Summary:

- 3M is an attractive investment with a low P/E ratio of 9x and a healthy 7% dividend yield.

- The company beat profit estimates in the third quarter, showing strong profit momentum.

- The recent settlement of litigation over defective combat earplugs removes a valuation headwind and could lead to a re-rating.

jetcityimage

Industrial conglomerate 3M Company (NYSE:MMM) is a potentially attractive cyclical bet on profit growth after it was reported that the U.S. economy advanced at a 4.9% annualized rate in the last quarter.

3M recently reported earnings and the most compelling factor of an investment in the conglomerate is that its earnings sell for a 9x multiple, plus the stock pays investors a very healthy 7% yield.

3M’s cash flow improved in the last quarter and the conglomerate raised its adjusted profit forecast too. In my view, the low P/E ratio of 9x incorporates a huge margin of safety, and the dividend is solidly covered by expected adjusted earnings for 2023.

With the stock being as cheap as it is and economic tailwinds being favorable, 3M makes a compelling value proposition for passive income investors.

Business Composition And Healthcare Spinoff

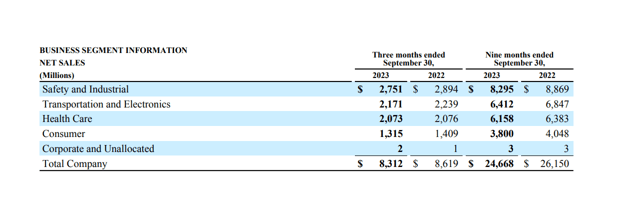

3M is a diversified conglomerate with a number of business interests that include Health Care (to be spun off next year), Safety & Industrial, Transportation & Electronics and Consumer. The portfolio of industrial businesses produced $8.3 billion in net sales in the third quarter and $1.9 billion in adjusted free cash flow.

Net Sales (3M Co.)

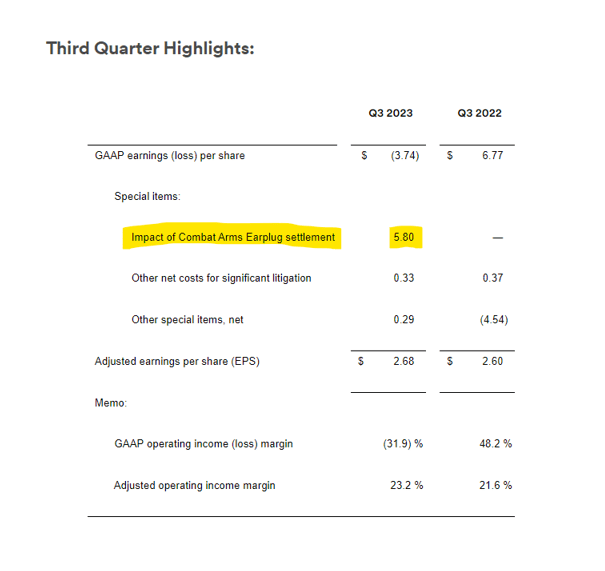

The company took a $4.2 billion pre-tax impairment charge in the third quarter. The impairment was related to a settlement over combat arms earplugs (which is discussed further below).

Combat Arms Earplug Settlement (3M Financial Earnings Release)

Just like General Electric, 3M has decided to spin off its health care business. Spinoffs have the potential to re-rate to a higher valuation multiple post-spinoff if the entity is run independently and investors gain a clearer understanding of the spinoff’s stand-alone operations.

The health care business spin-off is expected in the first half of 2024. GE Vernova, General Electric’s energy business spinoff is also expected to come to the public markets next year.

Combat Arms Resolution Is Removing A Valuation Headwind

3M has been involved in litigation about defective combat arms earplugs that were manufactured by Aearo Technologies and 3M. Ongoing litigation has been a headwind to 3M’s valuation in the last year, but a major milestone was reached in August when the conglomerate agreed to resolve such litigation claims and settled for a total contribution of $6 billion ($5 billion in cash + $1 million in common stock). 3M took a considerable impairment charge in the third quarter, to the tune of $4.2 billion, or $5.80 per share.

Combat Arms Claims Settlement (3M Co.)

