Summary:

- The news of 3M Company’s settlement with public water suppliers was quite positive – on the surface.

- Investors need to keep in mind that this settlement only covers part of the PFAS litigation disaster. Product-related liability claims and foreign claims are not included.

- The front-loaded payment profile of the current settlement, as well as more than $9 billion in debt coming due by 2027 are weighing on MMM’s financial position.

- Unless 3M Company significantly improves its operations over the next few years and a recession is avoided, the dividend looks unsustainable.

- Avoid 3M Stock.

Zolnierek

Introduction

On June 23, 2023, investors in troubled industrial conglomerate 3M Company (NYSE:MMM) breathed a sigh of relief when the company announced an agreement to provide funding for public water suppliers of up to $10.3 billion for PFAS (per- and polyfluoroalkyl substances, “forever” chemicals) treatment technologies and testing over a period of 13 years. However, what reads as if the dreaded PFAS litigation has now been settled once and for all should not be over interpreted.

In my article published shortly after the “tentative settlement of at least $10 billion” was announced, I outlined the main reasons – beyond litigation – for my decision to sell my position in 3M. In this update, I explain why I have not become more optimistic despite the recent “good news” about a broad class resolution. I also examine the safety of the 3M dividend (current yield around 6%) using a model calculation that takes into account payments related to litigation and refinancing of upcoming maturities.

Why The Broad Class Resolution Is No Cause For Excitement

Initially, investors reacted quite positively to the news that 3M has agreed to pay up to $10.3 billion related to PFAS-related claims. However, after closer inspection, I don’t quite share the market’s optimism – let me explain.

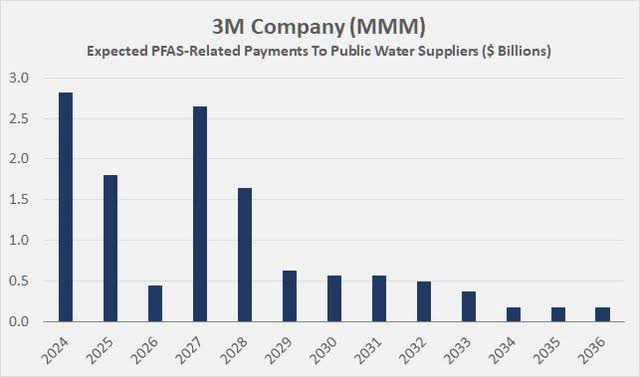

First, investors shouldn’t simply take the $10.3 billion charge 3M will record in the second quarter of 2023 at face value and divide it by 13 years. The company refers to the charge as “present value,” meaning the amount was discounted at a specific rate. On an undiscounted basis, 3M has agreed to pay up to $12.5 billion between 2024 and 2036. In the best-case scenario, the broad class resolution amounts to only $10.5 billion, as 3M is expected to enter into a separate settlement agreement with the cities of Stuart, Florida, and Rome, Georgia (p. 4 f., 3M press release). To be conservative, I assume a cost of $12.5 billion, and it’s also important to note that the payments are heavily front-loaded. The payment schedule is expected to be as follows:

Figure 1: 3M Company (MMM): Expected PFAS-related payments to public water suppliers (Own work, based on data found in www.sec.gov)

Given the significant upcoming debt maturities ($6.7 billion through 2025), the front-loaded payments put great pressure on 3M’s financial position. In theory, the company needs to raise $11.3 billion between 2023 and 2025 to cover both upcoming maturities and expected PFAS-related payments. Since 3M’s debt repayment capacity is currently rather low, the company will most likely need to refinance most, if not all, of the upcoming maturities and may need to raise additional debt to fund the PFAS-related payments – more on this later.

Second, it’s important to remember that the settlement only addresses claims by public water suppliers in the United States. It does not include other plaintiffs, such as individuals seeking compensation for health damages. With widespread media coverage of PFAS lawsuits, the door is now wide open for individuals seeking compensation for PFAS-related health problems. Remember, PFASs – largely due to their widespread use over long periods of time – are detectable in the blood of about 98% of the U.S. population. Of course, a measurable serum concentration does not necessarily mean adverse health effects, but there is a growing body of research linking PFAS serum or drinking water concentrations to specific health problems.

The Centers for Disease Control and Prevention stated that “PFAS may affect reproduction, thyroid function, the immune system, and injure the liver.” There also are a few studies linking PFAS to various forms of cancer (e.g., prostate cancer, breast cancer). This 2022 review article concludes that the “cancer sites with the most evidence of an association with PFAS are testicular and kidney cancer.”

All in all, I would argue that it will be difficult to prove a causal link between PFAS and certain types of disease or the development of certain types of cancer, but that does not mean that litigation will be unsuccessful. I remain extremely cautious about PFAS-related liabilities, in part because of 3M’s limited financial flexibility.

