Summary:

- 3M Company is experiencing increased competition, and a deteriorating ability to maintain pricing power.

- While 3M Company earnings have steadily marched higher, share price has moved in the opposite direction.

- 3M shares appear to be sitting marginally below their fair estimated value.

- This article focuses on the fundamentals, the real value versus the current share price, and whether 3M is currently worth investing in.

jetcityimage

In recent weeks, 3M Company (NYSE:MMM) announced it was cutting 2,500 manufacturing jobs as the company braces for slowing demand. The company is expecting sales to decline by as much as 15% in the first quarter of 2023 when compared to a year ago.

3M faces new lawsuits related to contamination from the manufacturing of so-called forever chemicals. The Illinois Attorney General announced he is seeking money to compensate the state for continued expenses related to contamination discovered around a 3M plant. Perfluoroalkyl and polyfluoroalkyl substances, known as PFAS, have been found in 100 drinking water systems throughout Illinois.

And one of the company’s largest shareholders is publicly calling for the ousting of 3M’s CEO if better results aren’t achieved immediately. 3M’s eighth-largest shareholder, Bert Flossbach, said falling returns and increased pressure from competitors are causes for concern for the future financial health of the company.

When considering these current stories about 3M, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. The downturn in the economy that led to layoffs may be short-lived. Conversely, the threat from the growing number of lawsuits related to 3M’s products could be a drag on earnings for years to come.

While current news stories, good or bad can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if MMM is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. 3M Company has high scores for 10-Year Price Per Share, ROE, Earnings per share, Ability to Recover from a Market Crash or Downturn, ROIC, and Gross Margin Percent. It has a low score for PEG Ratio. A low PEG Ratio score indicates that the company may not be experiencing high growth consistently over the past 5 years. In summary, these findings show us that MMM seems to have above-average fundamentals since most categories produce good scores.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

Fundamentals

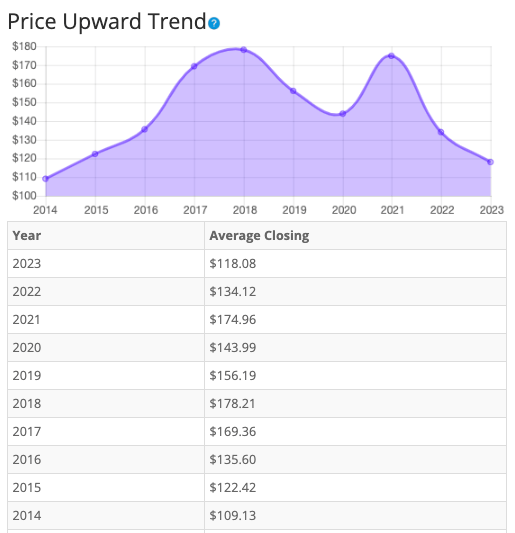

Let’s examine the price per share history first. In the chart below, we can see that price per share has been mostly declining after reaching a peak in 2018. From 2019 to 2023, share price has fallen in four of the last five years. Share prices currently sit below their price back in 2015. Overall, share price average has grown by about 8.20% over the past 10 years or a Compound Annual Growth Rate of 0.88%. This is a very poor return for this time period.

3M is a true industrial conglomerate operating segments in transportation, healthcare, electronics, and industrials. It also produces consumer-facing products like Post-it Notes and air filters. Analysts note the company has “no significant concentration in any one product or customer.” And, while its product offerings are diverse, they are not often unique. 3M faces competition from multiple companies for products that can easily be replicated. This poses three unique challenges to 3M and explains the growing pressure on share price: managing product price, growing market share via acquisitions, and growing product offerings through costly research and development.

In its product areas with lots of competition, it is extremely challenging to control pricing. And in the current inflationary environment, costs to make products are increasing, but 3M is not able to pass along the entire costs to consumers as alternate and cheaper versions from competitors abound. This is eroding profit margins.

3M moved to gain a larger market share in healthcare with the acquisition of wound-care company Acelity. While the merger boosted revenue, it also came with $3 billion dollars in additional debt.

Lastly, as the company searches for new product lines or improvement in current offerings, its costly spending on research and development continues to grow. In 2020, 3M spent 6% of its revenue on R&D. While the costs are real, promised revenue from the research does not always materialize.

