Summary:

- 3M reported quarterly earnings that beat profit estimates, but the stock price dropped 11% due to a softer-than-expected profit outlook for 2024.

- The outlook for 2024, in terms of adjusted profits per share and free cash flow, supports a strong buy classification.

- Despite the sales decline in the fourth quarter, 3M’s segment profits remained high, and the company’s dividend yield is at 6.2%.

jetcityimage

Industrial conglomerate 3M Company (NYSE:MMM) reported quarterly earnings on Tuesday that triggered an 11% price crash, even though the industrial company sailed past the Street’s profit estimates.

The reason for the stock drop apparently lies in 3M’s softer-than-expected profit outlook for 2024 due to headwinds in China and in consumer markets.

I think 3M’s earnings release was not nearly as bad as investors made it out to be, and I think the drop represents a buying opportunity, particularly because 3M is solidly profitable on a free cash flow basis and the stock yield has skyrocketed above 6%.

I also think that the outlook for 2024, in terms of adjusted profits per share and free cash flow, is solid enough to warrant a stock classification of Strong Buy.

My Rating History

After 3M raised its profit forecast for the full year in 3Q-23, even under consideration of charges related to the company’s combat earplug settlement, I slapped a Buy sticker on the industrial company’s stock.

The earnings and free cash flow forecast for 2024 also strongly supports the bull case here, in my view. 3M’s stock is now selling for a 9x earnings multiple and the stock pays a 6.2% yield.

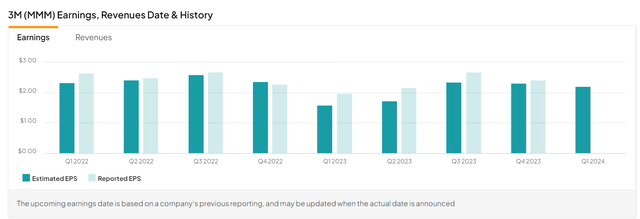

3M Beat Profit Estimates

Taking into account that 3M actually beat profit estimates by $0.11, I think that the 11% price plunge on Tuesday is grotesque. Investors should see the price drop as a buying opportunity as the company reported only moderate sales headwinds in the fourth quarter.

Investors Overreact To 3M’s 4Q-23 Earnings

3M is a leading industrial company with businesses operating in four core segments: Safety & Industrial, Transportation & Electronics, Healthcare (to be spun off in 1H-24) and Consumer. The combining thread of these segments, with the exception of Healthcare, is that these businesses are cyclical.

Industrial conglomerates tend to perform well in expanding economies with strong economic growth which is what I think is still the case in the United States.

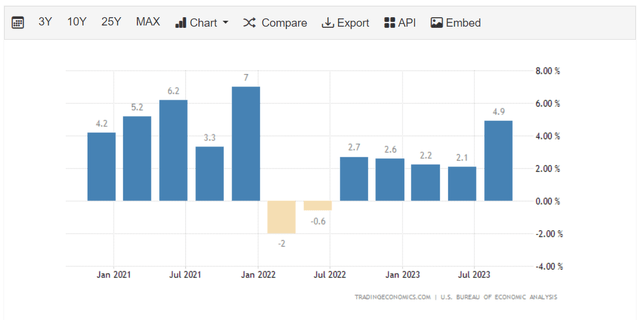

The U.S. economy grew at an annualized rate of 4.9% in the third quarter, and the outlook is robust: Employers added 216K jobs in December and the unemployment rate remained steady at 3.7%.

U.S. Economy (Tradingeconomics.com)

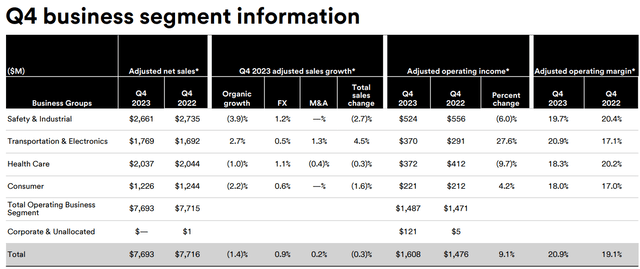

One reason why investors turned against 3M was that the industrial company reported a YoY sales decline for the fourth quarter. 3M said that it had adjusted sales of $7.7 billion in 4Q-23 which reflected a rather small 1.4% drop YoY. It was a decline nonetheless and the drop in sales together with a softer-than-expected outlook for 4Q-23 ticked investors off on Tuesday.

