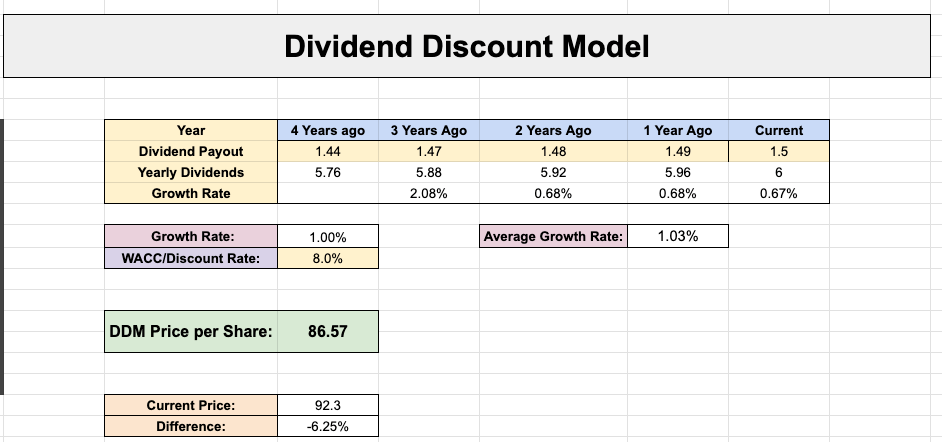

With our dividend discount model, after projecting a dividend growth rate of just 1% and a discount rate of 8%, we come to a dividend discount model price per share of $86.57, which is around 6% lower than 3M’s current share price.

3M Dividend Discount Model (Dividendology Patreon)

It’s also worth noting that investors are willing to pay a premium for stability and predictability in a company’s cash flows, and unfortunately, 3M does not have this to offer at this time, leading the share price to further be pushed down in my opinion.

Forward-Looking Guidance to Investors

3M has typically been a popular for stock that investors can rely on when looking for immediate high levels of dividend income. The over 50 consecutive years of dividend growth and high yield are no doubt enticing and would lead one to believe this is a ‘safe high yielder.’ But a deeper dive tells us that this is no longer the case.

For anyone looking to utilize dividend income as a source of cash flow in retirement, 3M is not a stock I would recommend. Investors seeking income should be looking for investment opportunities that have stable and predictable cash flows, a solid yield, a dividend growth rate that outpaces the rate of inflation, and sustainable dividends.

When you factor in opportunity cost as well, it makes it difficult to consider an investment into 3M in its current state. There are simply better opportunities for people looking for safe high yielding investments, such as the REIT I discussed in a previous article.

Final Thoughts

While it is true that we should seek to be greedy when others are fearful and fearful when others are greedy, this statement only proves true when assessing quality companies that are managing short-term headwinds. While 3M does have the potential to manage their current headwinds and come out with stronger financials, I don’t see this happening in the next 5 years, and maybe not even in the next 10.

While a dividend cut is something I never want to see from my investments, in my opinion, a dividend cut appears to be in the best interest for this company to get back into a healthy financial state. Lawsuits, slow growth, declining margins, and high payout ratios are too much for this company to handle without dramatically changing their capital allocation plan.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.