BTMA Stock Analyzer

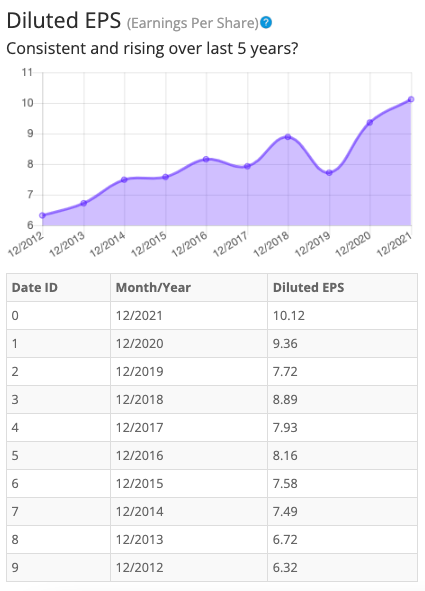

Earnings

Looking closer at earnings history, we see that earnings have almost always grown over the past 10 years. Earnings dipped only twice in the period, with strong rebounds after those dips in 2017 and 2019.

Consistent earnings make it easier to accurately estimate the future growth and value of the company. So, in this regard, MMM is a good example of a stock where you may accurately estimate future growth or current value.

BTMA Stock Analyzer

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

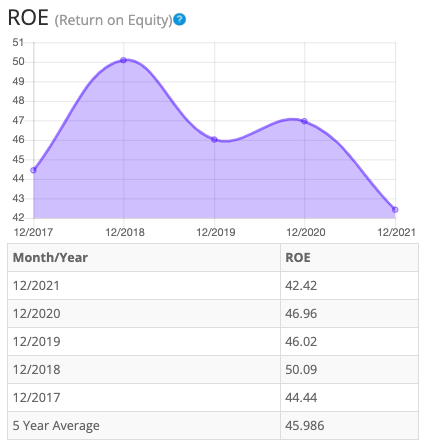

Return on Equity

The return on equity has fluctuated, with a large increase in 2018 before falling in 2019 and 2021. ROE has slightly decreased over the past 5 years. It is worth noting that even with the declines, ROE is at high levels. Average ROE is above expectations at around 45.98% between 2017 and 2021. For return on equity (ROE), I look for a 5-year average of 16% or more. So, MMM easily meets my requirements.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 23 so-called “diversified” companies or conglomerates is 0.82%.

Therefore, MMM’s 5-year average of 45.98% and current ROE of 42.42% is well above-average.

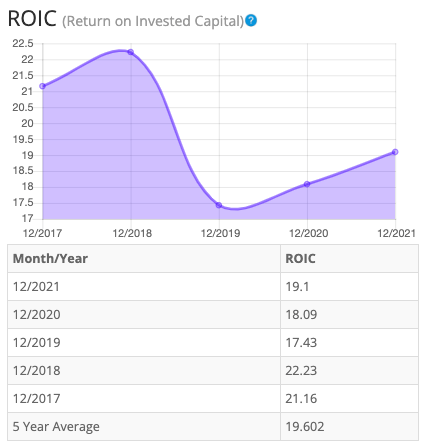

Return on Invested Capital

The return on invested capital has been inconsistent from 2017 to 2021. ROIC grew in 2018 before falling sharply in 2019. ROIC grew again in 2020 and 2021 but never rebounded to the 2018 levels. 5-year average ROIC is above expectations at around 19.6%. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, MMM exceeds the levels required to pass this test.

BTMA Stock Analyzer

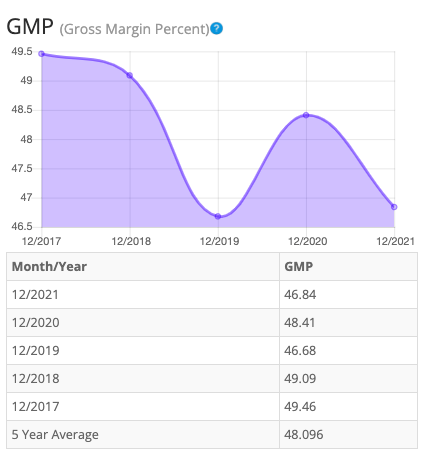

Gross Margin Percent

The gross margin percent ((GMP)) has mostly decreased over the last five years. GMP fell in 2018 and 2019, but then increased in 2020 before dropping sharply again in 2021. Even at its lowest point in 2019, gross margin percent was at strong levels. Five-year GMP is good at around 48.10%. I typically look for companies with gross margin percent consistently above 30%. So, MMM has proven that it has the ability to maintain acceptable margins over a long period.

