Summary:

- 3M has performed badly in the recent past from a share-price perspective.

- The company is threatened by huge lawsuits that could bankrupt the company in a worst-case scenario.

- Management might be slightly optimistic, however. The potential rewards in a scenario where major lawsuit losses can be avoided are steep.

JamesBrey

Article Thesis

3M Company (NYSE:MMM) is an industrial company that has seen its shares slump over the last year. 3M’s valuation is at one of the lowest levels in its history, and its dividend yield is at one of the highest levels in its history. At the same time, major lawsuits pose significant risks for the company. Overall, this makes 3M a high-risk, high-reward play – if things go right, total returns could be highly attractive, but if things go wrong, the company could be in trouble.

Inexpensive For A Reason

The last year has been rough for many equities, but 3M Company is one of the worst performers in this period. Its shares dropped 29% over that time frame and are down 14% in 2023 so far alone. Even worse, at least for long-term holders, is the multi-year record – 3M is down 51% over the last five years, and flat over the last decade, despite a raging bull market.

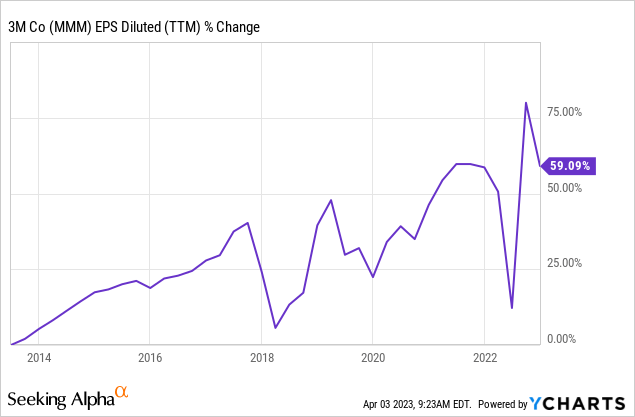

This isn’t due to a bad operating performance, however. In fact, 3M Company saw its sales and EBITDA grow over that time frame, and its earnings per share are up by almost 60% over the last decade:

That pencils out to an annual earnings per share growth rate in the mid-single digits. It’s thus not correct to describe 3M as a company that has been stagnating in that time frame – at least on an operating basis, although the share price has pretty much stagnated over the last decade (with some ups and downs in between).

3M’s bad share price performance was the result of multiple compression primarily – the company used to be somewhat expensive and has now become pretty cheap. There are several reasons for that.

First, the increase in interest rates that we have seen over the last year justifies a valuation compression for most or all equities. Especially, income stocks are impacted by this development. After all, buying a 3%-yielding dividend stock makes a lot more sense in a zero-rate environment compared to a world where riskless CDs offer yields of 4% or even 5%. In other words, as fixed-income investments such as CDs, treasuries, and so on have become more attractive in terms of the yields they offer, income stocks such as 3M have become less attractive, all else equal. Some valuation compression, and a corresponding increase in the dividend yield, are thus normal for 3M and the wider income stock universe. 3M’s dividend yield was just 2.3% a decade ago – in the current high-inflation environment where interest rates are way higher, it would not make a lot of sense for 3M to trade at a similar yield, I believe.

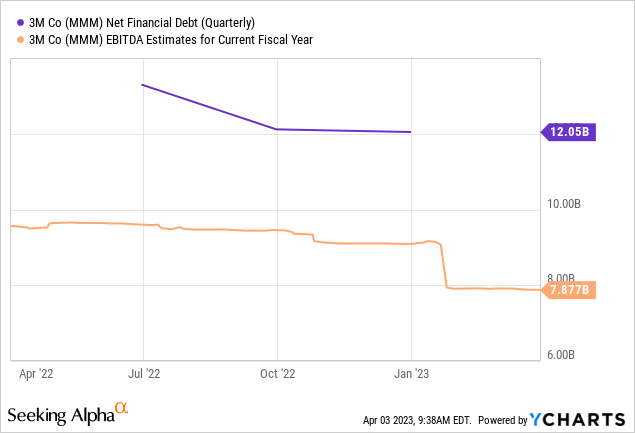

The second reason for 3M’s bad share price performance is a company-specific one. The company battles several lawsuits tied to two major issues, so-called forever chemicals, and (possibly) faulty hearing protection gear. Looking at estimates for how much these lawsuits could cost 3M, the sell-off in its shares could indeed be justified. Seeking Alpha reports that some analysts believe that 3M might be forced to pay up to $100 billion, which could mean the end for 3M Company. After all, with around $6 billion in net income, 3M could likely not even pay the interest on $100 billion in additional debt, while paying down the principal is even less realistic. Today, some of 3M’s bonds trade with yields to maturity of more than 5% already. If the company were to add massively to its debt pile, the yield on this additional debt would likely be significantly higher. Another way to look at things is to compare the potential $100 billion cost of the lawsuits to 3M’s current EBITDA, or its earnings before interest, taxes, debt, and amortization.

