Summary:

- 3M’s stock has surged on a YTD basis, well outperforming the market and exceeding our expectations.

- The company’s robust performance is driven by the improved balance sheet, leaner business, and focus on highest return projects, leading to the raised FY2024 guidance.

- 3M’s strategic focus on high-growth markets such as data center/ semiconductor/ electrification end markets have also triggered the raised consensus forward estimates through FY2026.

- Even so, with the stock already pulling forward much of its upside potential and dividends cut after the SOLV divestiture, its investment thesis has deteriorated at current levels.

- While long-term investors may continue DRIP-ing, traders may consider unlocking part of their gains since MMM appears fully valued here.

freemixer/E+ via Getty Images

We previously covered 3M (NYSE:NYSE:MMM) in June 2024, discussing the completion of the Solventum (SOLV) divestiture as of April 01, 2024, which left the former’s balance sheet much healthier – allowing the legacy company to opportunistically invest in its long-term growth.

Combined with the much leaner and focused company, we had reiterated our Buy rating then, especially since bullish support had already been established around the $76s.

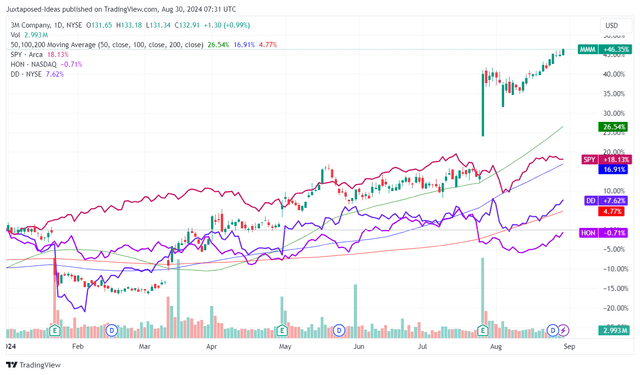

Since then, 3M has already dramatically rallied by +35%, well outperforming the wider market at +4.4%.

With the stock buoyed by extreme optimism, we are downgrading to a Hold instead, with most of its upside potential already baked in and the cut dividends offering investors with an underwhelming near-term return profile.

We shall discuss further.

MMM’s Execution Remains Promising, Thanks To The Highly Competent Management Team

MMM YTD Stock Price

MMM has had an eye-popping YTD performance indeed, well outperforming much of its peers, including Honeywell International (HON) and DuPont de Nemours (DD).

Much of the tailwinds can be attributed to the completed SOLV divestiture, which took its balance sheet from a net debt situation of -$10.02B in FQ4’23, to -$9.62B in FQ1’24, and finally down to -$2.78B in FQ2’24.

The accelerated deleveraging is highly impressive indeed, especially aided by the resolution of MMM’s legal troubles, as discussed in our previous article.

The strategic combination of both developments naturally allow the company to emerge much stronger, significantly aided by the double beat FQ2’24 earnings call and raised FY2024 guidance.

For reference, MMM has reported FQ2’24 pro forma revenues of $6.25B (+4.3% QoQ/ inline YoY) and adj EPS of $1.93 (NA/ +38.8% YoY), with much of the bottom-line tailwinds attributed to the growing gross margins by +2.3 points YoY and the moderation observed in its adj operating expenses by -6.7% YoY.

It is apparent that the management’s efforts to improve its operational performance has paid off handsomely, as best reiterated by William Brown, the CEO of MMM:

So in the near-term we have to focus on commercial excellence to sell more of what we currently offer, and that means better sales force and distributor effectiveness, targeted marketing, optimized pricing, and much better execution at the customer interface, in particular, on time, in full performance, which is a key part of my second priority, operational performance. (Seeking Alpha)

With an adjusted Free Cash Flow generation of $1.2B (+50% QoQ/ -20% YoY), we believe that MMM remains well capitalized to opportunistically invest in its long-term highest return projects and pay down its legal obligations.

For example, the management continues to report growing contract wins in the consumer electronic devices and semiconductor manufacturing end market, along with the automotive OEM businesses.

These developments have already triggered the robust growth in MMM’s electronics business by “low double digits organically as we continued to gain spec in wins on consumer electronic devices and in semiconductor manufacturing” and its auto OEM business up by “5% in Q2 versus a 0.5 point decrease in global car and light truck bills” as “we continued to gain penetration on new platforms.”

These factors have already led to the Transportation and Electronics segment’s robust growth in adj operating incomes to $426M (+16% YoY proforma) and adj operating margins to 22.3% (+2.5 points YoY proforma).

With the data center/ semiconductor/ electrification end markets still booming and long-term prospects robust, we believe that MMM’s strategic shift to higher growth markets have been highly prudent indeed.

