Summary:

- 3M Company reported solid first quarter results with adjusted EPS growing in the double digits again.

- The company spun off its healthcare business into a new company called Solventum.

- 3M Company cut its dividend in half, but the stock is still undervalued and seems well-supported from a technical point of view.

- With major lawsuits almost resolved, we can be optimistic for 3M Company to return to previous growth and efficiency levels.

josefkubes

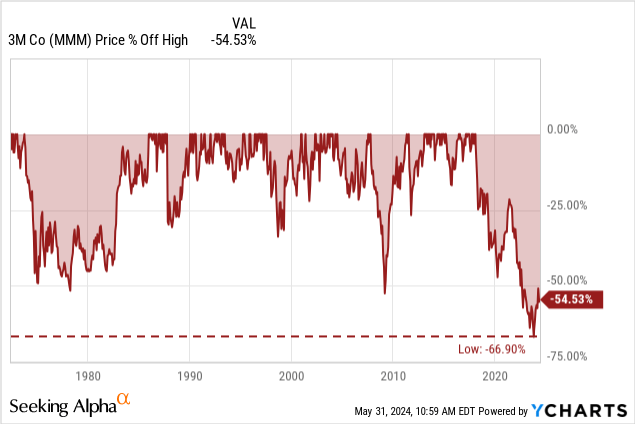

One of the biggest disappointments in my portfolio is 3M Company (NYSE:MMM) and the position is still down 30%. Of course, this is not including dividends I collected in the last few years, and we also must take into account the position in Solventum Corporation (SOLV) I now have (we will get to this). And while I already thought I made a great investment as I bought the stock clearly below its all-time high, the stock is now trading 55% below its previous all-time high (and a few quarters ago, the stock declined as much as 67%).

I continue to hold the stock during this difficult time, and I will continue to hold the stock as I think 3M Company has a great moat around its business and is a great long-term investment. In the following article, I will provide an update on 3M Company and look at the healthcare segment, which was spun-off as Solventum Corporation. I will also look at the dividend and finally determine again if the stock is a “Buy”, “Sell” or “Hold”. But we start by looking at the chart.

Technical Picture

My last article about 3M Company was published in early January 2024 and since then, the stock actually returned about 10% and was more or less in line with the S&P 500 (SPY). In previous articles I was also bullish about 3M Company, but in most cases the stock clearly underperformed the overall market, and, at least in the short term, these bullish calls were wrong.

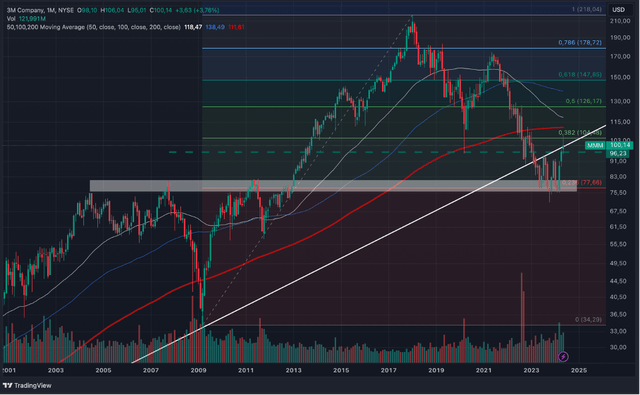

3M Company Monthly Chart (TradingView)

But at this point we actually have more reasons to be optimistic and when looking at the chart we can make the argument that 3M Company might have found its bottom around $75. This bullish outlook can be based on two arguments:

- 3M Company has built a strong support level during the last two decades. Between $75 and $80 we have several market tops from the years 2004, 2007 and 2011. And what was once a resistance level became a support level when 3M Company finally moved higher. And the fact that these are major support levels stretched over decades makes this a strong support level overall.

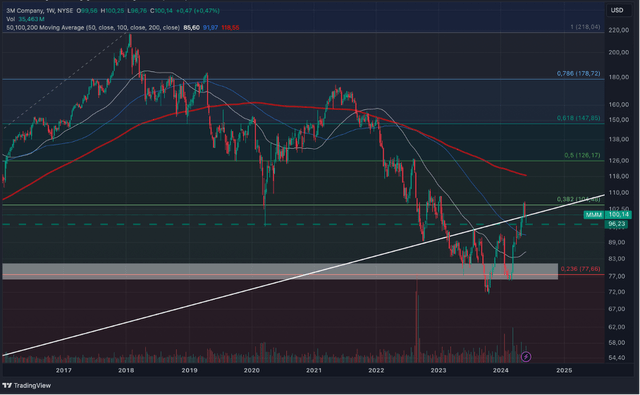

- When looking at the weekly chart, we can see a bottom structure forming during the last few months. In my opinion, we can identify an inverse head-and-shoulder pattern with a neckline around $95. In the recent past, the stock moved above that neckline, and we therefore can see the head-and-shoulder pattern as completed and higher stock prices are likely.

