Summary:

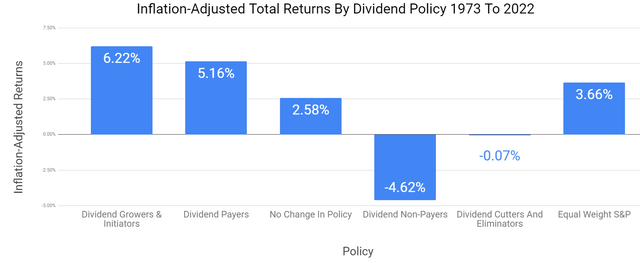

- The historical data is clear. Dividend growers are the easiest way to grow your wealth, while dividend cutters are terrible long-term investments.

- 3M Company now offers the highest yield in recorded history, but the latest legal bombshell might be what forces a 20% to 50% dividend cut.

- Given the $18 billion in legal settlement costs (S&P thinks it will be much more), I believe 3M can no longer sustain its current dividend.

- This article shows you the easy-to-understand math of why 3M will be $1 billion short in covering its current dividend in 2024 and 2025.

- The day the board agrees to the ear-plug settlement is the perfect time to cut the dividend by 30% (to make it sustainable) or even 40% or 50% to minimize the need to have to cut it again if anything else goes wrong.

- If 3M does cut its dividend, there would be little reason to believe it can match the S&P’s long-term returns, much less that of superior dividend ETFs like VIG or SCHD. I estimate 3M’s dividend cut risk has soared from 1% to 16% in recent weeks, and if they cut, it becomes a sell.

lucadp

I love pointing out Buffett-like “fat pitch” opportunities.

Wait for a fat pitch and then swing for the fences.” – Warren Buffett.

A “fat pitch” is a rare opportunity when the investing stars align. Remember Buffett’s famous “Be fearful when others are greedy and greedy when others are fearful”? This is the kind of opportunity he was talking about.

Of course, only in hindsight will you find out whether a company’s stock price going off a cliff and its yield soaring to record highs was a value trap or a Buffett-style “fat pitch.”

I last warned about 3M’s rising dividend cut risk two months ago, and now it’s time for an update due to late-breaking events.

Why Dividend Safety Matters More Than You Think

Naturally, avoiding dividend cuts matters for retirees living on dividends. But it also matters to younger investors who have years or even decades until retirement.

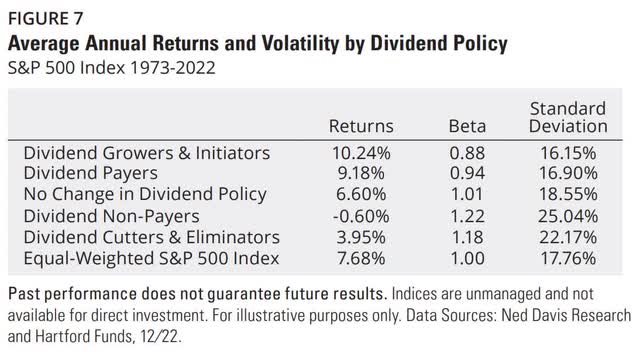

Here is the latest 50-year data for how stocks performed with various dividend policies.

50 Years Of Data: When the Dividend Is Cut, It’s Time To Sell

| Policy | Absolute Total Returns | Inflation-Adjusted Returns | Cumulative Inflation-Adjusted Returns ($1 Turns Into) |

| Dividend Growers & Initiators | 10.24% | 6.22% | $20.43 |

| Dividend Payers | 9.18% | 5.16% | $12.37 |

| No Change In Policy | 6.60% | 2.58% | $3.57 |

| Dividend Non-Payers | -0.60% | -4.62% | $0.09 |

| Dividend Cutters And Eliminators | 3.95% | -0.07% | $0.97 |

| Equal Weight S&P | 7.68% | 3.66% | $6.03 |

(Source: Hartford Funds, Bureau of Labor Statistics.)

You can see that dividend growth blue chips performed the best, while dividend cutters achieved approximately half the market’s annual gains.

Imagine you were 20 years old 50 years ago. Your grandfather told you, “Stocks are the best-performing asset class in history, so put all your savings into the stock market, and you’ll retire rich in 50 years.”

