Summary:

- Spinning off healthcare alone might lead to dividend cut.

- Likely near-term settlement for earplugs can drop the company to junk ratings and imperil the dividend.

- First trial for PFAS liabilities starts this June. Total PFAS liabilities possibly large enough to drive company into bankruptcy.

- My new Investment Group launch, Catalyst Hedge Investing, this Thursday!

saleletic/iStock via Getty Images

Three Ways to Win with the Short

3M (NYSE:MMM) is lining up as a high conviction short. The company just reported lackluster results this morning (April 25th), but operations are largely immaterial at this point.

The best shorts have multiple points of attack with specific catalysts to dent a company, the sooner the better. This was the case with Silicon Valley Bank “SVB Financial: Blow up Risk”, which had 2 catalysts. I believe 3M has three negative catalysts that could play out in the next several months, with one potentially driving the company into bankruptcy.

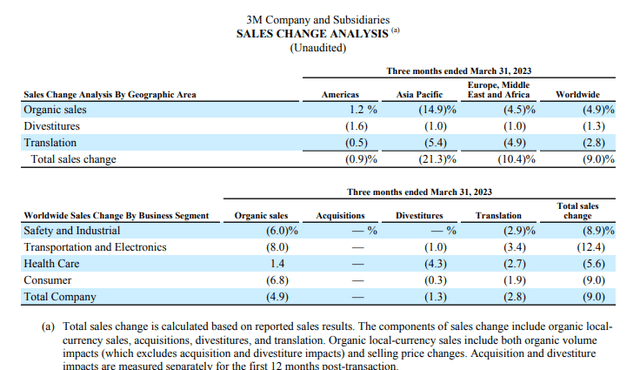

Underwhelming Operating Results in All Segments

3M currently has four operating segments: Safety and Industrial, Transportation and Electronics, Health Care and Consumer. None of these businesses and no geography is growing particularly strongly.

3M Segment Organic Sales Breakdown (3M Q1 Quarterly Report)

As one can see, the only business segment with even de minimis organic growth is healthcare. That segment is not exactly lighting the world on fire at 3.2% organic sales growth for 2022 and 1% very adjusted organic growth for Q1 ’23.

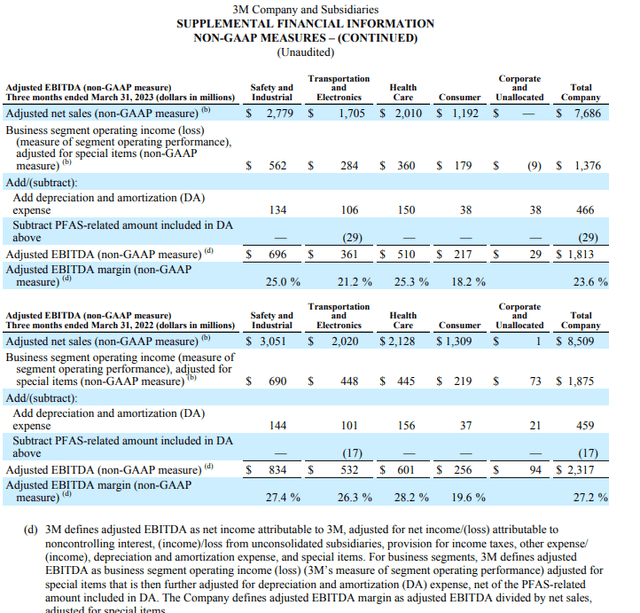

Margins are also under continued pressure across the board. Every segment’s EBITDA and EBITDA margins were down year over year this quarter.

3M Segment Operating Margins (3M Q1 Quarterly Report)

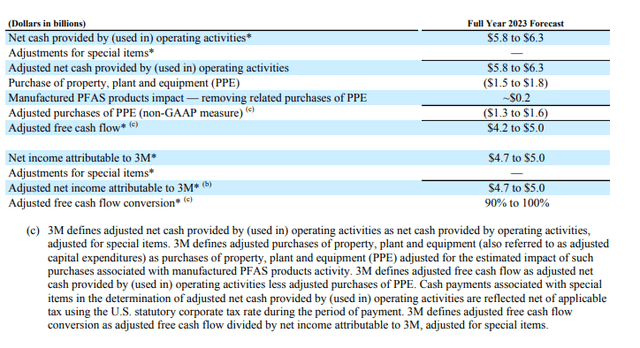

These numbers shouldn’t overwhelm anyone. The company is guiding toward a weak Q2 and announced a large restructuring with these Q1 numbers. They maintained guidance, which implies improvement in the back half of the year. I think that’s highly speculative given a weakening economy, which I wrote about last month.

