Summary:

- Shares of 3M Company fell over 11% in a bloodbath, reaching the lowest level in over a decade.

- The company has been a destroyer of capital for long-term shareholders, down over 25% in the past decade.

- Despite the challenges, I believe there is long-term value waiting to be unlocked for patient investors.

PM Images

The last two days have been an absolute bloodbath for shares of 3M Company (NYSE:MMM) as they fell through the $100 level and finished down 11.03% on Tuesday. It had looked as if shares had finally bottomed in October as MMM started to recover after reaching $85.35, which was the lowest level in more than a decade. Shares of MMM have been a destroyer of capital for long-term shareholders as they have been down more than -25% over the past decade, and have fallen more than -60% since reaching around $260 per share at the beginning of 2018. Despite a growing dividend, continued settlements for earplugs and PFAS pollution are costing the company $15.8 billion. Despite being a Dividend King, MMM hasn’t been as compelling as it once was, and the last few days have been rough for shareholders. After reading through the earnings report and the commentary by senior leadership on the conference call, I think the double-digit slide is an overreaction. I could be 100% incorrect, and shares could continue to test the 52-week lows, but after going through the numbers, I think there is long-term value waiting to be unlocked for patient investors. I ended up with dollar cost averaging into weakness on Tuesday, and if shares end up in the $80s, I will make another purchase as long as a dividend cut doesn’t get sprung on us.

Following up on my previous article about 3M Company

Well, this article and prediction didn’t age well. On December 14, 2021, I wrote an article on MMM (can be read here), and since then, shares have declined by -45.02% compared to the S&P 500 appreciating by 4.66%. While the market has been relatively flat since reaching its previous highs in 2021, MMM has destroyed shareholder value. The large dividend hasn’t even been enough to offset the losses, as when the dividends are factored in, the total return for MMM is -39.22% over this period. At the time, shares of MMM were trading at $174.85, and I felt it was a value play. It ended up being a value trap, and the latest litigation didn’t help. As shares declined by just over 11% on Tuesday, I took this as an opportunity to execute some dollar cost averaging into my position. It could take some time, and maybe things won’t play out how I think they will, but I think MMM is an opportunity under $100.

Things haven’t been going well for MMM and there are risks to my investment thesis

I’ve been wrong, as shares of MMM continued to decline since I became a shareholder. I made the decision to purchase shares based on my long-term thesis, not what would occur in a month or a year. Investing in individual equities isn’t for everyone, and things don’t always go as planned. I have time and capital on my side as I can sit back and wait for my investment thesis to potentially unfold while collecting and reinvesting the dividends along the way, and adding to my position when opportunities present themselves.

Litigation is front and center, and while MMM is working to move past the military earplug settlement, it’s just opening old wounds. MMM had faced lawsuits over PFAS, which were forever chemicals, for which they reached a $10.3 billion settlement. In June of 2023, details were released and outlined that MMM committed to $10.3 billion over a 13-year period. At the end of August 2023, MMM agreed to a $5.5 billion settlement to resolve over 300,000 lawsuits claiming the company sold defective combat earplugs to the US military. MMM is expected to pay this out over a 5-year period. Assuming that payments start in the 2024 calendar year, MMM would be paying $1.89 billion on an annual basis over the next 5-years toward these settlements. Once the earplug settlement is finished in 2029, their payments would drop to $792 million annually over the next eight years to close out the forever chemical settlement.

In addition to the cash flow going out the door, macroeconomic challenges have impacted supply chains and margins, while the market doesn’t seem convinced there are adequate future growth drivers. The market sold the news as the street was looking for $9.82 of EPS in 2024, while MMM provided an EPS guidance range of $9.35-$9.75. MMM’s guidance was impacted by one-time items, but the street didn’t seem to care.

There are many risks to my investment thesis, and while I am bullish, MMM could continue lower. Litigation is taking a chunk out of MMM’s profitability, and instead of using that money to fuel organic growth or make acquisitions, it’s paying off liabilities. We have no idea if future litigation will occur with MMM either. MMM isn’t grabbing the right kind of headlines, and the combination of long-term capital destruction, litigation, slower growth, and lower-than-expected earnings guidance could cause investors to cut their losses and look elsewhere for yield or capital appreciation.

I think the selloff is overdone, but it could take a while for things to play out

I will admit that I may be looking too much into the numbers. Investor sentiment is poor, and the street is down on MMM’s guidance. The difference for me is numbers tell an irrefutable story, and things may not be as bad as what is being projected for MMM. When you invest in a company, you’re paying the current market price for an equity stake in a company. Your shares represent a portion of all the future revenue and cash flow the company will produce in the future. Other factors, such as investor sentiment and future growth prospects, go into a company’s share price, but for now, I am focused on two things. Can MMM continue to pay the dividend, and will they have room left over in their earnings to pay the agreed settlements after the dividends are paid?

