Summary:

- 3M reported better-than-expected earnings in Q3, driven by cost cuts.

- Weak organic and net sales continue to be a concern for the company.

- Legal liabilities, particularly related to PFAS pollution, pose a significant risk to 3M’s financial stability.

boygovideo/iStock via Getty Images

3M Third Quarter Update:

3M (NYSE:MMM) reported mixed third-quarter results the morning of October 24th. Headline earnings were better than expected at $2.68 per share versus expectations of $2.34. The company raised the midpoint of its full-year earnings guidance by less than the quarterly beat, from $8.85 ($8.60-$9.10 range) to $9.05 ($8.95-$9.15 range).

The earnings beat was driven primarily by cost cuts. Quite a leap of faith is required to fully digest these adjusted numbers as there are a number of one time charges/expenses and the tax treatment for those charges are always an adventure. Moreover, costs cuts in R&D are not something to cheer given the lack of innovation highlighted by a Wall Street Journal article earlier this month.

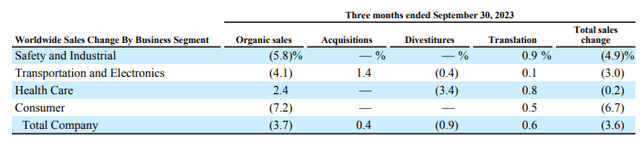

That lack of innovation continues to reveal itself in weak organic and net sales. As you can see below, organic sales were down 3.7% this quarter and total sales are down 3.6%.

3M Q3 2023 Organic Revenue (Q3 Earnings Presentation)

The small improvement in organic sales in Healthcare need to be taken with a grain of salt as the company sold a division and its overall sales were still down. Perhaps organic sales were aided by the reclassification of sold business.

The company called out year over year free cash flow improvements, but those appear entirely driven by working capital swings including inventory reductions. This free cash flow does not include the outflows that will result from payments already agreed to with the water utility district and earplug settlements. Even without these settlements, dividend coverage is tight under the company’s current structure, $3.3 billion of dividends versus ~$4 billion of cash flow assuming neutral working capital. This coverage will go negative if the Health Care spin is indeed completed in H1 2024 as I believe that division generates about 30% of the company’s EBITDA and close to half of the company’s free cash flow.

Legal Liabilities Remain:

I have consistently believed that operations don’t matter much as part of 3M’s broader investment thesis. People temporarily celebrated the company’s slightly better than expected earplug settlement cost. That goodwill dissipated rather fast.

I pointed out in the commentary section of my last broadly published piece on the company, in August, that market was ignoring a dose of bad news the water utility district settlement received around the same time as the earplug settlement announcement. State Attorney Generals sued to block the water utility agreement saying it didn’t protect ratepayers (taxpayers) enough. More protections were added in the settlement with the attorney generals, New York AG Letitia James announced

“The uncapped indemnity in favor of 3M, which could have left water systems liable for damages well beyond their expected recovery from the settlement, is removed in its entirety, significantly increasing the value of the settlement to participating water systems,”

In other words, instead of the company’s liability for cleaning up water utilities being capped at $10.5-12.3 billion, the liability just for the water utility is now uncapped and that $10.5 billion agreed payment is now a minimum.

Moreover, the water utility litigation is just one component of PFAS liability. State AG’s are still suing the company and there are issues surrounding personal injury, property damage, and liabilities in Europe. There is also the looming EPA superfund potential, especially if PFAS is labeled a hazardous material.

Valuation:

I think it’s fair to add the $16 billion of payments the company has already agreed to as liabilities.

| Market Cap (@ $89/share) | $49.128 billion |

| Cash | $5.14 billion |

| Legal Liabilities | $16 billion |

| Debt | $16 billion |

| Enterprise Value | $76 billion |

| EV/EBITDA (using $8 billion) | 9.5x |

I don’t see this valuation compelling for a company with negative organic revenue trends and major lingering liabilities.

Risk:

The stock has been volatile over the past few months, particularly around settlement and earnings announcements. All spikes have been followed by slow bleeds lower. That’s common with shorts: brief spikes that lead to lower lows. The main risk to the short is continuation of this spike dynamic driven by more settlement announcement and/or an improvement in sales and margins. A very successful spin off of the Health Care division in H1 2024 (where the division garnered an EBITDA multiple better than 12x) would hurt the short as well. If one wanted to mitigate or cap the potential losses related to being short, volatility remains low in the company and therefore puts are relatively cheap.

Conclusion:

I continue to believe that 3M has mediocre core operations that are paired with potentially massive legal liabilities primarily related to PFAS pollution. The company has tried to settle where they can, but the one major PFAS settlement announced so far is uncapped and remains a major risk. I expect to see other large liabilities materialize over the coming months, particularly if the EPA gets a hazardous materials designation for the chemical over the company months.

At If these PFAS liabilities prove out where I believe they might, then the company will find itself in dire straits. Even without these liabilities, I do not believe the company will be able to support its current dividend if the Health Care spin proceeds.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This article was discussed in broader detail in my investment group Catalyst Hedge Investing.