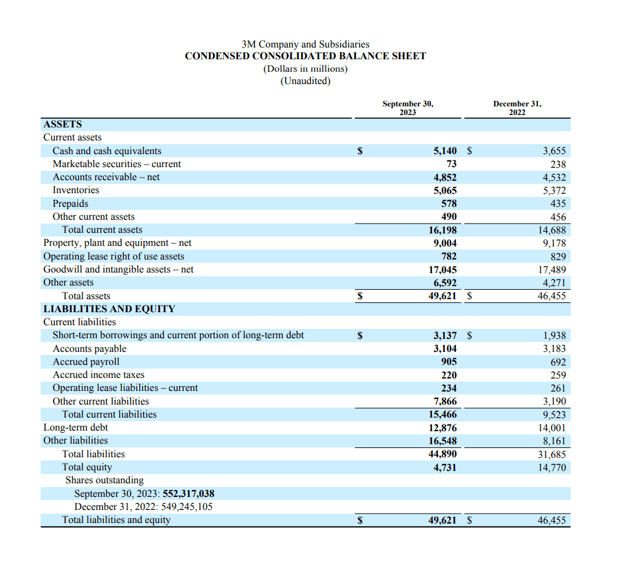

Balance Sheet Discussion

3M’s balance sheet reflected a strong cash position, with $5.14 billion in cash presently sitting in the conglomerate’s accounts. Compared to the end of 2022, 3M’s cash and cash equivalents have increased by $1.49 billion and its free cash flow should further swell this cash balance in the fourth quarter.

In terms of financial obligations, 3M has a bit of debt (and thus leverage): Long-term debt, as of the end of 3Q-23, was $12.88 billion, but nonetheless, reflected a decline of $1.13 billion in the last nine months. A high amount of debt could potentially become a challenge for the conglomerate during a recession as industrial profits tend to decline during economic downswings.

Balance Sheet (3M Co.)

3M Raised Its Profit Forecast For 2023

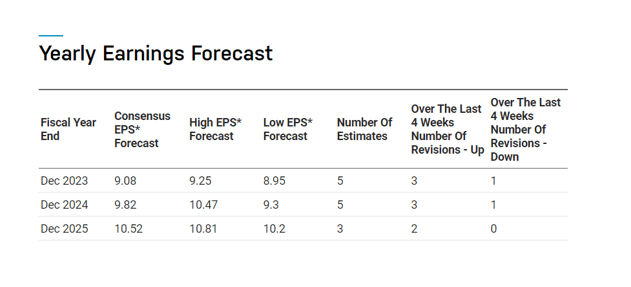

Despite the settlement, 3M’s management is optimistic about the underlying momentum in its industrial operations which led the conglomerate to lift its adjusted profit forecast for 2023 from $8.60 to $9.10 per share to $8.95 to $9.15 per share, reflecting a raise of 4.1% at the lower end of the profit guidance.

3M Ultimate Advantage: Pay A 9x P/E, Get A 7% Yield

The most appealing aspect of an investment in industrial conglomerate 3M is the company’s low valuation multiple based on earnings.

Right now, investors only pay nine times leading earnings for an investment in 3M that yields 7%. 3M pays a $1.50 per share per quarter dividend which implies a total annual dividend pay-out of $6.00 per share.

With a profit forecast of $8.95 to $9.15 per share, 3M is on track to pay out 66% of its adjusted earnings this year. 3M has paid a dividend for more than a century and raised its dividend consistently in the last 64 years.

Based on 3M’s profit expectations, sourced from Nasdaq, the market models a 2024 profit figure of $9.82 per share, on average, reflecting about 8% YoY profit growth. For the following year, the market models 7% profit growth per share.

3M is particularly a steal when its low P/E valuation of 9x is compared against General Electric which is selling for a leading P/E ratio of 23.5x. 3M’s litigation as well as impairment charge for the third quarter have been a headwind for the conglomerate’s valuation as of late.

Yearly Earnings Forecast (Nasdaq)

Why 3M Might Trade At A Higher/Lower Earnings Multiple

3M is a cyclical industrial conglomerate that profits from robust economic growth. The U.S. economy grew at a 4.9% annualized rate in the third quarter, so the macro backdrop is still quite favorable for 3M. Slower-than-expected profit growth during an economic contraction would probably be a headwind for the industrial conglomerate.

Since 3M recently resolved its main litigation issue, I think that 3M has a much better risk/reward relationship than it had at the start of the year.

My Conclusion

3M could profit from economic tailwinds which would support its cyclically-oriented industrial operations.

The recent settlement over defective combat earplugs has removed a considerable headwind and could clear the way for a re-rating.

3M’s ultimate value proposition, in my view, is its low valuation that leads to a huge dividend yield which is covered by adjusted earnings. Passive income investors can collect a 7% yield here while paying only 9x leading earnings for 3M.

The valuation multiple contains, thus, a high margin of safety, in my opinion, and with the U.S. economy remaining in solid shape in the third quarter, the case for a re-rating could easily be made.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.