Summary:

- 3M Company’s stock has experienced a significant decline recently.

- The company offers a high yield and low valuation, making it a potential opportunity for those looking to invest.

- Legal risks have declined but remain meaningful.

josefkubes

Article Thesis

3M Company (NYSE:MMM) is a battleground stock that has, once again, fallen considerably in the recent past. With a high yield and a low valuation, it is time to take another look at this stock and its prospects.

3M Company: Still A Battleground Stock

3M Company had been a reliable dividend payer that was seen as a low-risk pick by many for years, but that changed when more and more lawsuits and legal problems emerged. Combat earplugs that were produced by 3M are one of the key legal risks, while so-called forever chemicals pose major legal risks as well. The opinions about what the impact of these lawsuits will look like vary a lot, with some seeing the company as a whole at risk, while others believe that this will be a short-term headwind only.

Due to the different opinions among investors, and due to news emerging about ongoing lawsuits from time to time, 3M has become a very volatile stock. Over the last year, 3M Company saw its share price decline by 16%, which made for a substantial underperformance versus the broad market. Relative to the all-time high of more than $250 per share that was hit a couple of years ago, 3M has been more than cut in half. Today, shares trade just a couple of percentage points above the 52-week low in the $90s. Let’s take a closer look at some of the recent news that we got regarding the aforementioned lawsuits.

Recent Lawsuit News

In August, 3M’s board of directors approved a settlement worth $6 billion regarding the combat earplugs. Some analysts had predicted a higher cost of settlement for these lawsuits, thus the $6 billion number was a bit of a positive surprise, and shares initially reacted positively to this development. That being said, $6 billion is still a major amount of cash, equal to around 120% of the forecasted net profit of around $5 billion for the current year. In other words, the settlement will eat up more than one year’s worth of profits if it goes through. There are still some question marks when it comes to that happening, however. Seeking Alpha reports that there is a possibility of this settlement failing if a large enough number of veterans do not agree to the settlement. This could happen, for example, if veterans want to see a higher settlement amount. I do not believe that the settlement is likely to fail, but investors should keep the possibility in mind, and it makes sense to keep an eye on any news emerging regarding this settlement.

When it comes to the other major legal risk, the forever chemicals that 3M is responsible for and that have contaminated water supplies, 3M has made some progress this year as well. In June, 3M Company agreed to a settlement of $10 billion that will be paid over 13 years. While the $10 billion total amount is equal to around two years’ worth of net profits for 3M, the fact that this will be spread out over more than a decade helps in reducing the actual per-year impact considerably. 3M will have to pay less than $800 million per year, which is a lot more stomachable compared to a $10 billion upfront payment. However, while this PFAS settlement solves part of the problem – the contamination of water supplies – there are still some other PFAS-related legal risks. 3M still faces lawsuits when it comes to non-US water supplies, wastewater, and so on. It is thus definitely possible, and I believe even likely, that the company will eventually have to pay additional money for other lawsuits and settlements. Still, the fact that this part of the PFAS problem has been solved is a good start, and it is unlikely that the remainder of the settlements that will (likely) come will break the company. Still, the profit drag on 3M Company in the coming years, accounting for the earplug settlement, the water supply settlement, and potential other PFAS settlements and lawsuits, will be quite substantial.

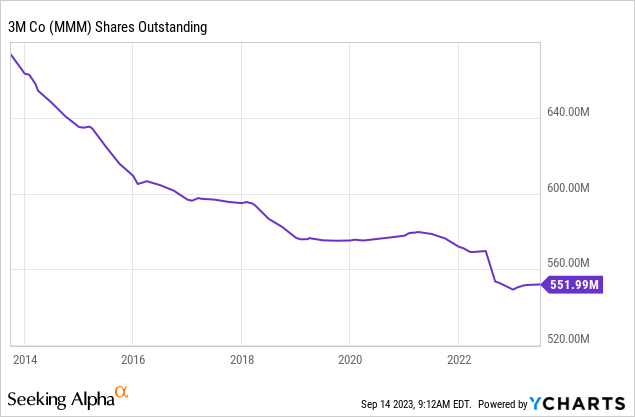

Not only will this result in lower reported profits, but the settlements will also be a drag on 3M’s cash flows. This, in turn, will mean that the company will have fewer resources for other purposes, such as paying out cash to its shareholders (via dividends and buybacks), debt reduction, M&A, and so on. While 3M Company has not cut its dividend and may very well maintain it going forward, the reduction in buybacks has been quite meaningful already:

