Summary:

- MMM experienced a significant 22.99% increase in shares after strong earnings and positive outlook.

- Despite past challenges, MMM has a strong balance sheet, with ample cash to meet obligations and potential for future growth.

- MMM is undervalued compared to competitors like Honeywell, offering potential for further value unlocking and growth.

josefkubes

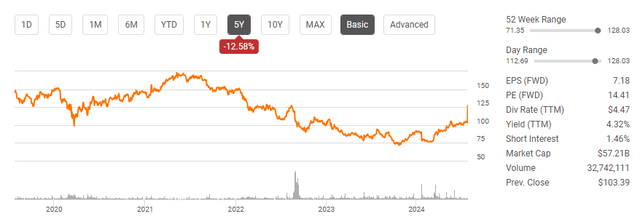

While there is still some work left to do, today was a win for 3M Company (NYSE:MMM) and its shareholders. MMM experienced a long retracement as shares declined from around $170 in May of 2021 to the low $70s in October of 2023. Some shareholders weren’t excited about MMM spinning off its healthcare business, which formed Solventum Corporation (SLOV) in the fall of 2024, and the resetting of the quarterly dividend from $1.26 to $0.70. Shareholders that stuck with MMM experienced MMM’s best day ever as shares finished up 22.99% on strong earnings and an outlook that set the stage for a positive future. Technology has been front and center for so long that not much attention has been paid to old-world companies. MMM just delivered an impressive quarter, blowing out expectations as they beat non-GAAP EPS expectations by $0.25 in Q2, coming in with $1.92 per share. While I am still very bullish on many technology companies, I am excited about the conglomerates of yesterday that have been overlooked for far too long. I don’t believe today was an overreaction, and MMM’s earnings could make investors get excited about companies in the broad market outside of technology. When I look at the numbers, MMM still looks undervalued on a forward-looking basis, and the rally could just be getting started as we enter a lower-rate environment.

Seeking Alpha

Following up on my previous article about 3M Company

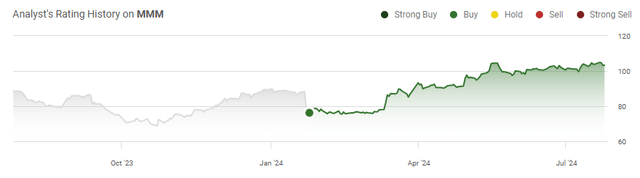

Settlements for earplugs and PFAS pollution cost MMM $15.8 billion, and shares plummeted in January, falling from $90.31 on January 22nd to $80.35 on January 23rd. I wrote an article on January 24th (can be read here) indicating that I felt the market was overreacting to their Q4 2023 earnings and the settlement news. Since then, shares of MMM have lapped the market, returning 62.18%, while the S&P 500 increased by 11.71%. After the dividend is factored in, MMM’s total return over this period has been 66.02%, and while shares of MMM are still lower today than they were back in 2021, there is a lot to be excited about. I think the bad news is in the past, and investors should look toward the future as MMM is still a strong company, and they just gave the market a real reason to get excited. I am following up with a new article to discuss why I am excited after the rebound and think shares of MMM can go higher as the year progresses.

Seeking Alpha

Risks to investing in MMM

There is a lot to be excited about, but there are still risks to the investment case for MMM. There is a history of litigation and settlements that have cost MMM billons, and at any point, they could get hit with a new lawsuit that could add additional payouts after a $10.3 billion settlement was reached for Forever Chemicals and a $5.5 billion settlement to resolve defective combat earplugs. In addition to the potential of new lawsuits, MMM faces increased competition, and the possibility of a weakening economy that could impact earnings. There is instability on the geopolitical stage, and at any point, supply chains could be impacted, and margins could erode if the cost of goods increases. MMM is also not in an exciting sector, and if big tech comes in strong next week, the enthusiasm shareholders experienced today could shift back to technology as the AI story could intensify. While one-time items impacted the previous guidance at the beginning of the year, MMM isn’t out of the weeds just yet. Their going to need a few more good quarters to convince some investors that the turnaround is real, and any type of bad news could make investors look for other opportunities, as MMM could become too much of a liability for their portfolios.

3M Company just gave the market a reason to believe in them again

Sometimes, it really is the darkest before the dawn, and MMM experienced some tough times getting to this point. Lawsuits and settlements costing them billions, a reduced dividend, and softer investor confidence drove shares of MMM to their lowest point in a decade, but it looks like MMM is turning the page to a new chapter. MMM generated $6.26 billion in revenue, which was down -0.5% YoY on an adjusted basis for the spinoff of the healthcare business, but profitability was the story to dig into. MMM’s gross profit increased by 5% from $2.56 billion to $2.68 billion and they picked up 2.2% on their gross profit margin as it came in at 42.9%. MMM’s cost of goods declined by -$157 million (-4.21%), and they posted $1.27 billion in operating income. After taxes, MMM generated $1.15 billion in net income, which is a 18.31% profit margin. MMM’s operating margins expanded by 440 bps in Q2, and they generated $1.2 billion in free cash flow (FCF). On a forward-looking basis, if they can maintain these levels, MMM would have a $4.8 billion FCF run-rate. This places their price to FCF multiple at 11.92x, which is very inexpensive as their market cap is $57.21 billion.

