Summary:

- The final amount of 3M’s liabilities is unclear.

- The company has historically been sustainable and profitable.

- Comparison with the Volkswagen AG Dieselgate scandal.

- 3M is significantly undervalued.

Environmental Hazard: Toxic PFOS Chemical Fire Foam Floating Down the Street, PFAS Firefighting Chemicals Peter Togel/iStock via Getty Images

Ambiguity Of Final Liabilities

3M Company’s (NYSE:MMM) survival depends on the size of its ultimate liabilities related to litigation. It is not yet clear how big these amounts will actually be. Although to date an agreement has been reached in the case of earplugs in terms of compensation for the health damage caused, the final obligations related to the case of PFAS are still unclear. I think that if the final liabilities for the PFAS and earplug cases do not exceed the amount mentioned below by RBC Capital, then the company will overcome its predicament in time. If the total amount of liabilities is significantly more, the whole story ends with bankruptcy. Before we analyze 3M Company’s prospects for paying court fines, let’s take a closer look at the latest news, the earplugs settlement.

Agreement To Settle The Case Of Earplugs

On August 27, there was important news that 3M had reached a settlement with the plaintiffs in the earplugs case. Under this settlement, 3M Company agrees to pay compensation of $6 billion over the period 2023-2029. Of that, $5 billion is to be paid in cash and $1 billion in the company’s common stock. This settlement involves more than 300,000 lawsuits. The contract also covers possible future claims. In my opinion, this last fact is very important from the point of view of protecting the interests of 3M. It is also important that the company claims that the earplugs were not defective, but that the health damage was caused by not being instructed to use them correctly. So, in my opinion, it is quite likely that the company will not incur additional liabilities later because of the earplug incident.

Opinions On The Total Amount Of Liabilities

According to RBC Capital, 3M’s PFAS liability risk amounts to an estimated $20 billion to $25 billion. RBC Capital’s forecast is just one of many, but it seems quite realistic for various reasons. I think that the psychology of the plaintiffs has been taken into account here. Approximately as much as the company is able to pay may also be claimed. If the court imposes a significantly higher penalty, it will most likely bankrupt the company and the plaintiff may not receive the desired compensation in the expected amount. Given the company’s P/B ratio of 5.07 (FWD), I think this approach is reasonable. Let’s say the company were to go out of business now and its assets would be distributed to the plaintiffs based on the judgment. In such a scenario, the plaintiffs would only be able to receive a total of $11.47 billion. I proceed with the following calculation:

market capitalization of $58.2 billion, P/B ratio 5.07.

58.2/5.07=11.47

There were also several different opinions regarding compensation for the earplugs case. Morningstar estimated in late June that the earplug case could cost $4 billion. However, Wolfe Research‘s analyst Nigel Coe estimated this amount to be “well in excess” of $10 billion. By now it is known that the real amount remained in the middle of them.

For the present moment, the total amount of liabilities is therefore $16.3 billion. Of this, $10.3 billion is the case of PFAS and $6 billion is the case of earplugs. Since the PFAS compensation has been agreed to be paid over 13 years, the $10.3 billion amount becomes $12.5 billion adjusted for inflation.

However, these liabilities aside, 3M is actually a stable and well-performing business. Therefore, it is reasonable for claimants to agree that payments are spread over a longer period and are on a realistic scale for both parties. Analyzing the company’s ability to pay its liabilities, I will use the current amount of $16.3 billion as a basis. I assume a payment period of 13 years for PFAS and 5 years for earplugs. It is currently unknown whether and how many liabilities there will be in the future in relation to PFAS. For earplugs, I think the total liability is generally clear by now.

3M Company’s Prospects For Meeting Liabilities

Assuming total liabilities of $16.3 billion, 3M Company should pay $1.99 billion (5X 1.2+0.79) over the next five years. I mean $1.2 billion a year for earplugs and $0.79 billion for PFAS. In subsequent years (up to year 13), the annual commitment is $0.79 billion.

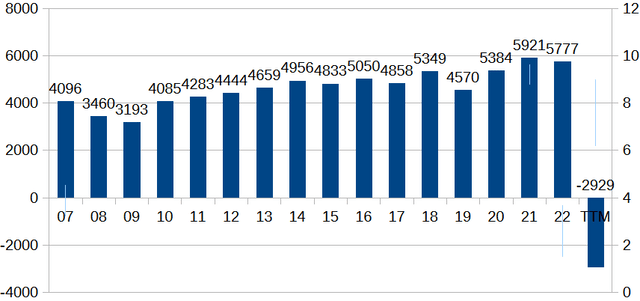

The following bar chart shows the company’s net income in the period 2007-2022

3M Company net profit 2007-2022 in millions of dollars (author`s bar chart, data: roic.ai)

As can be seen, 3M has been a consistently profitable company. At the same time, in the period 2007-2022, the net profit has increased by an average of 2.31% per year.