Third and finally, PFAS contamination of drinking water outside the U.S. also is not covered by the settlement. 3M Company also faces pressure from the European Union and Belgium in particular. The company’s Zwijndrecht plant produced perfluorooctanesulfonic acid (PFOS) until 2002, and residents have been found to have serum PFOS concentrations apparently as high as those commonly found in industrial wastewater, and have been diagnosed with thyroid malfunction. 3M also is facing criminal charges for illegal waste disposal in the area. Due in part to ongoing contamination (lack of proper filtration systems), 3M was ordered to temporarily close the plant, but was allowed to partially resume production shortly thereafter.

The associated compensation and clean-up costs cannot be estimated with sufficient accuracy, but are also likely to run into the billions. Finally, 3M’s internal legal costs should not be forgotten. I do not think it is unreasonable to expect the PFAS litigation to cost the company more than $20 billion.

Following The Settlement, Is The Dividend In Danger?

3M is a dividend aristocrat with a 64-year track record, so it’s hard to imagine a dividend cut. However, I always find the fact that a company has a decades-long track record quite tenuous in the context of defending dividend safety – especially given the large payments ahead. What matters are the fundamentals, so let’s look at those.

Over the past three years, 3M generated annual free cash flow (normalized for working capital movements and adjusted for stock-based compensation) of $5.6 billion.

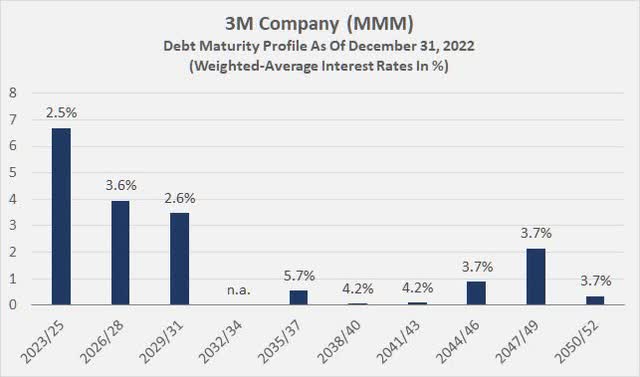

An examination of 3M’s debt profile (p. 75, 2022 10-K, Figure 2) shows that the company currently pays about $560 million in interest on its debt. Adding these costs to free cash flow does not take into account a beneficial tax shield effect, but I believe it’s a fairly accurate proxy for the company’s debt service costs. Leaving aside the tax shield effect of interest expense, the result is a small margin of safety, or hidden reserve, if you will.

Figure 2: 3M Company (MMM): Debt maturity profile as of December 31, 2022 (Own work, based on data found in www.sec.gov)

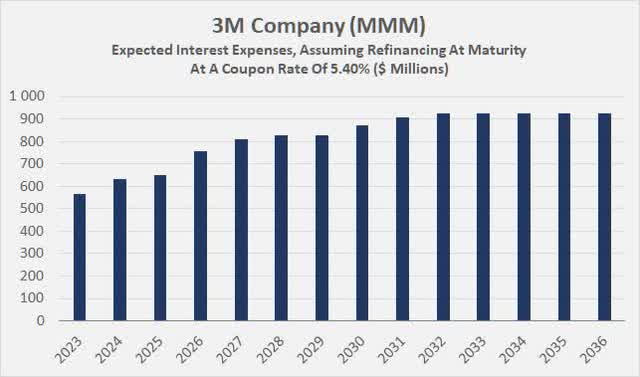

Since the maturities of 3M’s upcoming debt are known, it’s easy to model the impact of refinancing the debt. 3M’s longer-term bonds currently have a yield-to-maturity of about 5.4%, which is a reasonable estimate of the company’s current refinancing costs. For simplicity, I assume that interest rates (and 3M’s credit rating, currently A1 with negative outlook) will remain stable in the coming years. In this way, and assuming that 3M refinances all bonds at maturity, the following annual interest expense can be expected:

Figure 3: 3M Company (MMM): Expected interest expenses (Own work, based on own calculations and data found in www.sec.gov)

The curve flattens out from 2031 onwards due to insignificant maturities in the later years (see Figure 2). I acknowledge that it’s a conservative assumption that 3M will need to refinance all upcoming maturities. However, given expected litigation costs, there will likely be little or no excess free cash flow left to use to repay bonds at maturity. Recall that 3M’s payout ratio was approximately 80% of free cash flow for 2022, or 60% of average free cash flow for 2022 to 2022.