You invested 100% of your money into individual companies, with terrible luck, dividend cutters. Fifty years later, you discover that adjusted for inflation, you’ve lost 3% of your money while someone who bought the S&P 500 (SP500) was up 6X.

And your friend who was always investing in pure dividend growth stocks? He’s turned $1 into $20, adjusted for inflation.

- $1 is now $131, not adjusted for inflation for the dividend growth investor

- and $7 for the dividend cut investor.

The dividend growth blue chips outperformed the market by about 50% per year and did so with lower volatility. Dividend growth blue chips had the lowest volatility of any company in this study.

Why does volatility matter?

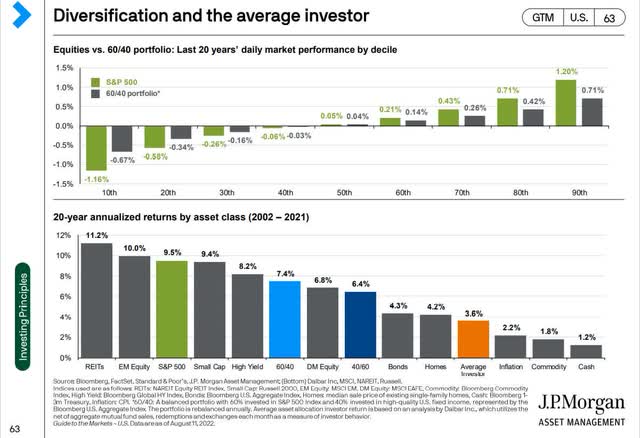

Because if you can’t sleep well at night in a downturn and panic sell and/or try to market time, you will almost certainly fail to keep up with the market, much less beat it.

The easiest way to lose everything? Spend decades trying to time the stock market.

And this brings me to the 3M Company (NYSE:MMM) battleground dividend stock.

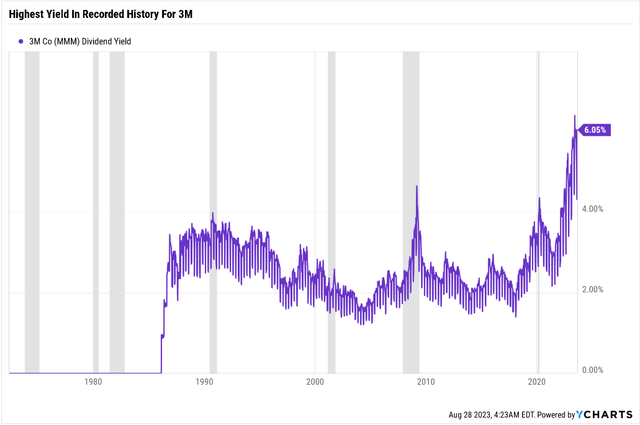

3M’s Yield Hits A Record High…But

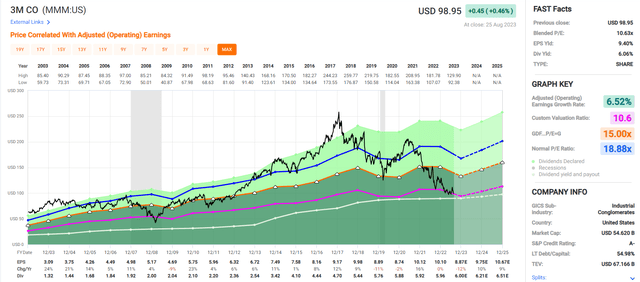

How attractive is 3M’s 6% Yield?

While it’s possible that the yield was higher during the Great Depression, as far as recorded history going back to around 1986, it’s never been higher.

Okay, but what about the growth outlook? If 3M’s growth outlook is now zero or less than a 6% yield, it might not be worth it.

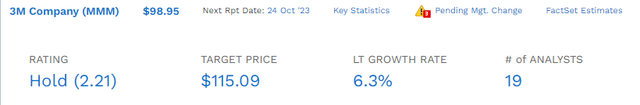

Analysts expect about 12% to 13% long-term returns from 3M at these valuations.

That’s Nasdaq-like returns from this dividend king with a 64-year-dividend growth streak, A-credit rating, and a history of rallying off bear markets like a champion!

