Summary:

- Despite the strong rally recently, I see more upside for 3M Company stock prices.

- The top drivers include the Solventum Corporation spin-off and the settlement of its legacy lawsuits, both enhancing the clarity of its growth curve ahead.

- The attractive valuation multiples add further upside potential.

Yevhenii Orlov/iStock via Getty Images

MMM stock: Still a buy at near 52-week high

I last wrote on the 3M Company (NYSE:MMM) stock earlier this year in February. As illustrated by the chart below, I argued for a bullish thesis based on the following considerations:

3M recently settled its class action lawsuits involving the use of PFAS (aka, the forever chemicals)and combat earplugs. These settlements could improve public perception and lead to increased investment and investor confidence. MMM’s current valuation is attractive, with a high dividend yield and favorable topline metrics.

Indeed, the stock enjoyed a strong rally after that. Its prices have advanced 30.6% since then as seen and the total return exceeds 31.5%, far outpacing the broader market’s 7% return over the same period. MMM’s return is even higher if the share distribution from the Solventum Corporation (SOLV) spinoff is considered (more on this in a minute).

Usually, such a large price advancement over a short period of time would weaken (or even invalidate) a bull thesis. As prices advance, valuation elevates and risks heighten. However, in the case of MMM under current conditions, I will argue that the bullish thesis remains valid.

In the remainder of this article, I will explain the fundamental profit drivers that can support even higher stock prices. And the leading factor is the completion of the Solventum spinoff, discussed immediately below.

MMM stock and the Solventum spinoff

For readers unfamiliar with the background, MMM had announced plans to spin off its healthcare segment a while back. The spinoff finally took place recently in April. The new company is named Solventum and now trades under the ticker SOLV on the New York Stock Exchange. 3M shareholders received one share via a tax-free distribution of SOLV for every 4 shares of MMM, providing a further boost to their total returns.

I view this spinoff as very positive for both companies. I expect MMM to receive close to $8 billion in proceeds from the transaction. MMM could use these funds to further strengthen its financial position and/or pursue growth in its other operating units.

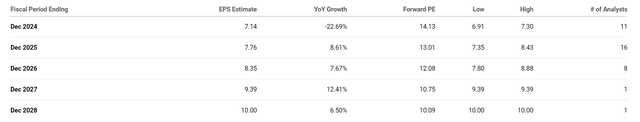

MMM’s healthcare segment composed roughly a quarter of total revenues before the spinoff. So shortly after the spinoff, MMM’s accounting EPS may take a hit in the near term as seen in the chart below. More specifically, the chart shows the consensus EPS estimates for MMM in the next few years. As seen, the market expects its EPS to experience a sizable decrease in FY 2024. Its EPS is estimated to be $7.14 in FY 2024, a decrease of more than 22% from the prior year.

Besides the impact of the spinoff, I won’t be surprised that other expenses could weigh on the bottom line as well. The top issues on my list include restructuring charges and legal expenses. As mentioned in my earlier article, the company recently settled class-action lawsuits, agreeing to pay $10.3 billion to public water systems over the next 13 years to resolve the PFAS issues. It will also compensate $6 billion over the next six years to litigants in the Combat Ear Plugs case.

Despite these headwinds (which are either temporary or settled in my view), analysts forecast EPS to rebound strongly after FY 2024. To wit, its EPS is projected to be $7.76 and $8.35 by FY 2025 and 2026, representing a growth of 8.61% and 7.67% respectively. All told, its EPS is expected to climb to about $10 in 5 years.

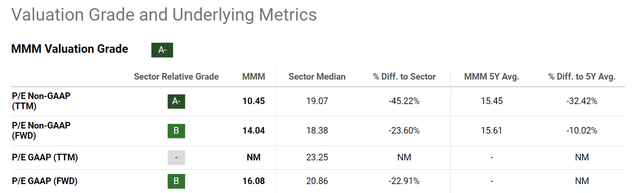

At 14x FWD P/E, the stock is already trading at a very attractive valuation, as seen in the next chart below. According to MMM stock’s valuation grade, its P/E ratios are significantly below both the sector median and its 5-year average. For the forward P/E ratio (based on the FY 2024 estimates shown above), MMM is trading at 14x. With a sector median of over 18x, this translates to a discount of 23.6%. The 5-year average P/E ratio for MMM is around 15x, about 10% above its current FWD P/E. With the projected growth, the valuation multiples would further shrink – at a quite rapid pace – to about 10x only in 5 years.

