Summary:

- 3M Company stock is deeply mired in a long-term downtrend. Its initial early summer recovery has completely dissipated as MMM fell back toward its June lows.

- Despite strong adjusted free cash flow conversion and a well-diversified business model, MMM’s performance has disappointed.

- Investors shouldn’t underestimate the uncertainties surrounding 3M’s legal liabilities. I believe investors de-rated MMM significantly to reflect its legal woes.

- To be convinced that MMM has recovered its bullish thesis, I must ascertain highly robust buying sentiments at MMM’s critical support levels. However, I have yet to see any.

- As such, I urge investors to be wary about adding MMM because it’s “cheap.” It’s more likely to be a perilous value trap that should be avoided for now.

josefkubes

3M Company (NYSE:MMM) investors must be wondering how much further could the downward spiral go, as MMM remains deeply mired in a long-term downtrend. As such, the initial sharp recovery in early summer has been completely digested, with MMM falling back toward its June lows at the $92 level.

My price action instincts suggest if a stock is in a long-term downtrend like MMM, it takes substantial effort to reverse its dominant downtrend bias, notwithstanding its attractive valuation. Buyers could argue that 3M company has strong adjusted free cash flow or FCF conversion (90% to 100%). Coupled with its well-diversified business model, predicated on its proprietary technologies, the company justifiably deserves a wide-moat label.

Despite that, I can understand why some value investors could hardly believe MMM’s performance, as it continued selling off since topping out in May 2021, after an initial recovery from its COVID lows. Moreover, MMM has dropped even further, revisiting lows last seen in late 2012.

MMM Quant Grades (Seeking Alpha)

Seeking Alpha Quant’s “B” valuation grade corroborates my assessment that MMM is relatively attractive to its peers. Its best-in-class “A+” profitability grade bolsters my case that 3M is well-supported by its wide-moat business model.

However, its “D-” growth grade suggests that the market needs to price in relatively anemic growth potential. While the company remains confident in achieving GDP-plus growth in the medium- to long-term, investors must question why MMM remains “trapped” in a long-term downtrend. A quick glance over at MMM’s “D+” momentum grade would have raised caution, behooving investors to ask, “What am I missing out here?”

Keen investors should be aware that the company is still sorting out the PFAS-related liabilities. In addition, its recent Combat Arms Litigation settlement agreement of $6B can still be shot down if “at least 98% of claimants don’t approve the deal.” As such, it could put the agreement into jeopardy, with 3M potentially facing “further negotiations and jury trials that the settlement sought to avoid.”

Possible? Why not. The settlement provides an estimated payout of $24K per claimant. However, Law professor Carl Tobias from the University of Richmond criticized the “too low” settlement amount relative to “damages awarded in bellwether trials ranging from approximately $1 million to $77.5 million.”

As such, I believe there’s significant uncertainty regarding this and other potential liabilities emanating from 3M’s legal woes. Therefore, I believe the market is right to structurally de-rate MMM’s valuation downward.

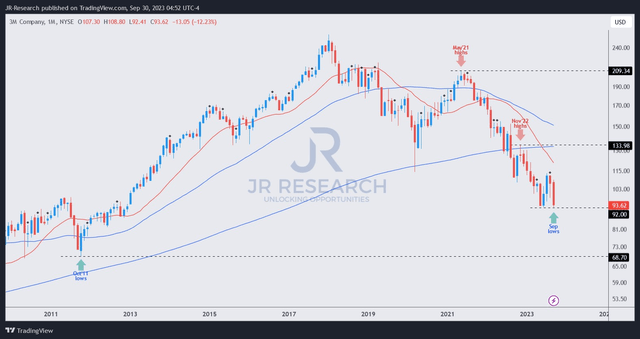

MMM price chart (monthly) (TradingView)

As seen above, MMM’s long-term downtrend has inflicted significant damage on its price action for bullish investors. After topping out decisively in May 2021, MMM never recovered its critical moving averages or MAs to recover its long-term uptrend bias.

In addition, while MMM buyers attempted to stage another recovery in November 2022, they eventually failed. It turned out to be an astute bull trap, as selling pressure intensified, leading to a loss of its critical 200-month MA (purple line).

As such, I urge buyers who are considering buying MMM because it’s “cheap” to not ignore the red flags suggesting MMM seems like a value trap. Buyers have not demonstrated their resolve to support MMM at its critical support levels, notwithstanding its attractive valuation. Worsened by its downtrend bias, attempting to catch the falling knives at the current levels could be a perilous endeavor, regardless of your conviction level.

Therefore, I urge investors to give MMM more time to debunk my value trap proposition. Given the significant damage inflicted against its buying sentiments, investors should consider waiting until buyers can recover its 200-month MA decisively before adding exposure.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!