3M did see the largest sales decline in Safety & Industrial, with 3.9%, but even this decline did not change the fact that the company’s segment profits (and margins) remained rather high. Safety & Industrial is 3M’s largest segment with an operating income of $524 million, reflecting a 6% decline YoY.

Transportation & Electronics, which was the most profitable segment in 4Q-23, actually benefited from growth in orders and sales, resulting in a 3% organic sales gain and a 28% jump in segment operating income.

Consumer, which was expected to struggle due to inflation headwinds, saw a rather moderate 2.2% decline while profits increased 4.2%.

All things considered, it was not a bad earnings release for 3M and I think that investors overreacted to the earnings release, particularly with respect to the 1Q-24 earnings forecast.

Q4 Business Segment Information (3M)

2023 Guidance Outperformed

The industrial conglomerate outperformed its 2023 adjusted earnings and adjusted free cash flow conversion guidance by a substantial amount. 3M produced $9.24 per share in adjusted earnings, surpassing its January 2023 guidance by $0.24 at the top end.

Free cash flow also came in stronger than expected, with a free cash flow conversion ratio of 123% as opposed to a guidance of 90-100%. 3M was able to outperform its guidance primarily due to price increases and cost cuts.

Guidance For 2024 And FCF Multiple

3M sees an operating cash flow of $6.5 to $7.1 billion in 2023 and a free cash flow conversion ratio of 95-105%. Adjusted profits are expected to fall into a range of $9.35 to $9.75 per share which ticked off some investors.

The Street estimate for 2024 profits was 9.81 per share, so based on the midpoint average, guidance came in less than 3% below the estimate. I don’t think that this justifies an 11% stock price drop.

At the midpoint, the industrial company anticipates to generate approximately $6.8 billion in free cash flow this fiscal year. The industrial conglomerate presently has an equity market value of $53 billion which reflects a 7.8x forward-looking free cash flow multiple.

A 9x FCF multiple does not seem unreasonable to me when taking into account that the industrial company just sold at this multiple yesterday and that the conglomerate is substantially cheaper than the leading U.S. conglomerate.

General Electric Company (GE), which I think also released quite solid earnings for 4Q, is selling for a much higher 25.2x free cash flow multiple due to the company’s strong execution in the Aerospace segment that attracts a higher number of engine orders.

Thus, 3M, from a comparative valuation point of view, reflects a stronger value than General Electric, in my view, and I particularly like the 6.2% dividend the stock pays right now.

3M Pays A Robust 6% Yield

A pretty good reason besides profit growth and free cash flow resilience is the fact that 3M pays shareholders a very robust dividend of $1.50 per share which equates to an annualized dividend pay-out of $6.00.

Based on a stock price of $96 at the time of writing, 3M’s stock pays a yield of 6.2%. The leading dividend payout ratio, based on the adjusted profit guidance for 2024 is 63%.

Headwinds To The Investment Thesis

Inflation and higher costs have been an issue for 3M. Though inflation is broadly receding, it did experience a flare-up in December which, if this trend does not self-correct, could create new problems for the industrial company.

A drift into a U.S. recession and softening pricing power in the consumer business are two considerations that may weigh on the investment thesis in 2024. I think that the dividend is rather well-covered, however, and passive income investors should get their customary annual increase this year.

My Conclusion

The 11% price is exaggerated, and I doubled my investment in 3M on Tuesday. 3M is a solid industrial conglomerate that delivered decent earnings for 4Q-23.

The company beat the profit estimate and the guidance for 2024 implies only a small decrease in adjusted profits due to headwinds in the consumer business. Nonetheless, 3M comfortably covers its dividend with its 2024 adjusted profit outlook and will remain highly profitable on an FCF basis.

I think that the two most compelling justifications for buying 3M lay in the low FCF valuation and the well-covered 6.2% dividend yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.