At the same time, the management has been highly measured in its R&D efforts, with it only comprising 4.2% of its H1’24 revenues as compared to FY2023 levels of 5.5% and FY2019 levels of 5.8%, with it allowing the company to potentially generate expanded profitability over the next decade.

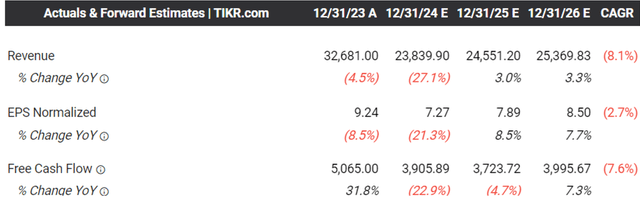

The Consensus Forward Estimates

These developments have allowed MMM to raise their FY2024 adj EPS guidance from continuing operations from the $7.05 (+16.7% YoY) offered after the divestiture to $7.15 (+18.3% YoY) by the FQ2’24 earnings call, thanks to the ongoing cost optimizations across COGS, sourcing/ freight/ distribution expenses, and 2023 headcount reduction.

As a result, it is unsurprising that the consensus have also raised their forward estimates, with MMM expected to generate an accelerated top/ bottom-line growth at a CAGR of +3.2%/ +8.1% between FY2024 and FY2026, respectively.

This is compared to the previous estimates of +2.8%/ +6.7% and the historical growth of +1.2%/ +1.8% between FY2016 and FY2023, respectively.

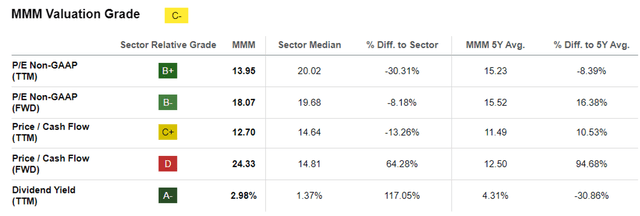

MMM Valuations

Perhaps this is also why the market has upgraded MMM’s FWD P/E valuations to 18.07x, up from the previous article at 14.05x and its 1Y mean of 11.88x, while nearing its 3Y pre-pandemic mean of 20.39x.

The upgrade is not overly aggressive as well, since MMM at a PEG ratio of 0.89x remains cheap compared to its direct peers, including HON at 2.54x and DD at 1.97x, thanks to the former’s accelerated bottom-line growth over the next two years.

So, Is MMM Stock A Buy, Sell, or Hold?

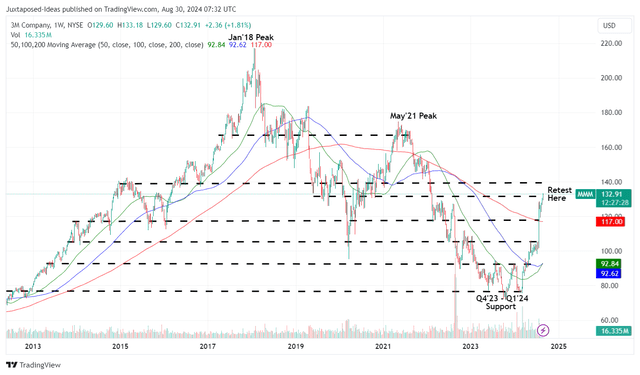

MMM 10Y Stock Price

For now, MMM has charted an extremely satisfying vertical rally from the October 2023 bottom, while running away from 50/ 100/ 200 day moving averages.

For context, we had offered a bull-case long-term price target of $154.80 in our last article, based on the consensus FY2025 adj EPS estimates of $7.74 and the upward rerating nearer to its historical P/E valuations of 20x.

Based on the consensus raised FY2025 adj EPS estimates of $7.89 and the same P/E, it is apparent that MMM has already pulled forward part of its upside potential to our updated long-term price target of $157.80.

At the same time, the massive rally has triggered the moderation in its forward dividend yields to 2.13%, down from the 4Y average of 4.48% – thanks to the dividend cut by -53.6% after the SOLV divestiture.

As a result of the reduced margin of safety, we prefer to downgrade our rating for the MMM stock to a Hold instead.

Long-term investors may continue DRIP-ing to regularly accumulate additional shares on a quarterly basis. Otherwise, we do not recommend new investors to initiate a position here, because of the minimal upside potential and underwhelming dividend income prospects.

Traders may consider unlocking part of their gains here as well, since it is uncertain how long MMM may sustain its upward momentum as the wider market increasingly nears greed territory.

It may be more prudent to wait and observe the stock’s movement for a little longer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.