3M 2023 Guidance (3M Q1 2023 Presentation)

Healthcare is the highest margin business at just over 25% adjusted EBITDA margins. It also generates the most cash flow (only about $275mm of annual capital expenditures). Therefore, it’s no surprise that the company announced plans last July to spin out this business. The separated healthcare business will pay a $7.5 billion dividend to the parent, which would also continue to own just under 20% of the company that it will liquidate over time.

Some see this business trading at 12 times EBITDA or better. I think that’s high given the revenue growth rate and that multiple is inline with bigger and higher margin co’s like Johnson & Johnson (JNJ) and GE Healthcare (GEHC) trade at that multiple, but let’s stick with that number. It doesn’t really help MMM at versus its current valuation.

Below I use an aggressive EBITDA number of $8,400 billion, flat with 2022. Company guidance implies $8 billion at best, but this is a short thesis, so I want to err on the high side. I also only assume $100 million in lost efficiency from deconsolidating the company. Again, this gives the company the benefit of the doubt. Lastly, I don’t include over $8 billion of “other liabilities” as part of Enterprise Value below. I assume the Spinco will need $200 million of operating cash paired with the $7.5 billion of debt incurred from the payment to the parent.

All numbers in Millions

| Current | Spinco | Remainco | New Total | Difference | ||

| EBITDA | 8,400 | 2,400 | 5,900 | 8,300 | -100 | |

| EBITDA Multiple | 8.34 | 12 | 6 | n/a | ||

| Implied EV | 70,000 | 28,800 | 35,400 | 64,200 | -5,800 | |

| Debt | 15,960 | 7,500 | 8,460 | 15,960 | 0 | |

| Cash | 3,824 | 200 | 3,624 | 3,824 | 0 | |

| Market Cap | 57,937 | 21,100 | 30,564 | 51,664 | -6,273 | |

| Stock Price (Implied) | $105 | ($93.76) | ||||

| Leverage | 1.5x | 3x | 1x |

Sources: Author’s calculations, Seeking Alpha data

You can see above that the Spinco would have to trade at 14x or Remainco would have to trade at 7x EBITDA just to stay flat with the company’s current valuation (and using a high EBITDA estimate for ’23 and only $100 million of deconsolidation margin loss). One can argue that I’m using too low a multiple for the Remainco. I don’t think so since the current biz (with healthcare Spinco embedded) trades at 8x and Remainco will essentially be a commodity chemical manufacturer with no growth.

Another thing cutting against Remainco’s valuation will be dividend support. 3M generates about $4.5 billion of free cash flow on a normalized basis to support $3.3 billion of dividend payments ($6/share, just under 6% yield). I believe that many investors own 3M stock for this dividend. It uses the rest of its cash to buy back stock.

However, healthcare generates about $2.2 billion of free cash pre-tax and about $1.9 billion after tax. Removing that cash flow leaves the company with at best $2.6 billion of free cash, $700 million short to support its dividend. Assuming the company will want 20% wiggle room on the dividend, will leave about $2.25 billion available for dividends. Meaning the current dividend has to be cut by about one third. Will investors still find 3M attractive at a 4% dividend yield? If not the stock has to drop by 1/3 to regain the 6% yield.

A counter argument is that the Spinco will pay a healthy dividend. Perhaps, but it’s not certain the two separate dividends would equal the current whole dividend and investors don’t always tie everything together.

Long story short, I don’t see the healthcare being a huge value creator here. If I’m wrong on that front, it will be due to the market feeling much better about the Spinco ability to grow out from under 3M’s yoke. Again, I don’t think this business warrants a higher multiple than JNJ or GEHC, but that’s the biggest risk to the short.

Legal Liabilities Possibly Creating Financial Stress

3M is a bit unique in that it faces two massive legal liabilities. One could add over a turn of leverage and the other could bankrupt the company. Both issues could come to a head soon.