BTMA Stock Analyzer

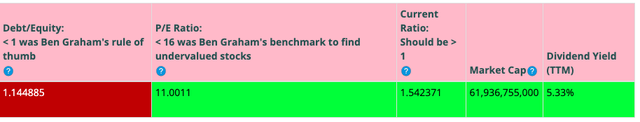

Looking at other fundamentals involving the 3M Company balance sheet, we can see that the debt-to-equity is greater than 1. This is not ideal, because it tells us that the company owes more than it owns.

MMM’s Current Ratio of 1.54 is satisfactory, indicating it has an adequate ability to use its assets to pay its short-term debt.

Ideally, we’d want to see a Current Ratio of more than 1, so MMM exceeds this amount.

According to the balance sheet, 3M Company appears to be in so-so financial health. In the long term, the company has been paying down debt, but carries more debt than equity. In the short term the company is generating lots of cash, but cash flow has decreased from 2016 to 2022.

MMM currently pays a 5.31% dividend, and a 5.33% dividend yield over the past 12 months.

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 11.01 indicates that MMM is selling at a low price when comparing MMM’s P/E Ratio to a long-term market average P/E Ratio of 15.

The 10-year and 5-year average P/E Ratio of MMM has typically been 19.8 and 19.07, respectively. This indicates that MMM could be currently trading at a low price when compared to its average historical P/E Ratio range.

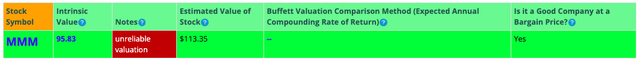

The Estimated Value of the Stock is $113.35, versus the current stock price of $112.99. This indicates that MMM is currently selling near its fair value price.

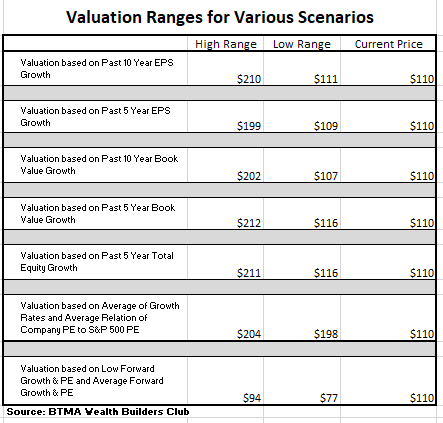

For more detailed valuation purposes, I will be using a diluted EPS of 10.18. I’ve used various past averages of growth rates and P/E Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

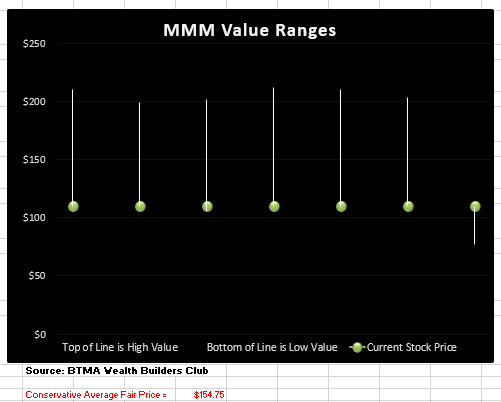

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

According to this valuation analysis, 3M Company is undervalued according to 6 out of 7 valuation methods used.

This analysis shows an average valuation of around $154 per share versus its current price of about $110, this would indicate that MMM stock is undervalued.

Summarizing the Fundamentals

According to the facts, 3M Company needs to improve its financial health in the long-term sense by growing equity as compared to its debt. In the short term, the current ratio indicates that 3M Company has more than enough cash to cover current liabilities. However, declining cash from operations merits questioning how much longer operations can keep up with the company’s debt load.

3M Company has an impressive earnings record, which shows overall earnings improvement over a 10-year period.

Other fundamentals are at strong levels, despite fluctuations, including Gross Margins and Return on Equity. ROIC is at acceptable levels.