The Last Time 3M Was This Undervalued

| Time Frame (Years) | Annual Returns | Total Returns |

| 1 | 81% (Medallion Fund Returns) | 81% |

| 3 | 33% (Joel Greenblatt-Like Returns) | 133% |

| 5 | 28% (Peter Lynch-Like Returns) | 237% |

| 7 | 22% (Warren Buffett-Like Returns) | 313% |

| 10 | 19% (Ben Graham-Like Returns) | 489% |

| 15 | 16% (John Templeton-Like Returns) | 782% |

(Source: Portfolio Visualizer Premium.)

Whenever 3M’s thesis doesn’t break, it always comes tearing off bear market lows with a vengeance. Brave and disciplined deep-value investors have never regretted buying 3M at valuations like these:

- 6.1% yield vs. 3.5% 5-year average and 2.5% 13-year median

- 10.5X forward earnings vs. 17.9 5-year average and 18.9 20-year average.

MMM’s P/E is the lowest in 14 years, only falling lower during the darkest days of the Great Financial Crisis.

What does this mean for 3M investors? If you think the thesis won’t break, it’s the best time to buy this dividend king.

Why I Am Not Buying 3M Right Now

My family is facing five medical crises, including two relatives with cancer, so I can’t afford to buy anything right now.

But if I could, I wouldn’t buy 3M, and here’s why.

If 3M cuts its dividend, what will that mean? The thesis is broken; it’s no longer a dividend king; it will be eliminated from various ETFs like (NOBL) and (VIG), (SCHD), and most importantly…

Things are the worst they have ever been in at least 64 years.

Short-term stock prices are vanity, cash flow is sanity, but dividends are reality.

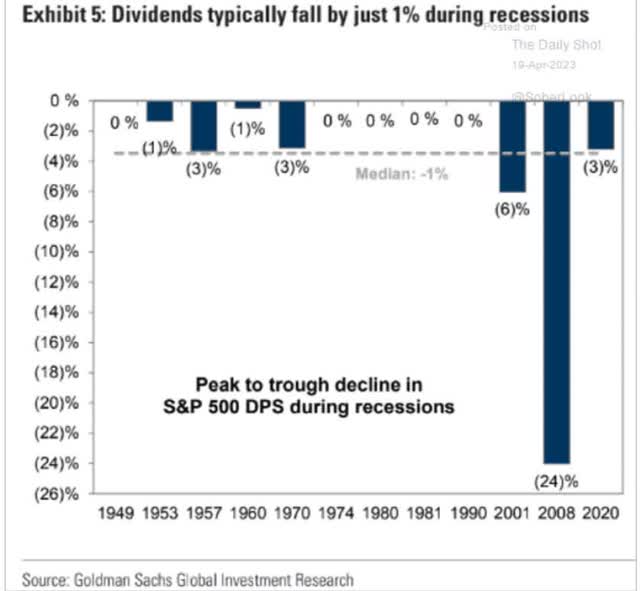

Do you know the usual dividend cut for S&P companies in recessions? The median since WWII is just 1%.

Even in the Great Recession, when the Fed forced large banks to hack or eliminate their dividends, S&P’s dividends only fell 24%.

Why? Because when it comes to investing and dividends, Americans are a nation of Rockefellers.

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” – John D. Rockefeller.

John Rockefeller was so passionate about safe and growing dividends that he set up his oil companies to raise their yearly dividends. That’s why Exxon and Chevron, the last remaining Standard Oil spin-offs, are the only aristocrats in the oil sector.

The point is that U.S. companies are loath to do it when it comes to cutting dividends…unless they have no choice. The dividend must be cut or eliminated if the company’s future is threatened.

Why We Just Downgraded 3M’s Dividend Safety…For the 2nd Time In 4 Days

3M Dividend Safety

| Rating | Dividend Kings Safety Score (250 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| MMM | 21% | 2.0% | 16% (Current Risk Of Cut) |

| Risk Rating | High Risk 93rd percentile risk management | A- Negative outlook credit rating = 2.5% 30-year bankruptcy risk | 2.5% or less max risk cap- speculative |

I estimate the current risk of 3M cutting its dividend is about 8% or 1 in 12.