The company currently spends $3.31 billion on annual dividend payouts. Assuming that 3M Company is able to generate at least the same level of net profit in the future, it is possible to maintain the current dividend payment for the above total liability of $16.3 billion. $3.31 billion in dividends + $1.99 billion in liabilities. A total of $5.30 billion. 3M’s Q1 2023 (TTM) net profit was $5.45 billion. I think that the company is able to increase its dividend even minimally in order to maintain the title of dividend king. At least for now.

Fine For Violation Of US Anti-Bribery Law

On August 25, it was announced that 3M Company would have to pay a $6.5 million fine for violating the US anti-bribery law. The reason was that employees of 3M’s Chinese subsidiary organized foreign trips for Chinese government officials associated with state-owned enterprises to encourage them to buy the company’s products. Reuters reports that 3M discovered the mentioned violation 5 years ago. At least 24 Chinese officials received roughly $1 million in travel subsidies in the process. 3M Company fully cooperated with the investigating authorities in this case and therefore the fine was limited to 6.5 million dollars.

What to think about this case? It will certainly hurt the company’s already weak reputation. One might ask, why was this incident publicly reported only now? At the same time, it is still a relatively small-scale violation, the culprit of which could only be the employees of 3M’s Chinese subsidiary. In my opinion, the 3M Company has definitely suffered reputational damage here.

Changes In The Balance Sheet

Since June of this year, 3M Company’s balance sheet has undergone significant changes. The amount of long-term liabilities has increased significantly. While in March the total liabilities were $31.5 billion, in June it increased to $41 billion. This increase has occurred primarily due to the Other Non-Current Liabilities line. The heading Other Non-Current Liabilities expresses the company’s liabilities related to PFAS and earplugs. In March, the amount of Other Current Liabilities was $5.35 billion. To date, it has risen to $14.55 billion. The company’s long-term debt is $13.05 billion. This is only about 1/3 of the total liabilities. Shareholders’ equity has decreased from 15.35 billion dollars to 7.85 billion dollars.

The debt-to-equity ratio is 5.22 as of the end of June 2023. In March of the same year, it was 2.05. Although the debt-to-equity ratio has deteriorated significantly, the company’s shareholders’ equity is currently still positive.

It should be noted that this description does not include the recently added $6 billion case of earplugs.

Profitability Is Extremely High

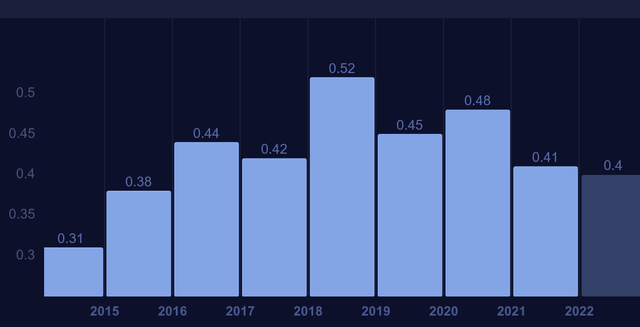

3M Company has consistently been one of the most profitable companies in its industry. The following bar chart provides an overview of the company’s return on equity in the period 2014-2022.

3M return on equity 2014-2022 (macroaxis.com)

3M’s average return on equity over the past 9 years was as high as 42.33%. This is roughly three times higher than the current sector median of 13.81%. If a company’s return on equity is equal to or slightly above the industry average, this is a good sign of strong profitability. However, if the return on equity is consistently 2 to 3 times higher than the industry average, then this can be a warning sign to the contrary for various reasons. In this case, it seems to me that one of the reasons for 3M Company’s high return on equity is the aggressive increase in debt since 2014. By increasing the debt, the shares have been bought back continuously. The following table provides an overview of the gradual growth of 3M’s debt load in the years 2014-2022

| Date | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|

Long term debt |

18.07 | 21.42 | 22.56 | 26.37 | 26.96 | 34.53 | 34.41 | 31.96 | 31.69 |

|

Shareholder`s equity |

13.14 | 11.47 | 10.34 | 11.62 | 9.85 | 10.13 | 12.93 | 15.12 | 14.77 |

| Debt/equity ratio | 1.38 | 1.87 | 2.18 | 2.27 | 2.71 | 3.41 | 2.66 | 2.11 | 2.15 |

