Summary:

- 3M’s Q2 earnings report was exceptionally strong, leading to a 23% stock surge and a 46% YTD performance, the best in the DJIA.

- Despite robust technical momentum and a rising trend, 3M’s stock is close to fair value, warranting a hold rating for now.

- Key risks include potential macroeconomic slowdowns, a strong US dollar, and an untested new CEO, but future EPS growth looks promising.

- With a decent 2.11% dividend yield and potential for payout boosts, 3M’s long-term growth trajectory appears stable post-Solventum spinoff.

- I outline key price levels to monitor on chart, as momentum remains very impressive.

josefkubes

3M Company (NYSE:MMM) had one of the biggest and bullish earnings stories during the Q2 reporting period. While mega-cap tech usually captures most of the financial media’s attention, shares of the Minnesota-based Industrials sector company soared following its quarterly results and FY 2024 guidance hike.

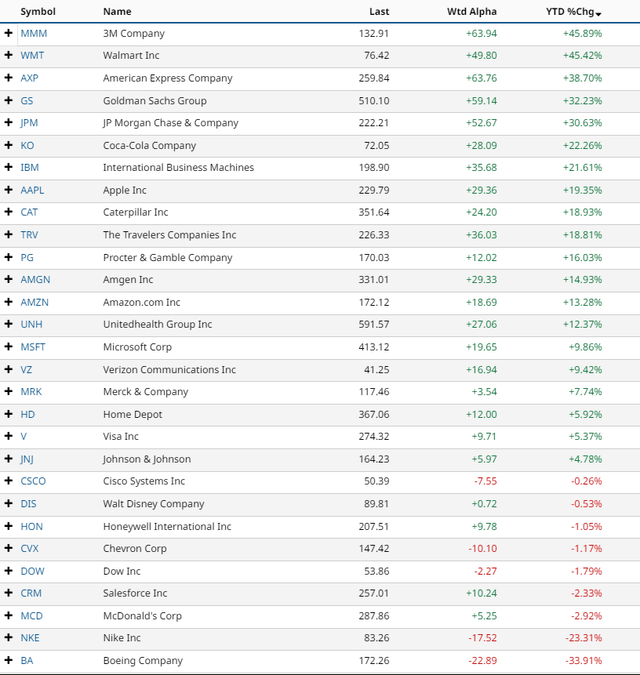

The stock rose 23.0% for its best single session going back to at least 1980. It wasn’t just a one-day event, either. Shares have continued to climb since late July, now above $130 per share. Its 46% year-to-date performance is good enough to make it the best return in the Dow Jones Industrial Average as we wrap up August.

It’s a comeback that I had been anticipating as both the fundamentals and technicals came together on this blue-chip name. Today, I see very strong upside momentum, with technical resistance about 15% above the current price. On valuation, the stock looks close to fair value, warranting a downgrade to a hold.

3M’s Q2 Stock Reaction Was the Best in its History

DJIA YTD Gainers

Back in July, 3M reported a gangbuster quarterly report. Q2 non-GAAP EPS of $1.93 topped the Wall Street consensus forecast of $1.68 while revenue of $6.0 billion, up just 1% from the same period a year earlier, was a solid $170 million beat. Sales rose across all its segments as the firm operated well despite a few lingering regulatory issues.

Second-quarter net income hit $1.15 billion, compared to a massive $6.84 billion loss in Q2 2023. The firm successfully spun off its healthcare business earlier this year, allowing the management team to focus on core operations. With most liability risks out of the way and with Solventum (SOLV) now operating on its own, 3M’s management team expects FY 2024 EPS to be in the range of $7.00 to $7.30, a significant increase from the previous EPS range of $6.80 to $7.30. Organic sales growth is now seen flat to up 2% in 2024. During the quarter, 3M successfully passed through price increases despite slowing demand in its consumer and industrial businesses. “…the benefits of restructuring coming through,” said new CEO Bill Brown.

3M has worked through class-action lawsuits related to its US military earplugs and liability around its forever chemicals, but that’s largely in the rearview mirror now. Shares surged 23% in the session that followed, as a fresh-start period now ensues. It’s possible that the 2024 guidance was even to the conservative side, given that this is Brown’s first year at the helm of the $73 billion company. On the conference call, Brown noted, “As I look ahead, I am focused on three priorities: driving sustained organic revenue growth, increasing operational performance, and effectively deploying capital.”