3M Overall Quality

| MMM | Final Score | Rating |

| Safety | 21% | 2/5 below-average |

| Business Model | 80% | 3/3 wide moat |

| Dependability | 21% | 2/3 below-average |

| Total | 41% | 7/13 Speculative-Below-Average |

| Risk Rating |

2/5 High Risk |

|

| 2.5% OR LESS Max Risk Cap Rec – Speculative |

40% Margin of Safety For A Potentially Good Buy |

I wouldn’t recommend 3M to anyone for less than a 30% discount to historical fair value to compensate for its speculative risk profile.

| Rating | Margin Of Safety For Medium-Risk 7/13 Speculative Below-Average Quality Dividend King | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Speculative Buy | 0% | $182.36 | $188.93 | $186.78 |

| Potentially Speculative Good Buy | 40% | $127.65 | $132.25 | $130.75 |

| Potentially Strong Speculative Buy | 50% | $109.42 | $113.36 | $112.07 |

| Potentially Speculative Very Strong Buy | 60% | $63.83 | $94.46 | $93.39 |

| Potentially Speculative Ultra-Value Buy | 70% | $72.94 | $75.57 | $74.71 |

| Currently | $98.95 | 45.74% | 47.63% | 47.02% |

| Upside To Fair Value (Including Dividends) | 90.36% | 97.00% | 94.83% |

MMM is approaching a potential speculative, very strong buy; it’s so cheap…but that’s for a good reason.

Hope For A Hopeless World! Fiber Can Cleanse Your Blood Of PFAS!

In June, 3M announced a $12.5 billion settlement for its PFAS contamination, which has largely spread “forever chemicals” worldwide.

- In the U.S., the CDC estimates Perfluoroalkyl and Polyfluoroalkyl Substances (PFAS) of Americans are contaminated.

A high-fiber diet can help reduce PFAS contamination in humans. PFAS are a group of man-made chemicals known to accumulate in the body. They can be found in various products, including food packaging, non-stick cookware, firefighting foam, and clothing.

Fiber can help to bind to PFAS and remove them from the body. A study published in the journal Environmental Science & Technology found that people who ate a high-fiber diet had lower levels of PFAS in their blood than people who ate a low-fiber diet.

- Deng P, Durham J, Liu J, Zhang X, Wang C, Li D, Gwag T, Ma M, Hennig B.

- Dietary fiber intake is associated with lower serum perfluoroalkyl and polyfluoroalkyl substances (PFAS) concentrations in adults: The HOME study. Environ Sci Technol. 2020 Jun 18;54(12):8414-8422. doi: 10.1021/acs.est.0c02450. PMID: 32540019.

The was conducted by researchers at the University of Kentucky. They looked at data from 648 adults in the National Health and Nutrition Examination Survey (NHANES). The participants were divided into two groups: those who ate a high-fiber diet (25 grams or more per day) and those who ate a low-fiber diet (15 grams or less per day).

The researchers found that the people who ate a high-fiber diet had significantly lower levels of PFAS in their blood than those who ate a low-fiber diet. The average difference was 8.36%, which is a significant amount.

The researchers also found that the people who ate a high-fiber diet had lower levels of specific PFAS, such as PFNA and PFOA. PFNA and PFOA are two of the most common PFAS in the environment.

The study suggests that a high-fiber diet can effectively reduce PFAS exposure.

And here’s even better news!

Humans evolved to eat 100g to 150g of fiber per day.

- I’m up to 55 g per day myself, but I am trying to get as high as possible.

Even higher fiber diets could likely reduce PFAS exposure even more, though further research is needed to confirm it.

All The Proven Benefits Of A High Fiber Diet

- improved gut health.

- Reduced risk of diverticulitis

- improved weight loss (through feeling fuller longer) – 42% U.S. obesity rate and climbing to 50% by 2030 (OECD) and 85% by 2050 (CDC)

- lowers LDL cholesterol

- reduced blood pressure

- reduced risk of heart disease (America’s #1 killer)

- lower insulin resistance and risk of type two diabetes

- lower risk of cancer

- lower risk of stroke

- lower risk of mortality in general.

Fiber is the most important macronutrient most Americans lack and don’t appreciate.

- 25 g of fiber for women and 38 g for men is the official recommendation

- According to the National Health and Nutrition Examination Survey (NHANES) 95% of Americans are fiber-deficient.

One reason is that our diets have become increasingly processed over the years. Processed foods are often low in fiber and high in unhealthy fats, sugar, and salt.