figures (excluding debt/equity) in billions of dollars source: macrotrends

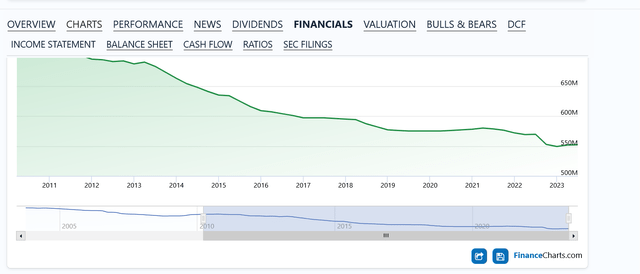

As we can see, in the period 2014-2019, the company’s debt to equity ratio has continuously increased. At the same time, the number of shares of the company has continuously decreased during the mentioned period. If in 2014 3M still had 653 million shares, by now their number has decreased to 551.9 million.

3M Company shares outstanding (financecharts.com)

Part of the share buyback has probably also taken place through retained earnings. However, I believe that 3M Company’s high return on equity is largely due to cost efficiency and good management. However, this, in my opinion, provides additional opportunities to overcome the current problems related to legal claims.

At this point, however, the company’s return on equity has turned negative due to an agreement related to large-scale liabilities.

The company’s net profit margin is also well above the median of its sector and industry

3M net income margin vs sector and industry (trefis.com)

The average net profit margin of 3M Company for the period 2018-2022 was 16.18%. A high net profit margin generally shows the company’s ability to operate cost-effectively. Also, it is often associated with an economic moat that allows a company to sell its products at a higher price than its competitors.

Last Quarter Results

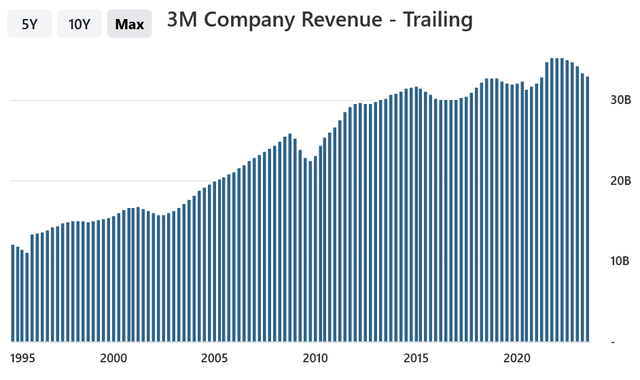

The second quarter results show that 3M Company is still in the downward phase of the cycle, which already started in late 2021. The following chart characterizes the cyclical nature of this company’s sales from 1995 to the present.

3m Company revenue 1995-2023 TTM (stockanalysis.com)

Although the overall trend is upward, there have also been 5 downward phases over the past 28 years. The length of the declining phases of the cycle has been 2-3 years. The current decline phase has lasted 1.5 years to date. If it is a normal cycle length, the decline period should end after 1 year.

In Q2 2023 results, 3M beat analysts’ estimates for both profit and sales. The earnings forecast per share was $1.73. However, the actual result was $2.17 (it does not include the obligation of the PHAS agreement). The sales forecast was $7.955 billion. The company’s actual second quarter revenue was $8.325 billion. At the same time, the company’s sales declined year-on-year in all four business segments.

I see the company’s declining sales and profits in the context of a down cycle. It has been affected by the headwinds in the global economy that are currently affecting many companies. However, I don’t think there is anything fundamentally wrong with 3M’s business model. The company has been efficient and profitable and will likely continue to be so. It is only a matter of these huge and yet vaguely sized liabilities.

Comparison With The Volkswagen Case

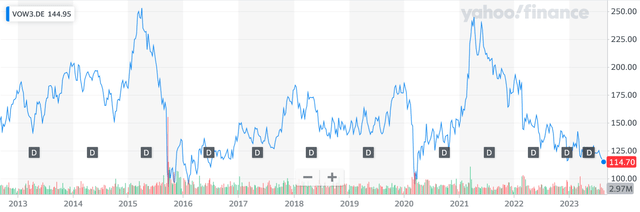

Involuntarily, in the case of 3M, there is a desire to compare it with Volkswagen’s 2015 Dieselgate scandal. As a brief reminder: 8 years ago, Volkswagen AG (OTCPK:VWAGY), one of the world’s largest car manufacturers, was involved in a large-scale scandal. This was due to the fact that during the tests, the manufacturer had shown the amount of exhaust gases to be significantly lower than the actual amount. The result was large lawsuits against Volkswagen AG in the US and other countries.