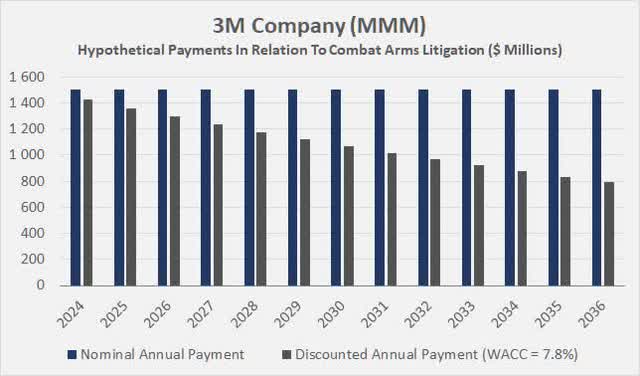

PFAS-related liabilities to U.S. public water suppliers can be directly included in the model according to the payment profile in Figure 1. To remain conservative, I added recurring annual legal costs of $200 million to the equation, growing at 3% per year to account for inflation. Finally, assuming Morningstar is correct about the expected $4 billion charge (most likely present value estimate) associated with the Combat Arms litigation, and using a weighted-average cost of capital of 7.8% as the discount rate, 3M could have to make annual payments of $425 million by 2036 to settle the claims:

Figure 4: 3M Company (MMM): Hypothetical payments in relation to Combat Arms litigation (Own work, based on own calculations and Combat Arms litigation estimate from Morningstar)

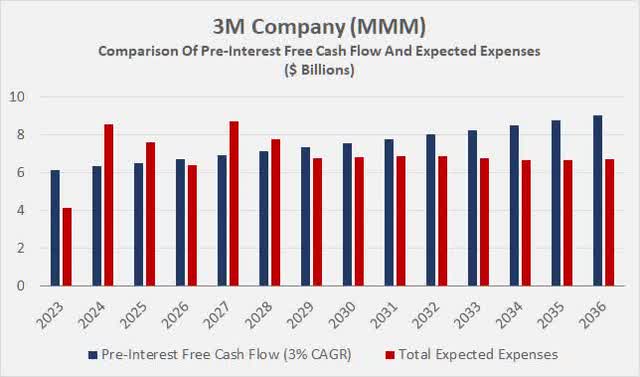

Adding up all of these more or less precisely determinable expenses and relating them to pre-interest free cash flow, 3M’s dividend looks safe (Figure 5). Even though there will be years when total expenses are likely to be higher than pre-interest free cash flow, on a cumulative basis the expenses are more than covered. In addition, it should not be forgotten that 3M has announced restructuring plans that should result in pre-tax savings of $700 million to $900 million. On the other hand, one could argue that expecting organic free cash flow growth of 3% p.a. is a bit aggressive. But even assuming that 3M’s free cash flow is treading water over the next decade, expenses are still (barely) covered.

While this may sound like good news on the surface, it’s important to remember that litigation related to PFAS that does not involve public water suppliers is not included in this model. Including an additional $10 billion (present value) in costs, bringing PFAS litigation costs to a total of approximately $20 billion, a dividend cut should be expected assuming that 3M does not incur significant additional debt ($3 billion to $5 billion) to avoid liquidity gaps over the next five years.

Figure 5: 3M Company (MMM): Comparison of pre-interest free cash flow and expenses (Own work, based on own calculations and estimates, and the company’s 2020 to 2022 10-Ks)

Summary and Conclusion

Investors initially reacted positively to 3M’s settlement with public water suppliers – lower uncertainty is, as so often, good for a stock. However, upon closer look, the significantly front-loaded payment profile and the fact that the payment will be more than $2 billion higher in absolute terms were quite disappointing to see. Similarly, it’s important to understand that foreign claims are not covered by the agreement, nor are claims related to product liability. All told, the PFAS litigation could cost 3M well over $20 billion.

Taking into account 3M’s maturity profile, which is characterized by significant near-term maturities, PFAS litigation payments of more than $7 billion through 2027 are a significant drag on the company’s financial position. However, even if interest rates remain at current levels and 3M refinances all upcoming maturities at a coupon of 5.40%, the company will still be able to cover its interest and litigation expenses, as well as its dividend, from free cash flow. Of course, this assumes that 3M’s operating performance improves significantly in the coming years and that a recession can be avoided.

Factoring in $4 billion in present-value Combat Arms litigation expenses spread over 13 years and another $10 billion in PFAS litigation, the dividend becomes unsustainable. Also due to the suboptimal economic climate, I don’t think that a dividend cut by a low double-digit percentage is unrealistic. A modest dividend cut and suspension of share repurchases would likely also have a positive signaling effect on rating agencies such as Moody’s, which recently changed the outlook on 3M’s credit rating to negative. Finally, at the risk of possibly reading in tea leaves, let me end this article with a quote from yesterday’s press release – a dividend is not a contractual commitment or obligation:

The strength and stability of 3M’s business model and strong free cash flow capability, together with proven capital markets access, provide financial flexibility to deploy capital to meet its cash flow needs under this agreement and other contractual commitments and obligations.

– 3M press release, June 22, 2023 (emphasis added by the author)

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any form of investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.