Another reason is that we are eating less fruits and vegetables. Fruits and vegetables are some of the best sources of fiber. However, many Americans do not eat enough fruits and vegetables.

A fiber deficiency can lead to several health problems, including constipation, diverticulosis, and hemorrhoids. It can also increase the risk of heart disease, stroke, and type 2 diabetes.

So, if you want to reduce your risk from PFAS and almost every other toxin in the environment, eat less processed crap and more plants.

- There are over 100 known obesogens alone

- like BPA, DDT, and PFOA (a type of PFAS), Dioxins, and Phalates found in everything from vinyl flooring, personal care products and children’s toys

- Obesogens are chemicals proven or suspected to increase obesity by triggering stem cells to become new fat cells.

3M’s Legal Woes Are Coming Into Focus, And They Are Nasty

So we’ve seen how PFAS is almost everywhere, including in the rain itself, around the globe including Antarctica and the Tibetan plateau.

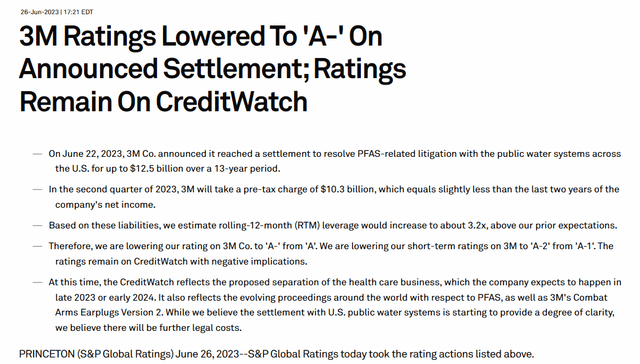

But what does that actually mean for 3M? Well, as S&P points out, it’s a $12.5 billion settlement over 13 years.

S&P downgraded 3M from A to A- and still has them on credit watch, which means a very high risk (over 50%) that they could be downgraded to BBB+.

Wide Moat Research

So basically, S&P thinks the PFAS settlement, at a cost of about $1 billion per year, has quadrupled 3M’s fundamental risk of failing as a company.

And possibly that risk will double again. Why?

We think the ultimate settlement figure regarding PFAS will be much higher but could stretch out over decades. At this time, we are not factoring specific additional settlements into our debt adjustments, but we believe it will significantly weigh on the company’s financial risk profile.” – S&P (emphasis added.)

S&P believes that PFAS cleanup costs will prove much higher than $13 billion. Barclay’s estimates $16 billion but it could potentially go higher. Though the good news is that it might be spread out over 20 or even 30 years.

The bad news is that 30 years of legal settlement costs dragging on a company’s fundamentals and valuation might be more than even the most patient deep value investor is willing to handle.

But that is just PFAS. Now we have news about those ear plug lawsuits, which numbered almost 300,000.

The Latest Legal Settlement Sends 3M’s Dividend Cut Risk Soaring

Compared to the $100 billion worst-case estimates that some analysts were throwing around over these earplug lawsuits, $5.5 billion sounds pretty good right? Easily something 3M can handle.

If this were a 13 to 30 year settlement period it absolutely would be.

- $183 to $423 million per year

- allowing inflation to eat away at it.

But the settlement period is just 5 years.

Under the settlement, 3M is expected to pay out the money over five years, according to a Bloomberg report on Sunday, which cited people familiar with the matter. 3M’s board still needs to sign off on the agreement.” – Seeking Alpha.

It’s not a done deal, as the Board has to agree to this first. But this would give the Board perfect cover to cut the dividend.

- the same announcement of the Board approving this could bring a 20% to 40% dividend cut.

Why a 20% to 40% dividend cut?

3M’s Dangerous Dividend Math

At first glance it looks like everything is fine. After a bad year of modestly declining earnings due to legal costs, earnings rebound at a steady rate and so does free cash flow.

The dividend keeps growth steadily and remains covered by free cash flow.

So why the safety downgrade?

Don’t forget about the spinoff.

The medical business is 20% of sales and the crown jewel of 3M’s assets. This is being spun off so it can be loaded down with debt, giving the parent company the cash it needs to start paying off the $18 billion (at least) in legal settlements.

25% of free cash flow is from the healthcare side of the business so let’s run the dividend math.

For 2024 (the year of the spinoff) $1.25 billion of that $5 billion in free cash flow goes away because the healthcare company is now independent.