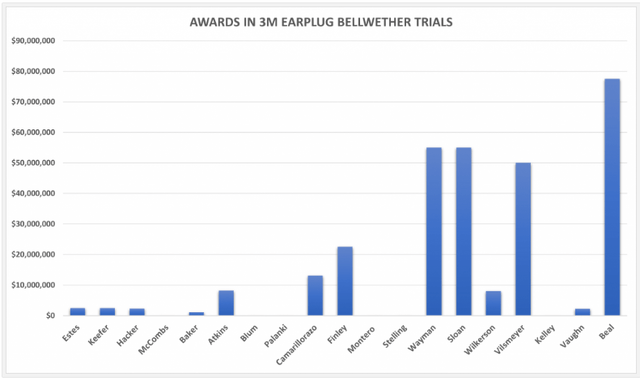

Earplug Liability

The first liability relates to the manufacture of earplugs for the military by the company’s subsidiary, Aearo Technologies between the years 2003 to 2015. Litigants accuse Aearo and 3M of misrepresenting the earplugs’ effectiveness and causing hearing damage and tinnitus.

Aearo filed for bankruptcy in July of 2022. At the time, 3M pledged $1 billion towards funding Aearo’s liabilities from potential lawsuits. Recent developments indicate that amount is going to be woefully inadequate and 3M’s gambit to isolate its liability via Aearo’s bankruptcy will fail.

There are currently around 230,000 earplug litigants. That $1 billion pledge equals between $4,000 and $5,000 per affected soldier. Meanwhile sixteen cases have reached trial with MMM losing ten of them and facing $300 million in damages from those cases alone.

While there’s no way each plaintiff will get millions, one analyst estimates that a range of $70,000-$110,000 is very possible, which implies a liability between $15-25 billion. Other sell side analysts seem to expect a total liability in the $6-7 billion range, or about $20,000-$30,000 per case. Just that lower level would add a turn of leverage and valuation for 3M. I believe any liability in the $10 billion range or higher would put 3M’s investment grade rating at risk.

For anyone looking for a historical summary of the cases and the verdicts as well as potential settlement methods and amounts, there’s a decent one here.

Aearo Technologies Liabilities by Case (Lawsuit Information Center)

3M’s strategy of bankrupting Aearo to limit its liability received a dose of bad news yesterday (April 4th). Johnson & Johnson (JNJ) tried a similar tactic over its talcum powder liability. Called a Texas Two Step, the company put the manufacturing subsidiary into bankruptcy. Judges rejected that filing and yesterday, JNJ agreed to pay plaintiffs almost $9 billion.

I think it’s possible the JNJ settlement will spur 3M to abandon its similar move with Aearo and attempt a settlement. Momentum, however, has clearly shifted to plaintiffs now in my opinion.

PFAS Liability

While the numbers discussed above are enormous, they pale in comparison to the company’s potential liability for polyfluoroalkyls aka PFAS aka forever chemicals. 3M discovered the technology behind PFAS in the 1930’s. It was used for decades in thousands of products from ScotchGard to fire suppressing foams to pizza boxes. The chemicals are so ubiquitous that nearly every American has PFAS in their bloodstream.

Studies have shown:

“links PFAS to health problems including kidney and testicular cancer, liver and thyroid problems, reproductive problems, pregnancy-induced high blood pressure, low birthweight, and increased risk of birth defects, among others. PFAS has also been linked to changes in cholesterol levels and in the timing of puberty. Evidence of PFAS impacts on immune function is another growing concern, and studies have found some PFAS may lower vaccine effectiveness.”

The EPA recently issued a proposal that the acceptable amount of PFAS in water is 4 parts per trillion. This ratio contrasts with state rules that range from 5 to 70 parts per trillion. There is a comment period so the standards could change, but I have a hard time seeing this standard relaxing much.

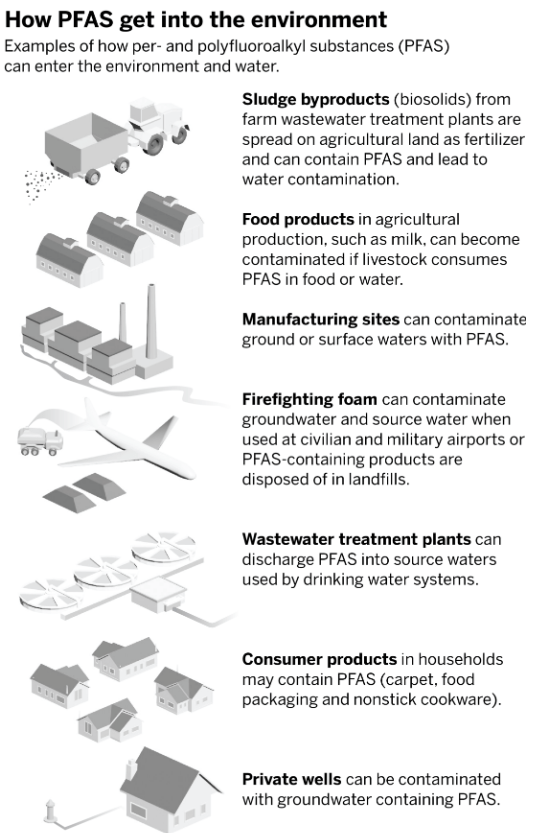

PFAS Sources (US Government Accounting Office)

The lawsuits are already lining up for clean up. A jury trial in South Carolina federal court will begin on June 5 2023 over pollution in Florida water utilities. This trial is just the first of potentially more than 3,000 cases.