While there was a very meaningful downward trend in 3M’s share count between 2014 and 2019, 3M’s share count has not declined very much since then. Over the last year, 3M’s share count has declined by just 0.14%, according to YCharts, which does not provide any meaningful growth tailwinds for the company’s earnings per share. This is one of the reasons for 3M’s rather sub-par earnings per share growth outlook in the near term, but the company is also experiencing weak business growth. The company’s CFO Monish Patolawala has just stated that he foresees a “slow growth environment” in 2024, due to factors such as consumers buying fewer discretionary items and instead shifting spending towards staples and experiences. A slow China business and a weak environment for 3M’s electronics business are other headwinds that the company’s CFO noted during Morgan Stanley’s (MS) Laguna Conference. Between a weak macro environment, legal costs, and no tailwind from buybacks, it is not surprising to see the company’s earnings per share growth forecast stand at a rather weak -12% for the current year, while earnings per share are forecasted to climb by 9% in both 2024 and 2025. Overall, earnings per share are thus expected to grow by around 6% in the 2022 to 2025 time frame, or by around 2% per year. That is not a disaster, but far from great, which explains at least some of the decline that 3M’s shares have experienced recently.

Potential Reward Going Forward

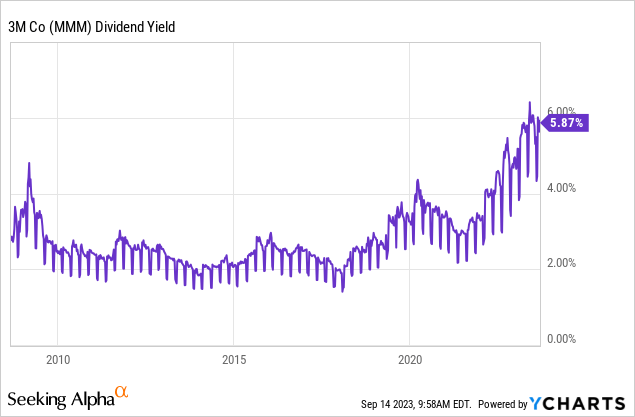

That being said, 3M Company’s shares are not expensive today, even factoring in the profit decline that is expected for the current year. Based on current earnings per share estimates for 2023, 3M Company trades for around 11.5x this year’s expected net profit. That is very inexpensive compared to how the broad market is valued, and also compared to how 3M was valued in the past. Of course, slower growth – relative to 3M’s growth rate in the past – justifies a discount, but shares still do not look expensive at all, even when we consider the weak growth rate in the near term. The weak share price performance has also made the dividend yield explode upward, as shares can currently be bought with a yield of 5.9%, which is very high compared to the yield 3M offered in the past, as we can see in the following chart:

Over the last 15 years, the dividend yield was mostly in the 2%-3% range – it is at twice the upper end of that range today. From an income perspective, 3M is much more attractive today, relative to the past, although it should be noted that the pending settlements and lawsuits could theoretically cause a dividend cut. I do not think that this is very likely, but one shouldn’t categorically rule out a dividend cut either.

Takeaway

3M still faces major legal challenges, but things look somewhat better than they did a year ago. The earplug settlement will not be as costly as feared, and 3M has also made progress in cleaning up the (legal) mess of its forever chemicals, although there are still some unknowns there, e.g. due to international water contamination.

3M is inexpensive and offers a nice dividend yield, and if things go right, 3M could be a pretty rewarding investment at current prices. But until the legal issues clear up some more, I will stay on the sidelines but want to note that 3M looks better here than it did a year ago, when the legal risks were even higher and when it was not as inexpensive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!