- $3.75 billion in free cash flow remaining.

Now factor in $2 billion in annual settlement costs for PFAS and ear plugs that we know about.

- keep in mind that Barclays and S&P think it could be higher.

Now we’re down to $1.75 billion in annual free cash flow.

The dividend currently costs $3.342 billion per year but assume that management wanted to make investors whole and the health-spin-co took on 25% of that.

- $2.5 billion per year is 3M’s post-spinco dividend cost.

In order for 3M to avoid a dividend cut it would have to take on $750 million in debt in 2024.

- 30% dividend cut would cover the difference

- Board might want to cut by more to give itself financial flexibility

- up to a 40% cut or even 50% in a worst-case “rip off the Band-Aid” move.

It would then need to take on about $250 million in additional debt in 2025.

So is 3M willing to borrow $1 billion in a high rate environment to preserve its 64-year dividend growth streak?

That is the question high-yield deep value investors have to ask themselves.

Bottom Line: 3M’s Record Dividend Yield Hides Soaring Risks That Makes It Unsuitable For All But The Most Passionate And Risk-Tolerant Speculative Value Investors

We now believe 3M is a value trap given its continued exposure to legal liabilities and the risk of a dividend cut.” – Morningstar.

I agree with Morningstar, and don’t recommend 3M for anyone other than the truly most passionate and risk-tolerant ultra-yield deep value investors.

Wall Street is littered with the corpses of shattered investor dreams, of people who didn’t recognize when the wheels had fallen off the bus.

When the facts change I change my mind. What do you do sir?” – John Maynard Keynes.

In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”— Peter Lynch.

3M might still avoid a dividend cut, but it now has all the cover it needs to slash the dividend by 20% to 50%.

How soon? Well, given the Board approving the ear-plug settlement would make the math no longer work for the current dividend, I wouldn’t be surprised to see a large cut within the next few weeks or even this week.

- I’m writing this at 7 AM EST on Monday, August 28th.

What if 3M does slash the dividend by a 3rd? Isn’t that still a 4% yield? Sure. But remember that before this settlement analysts though 3M would growth long-term at 6% to 7%.

Does 10% to 11% long-term returns sound attractive with a 4% yield if they cut the dividend soon?

Or what about the worst-case 50% cut scenario? A 3% yield and 6% growth is 9% long-term returns.

That’s below what analysts expect from the S&P much less VIG or SCHD, world-class companies not drowning in 3M’s legal woes.

Am I 100% opposed to 3M? No.

Are you insane if you buy it today? Or even buy it today and then hold on if they cut their dividend?

S&P during its June downgrade of 3M’s credit rating upgraded its long-term risk management from 87th percentile (out of all companies in the world) to 93rd.

So apparently S&P thinks management is managing the long-term risk of the company very well indeed.

But guess what that means for the dividend’s safety? Not much.

Because S&P isn’t concerned with the dividend, that’s not what the credit rating or long-term risk management rating is based on.

S&P is only concerned with 3M’s survival and a 20% to 50% dividend cut, right now, given the new information, I estimate a 16% risk of a dividend cut, and that is rising by the day.

Literally it has doubled since Friday when I last downgraded 3M.

Before 3M’s legal bills began exploding its dividend cut risk was about 1%.

It’s not up to 16%.

Is that something you’re comfortable with? I personally am not, and would not buy it.

If the dividend is cut? Is 10X earnings cheap enough? Adjusting for next cash it’s about 8X cash-adjusted earnings and a 1.25 PEG.

Is that reasonable? Sure.

But can I find a 3% to 4% yielding (post-cut) company growing at 6% to 7% or better? Yes.

TRP with an 8% yield and 7% growth rate is the first company I can think of and that’s just one among a dozen potential alternatives I don’t have time to recommend right now.

- this is an emergency article designed to hopefully get out ahead of a potential cut.

Here is an example of the kind of “fat pitch” Buffett is such a fan of.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Company Screener.

Membership also includes

- Access to our 13 model portfolios (all of which are beating the market in this correction)

- my personal correction watchlist

- my family’s $2.5 million charity hedge fund

- 50% discount to iREIT (our REIT-focused sister service)

- real-time chatroom support

- real-time email notifications of all my personal buys

- numerous valuable investing tools

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.