Other risks and final thoughts

In terms of downside risks, MMM and its industrial peers face many common challenges, like economic downturns, which can significantly reduce demand for industrial products. Additionally, fluctuations in commodity prices and ongoing inflation (in terms of labor cost, fuel cost, etc.) can squeeze profit margins.

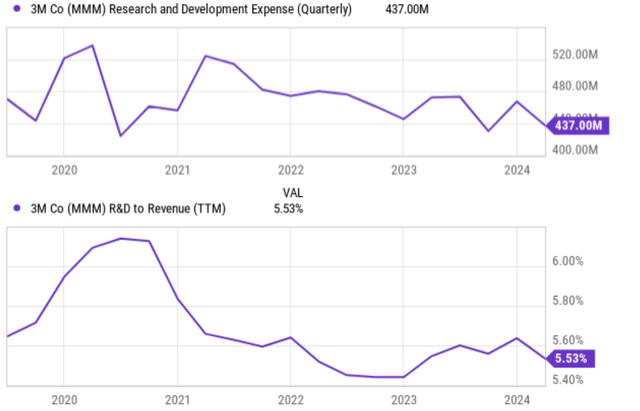

A more unique risk for MMM involves the possibility of innovation stagnation. MMM has historically been a leader in new product development, but recently, some investors are worried that this edge may be fading. There are good reasons for such concerns. For example, the chart below shows MMM’s R&D expenses compared to its historical average (top panel) and its R&D as percentage of revenue compared to its historical average (bottom panel), both are showing concerning signs.

Looking at the top panel, 3M’s current R&D expenses hover around $437M for the last quarter, a significant decline compared to the peak level of over $520M reached a few years ago. The bottom panel shows that 3M’s R&D expenses as a percentage of revenue are also lower than their historical average. As of the most recent quarter, 3M’s R&D to revenue ratio was 5.53%, again, a large decline from the peak level of around 6.2% reached a few years ago.

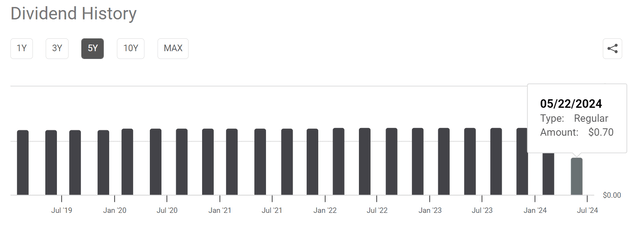

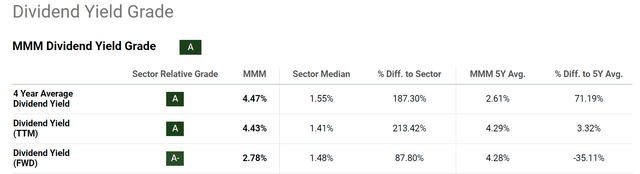

This leads me to the next risk: its recent dividend cut. As seen in the next chart below, the dividend king (MMM had been increasing its dividends nonstop for 65 years) recently decided to cut its payouts. Such a development could cause some short-term pain and negatively impact its sentiment among investors – especially dividend investors. However, overall, I see the decision as the right one for the longer term to help the company reinvest in itself and reinvigorate its innovation edge. Plus, the dividend yield after the cut is still quite appealing compared to the broader sector as seen in the second chart below.

All told, my verdict is that the positives far outweigh the negatives. Thus, my bullish thesis on MMM remains, and I keep seeing it as a compelling buying candidate. Admittedly, there will be some near-term EPS headwinds. However, I anticipate a robust EPS rebound in the next 1~2 years.

The top two catalysts in my mind are the spin-off of its SOLV and the settlement of its legacy lawsuits. The SOLV business is a slower-growth segment, in my view. The completion of the spinoff should streamline operations and unlock hidden stock value. Finally, MMM’s P/E ratio sits at a significant discount to the sector median and its own historical averages, adding further upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.