3M Company Weekly Chart (TradingView)

Despite being rather bullish, I also can make two counterarguments to my bullish thesis:

- At around $110 there is a solid resistance level generated by the 200-month moving average as well as the lows from the years 2014, 2015 and 2020. And before the stock is not able to move above this resistance level, we still should be rather cautious.

- And there is a second argument to be made, but I don’t know how valid it is. We have a long-term support line connecting the lows of the early 1980s and the low during the Great Financial Crisis. And that support line was broken in 2023 and can now be seen as a resistance level, and the stock already bounced off that resistance level. However, we can draw this line slightly different by connecting different lows from the early 1980s and the picture is less clear.

When pressed for a clear opinion, I would rather be bullish for 3M Company – not only because of the chart but also due to the valuation multiples 3M Company is trading for right now.

Intrinsic Value Calculation

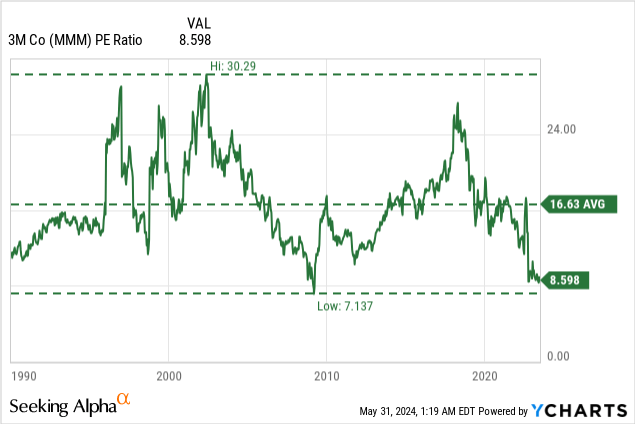

I have been arguing for a long time that 3M Company is undervalued, and the stock has not really moved higher so far. But that does not make the argument of the stock being cheap incorrect. And when looking at the price-earnings ratio, 3M Company is trading close to the lowest P/E ratio since 1990. At the time of writing, the stock is trading for 8.6 times earnings.

But we must be careful here. The P/E ratio is calculated with data from the last twelve months, and this is including earnings generated by the healthcare segment, which is not part of 3M Company anymore. Instead, we can use the guidance for fiscal 2024 and expected earnings per share will be between $6.80 and $7.30. When using the midpoint of the company’s guidance, the stock is trading for a forward-P/E ratio of 13.9. But while this is not extremely cheap anymore, it is still a rather low valuation multiple.

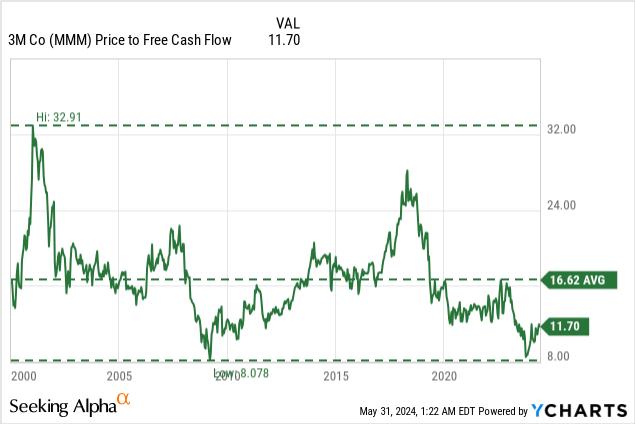

And we see a similar picture when looking at the price-free-cash-flow ratio. At the time of writing, 3M Company is trading for a P/FCF ratio of 11.7. Of course, we are faced with a similar problem that the TTM free cash flow is probably not the same as free cash flow in fiscal 2024. Usually, 3M Company is targeting about 100% free cash flow conversion and with $7.05 in expected earnings per share and 553 million shares outstanding we can assume free cash flow to be about $3.9 billion. This would result in a 13.9 forward-P/FCF ratio as well.