In terms of valuation, my analysis shows that MMM stock is undervalued from a P/E ratio analysis, and is also undervalued according to 6 out of 7 valuation methods used in the table above.

The BTMA Stock Analyzer has the stock slightly undervalued, with an estimated value of around $113.

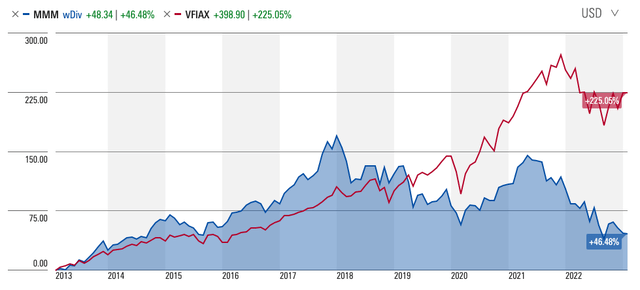

3M Company Vs. The S&P 500

Now, let’s see how MMM compares versus the U.S. stock market benchmark S&P 500 (SP500) over the past 10 years. From the chart below using Vanguard 500 Index Fund Inst (VFIAX) as a proxy for the market, we can see that 3M Company is underperforming when compared to the general market. MMM had slightly outshined the S&P 500 through 2019, but has since fallen short by a high margin. That performance gap widened through 2021, 2022, and into 2023.

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to shrink earnings at an average annual rate of -0.23%.

In addition, the average one-year price target for this stock is at $122.86, which is about an 8.73% increase in a year.

If you invest today, with analysts’ forecasts, you might expect about 8% return per year.

Here is an alternative scenario based on MMM’s past earnings growth. During the past 10 and 5-year periods, the average EPS growth rate was about 4.2% and 2.75%, respectively.

But when considering cash flow growth over the past 10 and 5 years, the average growth has been -0.57% and -4.6%, respectively. Therefore, when considering all of these return possibilities, our average annual return could likely be around 2%-5%.

As a comparison, the S&P 500’s average return from 1928 – 2014 is about 10%. So, in a typical scenario with MMM, you could expect to earn a lower long-term return as compared with an S&P 500 index fund. The individual 3M Company stock also doesn’t offer the diversification that the index fund does.

Does 3M Pass My Checklist?

- Company Rating 70+ out of 100? YES (84.6)

- Share Price Compound Annual Growth Rate > 12%?NO (0.88%)

- Earnings history mostly increasing? YES

- ROE (5-year average 16% or greater)? YES (45.99%)

- ROIC (5-year average 16% or greater)? YES (19.6%)

- Gross Margin % (5-year average > 30%)? YES (48.10%)

- Debt-to-Equity (less than 1)? NO

- Current Ratio (greater than 1)? YES

- Outperformed S&P 500 during most of the past 10 years? NO

- Do I think this company will continue to successfully sell their same main product/service for the next 10 years? YES.

3M scored 7/10 or 70%. Therefore, 3M Company may be worth considering as a potential investment.

Is 3M Currently Selling at a Bargain Price?

- Price Earnings less than 16? YES (11.01)

- Estimated Value greater than Current Stock Price? YES (Value $113.35 > $110 Stock Price).

Valuation metrics suggest that 3M Company is selling at a price that’s less than its value.

While many of the fundamentals appear to be telling a winning story, 3M Company stock’s share price hasn’t been following the same trend. If you consider the abysmal return over the past 10 years and the fact that the stock is trading just below its estimated value, there doesn’t look like there’s enough room for the growth and gain potential that I’d like to see.

Additionally, concerns about increased competition, an inability to increase pricing due to competition, decreasing cash flow from operations, and high debt show there could be more long-term risk ahead for 3M Company with little promise of high returns.

3M Company is certainly a consistent long-term performer with good fundamentals. I often choose their products over the competition because of my confidence in their product quality. I would certainly consider investing in 3M Company in the future, if it improves its issues with debt-to-equity, cash flow, and growth potential. But until that happens, I’m passing on 3M Company.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you want to find good companies at bargain prices that will provide you with long-term returns and dividends in any investing climate, then my Seeking Alpha Marketplace service (Good Stocks@Bargain Prices) is a good match for you.