I think there’s a real chance 3M could surpass its own estimates, but it’s now a bit of a show-me stock given the more than 50% rally from lows hit as recently as this past April. Key risks include a macro slowdown which could further pressure its consumer and industrial segments, a strong US dollar, and any lingering lawsuit-related items. Moreover, the new CEO has not yet been tested and remains in a honeymoon period. But 3M could be like the next GE Aerospace (GE) as it restructures and adds value – so watching future EPS forecast changes is key.

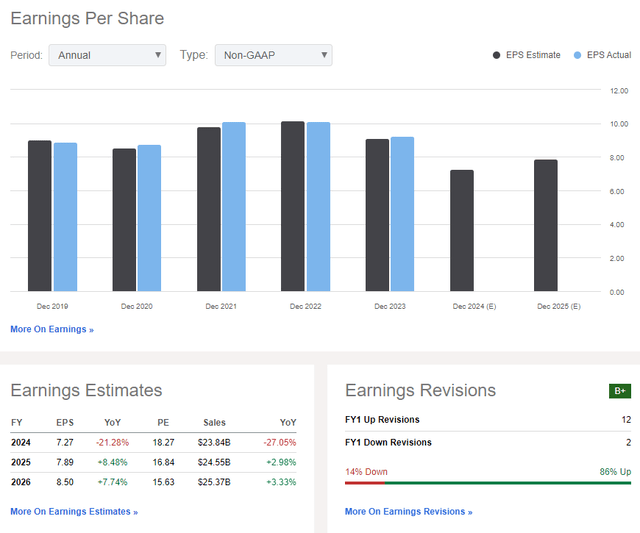

On the earnings outlook, analysts now expect $7.27 of operating EPS this year, with growth returning to the out year. By 2026, non-GAAP per-share profits could reach $8.50, cementing mid-to-high single-digit EPS growth in the quarters ahead. Revenue growth should be somewhat stable post the Solventum spinoff, and the sellside has turned more upbeat following the strong Q2 report in July.

The dividend yield is currently decent at 2.11%, and with more than $7 of free cash flow per share in the last 12 months, there’s room for a payout boost in the quarters to come. A $0.70 quarterly dividend will be paid on September 12.

3M: Sales & Earnings Forecasts

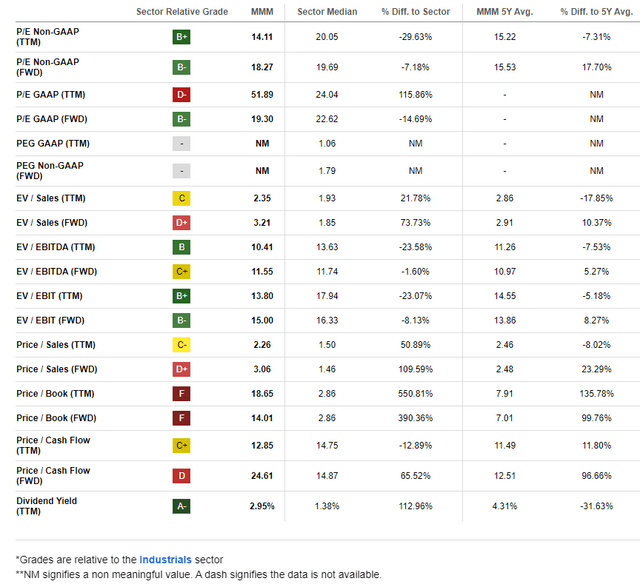

On valuation, if we assume normalized EPS of $7.70 over the next 12 months and apply a 17x multiple, then shares should trade near $131. While my EPS forecast is up just modestly based on a period shift, I am giving 3M a higher multiple following the robust Q2.

What’s more, an 8-9% long-term EPS growth rate along with a 2.0 PEG leads me to a mid-to-high teens multiple on that metric. The stock also trades close to its long-term average EV/EBITDA valuation and price-to-sales metrics.

3M: A Less Compelling Valuation Today

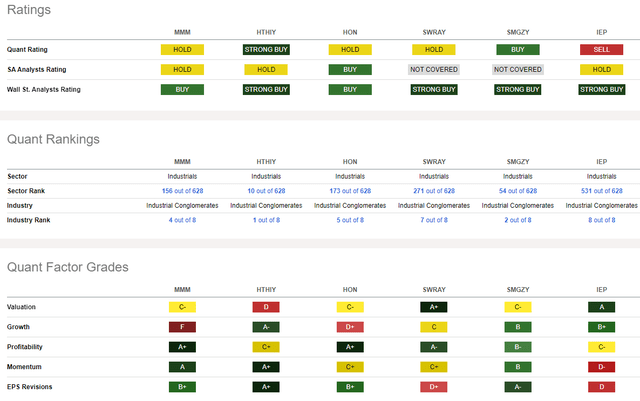

Compared to its peers, 3M sports a lukewarm valuation rating while its growth trajectory has been weak, but is forecast to improve and turn more consistent in the coming years.