Aside from looking at simple valuation multiples, we will use a discount cash flow calculation to determine what growth rates are necessary for 3M Company to be at least fairly valued. When calculating with 553 million outstanding shares, 10% discount rate and $3.9 billion in free cash flow, 3M Company must grow 3% annually from now till perpetuity for the stock to be fairly valued.

Quarterly Results

Now let’s answer the question if 3M Company is able to grow at least 3% annually and the last quarterly results might give us some hints. For starters, 3M Company could beat estimates for revenue as well as earnings per share again, and this was the fifth quarter in a row of beating EPS and revenue estimates.

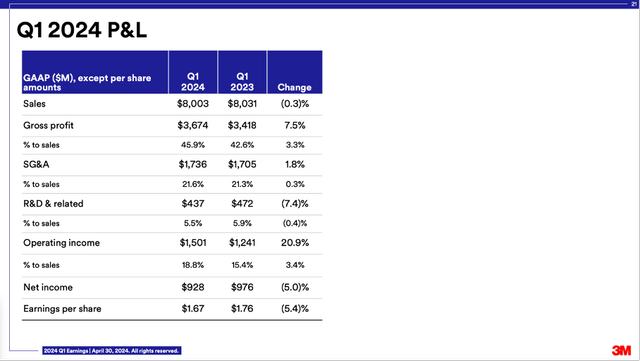

On April 30, 2024, 3M Company reported first quarter results and while net sales declined 0.3% year-over-year from $8,031 million in Q1/23 to $8,003 million in Q1/24, operating income increased from $1,241 million in the same quarter last year to $1,501 million this quarter – resulting in 21.0% year-over-year growth. However, diluted earnings per share declined 5.1% year-over-year from $1.76 in Q1/23 to $1.67 in Q1/24.

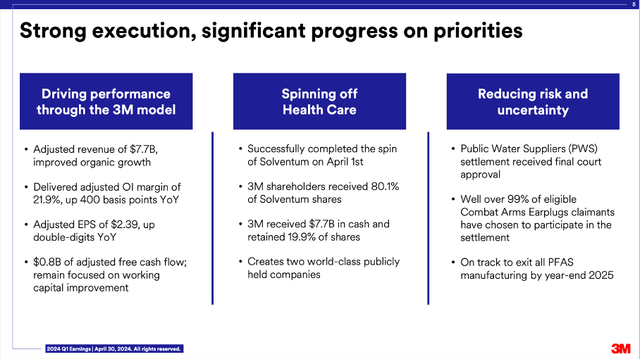

3M Company Q1/24 Presentation

We can also look at adjusted earnings per share, which increased 21.3% year-over-year from $1.97 in the same quarter last year to $2.39 this quarter. On the other hand, adjusted free cash flow declined from $946 million in Q1/23 to $833 million in Q1/24 – resulting in 11.9% year-over-year decline.

3M Company Q1/24 Presentation

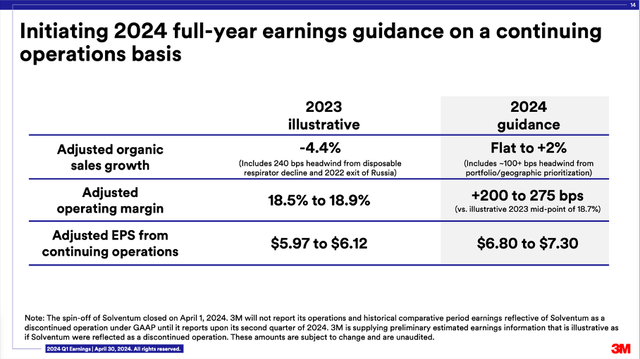

Additionally, we can look at the guidance for fiscal 2024, and we are already comparing the guidance to adjusted 2023 results (without results from Health Care segment which was spun-off as Solventum Corporation). Adjusted organic sales growth is expected to be flat to 2% and the adjusted operating margin is expected to improve between 200bps and 275bps. And finally, adjusted EPS is expected to grow to a range of $6.80 to $7.30.