Today, 3M Company operates with a net debt to EBITDA ratio of around 1.5, which is very reasonable for an industrial company. Adding $100 billion to its net debt would result in a net debt to EBITDA ratio of around 14, which would not be sustainable at all. I thus believe that the lawsuits can be described as company-threatening, although it is important to remember that major lawsuit losses are far from guaranteed. It is possible that 3M eventually succeeds with its moves to shift the blame for its problems onto subsidies in order to shield the company itself from damages. That has, so far, not worked, but 3M could succeed with this strategy eventually. It is also possible that 3M wins the majority of the pending lawsuits, or that it loses them, but is forced to pay significantly less than $100 billion.

3M itself has no idea how much it will have to pay, as showcased by the following statement from 3M’s CFO Monish Patolawala:

“We can’t predict what that number is going to look like, and therefore, the guidance that we’ve given you of [adjusted] EPS of $8.50 to $9.00 excludes those litigation matters. Every quarter, as we go through the quarter, we’ll show you what the actuals are.”

Another statement by the CFO reads (also linked above):

“Just make sure you are reading our ‘Ks’ and ‘Qs’ not only for combat arms and the updates to this, but for all our litigation matters because we try to make sure we are as comprehensive as we can on that.”

While I applaud the company’s willingness to be as open and comprehensive in its risk analysis as possible, the fact that the company itself has no idea what the impact of these lawsuits will look like is hardly reassuring for investors.

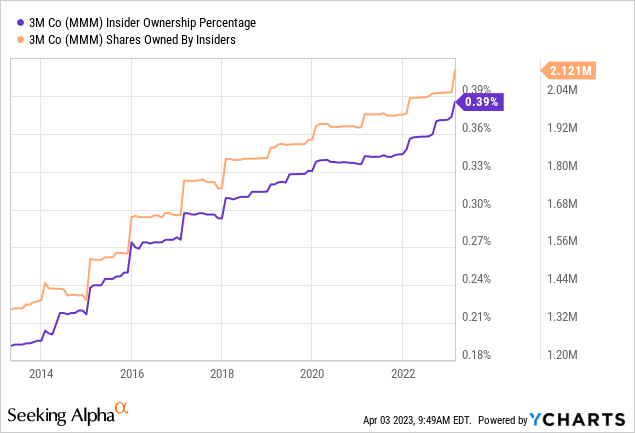

While the company and its management are not able to put a number on future lawsuit costs and the potential impact on the company, we can look for a clue about their gut feeling elsewhere. The following chart shows the number of shares owned by insiders and the insider ownership percentage:

We see that both the actual number of shares held by insiders, as well as their overall stake in the company, have grown considerably over the last decade. Insiders have also added to their position over the last couple of years, including in 2022 and 2023, when the problems were well-known. While there might potentially be other reasons for insiders to buy shares, one explanation could be the following one: Insiders might feel that the sell-off has been too steep and that the problems are unlikely to bring an end to 3M.

After all, if insiders were expecting a default or massive dilution of equity investors, they likely wouldn’t be adding to their positions. This also means that if insider ownership were to decline going forward due to increased selling activity, investors might interpret this as a sign that insider sentiment is changing for the worse and that 3M’s problems might have become larger. But at least for now, the rising insider ownership can be interpreted as a positive sign for 3M’s future, I believe.

High Risk, High Reward

As shown above, the lawsuits related to faulty hearing protection equipment and chemicals such as POFA could bring an end to 3M in a worst-case scenario. Or, to be more precise, they could wipe out shareholders in a worst-case scenario – the brands, production plants, etc. would of course still exist after bankruptcy. But while there is a large potential risk, there is also the potential for steep rewards in case things go right and 3M can avoid major lawsuit losses.

The company plans to earn $8.75 or so this year, despite 2023 likely being a rather bad year due to the ongoing economic slowdown. Things should improve in 2024 and beyond when economic growth picks up again. Analysts are currently predicting that 3M will earn $10 in 2025 and $12 in 2027. If 3M were to be successful in avoiding major lawsuit losses, either by winning lawsuits or by shifting the blame on daughter entities, 3M could see its shares rally substantially over the coming years. A 16x earnings multiple would be far from high under those circumstances, I believe. After all, 3M is a quality company with a strong (dividend growth) track record – its biggest problems are the lawsuits, but if that problem is dealt with, 3M would be a quality pick. If 3M were to trade at 16x net earnings in 2027, that would make for a share price of around $190. Shares could climb by more than 80% from the current level in this scenario, and investors would get a dividend yield of 5.7% on top of that. Between the share price increase and the dividend, total returns could be in the 18% range, per year, over the next five years, in such a scenario, which would be quite attractive.

Should One Invest In High-Risk, High-Reward Stocks?

3M Company is thus a company that will be an interesting investment over the coming years, to say the least. It faces a major and potentially existential problem, but it is far from certain whether the outcome will be as drastic as some believe. Management seems to be more optimistic, at least that’s what the rising insider ownership suggests.

If things go right, 3M could be a very rewarding investment that would very likely beat the broad market over the coming years. Is such a high-risk, high-reward pick good for investors? I think it can be the correct choice for some, but I personally don’t want to invest in 3M (yet). The best investments are those where limited downside goes hand in hand with potentially steep rewards, i.e. where the risk-reward is asymmetric. Here, it seems rather symmetric, as there is a large risk and a large potential reward. For aggressive investors, or for those that have more in-depth knowledge about the impact of the lawsuits, 3M might be interesting.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!