While in 2015 there was talk of the possibility of a fine of around 18 billion dollars, by 2021 this scandal had already cost Volkswagen $32 billion. Volkswagen shares fell more than 60% in 2015 due to the scandal. The market capitalization of this car manufacturer was then (and still is today) roughly the same size as 3M.

Volkswagen AG stock price 2013-2023 (finance.yahoo.com)

Of course, the Dieselgate case put Volkswagen AG in a difficult position for years and forced it to pay some of its profits as fines to the plaintiffs. At that time, the possibility of bankruptcy was also discussed as one of the possible scenarios for Volkswagen. However, Volkswagen was able to cope with the problems. To date, Volkswagen, along with Tesla, are, in my opinion, the two main winners of the electric car success story.

To illustrate the case of Volkswagen, it would be interesting to see how the fines imposed on the company affected its profits in the period 2015-2022.

| year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| EPS | 13.01 | (0.53) | 13.89 | 27.02 | 26.66 | 8.01 | 35.55 | 32.35 |

Volkswagen EPS 2015-2022 in euros source: investing.com

As can be seen from the table, in 2016, Volkswagen AG fell to a loss of 53 cents. However, already in 2017, the company was able to be profitable again, and the following year, profits increased to 27 euros per share. During the Covid period in 2020, the profit understandably dropped significantly. But the years 2021 and 2022 clearly showed the strength of the company, because the profit then already reached more than 30 euros per share. Throughout the period under review, the P/E ratio has been extremely low, reflecting the market’s uncertainty about Volkswagen. Of course, 3M is a completely different company from Volkswagen, but I still see some similarities in the case of these two companies.

Valuation

Let’s look at 3M Company’s current valuation based on various valuation metrics. Since the company is currently at a loss due to court claims, I will take the price/earnings ratio from the 10-year period 2013-2022. 3M Company’s 10-year average P/E ratio for the given period is 20.02. The company’s EPS (FWD) is 8.87. According to this metric, 3M Company has a price target of $177.57.

Next, let’s analyze the price/sales ratio in the same period. The 10-year average is 3.17. The current P/S ratio is 1.70. A fair price would therefore be $189.11 according to this metric. I used the following data as the basis for the calculation: sales (TTM) $33.054 billion, number of shares 0.554 billion.

Let’s also take a look at 3M Company’s valuation based on the price/book ratio. The company’s 10-year average price/book rate is 8.42. However, the current P/B ratio is 7.37. Based on a 10-year average P/B rate, the company’s fair value is $121.24. I base my calculations on the source data of August 29: share price $106.19, book value per share $14.40.

The DCF valuation model gives 3M Company a fair value of $136.79. All four of these valuation methods suggest that 3M Company is currently significantly undervalued. Which of these four target prices is considered fairest? In my opinion, the most realistic target price for this company is $121.24 calculated based on the 10-year average P/B model. The current high interest rates and the difficult situation of the company should be taken into account. Although there is approximately 15% upside from the current price level to the target price, I do not give this stock a buy rating, but a hold rating. The reason is the high risks associated with litigation.

Risks

As the main risks for the 3M Company in the coming years, I see the ever-accumulating claims related to the PFAS scandal. It is obvious that legal claims are not limited to the compensation amounts agreed to date. The key question, in my view, is whether or not the total liabilities will exceed $25-30 billion. If the total liabilities turn out to be significantly greater than the specified amount, it will be very difficult for the company to overcome its problems. The management of 3M itself admits that the legal claims may not be limited to the recently agreed amount of 16.3 billion dollars.

In my opinion, planned restructurings in the company can also become one source of risk. According to the company, these restructurings should bring a total profit of $700-900 million. There is a risk that the expected profit from the restructuring will turn out to be smaller or even not able to cover the related costs.

PFAS pollution is not only affecting America, 3M is also responsible for causing similar pollution in Belgium. In July 2022, 3M agreed to pay the Flemish regional government $582 million in compensation for PFAS pollution caused by the Zwijndrecht plant. Here, too, there is a risk that additional claims may be made in the future.

Final Thoughts

Industrial companies sometimes get involved in serious litigation, which slows down their development for years and can even lead to bankruptcy. It depends on the strength of the company and whether it can get out of the difficult situation. Dividend King 3M is a legendary company that has been operating competitively and profitably for a long time. To date, the market has priced this company very low. The reason is, of course, the already mentioned court claims, the final total amount of which is unclear. I believe that the 3M Company will meet its obligations over time, if they remain within the above-mentioned limits.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.