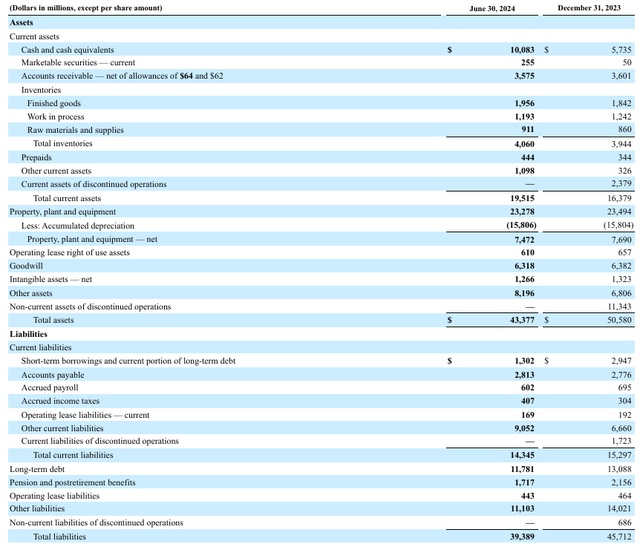

Despite the impacts from settlements, MMM has a strong balance sheet, and when I look at the FCF, I get excited about its future potential. MMM has $10.08 billion in cash on hand, with an additional $255 million in marketable securities. There is only $11.78 billion in long-term debt on the balance sheet which is the carrying value as the fair value is $10.37 billion. This is down from the close of 2023, as the carrying value was $13.09 billion while the fair value was $11.86 billion. MMM only has $53 million remaining for its 2024 debt obligations, with $1.87 billion owed in 2025 and $1.54 billion in 2026. More than half of MMM’s debt is due post 2029, and MMM’s cash pile allows them to focus on their operating business because they can meet all of the obligations over the next 5-years without touching their FCF. While the settlements were a difficult situation for MMM, the balance sheet is strong and places MMM in a position of strength. The Forever Chemical settlement will cost MMM $10.3 billion over a 13-year period which is $792.31 million per year, while the earplug settlement will be paid out over 5-years at roughly $1.1 billion per year. There is $1.89 billion in annualized settlement payments, which drops down to $792 million after 5-years, and the combination of MMM’s cash position and FCF allows them to meet their debt and settlement obligations while still paying the dividend and investing in their future.

3M

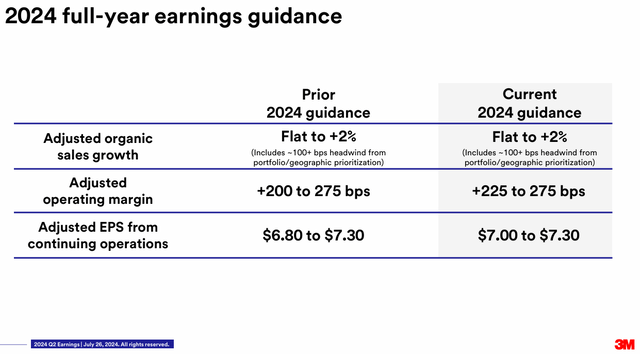

The big story was MMM’s guidance as they increased the bottom end of the range. MMM had previously guided for $6.80 to $7.30 for 2024, which increase to $7 to $7.30. This may not impress some investors because the top end didn’t grow, but I am looking at worst-case scenarios and margins. MMM is now expected to earn at least $7 per share, which places puts them trading at less than 20 times earnings, and their margins on the bottom line increased by 25 bps. As MMM invests in its operations and grows revenue, they could be in a position to expand margins further and increase their future earnings capabilities. While the news cycle didn’t paint the best picture, MMM is back in the driver’s seat as its financials are strong and profitability is improving.

3M Q2 Presentation

There is still value to be unlocked for shareholders

In Q2, MMM returned $786 million to shareholders in the form of dividends and share repurchases. MMM repurchased $400 million worth of their shares in Q2, and the remaining $386 million was used to support the dividend. Looking out to 2025, MMM has $1.87 in debt maturing, and $1.1 billion in settlement payments. If they maintain their current repurchase and dividend level, their outlay will be $3.76 billion, which is 78.25% of their annualized FCF if MMM maintains a $1.2 billion FCF quarterly run rate. There is more than enough room for share repurchases to continue and for MMM to return to dividend growth after resetting the dividend from the healthcare spinoff.

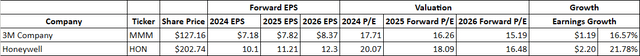

When I look at the earnings estimates for MMM compared to Honeywell (HON) I get more bullish about the future after going through MMM’s future obligations. MMM is trading at 17.71 times 2024 earnings, with 16.57% earnings growth on the horizon over the next 2 years. MMM is expected to generate $8.37 of EPS in 2026, which will place it at a 15.19 P/E for 2026. HON has a bit more growth, but trades at 20.07 times 2024 earnings and 16.48 times 2026 earnings. I think there is still value to be unlocked and that MMM is undervalued today.

Steven Fiorillo, Seeking Alpha

Conclusion

After going through the earnings report and breaking out the future expenses, I am bullish on MMM and believe the 22.99% jump is warranted. MMM has a strong balance sheet with a cash stockpile that negates its debt obligations past 2029. MMM generates $1.2 billion in quarterly FCF, which allows it to meet its settlement obligations, debt maturities, dividend commitments, and repurchases. Investors are getting MMM at earnings that are less than 18 times 2024, and it comes with a dividend that yields 3.52%. I think this was the quarter that broke the negative stigma on MMM shares, and shareholders could experience more upside potential as 2024 progresses.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.