As an investor, I know that there is a low percentage chance of MMM grabbing electrifying headlines the way companies are riding the artificial intelligence wave. This is why I need to be confident in the current numbers, rather than growth several years down the line. For me, a big piece of the investment is the dividend, and on today’s conference call, there was no talk about reducing the dividend payment. Management touted that their strong cash flow allowed MMM to reduce its net debt by $2 billion and return $3.3 billion to shareholders through the dividend. Some will argue that MMM should eliminate the dividend altogether and utilize the $3.3 billion to pay for the settlements while buying back shares with the remaining capital. I would rather receive the dividend and reinvest the payments back into MMM, so I need to see if it’s sustainable.

I have already determined that between the Forever Chemical and Earplug settlements, MMM will need to pay roughly $1.89 billion to settlements annually over the next five years, which will get reduced to $792 million annually for the remaining eight years on the Forever Chemical settlement. MMM has 553.9 million shares outstanding. On the low end of their guidance, MMM would produce $5.18 billion (553,900,000 * $9.35) in earnings in 2024, and on the high end, they would produce $5.4 billion (553,900,000 * $9.75). The $6 dividend per share eats up $3.32 billion (553,900,000 * $6) of MMM’s earnings on an annual basis. MMM would have between $1.86 billion and $2.08 billion left in retained earnings based on their 2024 guidance after all dividends are paid. MMM also finished 2023 with $5.93 billion in cash, so there is more than enough room for the dividend to be paid while making the payments on the settlements as long as their EPS falls somewhere within their guided range.

I am paying for all of the future revenue and earnings MMM will produce when purchasing shares today. There are 15 analysts that were guiding for $9.79 of EPS in 2024 and 12 analysts guiding for $10.56 in 2025. If I use $9.55 of EPS for 2024 since that’s the midpoint of MMM’s guidance, I am paying 10.06x 2024 earnings for MMM. If I lower the guidance for 2025 to $10 even, I am paying 9.61x 2025 earnings. Even though the analyst community was looking for around $9.82 before the earnings report, MMM is still producing over $5 billion in earnings annually, which should allow enough room to cover the dividend and the settlement payments.

Can MMM still increase the dividend in Q1 2024?

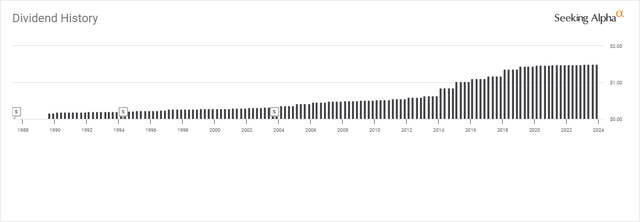

At this point, the fact that MMM is a Dividend King could be the most compelling reason to have an investment in them, given the current circumstances. Management didn’t discuss a dividend cut on the earnings call, so I would have to assume they are either going to keep the dividend the same or raise the dividend. Over the past several years, MMM has only increased the dividend by $0.04 annually or $0.01 per quarter. I don’t think management is interested in losing their Dividend King status and feel that this will be protected no matter what.

So, what would the impact be of another dividend increase at $0.04? If MMM was to provide shareholders with a dividend increase of $0.04 for the 2024 fiscal year, it would add $22.16 million to the 2024 dividend payments. MMM would be paying $3.35 billion in dividends rather than $3.32 billion. This would cause MMM to have between $1.83 billion and $2.05 billion in retained earnings rather than $1.86 billion and $2.08 billion after dividends were paid. This is still enough to meet the settlement obligations without touching the cash on their balance sheet if they come in on the high side of the range. I think we will more than likely see a dividend increase, and it could be less than $0.01 per quarter just to keep the Dividend King status alive.

Conclusion

Mr. Market put MMM in the doghouse over the last few days, and shares could certainly go lower. MMM has its troubles, but I think things are overblown. The bottom line is that MMM generated $9.24 of EPS in 2023 when guiding for $8.50-$9.00, and their guidance of $9.35-$9.75 in 2024 allows them to meet their liabilities obligations in addition to paying the dividend. Five years from now, $1.1 billion of annual payments to the earplug settlement will be finished. Investors should consider opportunity cost as MMM could be out in the cold for some time, but at around 10x earnings with a dividend yield that exceeds 6%, I am taking the opportunity to add to my position. I have time on my side, and ultimately, I think MMM will move higher.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.