Getting Back to Normal

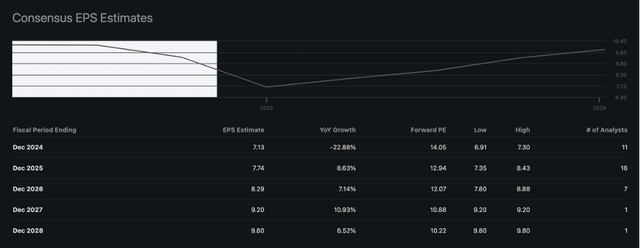

3M Company is expecting strong double-digit growth rates for the bottom line, and this would be a strong hint for the business returning back to normal. Between 1980 and 2022, 3M Company grew revenue with a CAGR of 4.20% and earnings per share grew with a CAGR of 6.51% during these 42 years. And we can hope for 3M Company to return to these levels. At least for the next few years, analysts are quite optimistic and in the years between fiscal 2024 and fiscal 2028 analysts expect the bottom line to grow with a CAGR of 8.28%.

3M Company EPS Estimates (Seeking Alpha)

One of the biggest problems 3M Company had in the last few years were the lawsuits, but the public water suppliers (PWS) settlement received final court approval and well over 99% of eligible Combat Arms Earplugs claimants have chosen to participate in the settlement. With the major lawsuits not being such a huge issue anymore, when can be optimistic for 3M Company performing in a similar way as in the past and sentiment about the company and stock might also shift.

3M Company Q1/24 Presentation

Going forward, 3M Company is now reporting in three different business segments – Safety & Industrial, Transportation & Electronics and Consumer. The fourth segment, the health care business, was spun off as Solventum Corporation.

Solventum Spin-Off

Now let’s look at the spin-off of the healthcare segment which led to the new business Solventum Corporation, which started trading on April 1, 2024. At that day the planned spin-off was completed, and 3M Company retained 19.9% of the outstanding shares of Solventum common stock, with the other shares being distributed to 3M Company shareholders. But so far, the performance of Solventum was also a bitter disappointment and since trading open at $80 about two months ago the stock declined to slightly below $60. And while we don’t have the space for a deep-dive into Solventum it is trading for a forward-P/E below 10 right now and is certainly not overvalued.

Dividend

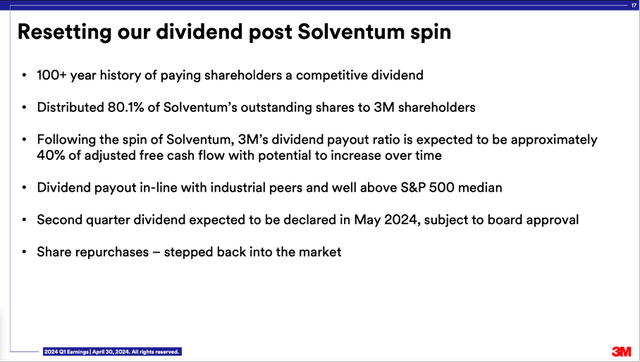

3M Company also used the Solventum spin-off to reset its dividend policy and resetting the dividend policy meant a dividend cut for investors. And although CEO Mike Roman tried to give the dividend cut a positive spin, it is still a dividend cut:

As a result, we anticipate a dividend of approximately 40% of adjusted free cash flow. This represents a dividend that is in line with our industrial peers and well above the S&P 500 median, with the potential to increase over time. We expect to seek Board approval to declare the second-quarter dividend in May, with payments anticipated in June. In addition, post-spin, we have stepped back into the market for share repurchases.

Instead of a previous quarterly dividend of $1.51, 3M Company is now paying a quarterly dividend of only $0.70 per share. And while it is acceptable for 3M Company to lower the dividend a little bit following the spin-off, management used the occasion to finally reduce the dividend. But considering the struggling business and rather high debt levels, preserving cash is the right move at this point.

3M Company Q1/24 Presentation

And going forward, 3M Company is targeting a 40% payout ratio of the free cash flow and with an expected free cash flow of $3.9 billion a quarterly dividend of $0.70 and annual dividend of $2.80 per share is almost perfect in line with the targeted payout ratio of 40%.

At some point, investors might receive a dividend from Solventum, but for approximately the next 24 months, management has decided not to pay a cash dividend on its common stock. Solventum also wants to focus on reducing debt levels in the next few years.

Conclusion

Despite the dividend cut, I remain optimistic about 3M Company. And although first quarter results were not perfect, double-digit growth for adjusted earnings per share is a good sign. Additionally, the stock remains deeply undervalued, and the chart is also giving us reasons to be optimistic. As always, I am investing with a long-term time horizon (at least 5 to 10 years) and I am holding on to my shares and remain optimistic that I will make a profit in the foreseeable future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM, SOLV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.