With very strong profitability trends and high share-price momentum, there are certainly ongoing bullish factors, and Wall Street EPS revisions have understandably turned better.

Competitor Analysis

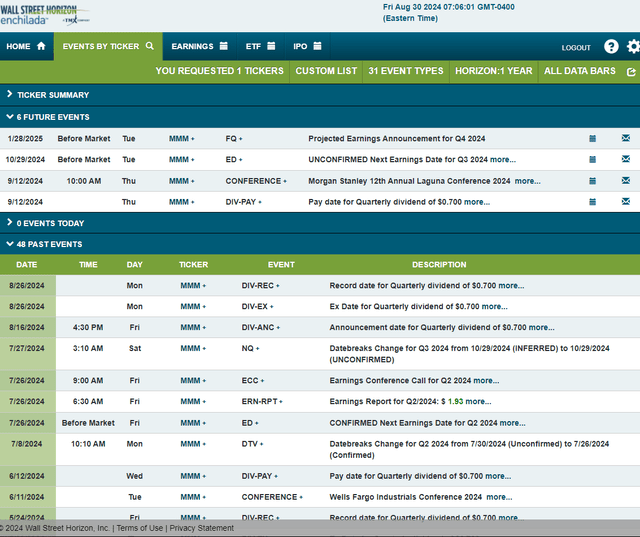

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2024 earnings date of Tuesday, October 29 before market open. Before that, 3M’s management team is slated to present at the Morgan Stanley 12th Annual Laguna Conference 2024 starting on September 12.

Corporate Event Risk Calendar

The Technical Take

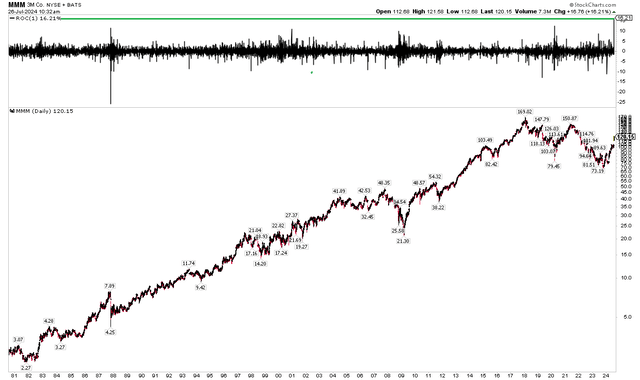

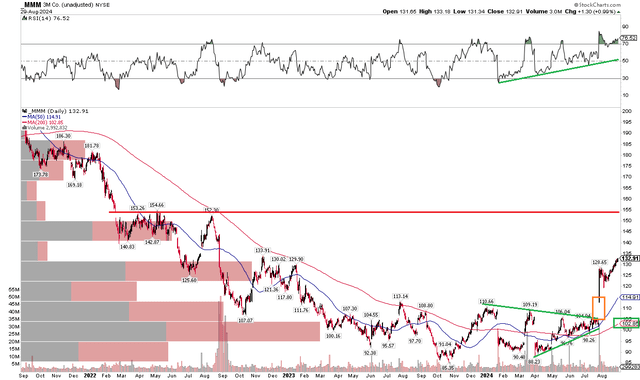

With MMM now close to fair value in my view and new leadership hitting its stride, the technical view is impressive. Notice in the chart below that shares have soared to the best levels since November of 2022. Last year and back in this past May, I noticed a developing technical pattern – a series of lower highs and higher lows formed a triangle formation. Shares reached an apex and then gapped up to multi-month highs in what’s known as a bullish breakaway gap.

The stock has increased since that earnings-related jump. Also take a look at the RSI momentum oscillator at the top of the graph – it has been notching technical oversold conditions since nearly one year ago. In this case, momentum led price action, and the stock has been in overbought conditions for more than a month as price creeps higher. With a rising long-term 200-day moving average, the bulls now control the primary trend. I see upside resistance in the $152 to $155 zone while support is near $120 and $102.

MMM: Healthy Technicals, $155 Resistance, Rising 200dma

The Bottom Line

I have a hold rating on 3M. The stock is now close to fair value in my view, while the technical situation is strong. If we see another strong quarter and guidance increase, then it could certainly warrant a buy rating if the stock doesn’t continue to climb aggressively before then.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.