An even scarier development for 3M is that if the EPA declares PFAS hazardous substances, they automatically fall under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) aka Superfund Law, by which the EPA can order clean up by responsible parties.

Cost estimates for the cleanup vary widely. Bloomberg pegged the liability at $30 billion payable over thirty years. If you ask me, that’s a rosy scenario for 3M.

The company certainly tries to paint a rosy picture. It announced an exit from PFAS in December that stated:

“This is a moment that demands the kind of innovation 3M is known for,” said 3M chairman and chief executive officer Mike Roman. “While PFAS can be safely made and used, we also see an opportunity to lead in a rapidly evolving external regulatory and business landscape to make the greatest impact for those we serve. This action is another example of how we are positioning 3M for continued sustainable growth by optimizing our portfolio, innovating for our customers, and delivering long-term value for our shareholders.”

A few datapoints paint an uglier picture for 3M. In 2018, the company settled with Minnesota for $850 million for PFAS pollution of drinking water just for the east metro area of the Twin Cities.

I suspect most municipalities will want their money sooner rather than later and the EPA’s ability to order Superfund cleanups will spur faster and potentially much large payments. These payments could resemble the opioid settlements that resulted in the bankruptcy of Endo Pharmaceuticals (OTCPK:ENDPQ) that I covered starting summer of 2021. In those cases, the only really viable path for settling mass tort suits involved bankruptcy. While 3M is in better financial shape excluding the PFAS and earplug liabilities than a company like Endo, the liabilities are also much larger.

Perhaps the asbestos saga is a better comparison to PFAS. Over seventy companies with asbestos exposure had to file for bankruptcy and pay into a trust. I see potential for PFAS producing companies ending up the same way. The main difference is that there are only a few producers of these chemicals, with MMM being the largest, most direct producer and therefore the biggest target for the EPA and tort lawsuits.

MMM does generate fairly significant cash flow. Theoretically, it could service combined PFAS and earplug liabilities that numbered into the tens of billions without filing for bankruptcy. But we’re talking about a company with just over a $55 billion market cap. A combined liability of over $30 billion would push this company far into junk territory and would displace a majority of the value if one holds the valuation constant. That’s a big if in my opinion. Companies with 5x leverage that don’t pay dividends trade at much lower multiples. Compressing the multiple and adding tens of billions of liabilities/debt would wipe out much of the equity value here whether the company technically files for bankruptcy or not.

All things considered, I see a potential bankruptcy of 3M as a very real possibility and at the very least a compelling short.

Risks

The main risks to the 3M short are settlements for earplug and PFAS liabilities that are much lower than I am projecting or spaced out over much longer time periods. I have to add, however, that even the low end of the ranges spaced out over very long periods of time would pressure 3M’s cash flow and almost certainly reduce its ability to support its dividend. As I mentioned above, I already think that the company’s dividend is at risk if the healthcare business is spun off, a transaction I do not believe will increase the overall valuation.

Conclusion

I view 3M as an unexciting cyclical industrial company with potentially two different massive liabilities. The company is certainly trying to create value via the proposed healthcare spinoff and fighting the lawsuits. It is certainly possible that the company will achieve more benign legal results than I fear. I just see too many similarities with the opioid companies such as Endo (OTCPK:ENDPQ). In many ways, 3M’s liabilities are significantly larger and broader-based and will be compelled by the EPA even without lawsuits. Therefore, I see bankruptcy as the only way out for 3M.

There is another company with similar liabilities that I have written up for my Investment Group subscribers, which leads me to…

Launching Catalyst Hedge Investing!

My new investment group, Catalyst Hedge Investing, launches Thursday, April 27. Most of my best ideas will remain private for my subscribers as will live portfolio of longs and shorts, an active chat board and direct access to me. There are generous introductory prices for early subscribers that will continue for the life of your subscription. I hope to see you as a subscriber and thank you for following my work.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.